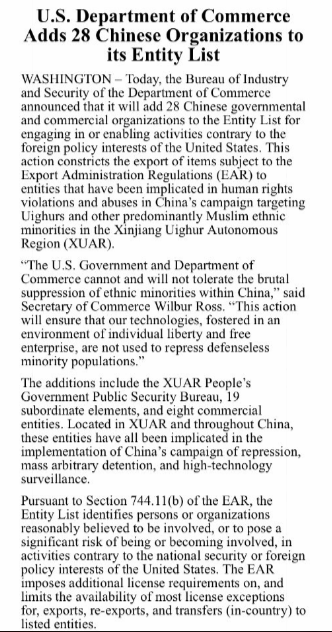

Ahead of the Thursday resumption of U.S./China trade talks, it seems both parties are doing their best to impede progress toward some sort of deescalation in the 15-month trade feud. The U.S. Commerce Dept. announced 28 new additions to its blacklist of Chinese entities, over human rights of its Muslim minority the Uighurs.

Not necessarily in response, but rather because of, Chinese state-run television network CCTV said it was suspending the current broadcast arrangements for the NBA’s preseason games in China. Tencent, which owns the digital streaming rights for NBA in China, said it would also “temporarily suspend” the preseason broadcast arrangements.

The decision follows a tweet made by Houston Rockets General Manager Daryl Morey in which he showed support for the anti-government protests in Hong Kong. The tweet, which was later deleted, drew strong criticism in the world’s second-largest economy.

While these tit-for-tat measures have been taken, U.S. officials are trying to put on a brave face and urging the public to do much the same by suggesting something more positive may come out of the negotiations this week. White House economic advisor Larry Kudlow said Friday that “positive surprises” could emerge from the trade talks between the U.S. and China next week in Washington.

“There could be positive surprises coming out of these talks. I’m not predicting. I’m just saying don’t rule that out. There could be some positive surprises.”

Coming into this, China has been buying some commodities. A small amount, but perhaps a good sign.”

Of course the comments from Kudlow don’t point to anything new or groundbreaking. Nonetheless, President Donald Trump stayed true to form, suggesting a deal is possible.

Unfortunately, what investors have come to realize over the last year or so, is that possible does not equate to probable. Over this time period, the trade feud has only escalated, dragging down global economic growth with it. Speaking of economic growth, this week will also prove a heavy economic calendar week for China, which released its latest service sector data overnight.

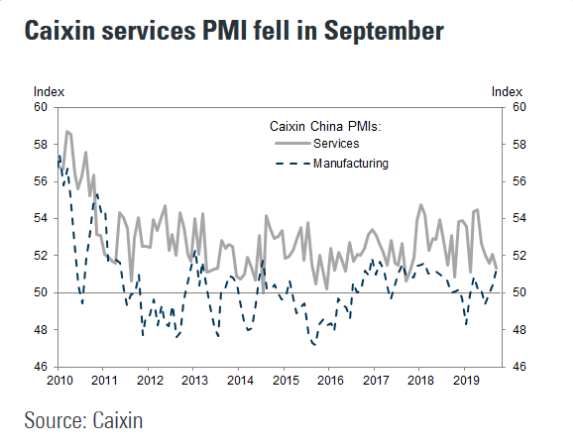

The Caixin China services purchasing managers index slipped to 51.3 in September from 52.1 in August, Caixin Media Co. and research firm Markit said Tuesday. The reading, the lowest since February, remained above the 50 mark that separates expansion in activity from contraction.

Services providers’ expectations of the sector’s development fell to the lowest level on record and companies are less optimistic about the sector, Caixin said.

Still, services companies in China experienced the quickest rise in new orders since the beginning of 2018, reflecting stable demand in the sector. The subindex for new export orders continued to drop in September, indicating that growth in new business was mainly driven by domestic demand.

Thanks to higher new orders, the subindex measuring services firms’ hiring rose sharply in September, reaching its highest level since January 2017, said Caixin.

China’s service sector is somewhat mirroring the weakness in the U.S. service sector, both parties would benefit from some sort of reversion to the trade status quo of the pre-Trump era. Most economists and analysts have moved away from the belief that a deal is going to be struck any time soon. As such, the last bastion of trade hope is for deescalation and a continuation of negotiations on the more pressing issues, going into 2020. Here’s what Goldman Sachs DOESNT expect from this week’s trade talks:

GOLDMAN Sachs: ” … we don’t expect an end to the conflict anytime soon and see no comprehensive US-China trade deal until after the 2020 election at the earliest. So policy uncertainty will likely remain a drag on sentiment for the foreseeable future.

On balance, we now think that the October 15 increase in US tariff rates on $250bn in imports from China may be delayed for at least a short period, in order to provide a bit more time for the negotiators to hammer out a mini-deal after the Chinese delegation headed by Vice Premier Liu He arrives in Washington for talks on October 10-11. However, regardless of the near-term outcome, we don’t expect an end to the conflict anytime soon and see no comprehensive US-China trade deal until after the 2020 election at the earliest. So policy uncertainty will likely remain a drag on sentiment for the foreseeable future.”

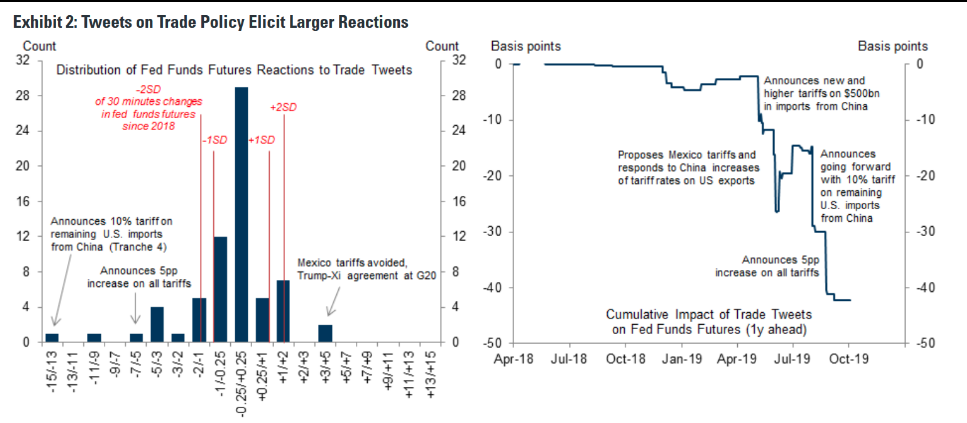

Deal or no deal, Goldman has recognized the power of Trump tweets. The evidence that President Trump’s trade-related tweets affect market expectations of Fed policy is strong. The moves in the fed funds futures market following such tweets are statistically highly significant, and the cumulative impact across all such tweets in our sample is about -40bp when we include both tweets indicating escalation of trade tensions and tweets indicating deescalation, and about -60bp when we focus only on tweets indicating escalation.

Much like Goldman Sachs, CNBC’s Jim Cramer suggests that investors shouldn’t hold their breadth when it comes to a trade deal as well.

“Chinese would rather take the pain of the tariffs than to give President Trump what he wants.”

Cramer’s sentiment and comments come on the heals of a good deal of noise and posturing by both parties ahead of the talks. A recent Bloomberg article over the weekend points toward Chinese trade delegates having a prepared offering for it’s U.S. counterparts to consider, but one that doesn’t offer that which the President desires the most, intellectual property right protections.

“Chinese officials are signaling they’re increasingly reluctant to agree to a broad trade deal pursued by President Donald Trump, ahead of negotiations this week that have raised hopes of a potential truce.

In meetings with U.S. visitors to Beijing in recent weeks, senior Chinese officials have indicated the range of topics they’re willing to discuss has narrowed considerably, according to people familiar with the discussions.

Vice Premier Liu He, who will lead the Chinese contingent in high-level talks that begin Thursday, told visiting dignitaries he would bring an offer to Washington that won’t include commitments on reforming Chinese industrial policy or the government subsidies that have been the target of longstanding U.S. complaints, one of the people said.“

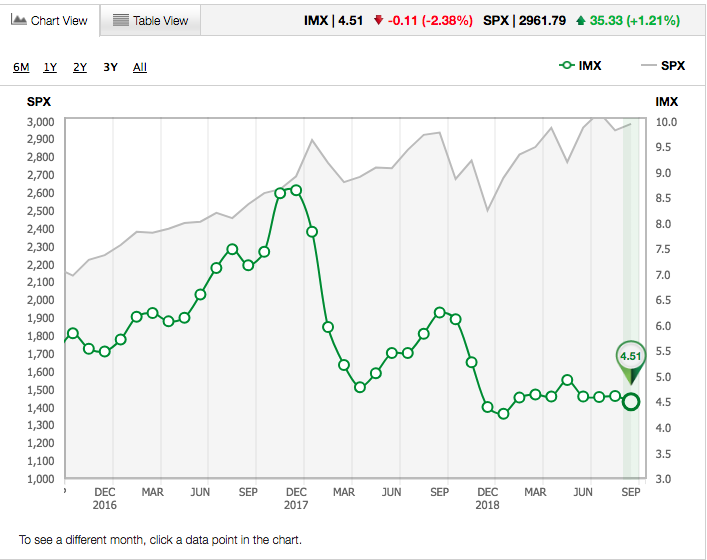

At present, one thing is very clear on the trade front: Expectations are low that this week’s talks between the U.S. and China will lead to a breakthrough or will be sufficient to postpone further the next round of tariff increases set for next week. With the uncertainty that comes from trade talks this week, the market had taken a step back/down on Monday. The S&P 500 (SPX) led the way lower by nearly half a percent, as U.S. equity futures continue to fall on Tuesday with now breaking news that Brexit talks are “close to breaking down”. Geopolitical uncertainty is clearly weighing down investor sentiment. Such sentiment can also be found with individual investor activity and through the latest release of the TD-Ameritrade Investor Movement Index (IMX).

TD-Ameritrade’s IMX metric, which tracks retail investor sentiment, was lower in September at 4.51 (down from 4.62) due to net selling and shifting into less risky assets such as bonds. It is the lowest reading since January 2019.

TD Ameritrade clients reduced exposure to equity markets during the September period, but found some names to buy. Slack Technologies Inc. (WORK), which issued earnings for the first time since its public-market debut, traded lower after missing on earnings and was a net buy. Walt Disney Company (DIS) was a net buy after it received an analyst upgrade and a price target increase. Uber Technologies Inc. (UBER), which was popular at the Delivering Alpha Conference and covered by two investment managers, was also a net buy. Abbvie Inc. (ABBV) reached a 52-week low during the period, but received an analyst upgrade citing its current valuation builds in a more pessimistic view of its acquisition target, Allergan (AGN), and was net bought. Roku Inc. (ROKU), which had risen over 400% year-to-date before trading lower following Apple’s streaming TV announcement, was net bought.

Additional popular names bought include Shopify Inc. (SHOP), Altria Group Inc. (MO), and Ulta Beauty Inc. (ULTA).

Apple Inc. (AAPL) made news during the period by announcing a streaming TV service, Apple TV Plus, with a price point of $4.99 per month, and was net sold as the stock neared an 11-month high. Facebook Inc. (FB) was net sold as the stock traded lower following the Senate announcing Big Tech antitrust hearings. Alibaba Group Holding (BABA) saw some volatility during the period after news broke the U.S. could delist Chinese companies traded in New York, and was net sold. Netflix Inc. (NFLX) was net sold after the streaming wars heated up, and the CEO announced tough competition was coming from AAPL and DIS. Chip makers Micron Technology Inc. (MU) and Intel Corp. (INTC) were both net sold. MU reached a 52-week high early in the period, then traded lower after missing on earnings and lowering guidance. INTC traded higher as a company executive announced optimism regarding cloud spending.

Additional names sold include Nvidia Corp. (NVDA), Boeing Co. (BA), and Alphabet Inc. (GOOG).

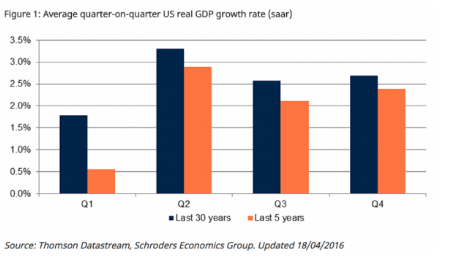

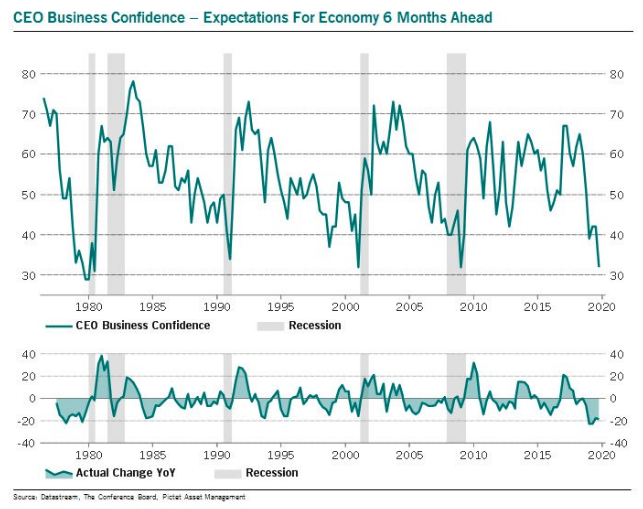

What investors are seeing in the way of geopolitical turmoil suggests that eventually markets will fall under the weight of a slowing global and domestic economy. Like China, the U.S. has witnessed a contraction in manufacturing and a slowdown in its service sector industries, as the trade war has carried forward. While the data from these industries is soft data, surveys, many economists remain of the opinion that the longer the soft data weakens it will eventually show up in the hard data.

The hard data, which refers to actual numbers about the economy such as unemployment and retail sales, continues to reflect economic strength.

The U.S. unemployment rate fell to a 50-year low in September while retail sales grew more than expected in August. But equity markets have struggled in recent months amid disappointing soft data, which includes corporate and consumer sentiment surveys as well as purchasing managers’ index (PMI) numbers.

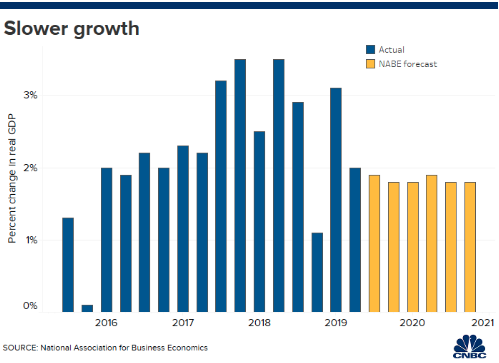

A survey released Monday by the National Association for Business Economics showed respondents expect the U.S. economy to grow by less than 2% next year as the trade war rages on. That would be the slowest pace for U.S. economic growth since 2016.

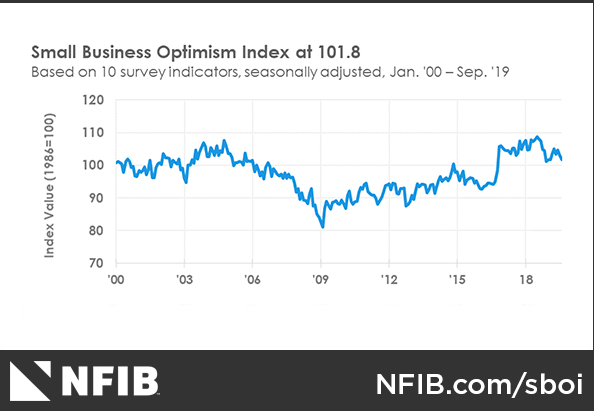

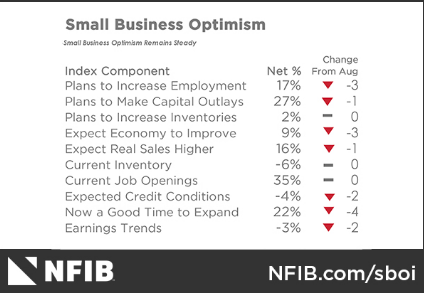

In addition to the NABE survey, the latest NFIB survey showed some weakening of business sentiment. The small business Optimism Index maintained a historically solid reading, but took a dip in September, falling 1.3 points to 101.8. September’s figure falls within the top 20% of all readings in the Index’s 46-year history. The survey shows no sign of a recession and indicated continued job creation, capital spending, and inventory investment, all consistent with solid, but slower growth. The Uncertainty Index rose 2 points, revisiting high levels of concern.

“As small business owners continue to invest, expand, and try to hire, they’re doing so with less gusto than they did earlier in the year, thanks to the mixed signals they’re receiving from policymakers and politicians,” said NFIB President and CEO Juanita D. Duggan. “All indications are that owners are eager to do more, but they’re uncertain about what the future holds and can’t find workers to fill the jobs they have open.”

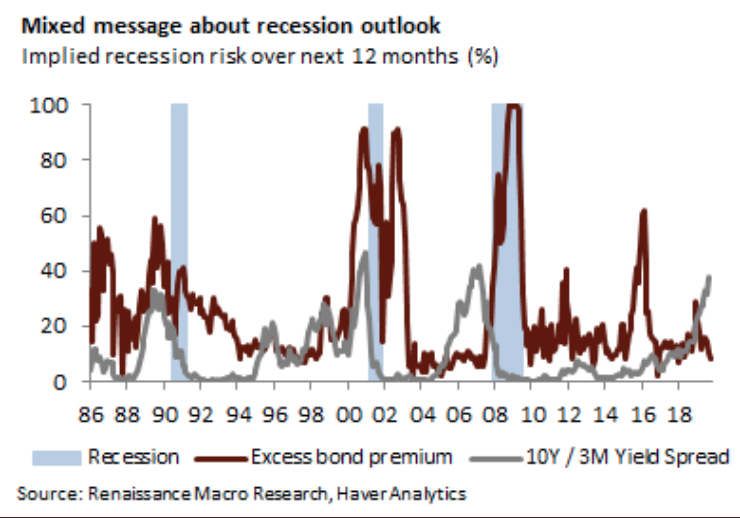

A recession doesn’t seem to be on the minds of consumers or small business operators, even though it’s all market participants seem to talk about of late. While the Treasury market is sending a loud recession signal for the next 12 months, corporate credit is singing a different tune altogether. In September, the excess bond premium, a measure of risk taking in corporate credit, implies less than a 10% chance of recession in the next 12 months.

With a very light economic data calendar this week, investors will remain highly focused on the geopolitical headlines, and possibly those frequently updating the impeachment inquiry process. With that being said, the probability of market weakness remains even, as the market looks to price in some potential fallout from the trade talks set to take place on Thursday and Friday.

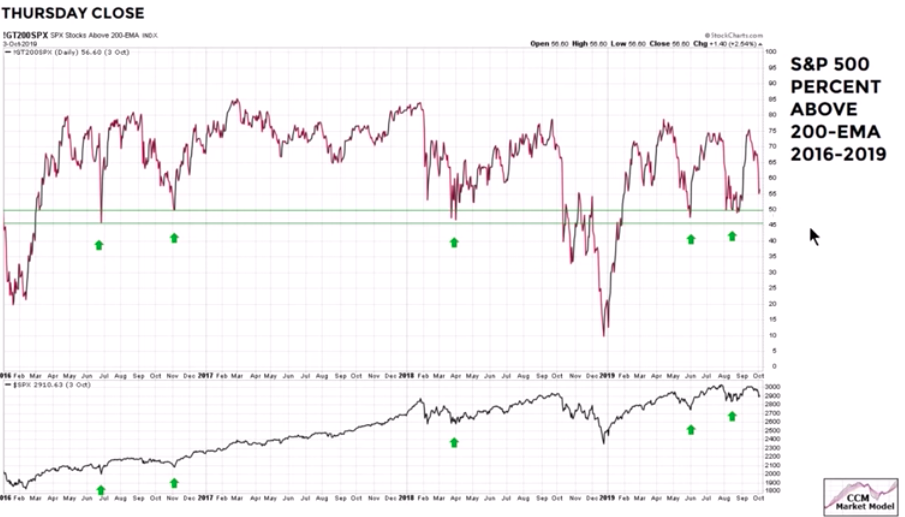

Several market internals suggest that while the S&P 500 did a great deal of heavy lifting last week, in order to recapture the 50-DMA, market internals spoke to some further deterioration ahead.

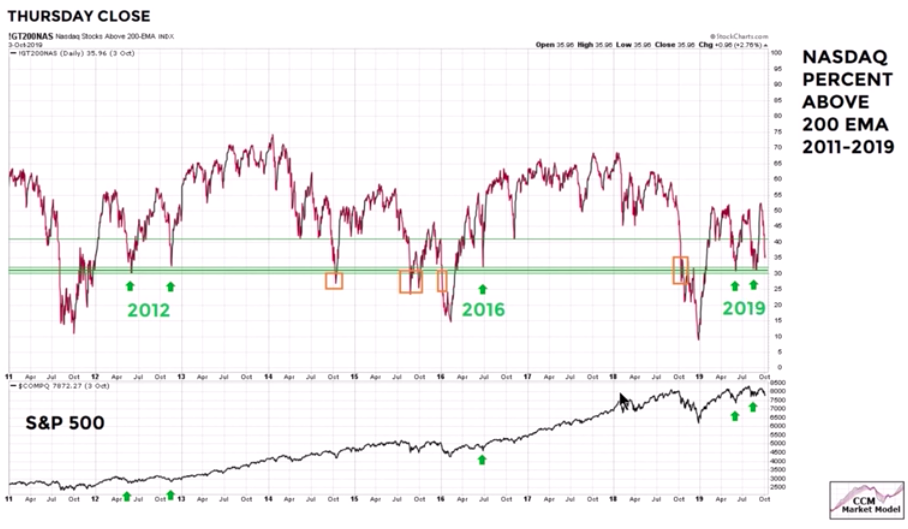

As shown in the chart above, the number of S&P 500 stocks above the 200-EMA had weakened last week and looks as though it will need to touch the support line before bouncing once again. The same can be said for the Nasdaq (NDX) as shown below:

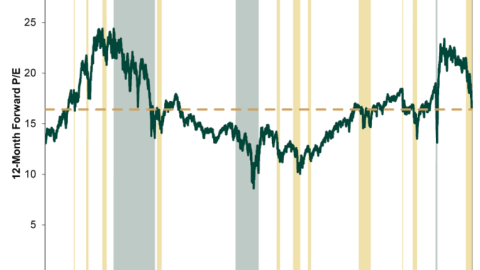

While the S&P 500 has fallen in each of the last 3 weeks, it remains only a couple percentage points off the all-time highs. Investors have been net sellers, deleveraging and hedging ahead of trade talks. Even so, a range of indicators including investor positioning before the most recent slump in markets suggests that the drawdown is about half finished, and will prove to be less painful than the rout last December, according to JPMorgan Chase & Co. analysis.

“Since corrections tend to be largest when markets are expensive and over-owned and when market depth is poor, these indicators give a sense of vulnerability even if they cannot anticipate the timing of a random shock,” John Normand, head of cross-asset fundamental strategy at JPMorgan, wrote in an Oct. 4 note. “Entering October, vulnerabilities were moderate rather than high.”

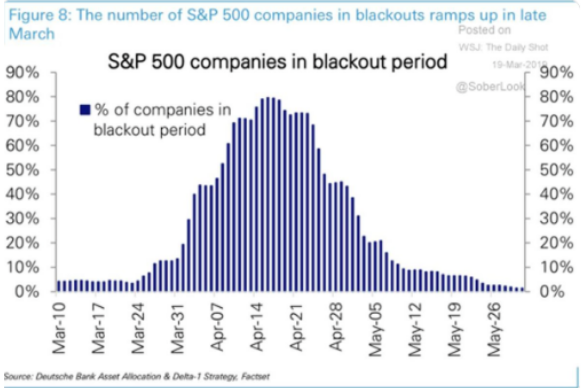

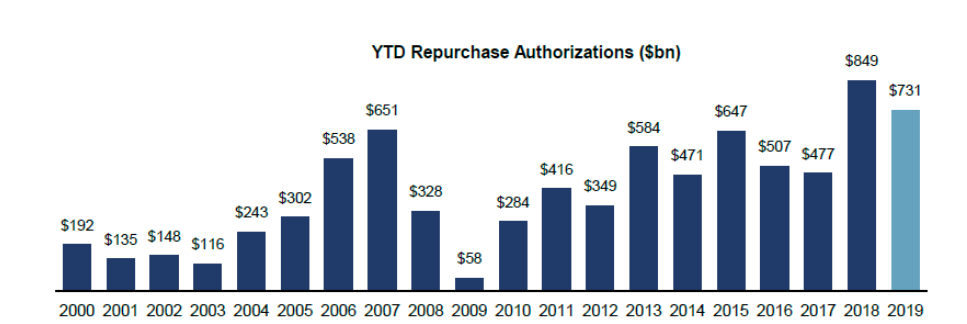

Moreover, the buyback bid for stocks has not left the building, despite heading into the heart of earnings season. In fact, one of the most significant reasons for the market come back late last week rest squarely on the shoulders of those corporate buybacks. Seems like the buyback bid once again saved markets from an even deeper decline last week, despite being in a partial black-out period. A few days into the sell-off, U.S. corporates increased buyback intensity by 50%, according to Goldman Sachs.

- Last week, we saw an uptick in buyback flows in response to broader market pullbacks midweek with the week’s ADTV tracking 1.5x vs 2019 ADTV.

- Though we are in blackout, it is important to note that U.S. corporates can continue to repurchase stock under 10b5-1 plans during this period.

- We witnessed many of our 10b5-1 plans, typically structured as scaled buy orders, materially increased rate on Tuesday and Wednesday as the broader market prices declined.

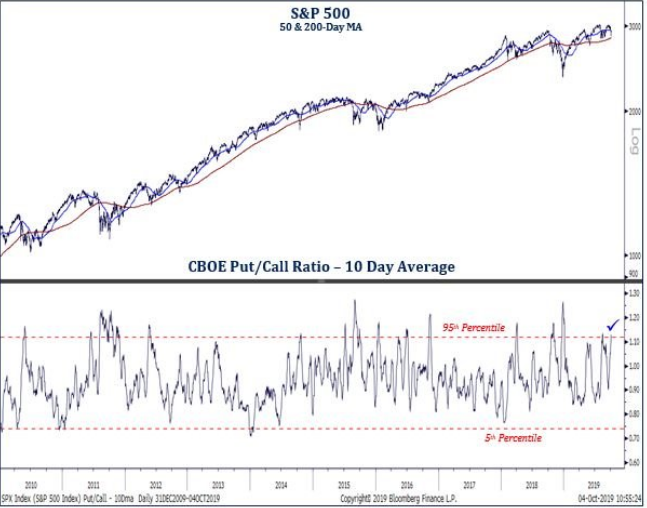

Again, while investors have been net sellers, it appears as though corporate buybacks are scooping up their proxy for earnings going forward. Selling and hedging is abound for the average investor and appears as though Tuesday’s market open will be met with much the same activity as Dow Futures are pointing to another triple digit loss at the open. With all the hedging and options activity of late, we’ve seen a sharp rise in the put/call ratio.

When the 10-day put/call ratio average enters the 95th percentile it is historically consistent with above average forward returns, according to the chart from Strategas’ Chris Verrone.

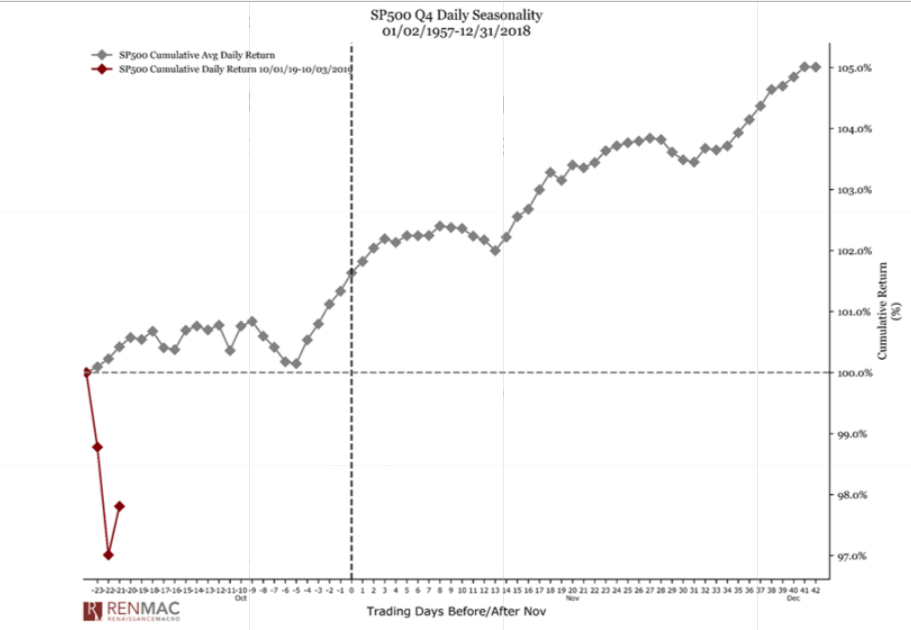

For investors, the current week marks the second week of trading for the month of October.

The third week in October has historically marked the beginning of the 4th quarter seasonal thrust for equities. Of course, that will largely depend on the results of trade talks and investor sentiment surrounding the pending earnings season. Moreover, least we forget the Fed. That’s right, the Fed will lend itself as support for markets going forward as well, especially if the economic data continues to wane. How much will lower rates benefit economic activity remains to be seen, but thus far the housing sector has outperformed and showing most major housing sector data growing YoY at this stage of 2019. It’s extremely difficult to produce a recession with new home sales at cyclical highs and household debt-to-income ratios at levels not seen since the 1970s, with rising wages to boot.