Welcome to this week’s State of the Markets with Wayne Nelson and Seth Golden. Please click the following link to review the SOTM video. COVID-19 continues to plague markets and has taken the economy as a prisoner until further notice. The U.S. economy has taken measures to track, reduce and eventually contain COVID-19, but the measures taken come at the expense of the economy. We are likely to see a U.S. economic contraction in the Q2 2020 period and further quarterly contractions are dependent upon the success of achieving containment. In the meantime, markets remain volatile and with a heavy bias toward the downside, as valuations remain uncertain. For now, the safest bet for investors has been to seek out the shelter and safe haven of the U.S. Dollar!

- The S&P has only fallen in January, then February and again in March in 8% of years since 1958 (first full year of data).

- It happened in 1973, 1974, 1977, 1982 and 2008.

- During the 5 years when the S&P was down in January, February and March, the S&P finished the year lower in every year except one, or 80% of the time and mostly by double digits.

- The average return from the close on the last day of March to the end of the year was -9.8%.

- Yesterday, the S&P 500 dropped 131 points. A 38.2% retracement comes to 50 points; 50% retracement comes to 65 points. Today’s session up 11.

- As the LPL Chart of the Day shows, there have been 14 previous bear markets since 1950, and it took an average of 20 months from the bear market lows to recover the losses*.

- Taking this a step further, when the economy avoided a recession, the recovery took only 10 months, versus 30 months for a recession, although a lot of that is because bear markets accompanied by recessions are typically deeper.

- Last, the last 3 bear markets that avoided a recession recovered the gains in 3 months, 4 months, and 4 months after the ultimate bear lows were made.

- Bridgewater’s All-Weather funds tumbled as much as 14% this year through Monday, according to a letter founder Ray Dalio sent Wednesday to investors that was reviewed by The Wall Street Journal. A leveraged version of the firm’s flagship macro fund, Pure Alpha, is down 21%.

- Mr. Dalio said the coronavirus hit the firm “at the worst possible moment” because it had a long tilt in its positions, meaning it was positioned for market gains. In total, Mr. Dalio said eight Bridgewater funds were in the red.

- Investors are extremely bearish. As you can see from the chart below, fund managers’ global equity allocation fell 35 points which is the biggest month drop on record (going back to 2001).

- As stock markets staged a modest rebound Tuesday, some of the most popular contracts were tied to VIX falling to 27 or 20, Trade Alert data show, closer to levels hit earlier this year when major indexes hit records.

- Still, turbulence in markets has been high, triggering diverging views on the gauge’s path. Analysts at Credit Suisse Group AG said another steep selloff similar to Monday’s could push the VIX above 100.

- Majority of the option traders kept buying expensive puts during the last 2 weeks as VIX was going from 50% to almost 90% in order to hedge and profit from the Armageddon type of scenario.

- The S&P 500 hasn’t been up back to back days for 23 trading days. This is the longest streak since 28 in a row in Sept/Oct ’18.

- The 5-Day Moving Average of Equity Put/Call Ratio is at its highest level ever, surpassing the prior record from November 2008.

- With data going back to 2003, there has never been as much fear as there is today in the options market.

- In another sign of increasing investor panic, BofA’s GFSI Skew Index which measures investor demand for downside protection just hit an all-time high.

- Here’s all calendar weeks where SPX weekly RSI(14) closed below 25.

- We’re there now, but it’s not Friday’s close yet.

- Polarizing situations like this, where there’s an articulate case and precedent for a huge boom/bust require absurd emotional competence, discipline & pain tolerance.

- Dow Jones has lost >30% of its value in just over a month, almost wiping out all of its gains since Donald Trump was inaugurated three years ago.

- Bad omen for reelection hopes.

- Deep SPY OTM puts lower on the day despite the S&P 500 being down 6%?

- No more hedgers left to hedge.

- This is usually a sign that a bottom may be in place for the S&P 500

- Somewhat akin to when skew flattens in commodities when they hit support or resistance.

- The equity risk premium compares the earnings yield on the S&P 500 (the inverse of the price-to-earnings ratio) to the 10-year US Treasury yield.

- That number as of March 18 was 4.9%, well above the long-term average of 0.8% (it was higher on March 16 when the 10-year Treasury yield was 0.73% rather than 1.18%). That compares to historical peaks between 6 and 7% in 1974 and shortly after the financial crisis.

- The bottom line is that if this trend holds equity investors could be well compensated over time for the risks they are taking now.

- We expect a total of approximately 3.5 million jobs will be lost with the biggest hit in 2Q of 1 million per month. This will send the unemployment rate higher, nearly doubling to 6.3%.”

- It’s looking ever more likely that this virus is going to push us into recession.

- Bloomberg’s Recession Probability Index is at its highest point of this cycle.

- It’s currently showing a 53% chance of a recession within the next 12-months. I’d say those odds are a bit on the low side too.

- Median estimate of forecasters sees an historic and ugly 8% 2nd qtr GDP decline followed by modest 4% gains in the second half.

- An 8% decline would tie for 3rd biggest quarterly fall in post-war era. Forecasters say huge room for errors here, but these are what models show now.

- Look at the increase to 281,000 in claims move above the 5-year moving average of 242,300, signaling recession.

- Will we see millions over next few weeks? Cyclical peak in last recession 665K in March 2009. All time high 685K in October 1982.

1.Has the probability of U.S. recession increased?

Yes, the probability of a recession has increased. It is difficult to pinpoint the exact starting date, but we are watching high-frequency data for signs of a broad decline in spending. Some conditions are still solid, such as mortgage refinancing at a 17-year high, and real-time estimates of first-quarter growth are around 3%. Still, many other conditions are already beginning to erode: freight-car loadings, steady declines in the weekly consumer sentiment indices, and weakening same-store sales. Consumers’ views of the future are deteriorating faster than their views of the current situation, and this difference portends a spending slowdown to follow.

2. The trend lines for the spread of coronavirus in the U.S. appear to mimic Italy—is that where you believe this is headed?

We doubt that the U.S. economy will have to shut down because of a nationwide quarantine. The impact should worsen, both with further infection and as testing reveals more cases. Our expectation, however, is that quarantines will remain primarily a local/regional decision. Also, the U.S. economy is larger geographically than Italy’s and much more dispersed. Moreover, we see a good chance that Congress will take up more substantial measures, such as tax cuts, direct relief to state and local governments, direct financial assistance to victims of the virus, and possibly assistance to industries most adversely affected (health care, manufacturing, and travel, tourism, entertainment–industries that would normally bring together a large number of people).

3. When will we get fiscal stimulus, and what do you believe would make a difference? Which companies may need help, and what help do states and municipalities need? What can be done fast through executive order and what requires Congressional legislation?

The President declared a state of emergency on Friday (March 13). Certain types of direct lending and possibly extended income tax filing are within the executive remit. The House passed a bill with provisions targeted mainly to help state and local authorities to assist victims of the virus and provide health care. (See Table 1.) The legislation will go to the Senate this week and then quickly to the White House for the President’s signature. A second round of fiscal stimulus may be more along the lines of what investors are looking for – namely, broad support for consumers and businesses affected by the spending slowdown caused by the virus. This second round could be available in the coming 3-4 weeks, depending on how long it takes the two parties to negotiate the deal.

Table 1. Stimulus measures that Congress may consider

Sources: Bloomberg, Wells Fargo Investment Institute, March 13, 2020.

*14 days in the event of a health emergency, offset by tax credits to employers. **Like airlines, hotels, cruise ships.

4. With the World Health Organization’s pandemic call, new travel bans, and major event cancellations, what do you expect for companies and earnings?

We believe earnings will be negatively impacted, but it is too soon to tell how much as the level of uncertainty remains high. With consumers at a standstill, cash flows become even more critical, and companies with high cash balances and low leverage should be best positioned to be able to withstand the turmoil. We could see further slowing in buybacks and business investment spending as cash is redirected toward ongoing operations. We suspect layoffs and further expense cutting would be a last resort if things slow too much. Asset classes best positioned are U.S. Large Cap and Mid-Cap equities and Commodities.

Where do things stand now?

The “bottoming out” process will likely involve two phases, Hyzy suggests: First, when markets gain confidence that policies are working. Second, when they start to assess the impact on corporate earnings and the economy.

One bright spot: compared with the financial crisis of 2008, the U.S. economy was in a stronger position when the virus outbreak occurred. “In 2008, there were much more daunting questions encircling the financial system, and the consumer was not on solid footing,” Hyzy says.

Yet given the many unknowns and the magnitude of the challenge, with S&P 500 asset values down 30% so far, these questions may take weeks or even months to resolve, Hyzy says. And financial estimates are likely to change frequently as the crisis evolves.

How are policymakers responding?

One of the biggest challenges for health officials right now is learning the effect that “social distancing” and other containment policies currently being enacted state by state and locality by locality are having in slowing the spread of the virus, Hyzy says. Better data and more coordinated policies will help from both a health and economic perspective, he believes. “Knowing how long people will have to stay home will help determine how consumers and businesses will manage through the crisis as well as the depth of any economic contraction.”

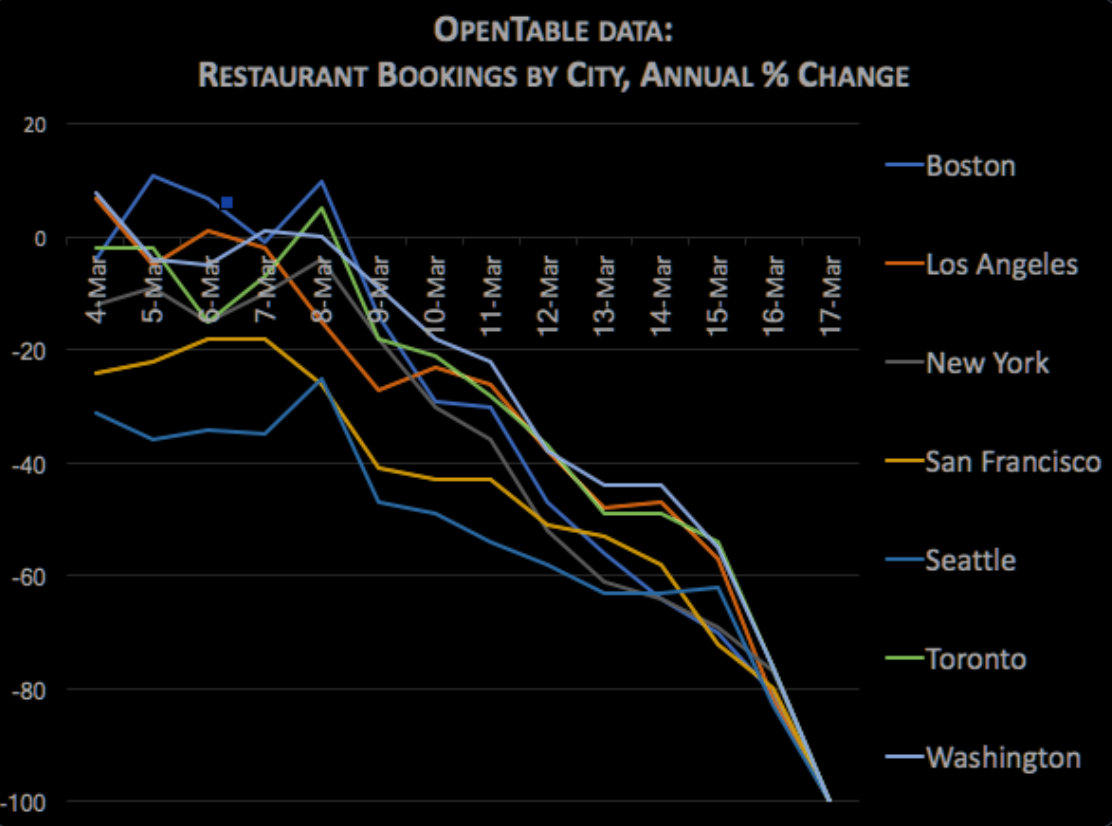

- On Tuesday, online restaurant bookings declined to zero in New York, Los Angeles, San Francisco, Seattle, DC, Boston, and Toronto.

Benjamin Graham (the father of value investing): The primary reason many individuals fail as long-term investors, Graham said, is that “they pay too much attention to what the stock market is doing currently.”

- Graham added: “The investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage.” Investors “would be better off if his stocks had no market quotation at all, for he would then be spared the mental anguish caused him by other persons’ mistakes of judgment.”

- No new cases in China yesterday.

- COVID-19 is beatable.

- In addition to widespread testing, South Korea learned quickly that hospital beds need to be reserved for the critical patients that need them the most. This saves lives and prevents overcrowding. Those with mild symptoms (the vast majority of cases) should not be using the hospital as their primary care center.

“We can’t quarantine and treat all patients [in the hospital]. Those who have mild symptoms should stay home and get treated [in residential centers]” – Dr Kim Yeon-Jae, an infectious disease specialist from the Korea National Medical Centre

- The results speak for themselves. With no lockdowns, roadblocks, or restrictions of movement employed, South Korea has managed to slow the growth rate of COVID-19 to the point where active cases are already starting to level off.

- The VIX closed at 76.45 Wednesday. That represents an extremely elevated and extremely rare reading for volatility expectations looking out 30 days. (Table from Chris Ciovacco)

- We entered Thursday’s session with an open mind and see how it unfolds.

- The term “unprecedented” can be used to describe numerous bearish events in recent weeks.

- We could view unprecedented events with a negative mindset or we can respect unprecedented events in the financial markets require unprecedented focus and determination if we wish to navigate to the opportunities on the other side.

- Nomura: Note the short gamma will go down by almost 50% after expiry tomorrow.

- Recall that markets crashed just after the last expiry in Feb where big long gamma expired. Bullish or bearish, but markets need to “chill” before taking any direction.

- As we have explained over past sessions, big part of de risking from systematic, CTA, vol books etc have by now been “processed”.

- Less short gamma will give less delta to be hedged