When China sneezes, the global markets may catch a cold! The benchmark Shanghai composite closed officially in bear market territory on Tuesday. The smaller Shenzhen composite moved into bear market territory in February this year. The Shanghai and Shenzhen composites were down around 22% and 26%, respectively, from their 52-week highs. Among the factors weighing on the market is the elevation in trade tensions between the U.S. and China, the world’s two largest economies, in recent months. Trade concerns continue to weigh on China.

Washington is due to unveil restrictions on foreign investment in U.S. technology companies on Friday, mostly aimed at China. The U.S. administration says China has misappropriated U.S. intellectual property through joint-venture requirements, unfair licensing policies and state-backed acquisitions of U.S. technology firms. China will assess the potential impact of the expected U.S. investment restrictions on Chinese companies, the commerce ministry said in a brief statement on Wednesday.

“We cannot rule out the possibility that China might fine-tune its opening-up policies as needed,” said the tabloid, which is run by the ruling Communist Party’s official People’s Daily.”

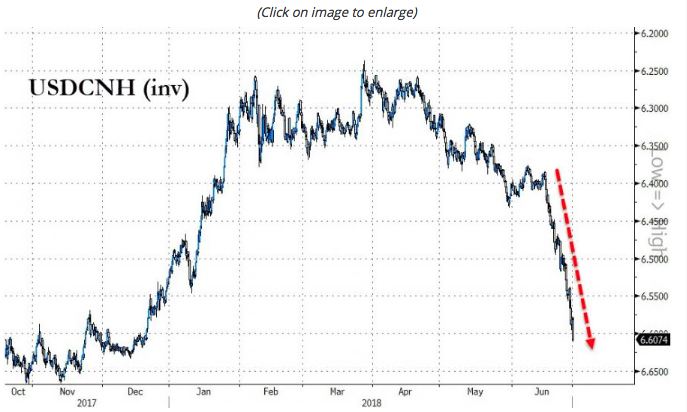

The offshoot of China’s equity market declines is the rapid decline in the Yuan. It’s decent is starting to wreak havoc on global markets. The chart below shows just how fast the Yuan has spiraled lower.

The Yuan plunged as much as 0.9% against the dollar in Mainland China during the Asian morning, with one dollar buying 6.6159 Yuan. That put the Chinese currency at its weakest level since Dec. 19 on an intraday basis, according to Wind Info.

“The kind of dollar selling from that bank was so aggressive that we knew instantly that it must be from the Big Mama,” said a Shanghai-based senior currency trader at an Asian bank, referring to the Chinese central bank’s nickname among local traders.”

The chart shows why the Chinese government may have stepped into the market on Wednesday.

Moreover, the situation may be getting more difficult for China’s President Xi when it comes to a tit-for-tat trade war with the United States as the country prepares for a potential trade war. Bloomberg reports that, according to a macro-research firm SGH Macro Advisors, China is girding for a full-scale trade war, and U.S. Treasuries may not be immune to the skirmish.

There may be some relief for China in the interim and as they ready for potential tariff implementation imposed by the U.S. on July 6th. President Donald Trump suggested Tuesday that he will ease off his demands for tough new restrictions on Chinese investment in technology industries and will rely instead a 1988 law being updated by Congress that authorizes the government to review foreign investments for national security problems.

“We have the greatest technology in the world, people come and steal it,” he said in response to questions from reporters at the White House. “We have to protect that and that can be done through CFIUS,” referring to an interagency group, the Committee on Foreign Investment in the U.S., which screens foreign investments to see whether they endanger national security.”

Again, when China sneezes, global equity markets tend to catch a cold as European equities and U.S. equity futures are lower in the 6:00 a.m. hour. Although the early going for U.S. equities look set for another rough market day for traders on Wall Street, Blackstone’s Byron Wien says there’s little to worry about, trade-war included. Blackstone’s Byron Wien says that the S&P 500 is on track to hit 3,000 in next half of 2018.

“The upside of the market is that we can get to 3,000,” said the vice chairman of Blackstone Group L.P.’s Private Wealth Solutions unit. He said during a CNBC interview: “I think that’s realistic,” referring to the potential upside for the S&P 500 index.”

On Tuesday Wien said that the bull case for stocks was strong and underpinned by expectations for earnings-per-share growth in the second quarter that he estimated would be 25% higher than the previous year. Although earnings growth is expected to be rather strong, the macro and geopolitical concerns leave investors with much concern, so the path to 3,000 will likely be a rocky one. Wien said investors are ridden by confusion in rhetoric over policies: “We have confusion on every level,” he said. Wien also said investors ought to take a vacation as he predicts that markets will be “dull” until the November midterm elections truly get under way.

While the famed Blackstone vice chairman remains bullish on both the U.S. economy and the market, B. Riley FBR’s chief market strategist Art Hogan is beginning to consider lowering his expectations and target for the S&P 500 in 2018.

“If the tensions don’t subside soon, the B. Riley FBR chief market strategist told CNBC’s “Trading Nation,” his S&P 500 price target of 3,000 may be unattainable.”

“It was our target at the beginning of the year, and it’s our belief that either trade conversations and trade discussions were going to turn to negotiations,” Hogan said Monday. “It’s hard to see the end game right now. And, this is one of the policies that could certainly get economic.”

“The second quarter is in the bag. It’s going to be fine,” he said. “But third- and fourth-quarter growth could be impaired. And, if that’s the case, we may see earnings revisions will come down. We might have to tweak down our price target for 2018 in the S&P 500.”

As we stated in yesterday’s daily market dispatch, there is not presently a catalyst for stocks, which would serve to move equity markets higher. The overpowering sentiment surrounding the potential for a trade war is weighing heavily on equity markets… and now with the Yuan and China’s markets in bear market territory, the sledding could get tougher until earnings season kicks-off.

As shown in the chart above, that will begin largely during the second week of July. We do still have some Q2 results trickling in ahead of the big bank earnings week in mid-July. Lennar reports on Tuesday before the market’s open, with the homebuilder expected to earn $0.45 per share in earnings on $5.23 billion in revenues, which compares to $0.91 per share on $3.26 billion in revenues in the year-earlier period. Lennar shares are currently trading close to 52-week lows and are now down -18.8% since the start of the year. KB Home is scheduled to report results Thursday morning and is down even more than Lennar year-to-date.

General Mills reports on Wednesday morning, with the company expected to earn $0.75 per share on $3.91 billion in revenues, which compares to $0.73 per share on $3.81 billion in revenues in the year-earlier period. Estimates have come down a bit in recent days and the stock has lost ground following each of the last two earnings reports. General Mills shares are currently down -22.3% since the start of the year, underperforming the struggling Consumer Staples sector’s -10.3% year-to-date decline.

Nike reports after the market’s close on Thursday, with the company expected to earn $0.64 in EPS on $9.39 billion in revenues, which compares to $0.60 EPS on $8.68 billion in revenues in the year-earlier period. The stock was down following each of the last three earning releases. Nike shares are currently trading close to their 52-high and are up +18.6% vs. the Consumer Discretionary sector’s +4.7% year-to-date period.

Our final word, which is usually consistent, suggests that investors trade what the market is bearing; no pun intended. But with the unintended pun the markets currently lack a primary buying catalysts. Yesterday found the Dow going into the final trading hour with more than a 100 point gain, but in the final 15 minutes gave up more than 70 points to finish the day higher by roughly 30 points.

With such a late day swing, this characteristically defines a lack of investor conviction and recognition of the geopolitical concerns. In the face of wild market swings, Finom Group encourages our subscribers to utilize our private Twitter feed to trade these daily market swings.

Tags: GS LEN NKE SPX VIX SPY DJIA IWM QQQ