Welcome to this weekly edition of State of the Market. The major averages succumb to modest selling pressure today, even with headlines and media coverage surrounding U.S./China that support a deal forthcoming. Please click the following link to review the SOTM video, which is roughly 1 hour in duration. Additionally, Wayne Nelson delivers our daily, Technical Market Recap here.

Outline of SOTM

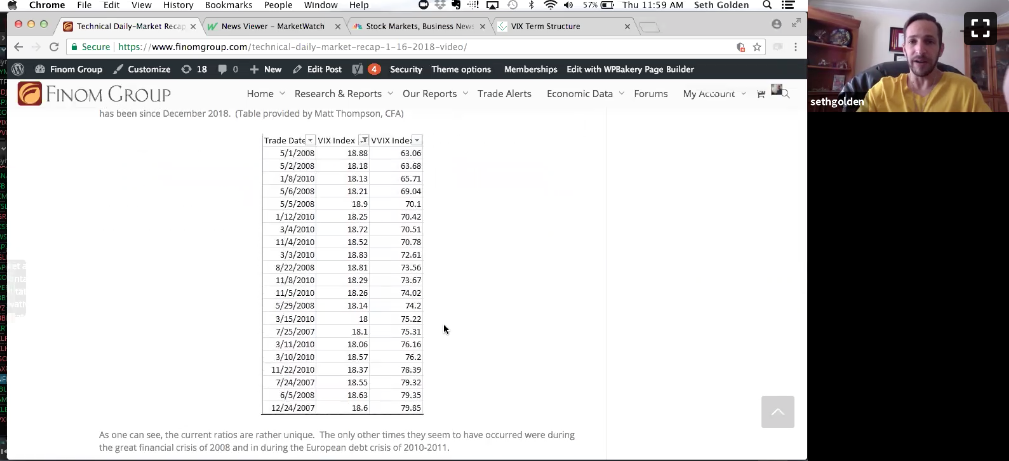

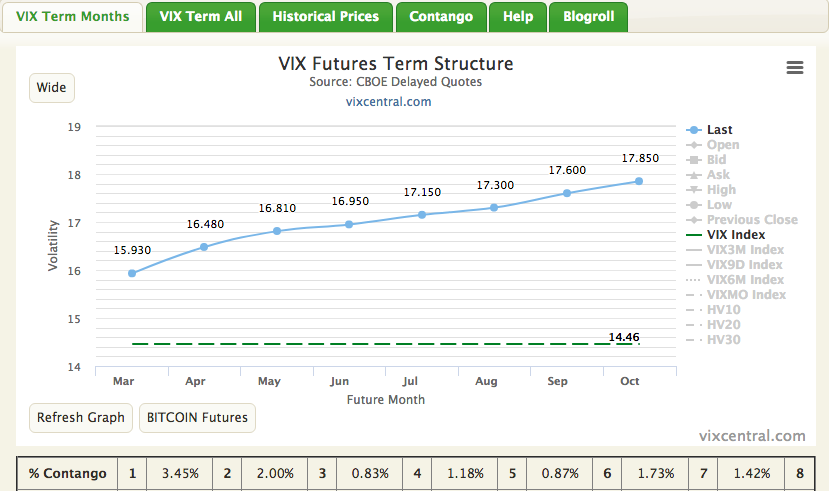

- Introduction and discussion on the state of volatility. Reviewing VIX Futures Term Structure with modest contango near 4%. Defining roll yield value (m1-spot VIX = roll yield) The higher the roll yield the better for shorting volatility. Too much time until m1 expires to make any declarations on what will happen in the volatility complex between today and m1 expiration. Introduction to CBOE to see daily change of individual VIX futures contracts. (0-15 minutes in)

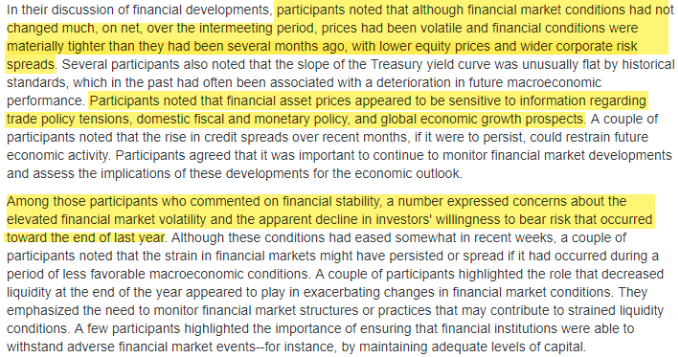

- Discussion on the FOMC minutes, permabears blame the Fed for everything that has benefited the 9-year long bull market. FOMC minutes showed committee members will remain patient, but they indicated market volatility and asset price volatility played a role in their decision to pause future rate hikes. (15-18 minutes in)

- Fed’s balance sheet and FOMC minutes discussed the possibility of ending the balance sheet reduction/QT by the end of 2019. Below is picture of QT/balance sheet reduction over the last year. Fed always follows the market, responds to the market because the market is a representation of the economy and vice versa. (18-27 minutes)

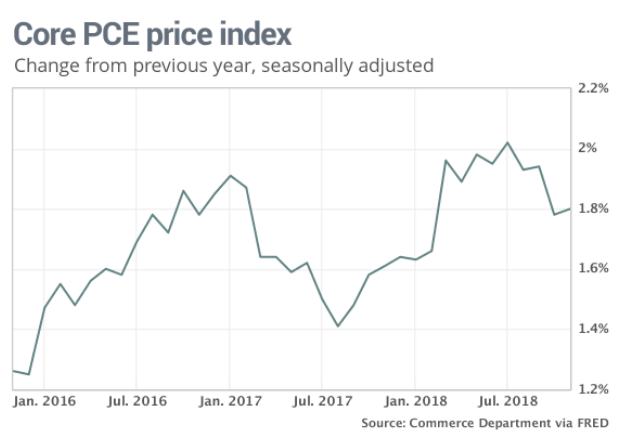

- Fed made a policy error in hiking 2 times while CPI and PCE indicated deflationary conditions. China likely to stimulate their economy by stablizing yuan and cutting rates. U.S./China trade deal likely to include removal of tariffs. (28-36 minutes)

- Disconnect in certain market correlations. Bond prices and equity markets have both moved higher lately, yields lower. 10-2yr yield spreads have remained very flat for a while now. Pay attention to some of the disconnects in the market correlations. (36-40 minutes in)

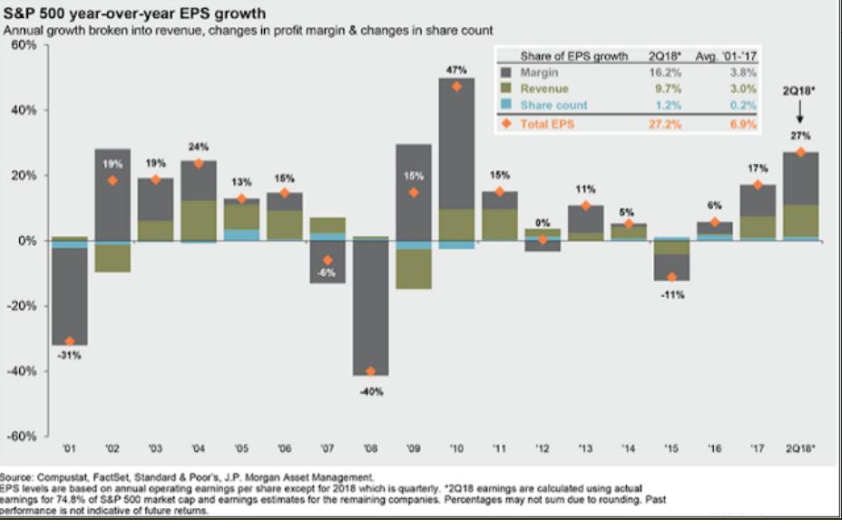

- Share repurchase programs have only accounted for roughly 3% of EPS growth in 2018. There are many myths that surround the strength of the market and many permabears have promoted that the market has only gone up based on buybacks. This is not true. Study by JPM (See Chart) Buyback legistlation is highly improbable as it won’t stop companies from increasing shareholder value in one shape or form. (40-44 minutes in)

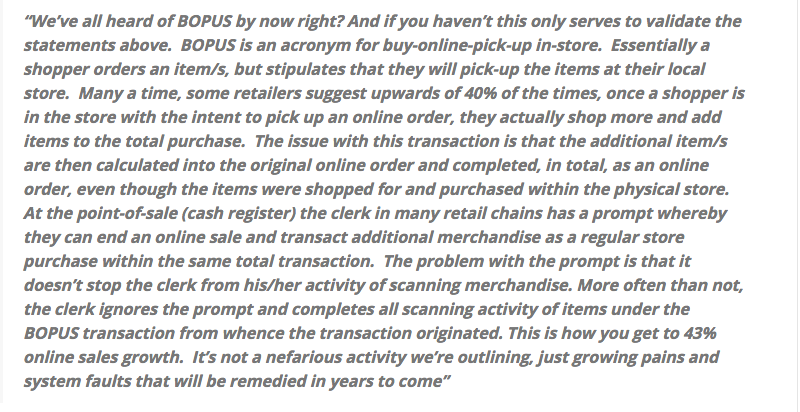

- Wal-Mart earnings beat analysts’ estimates but there was a key interest in online sales growth of 43% for Q4 2018. Discussion on how retailer record online sales that are part of the buy-online-pick-up-in-store (BOPUS). Seth Golden will be interviewed on TDNetwork on Tuesday at 9:00 a.m. EST (45-54 minutes in)

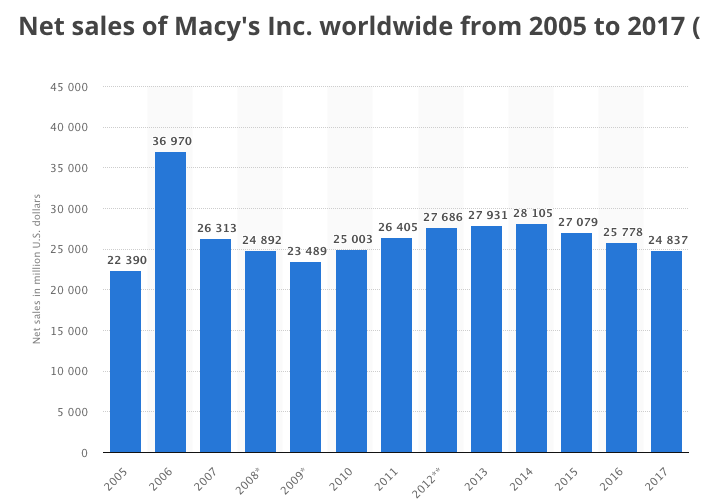

- Discussion on specific retailers such as SHLD, M, JCP and TGT. Which retailers will survive over the next 5-10 years and why. Concluding thoughts on the market and what may be the near-term moves to come. (54-60 minutes in)