-

Seth Golden posted an update 4 years, 4 months ago

Goldman on NFP: “We estimate nonfarm payroll growth accelerated from the +2.5mn record gain in May to +4.25mn in June (vs. consensus of +3.0mn)”

-

Seth Golden and

Mikecontango23 are now friends 4 years, 4 months ago

-

Seth Golden and

Jonathan T Klein are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

Tony Dwyer: “Following initial ramp to 3,200, we have been anticipating a multi-week/month period of consolidation w/intention of incrementally adding risk each time SPX pulls back to 3,000.” -

Seth Golden posted an update 4 years, 4 months ago

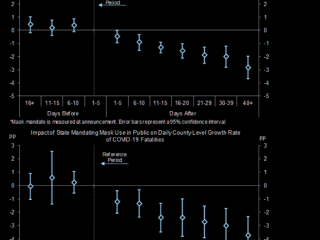

1. GS argues that a national face mask mandate could partially substitute for renewed lockdowns.2. “We find that face masks are associated with significantly better…

-

Seth Golden posted an update 4 years, 4 months ago

-

Seth Golden and

Jazz Khanna are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

Morgan Stanley Chief Economist: Looking ahead, we do expect new clusters of infections to emerge, and our base case assumes a second wave in the autumn and winter. However, we think that public health systems will be better positioned to manage the second wave. Testing and tracing capacity are ramping up, the authorities are more attuned to…[Read more]

-

Seth Golden and

Sanjay Hingorani are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

-

Seth Golden and

Aggy K are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

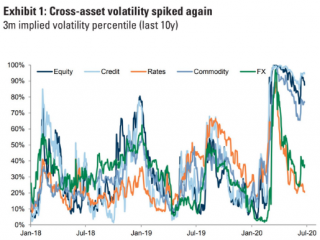

Goldman: “while equity volatility should normalise further with a better macro backdrop, it is likely to remain elevated compared with long-run history in the coming months” -

Seth Golden posted an update 4 years, 4 months ago

Citigroup: 1. Easy money/ loose monetary conditions helps to suppress equity market volatility and reduce the ‘fatter’ left tail in the return distribution

2. positive economic surprises increase confidence that 2021 EPS can bounce materially

3. We want to buy this equity ‘dip’

4. The search for yield could return as

a driver of spreads…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

JPM MId-year outlook: After month-end and the summer months, we expect volatility to decline and see the VIX falling by half, declining from 30 to 15. Lower volatility should drive equity inflows, while the present value of earnings is higher due to lower rates. Value experienced a record rally in May and then a slight pull back, but Value should…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

GS now estimating $65bn of rebal selling

The flow is very well-understood by the market and it has been frustrating for bears that we traded so well earlier….But as the Program Trading desks always say….”a sell-flow of >$50bn is a sell-flow of >$50bn….”

….. it needs to get executed…and it way more often than not has market impact with…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

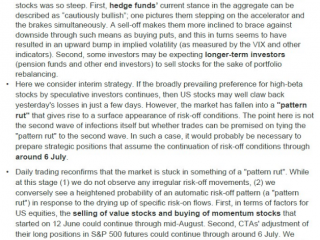

Nomura on yesterday’s sell-off -

Seth Golden posted an update 4 years, 4 months ago

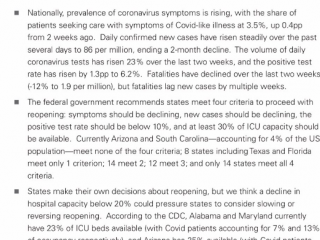

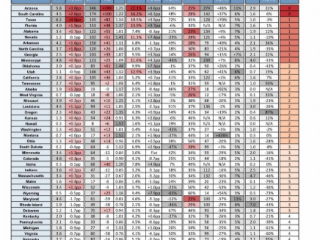

Goldman State Covid tracker -

Seth Golden and

Brandonb1 are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

Pantheon Macro: -

Seth Golden posted an update 4 years, 4 months ago

Deutsche Bank: Before we get too bearish on a Monday morning it is just worth revisiting the “sentiment & positioning” data. Yes – it has become less bearish over the… - Load More