After a week of choppy waters and since President Trump introduced the possibility of trade tariffs, U.S. equity markets have seemingly calmed down. In the final half hour of Wall Street trading yesterday, President Donald Trump signed two declarations, which would implement tariffs on steel and aluminum imports. The tariffs are expected to take effect in 15 days and will put a 25% charge on steel, and 10% on aluminum. Canada and Mexico have been exempted from the tariffs. This seemed to quell market fears of a trade war with our most prolific trading partners.

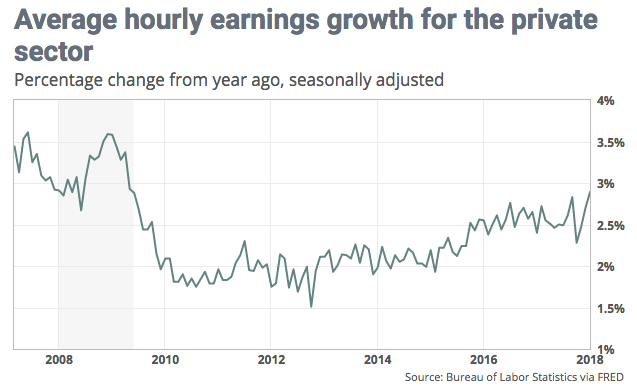

But today is going to be about the all-important Nonfarm Payroll report and the underlying wage inflation data. The economic data will be released at 8:30 a.m. EST. Hourly pay rose in January at a yearly pace of 2.9%, marking the fastest 12-month increase since 2009. The wage inflation data kicked off a rapid market correction of nearly 12 percent before equities caught a bid and retraced some of the losses in the weeks since. Wells Fargo senior economist Sam Bullard said he expects a “more tempered gain” in hourly pay.

While it is still a very fluid situation, it does appear that Toys R Us will be liquidating U.S. operations in the near future. The children’s toy retailer has been struggling for the greater part of the last 10 years, finding its sales syphoned off by the likes of Amazon, Wal-Mart and Target just to name a few competitors. Shares of Toys R Us debt holders Hasbro and Mattel saw their stocks fall in after-hours trade Thursday on the news surrounding a potential liquidation. Hasbro fell more than 3% and Mattel shares declined nearly 5 percent.

Bitcoin had been languishing between the $10 and $11,000 level over the last couple of weeks, but this week it has found itself under heaving selling pressure. The cryptocurrency came under pressure earlier in the week after the U.S. Securities and Exchange Commission said exchanges that offer trading of “digital assets that are securities” would have to register with the agency. The digital currency traded as low as $8,587.05 earlier in the day, according to industry site CoinDesk and is down nearly 20% for the week.

Investors and traders might also keep an eye on this interesting chart as alerted to by The Street. It looks like $58 could represent a breakout for the share price.

“Last year, Starbucks struggled to keep pace with a roaring broad market rally, ending a little over 3% higher than it started the year. Meanwhile, the rest of the S&P wrapped up 2017 with 19.4% gains. But Starbucks’ laggard status could finally be coming to an end. Better still, shares could be on the verge of accelerating a new uptrend in shares.”

Despite what seemed as an innocuous Presidential declaration on trade tariffs yesterday, markets remain on edge or jittery ahead of the Nonfarm Payroll report. While the economic data will be the highlight of the day and drive market-trading Friday, there are two Fed speakers on the docket as well. Chicago Fed President Evans is due to appear on CNBC at 8:45 a.m. Eastern, then on Bloomberg TV at 10:45 a.m. Eastern. He will then give a speech to the Shadow Market Committee in New York at 12:45 p.m. Eastern. Boston Fed President Eric Rosengren will speak at the Springfield Regional Chamber of Commerce in Springfield, MA at 12:40 p.m. Eastern. The U.S. 10yr Treasury yield is edging up slightly ahead of the monthly payroll report. Expectations are for the U.S. economy to have grown jobs by approximately 222,000 in the month of February and according to economists polled by MarketWatch. The unemployment rate is expected to tick lower, to 4 percent.

Tags: SBUX SPY DJIA IWM QQQ