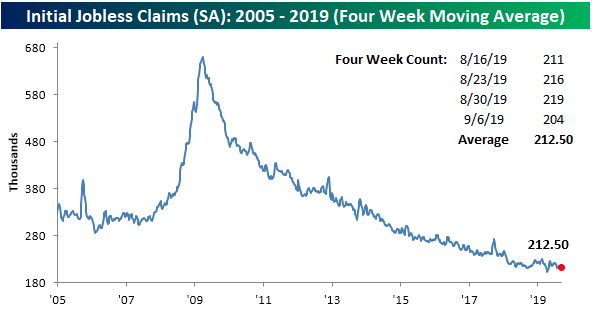

Welcome to this week’s State of the Markets. Please click the following link to review the SOTM video. Our emphasis in this week’s SOTM video concerns the 3-week rally in the major averages that has been characterized as a sector rotation rally. The bond sell-off we highly anticipated has taken form, underlying economic data remains healthy with CPI rising, but somewhat inconsequential with respect to FOMC considerations. Jobless claims plunged with the 4-week moving averaging dipping by 4,500. Retail sales, consumer sentiment and investor sentiment have all outperformed expectations.

- Investors expect Trump to fold on trade. Algorithms may cause stock markets to sell off when the president puts out bellicose tweets, but investors have taken their measure of the man and they think that rather than risk re-election, he’s going to ultimately cave in to China and end the trade war. Why? Because he’s folded on so many things before — from threatening “fire and fury” against North Korea to embracing bromance buddy Kim Jong Un even as “Little Rocket Man” has tested at least 18 missiles since May; from indirectly boasting he could kill 10 million people in Afghanistan to planning to meet the Taliban at Camp David days before the anniversary of the Sept. 11 terrorist attacks. He’s already caved in to China so much it’s hard to take the Capitulator-in-Chief’s threats seriously.

- That’s why the smart money is looking for a cosmetic trade deal some time next year that includes some modest Chinese concessions but no major givebacks on critical issues like technology policy, which China views as a vital national interest.

- Privately run Chinese firms bought at least 10 boatloads of U.S. soybeans on Thursday, the country’s most significant purchases since at least June, traders said, ahead of high-level talks next month aimed at ending a bilateral trade war that has lasted more than a year.

- The soybean purchases, which at more than 600,000 tonnes were the largest by Chinese private importers in more than a year, are slated for shipment from U.S. Pacific Northwest export terminals from October to December, two traders with knowledge of the deals said.

- Also on Thursday, the U.S. Department of Agriculture (USDA) reported China bought 10,878 tonnes of U.S. pork in the week ended September 5, the most in a single week since May.

- U.S. meat traders have been anticipating a pork shortage in China due to an outbreak of African swine fever, a fatal pig disease that has reduced the Chinese herd by a third since it arrived in the country more than a year ago. China is therefore willing to make some U.S. purchases despite a 72% tariff.

- China’s Customs Tariff Commission of the State Council will exclude some agricultural products including soybeans and pork from the additional tariffs on U.S. goods, The People’s Daily said in a tweet, citing official sources.

- Frank Cappelleri, executive director at Instinet, said the best-case scenario for the market is for the momentum laggards from earlier in the week to join the value and other stocks that are moving higher. He said the software sector is a key group to regain ground. Microsoft was up 1.4% Thursday after getting knocked down earlier in the week.

- “I think you always have to watch tech, how semiconductors are doing going forward. [The VanEck Semicondutor ETF] SMH has quietly gotten back to its highs of the summertime,” said Capelleri. “If you looked at what happened last year, they lagged since March of 2018.”

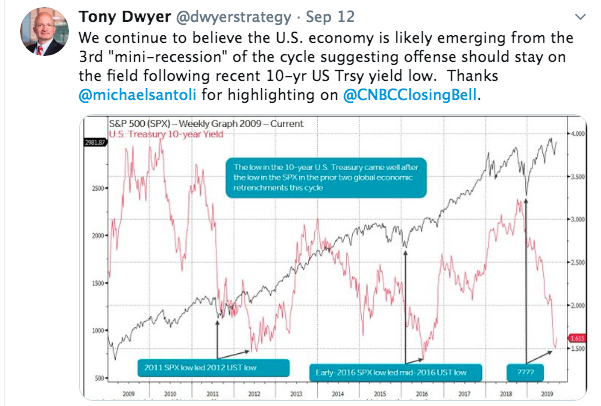

- Below is a chart of the ratio between the S&P 500 and the Russell 2,000 over the last 2 years. When the line is rising, the S&P is outperforming the Russell. When the line is falling, the Russell is outperforming the S&P.

- Since peaking earlier this month, however, the ratio has fallen dramatically as small caps have started to outperform. Even after the recent small-cap outperformance, the ratio remains well above its long-term average.

- Going against the wary crowd is our call of the day from Credit Suisse’s global equity strategist Michael Strobaek, who thinks the S&P 500 can climb higher and now’s the time to buy more stocks.

- “Recent weeks have seen political risks in Europe diminish and the U.S.A. and China make renewed efforts to resume talks. Accommodative central banks should further underpin investor sentiment,” Strobaek told clients in a note. He’s boosting equity exposure to overweight — meaning they see better value for money in stocks — with an emphasis on the U.S.

- Stocks simply have more return to offer than bonds right now, he said. “Moreover, throughout the strong year for equities to date, many investors have proven reluctant to jump on the bandwagon, leaving many with cash to deploy. This as well as still depressed investor sentiment suggest that this rally still has legs,” added Strobaek.

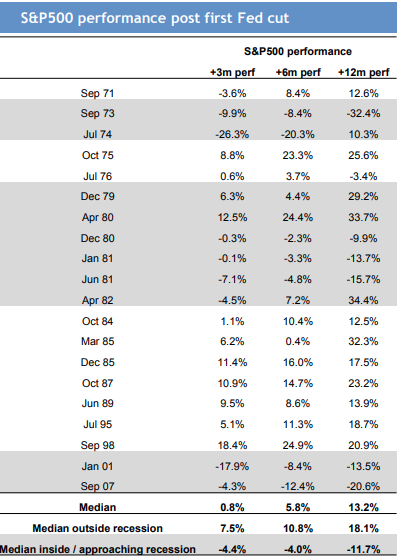

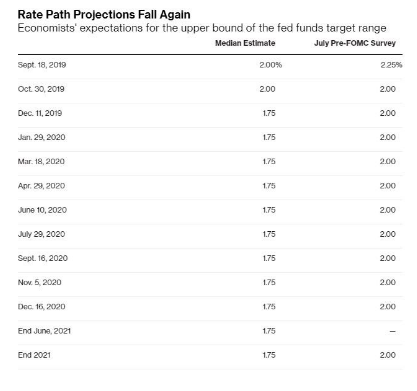

- Next week’s FOMC meeting is already producing risk management as VVIX diverges from the VIX on Friday. It’s all but certain that the Fed will cut rates by 25 bps.

- The key issue investors have to consider is the path of rates going forward. With economic data continue to perform better than the recessionary fears and bond market indicate, will the Fed be able to mold its message around investor expectations?

- Investors are anticipating another rate cut in December, based on the table above. The market is running hot into the FOMC meeting, which is typically not a favorable set up and may find additional hedging activity early next week.

- Economic data remains solid and supports trend-growth GDP (1.7-2.5%). Jobless claims fell by 15K in the previous week.

- Consumer Sentiment rose from 89.8 to 92 according to the University of Michigan survey.

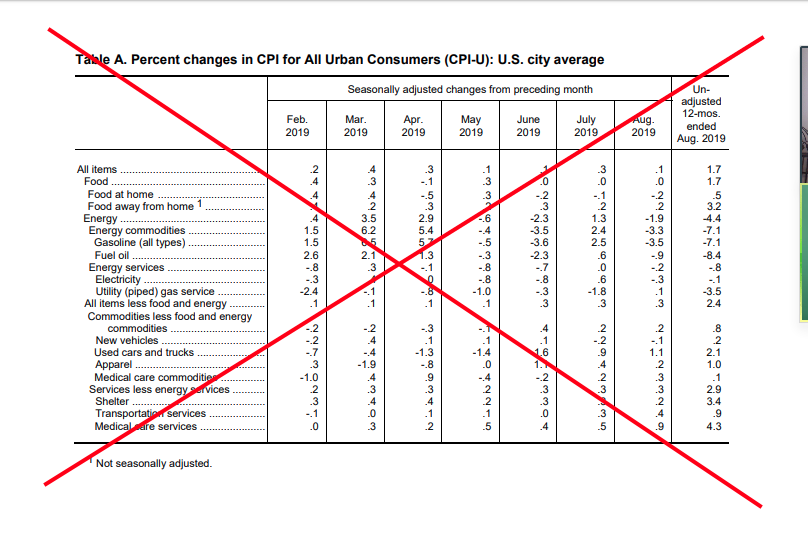

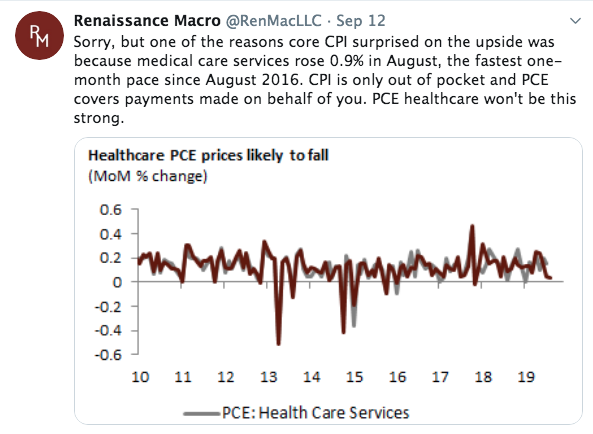

- Core CPI rose in the month of August, to its highest level since 2018.

- The biggest contributor to the increase in core CPI in August was the Medical care services line item displayed above.

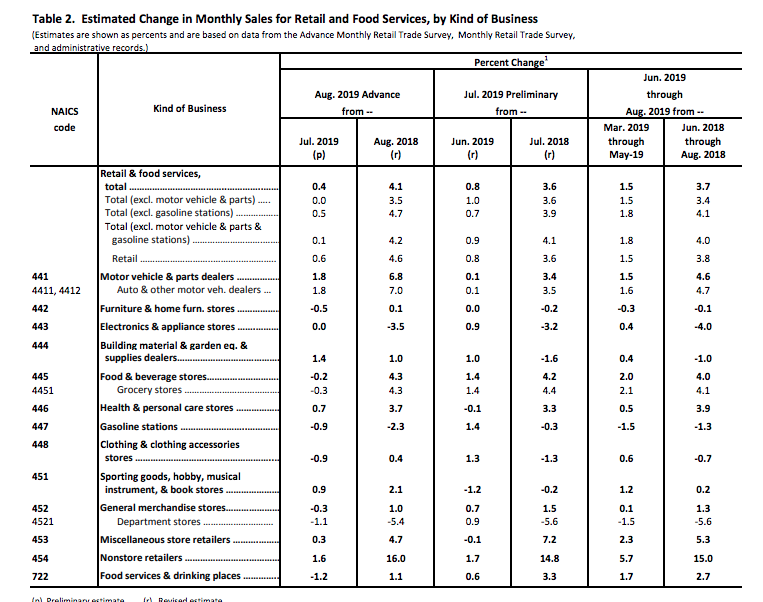

- Retail sales were also very strong in the month of August, growing by .4% and doubling economists’ estimates.

- Retail sales accelerated to a 4.1% YoY growth rate. Dept. store sales were down 1.2% MoM and 5.4% YoY.

- Nonstore sales (online) rose 1.6% MoM and 16% YoY

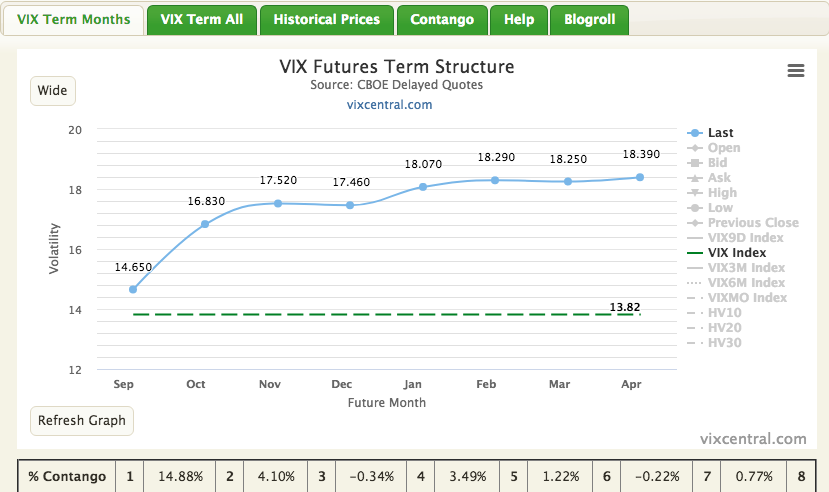

- 30-day implied volatility as measure by the VIX has been downtrending over the last 10 days and dropped below 14% this week.

- VIX futures, however, might be indicating a near-term rise in volatility, given the appearance of VIX futures term structure.

- Next week is VIX Futures expiration week, come Tuesday. The roll yield on m2/Oct. Futures suggests investors don’t anticipate the VIX remaining at these levels, but lifting over the near-term.