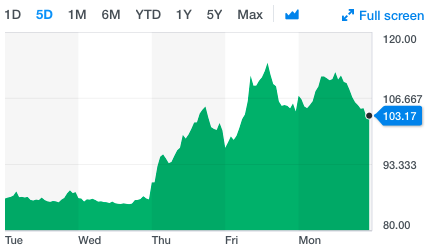

If you thought you were getting off the rollercoaster ride that is the stock market on Monday, think again. The major averages witnessed significant selling pressure throughout the morning on Monday, with the Dow down roughly 250 points at its low. But all 3 major averages staged a dramatic turnaround in the afternoon with the Dow finishing in positive territory and outperforming its peers. The Dow ended up about 40 points, or 0.2%, at 26,487, but the S&P 500 index finished the session less than 0.1% lower at 2,884, while the Nasdaq Composite Index closed down 0.7% at 7,736.

“The technical underpinnings of the equity markets argue on the side of caution. Despite new highs by the S&P 500 and Dow Industrials just a few days ago, the broad market continues to deteriorate,” said Bruce Bittles, chief investment strategist at Baird, in a note. “Less than 50% of S&P 500 and Nasdaq stocks are trading above their 50-day moving averages. Although the popular averages remain in close proximity to record highs, the number of NYSE issues hitting new 52-week lows doubled from the previous week.”

With the bond market closed yesterday, volumes were inherently lighter yesterday, lending the market vulnerable to whipsaw-like action. Much of the market angst continues to underscore the fear of rising rates and yields. Coming into the Tuesday trading session, Wall Street is pointing to another negative open with the 10-yr. Treasury note higher, tipping over 3.25% at the moment.

Rising rates, a weaker Yuan and stumbling global equity markets has many investors already heading for cover as the 4th Quarter gets underway. So why not pile it on with a negative global growth revision by the International Monetary Fund (IMF)? In its new forecasts issued concerning its world economic outlook, the IMF cut its global growth forecast for this year and next to 3.7%, which for both years is 0.2% below its prior forecast in July. This reflects weaker growth in advanced economies, rising trade tensions and higher oil prices. Recent data show weakening in trade, manufacturing and investment, said IMF chief economist Maurice Obstfeld. Global growth appears to have plateaued.

The IMF predicted the Federal Reserve will hike rates in December and four times next year to about a 3.5% rate by the end of 2019.

Although the S&P 500 is decisively lower over the last couple of weeks, the “buy the dip” investor is still buoying the market. We’ve seen this in each of the past 3 sessions, which started with a sizable sell-off but bounced back to some degree intraday. The S&P has closed at least 0.5% above its low of the day in each trading session.

Yesterday, the dip buyers pushed the S&P to within 0.01% of the previous day’s close. Recall, we began the trading week at roughly 2,885 on the S&P 500.

The market rebound on Monday, may prove only to be followed up with additional near term selling. Having said that, Finom Group wishes to reiterate that we view the selling pressure as a medium term opportunity to buy stocks or sectors with sound fundamentals. To some degree, Finom Group understood that Monday’s intraday reversal was likely and as we alerted our subscribers within our private Twitter feed. (See tweet below)

The CBOE equity put/call ratio was as high (.84%) as it had last been in February and ahead of the market correction. The level often coincides with a near-term bottom for which traders can attempt to trade off a bottom. In addition to the aforementioned tweet to subscribers, we alerted to some short-volatility trades that proved advantageous with the VIX also staging an intraday reversal to some degree. Coming into Tuesday’s trading session, the CBOE equity put/call ratio is roughly .66% with the VIX ramping higher once again, for reference.

Equity markets will likely continue to grapple with the effects of rising rates and yields until the 10-yr. settles into a new range, above 3% but sub 3.35 percent. As such, investors can and should expect greater volatility than that which took place from the late spring through summer months.

Depicted in the chart above is more near term volatility expectations as the Volatility of Volatility Index (VVIX) is signaling more market turbulence. VVIX rises with greater call option buying and is presently above 100 after falling as low as 84 last week.

Seeing how we may pick up with more market selling pressure and volatility on Tuesday, here is what CNBC’s Jim Cramer had to say about Monday’s market action.

“A new line of thinking has bubbled up on Wall Street, one that says interest rates have overshot their sustainable levels. And while the Federal Reserve insists that this thesis is wrong, Cramer said it could have an important effect on stocks.

If long-term rates stabilize here, … guess what? You could see a humongo rally, and these managers want to capture those potential gains,” he said. “That’s what helped us in the afternoon.

Finally, investors are starting to realize that stocks are oversold, which leads them to start checking items off their stock-picking shopping lists.

We’d been going down to the point where many people who’ve been waiting to do some buying finally came in and did some buying,” Cramer said. “That’s money management 101.”

Jim Cramer is not the only market pundit that believes the current market retreat will eventually give way to a market rebound. AB Bernstein’s top equity strategist believes the latest sell-off in equities will give way to gains through the end of the year.

“When yields experience large changes in short periods of time, stocks can struggle to digest the moves,” Bernstein’s Noah Weisberger wrote recently. “So long as signs continue to point to a growth-driven move in yields, we think that over the medium term, stocks will fare well. We would argue that financials have been held back over the last several months, with scope to catch up to where yields are already.”

“Higher yields tend to be positively correlated both to stock returns and to measures of economic growth, indicative of the direction of causality running from economic outcomes to markets,”

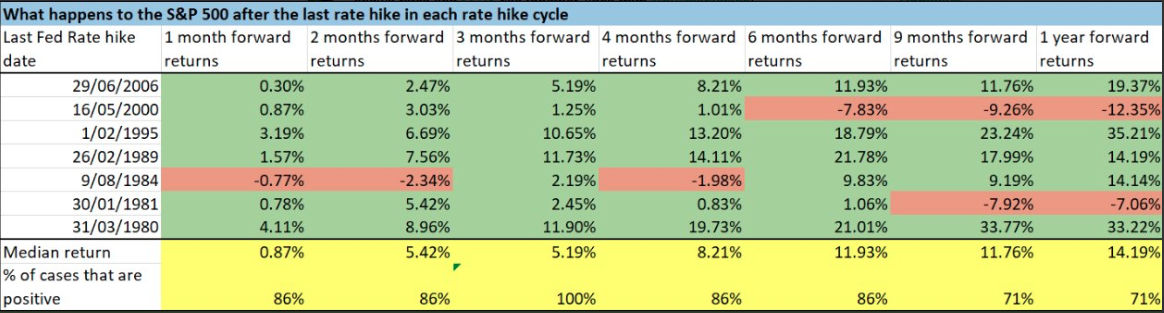

The following chart coincides with Weisberger’s analysis of rising rates and how they correlate to equity market performance.

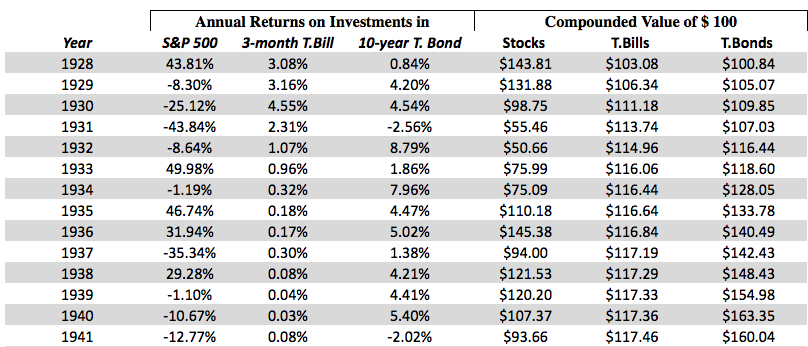

The market does indeed, historically, rise as rates rise. One has to go back to the late 1960s to find a period for which rates/yields and equities didn’t rise together. Moreover, from 1928 – present, there have only been 3 years during which the stock market went down while interest rates went up! (1931, 1941, and 1969) The modern economy does not reflect the factors in place some 50, 60 and 70 years ago that produced market declines as rates rose.

Unfortunately, we can’t provide a full screen shot of the aforementioned dates and statistics, so here is a link provided by NYU Stern School of Business depicting the performance of bond yields and equity market historically, line by line.

The data is irrefutable, although many market participants would have investors believe that markets perform poorly during periods of rising rates. When rates rise, it is usually a measure of economic strength that filters into corporate profits. Naturally, a tipping point between such profits and rising rates is always reached whereby those rising rates actually curtail profits in the form of inflation. But we are nowhere near that point at present. Some market pundits are not of that same opinion.

Wharton School finance professor Jeremy Siegel is predicting a difficult time ahead for the stock market. With all the good news on earnings already priced into equities, rising interest rates are now a “major impediment” for the fourth quarter he said in an interview recently on CNBC.

“It’s psychology. Look at all the potential negatives.

- U.S. government deficit of $800 billion and the Federal Reserve selling Treasury bonds as it unwinds it balance sheet.

- Plus, the Chinese haven’t been buying Treasurys.

“When faced with these types of factors with low rates, investors thought they could “relax. Now they are concerned it may be a problem for equities and bonds.

That sort of psychology is going to creep into the decisions that are going to make this quarter a difficult one. Not a bear market, it’s just that the good news is out there [in the market]. I don’t see any more … good news. I see potential risks. On a long-term basis the market isn’t overvalued, it just has to digest the news of a higher interest rate scenario. Therefore, in the end, the stock sell-off is healthy.”

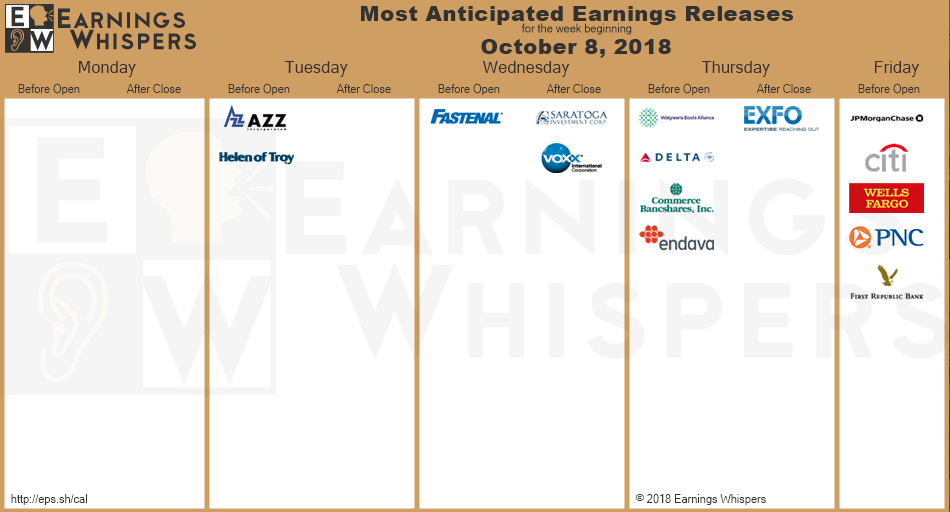

All of these various viewpoints on the current market pause/pullback can be confounding, befuddling and simply downright confusing. Ultimately, we have to listen to what corporate earnings and guidance suggests to investors. Banks will be kicking-off the earnings season come this Friday.

In terms of the economy, we understand the economy is still expanding… even with rates and yields rising. The latest view into the strength of the economy came within this morning’s reading on small business sentiment. The National Federation of Independent Business small-business optimism index fell 0.9 points in September to a seasonally adjusted level of 108.8. September’s slight downturn was the third-highest reading on record. Consumer spending temporarily slowed in August, likely producing excess inventories but has picked up again which will reverse the build-up.

“This is the longest streak of small business optimism in history, evidence that tax cuts and regulatory rollbacks are paying off for the economy as a whole,” NFIB President Juanita Duggan said in a statement. “Our members say that business is booming and prospects continue to look bright.”

Small business owners continue to face labor force challenges, but are increasing compensation to keep up,” said NFIB Chief Economist Bill Dunkelberg. “With profits and investment remaining strong, our hope is that policymakers will stay the course and not screw around with success.”

And that is where we leave our readers! Stay nimble in this topsy turvy market and with volatility rising. Look for opportunities to buy strong companies and/or sectors during the market pullback/pause and keep an eye and ear pointed toward earnings commentary.

Tags: SPX VIX SPY DJIA IWM QQQ TLT TNX TVIX UVXY VVIX WMT