Welcome to our weekly State of the Markets (SOTM) video analysis. Within this week’s episode we discuss all macor-fundamentals surrounding the economy to better understand where the equity markets may be heading in 2019. Please click the following link to review the SOTM and for the sake of streamlining, we have offered a segmented outline for revisiting in the future.

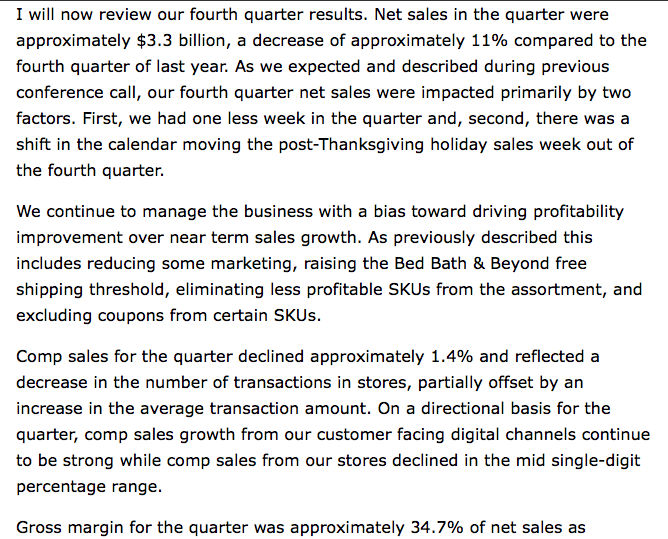

- Discussion on the latest Bed Bath & Beyond (BBBY) results which were found to have the lowest gross margins since the 1990s. Sales fell 11% YOY, while earnings beat the consensus analysts’ estimates. Below is a screenshot from the quarterly transcript, denoting -1.4% YOY SSS decline.

- Activist investors underlying the share price with the hopes of ousting CEO/management. CEO Temeras suggests company will reduce couponing.

- Macy’s (M), J.C. Penny (JCP) and Kohl’s (KSS) have similar problems as BBBY. Foot traffic is troubling. Macy’s annual sales back at 2009 levels. (0-14 minutes in)

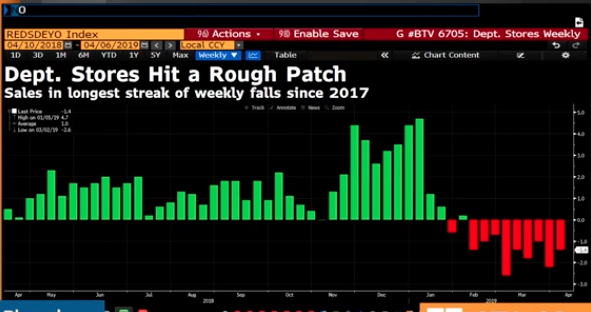

- Bloomberg department store sales index shows worst performance since 2017. If Macy’s has one bad quarter/miss, share price could drop to $17s. What happens to some of these retailers when a recession comes to pass.

- Discussion on the consumer and the market’s reliance on consumer spending and retailing. Online sales have syphoned a good deal of sales from brick & mortar retailers. Department store retailers have seen declining growth YOY while Online retailers like Amazon (AMZN) are still growing at double -digits.

- March retail sales showed growth of 2.2% YOY, slower than the 3.5% annual pace in 2018. (14-20 minutes in)

- Inflation is impossible and is better understood using the term “reflation“. All rates eventually go to ZERO!

- Consumer driven economies fail to achieve inflation. Since the 1980s, the U.S. has been a consumer-centric economy.

- Since the 1980s and through the turn of the century, technology has helped to reduce inflation probabilities as technology came to the forefront. Additionally, the rise of the Chinese consumer, has caused deflation around the globe.

- Quarter century has passed with low inflation.

- Price discovery through the introduction of mobile computing & retailing has served to drive prices lower in the 21st century. (20-36 minutes in)

- Recession discussion. Possible, but improbable for 2019.

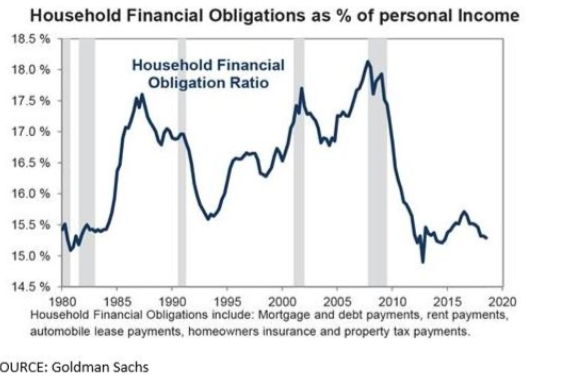

- Debt to income ratio at best level in decades. Wages are rising while delinquency rates are falling for most major debt categories.

- A recession must be separated from an assumption of how the equity market will perform under such economic conditions. The higher the market valuation going into a recession, the greater the magnitude of a market decline during a recession.

- Next recession, all else considered on par with current conditions, recession should prove shallow and with short duration.

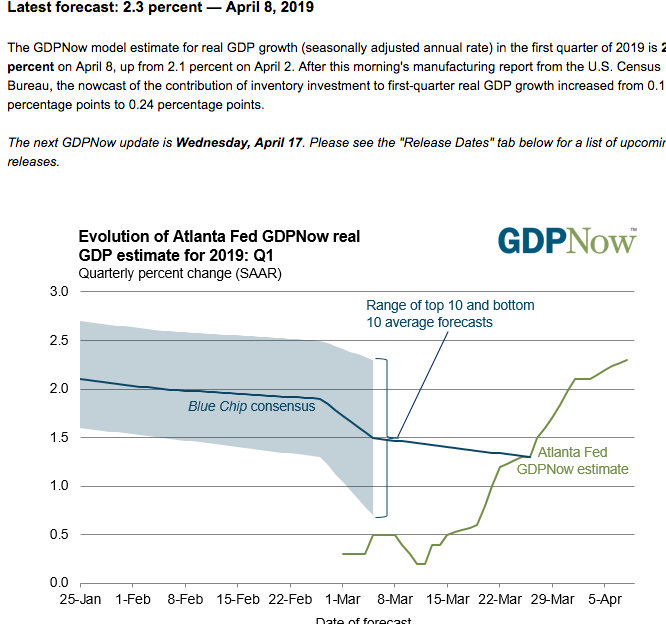

- Although EPS forecast have continued to decline for the Q1 period, GDP forecast have been rising. (36-47 minutes in)

- Economy looks to have trough in Q1 with housing showing signs of rebounding. Mortgage rates have declined nearly a point since November 2018. Mortgage applications have been surging since March with New home sales surging in March on a MoM basis and up YOY.

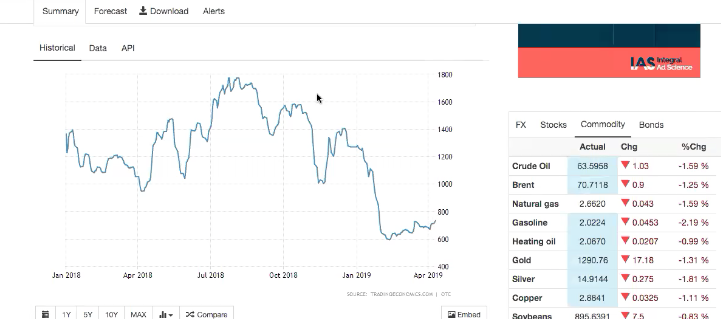

- Shipping indexes showing signs of life as the BDI and HSI have risen of late. (47-54 minutes in)

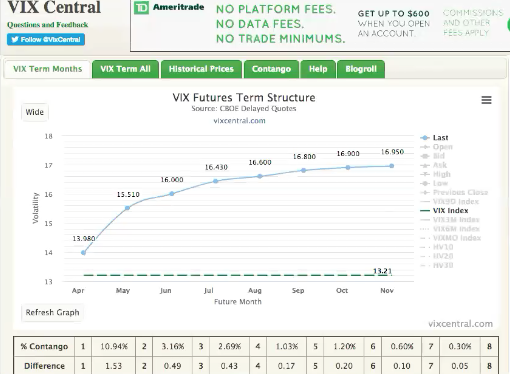

- Low volatility has persisted in the Q1 period. VIX Futures are set to expire/roll next week Tuesday. VXXB will revert to its former ticker symbol VXX on May 2nd. Contango has been building and suppressing price appreciation throughout the current m1 futures cycle. TVIX hit all-time trading price low.

- Friday sees a typical melting in the VIX, as hedges are removed going into the weekend. However, this Friday’s bank earnings may prove to impact hedging activities.

- Next week only 4 trading days. (54-101 minutes in)

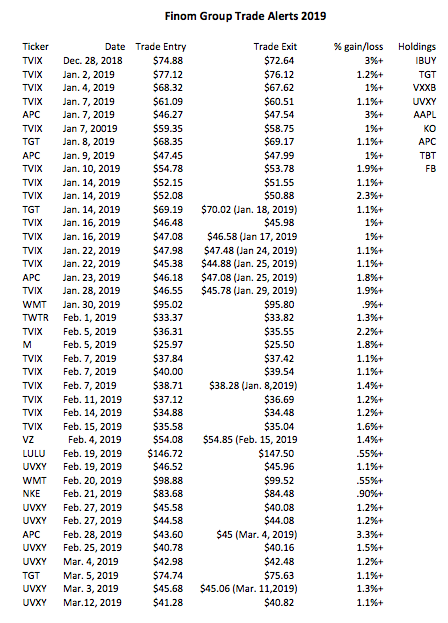

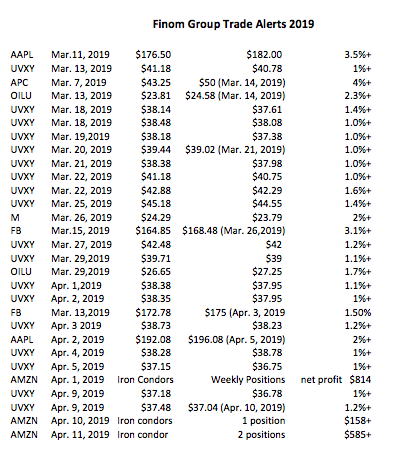

Thank you for reviewing this week’s SOTM video. We encourage our readers and visitors to subscribe to our weekly Research Report and daily/weekly trade alerts that is accompanied with a daily, live Trading Room hosted by Seth Golden and Wayne Nelson. Feel free to also review our YTD Trade Alerts with a significant YTD return and success rate, as follows:

- All VIX-ETP trades (UVXY/TVIX/VXXB) are short trades!

Hi Wayne, Seth , I enjoyed SOM this week. I especially liked the chart of PCE inflation chart over the last 25 years from market watch. If the inflation has been consistently below the target over the last twenty years doesn’t this show two things:

1. How hard it is for central banks to control inflation using monetary policy.

2. The Fed and other central banks have historically over tightened and inflation never stayed above target for very long and have at least contributed to many of the recessions we have witnessed over the last twenty years and have barely ever created a soft landing for the economy.

I’m not into Fed bashing as I recognise that their job is extremely hard. Just wondering to what extent central banks should be interfering with the economy

Short answer, yes! The economy would naturally regulate itself based on supply and demand. But there is little incentive to allow that in a capitalist system that begs of increasing profitability to perpetuate growth to “what end”. We can only really hypothesize what the economy would be like absent central bank involvement and for that I’m forced to appreciate and recognize that we don’t have the right answer for the economy absent a Fed involvement, just ideas to contemplate. Unless one day…