-

Seth Golden posted an update 4 years, 7 months ago

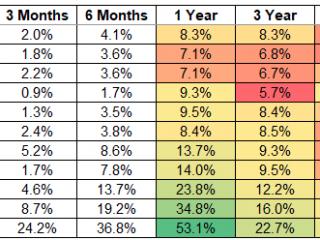

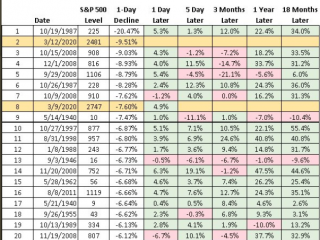

Once stocks fall 20%, long-term returns start to improve with every painful leg lower. This is why it’s so important to stay in the game. -

Seth Golden posted an update 4 years, 7 months ago

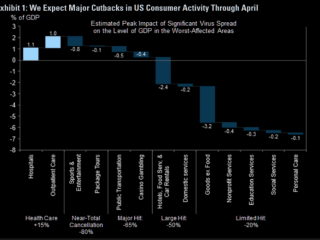

Goldman: “we now expect real GDP growth of 0% in Q1 (from +0.7%), -5% in Q2 (from 0%), +3% in Q3 (from +1%), and +4% in Q4 (from +2¼%), with further strong gains in early 2021. This takes our 2020 GDP forecast down to +0.4% (from 1.2%).”

-

Seth Golden posted an update 4 years, 7 months ago

Bank of America Merrill Lynch -

Seth Golden posted an update 4 years, 7 months ago

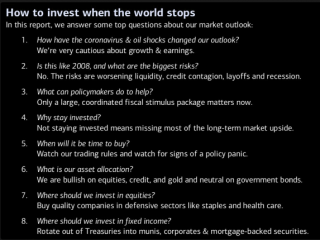

GS: There is no systemic risk

Feedback from conference call held Sunday.1. 50% of Americans will contract the virus (150m people) as it’s very communicable. This is on a par with the common cold (Rhinovirus) of which there are about 200 strains and which the majority of Americans will get 2-4 per year.

2. 70% of Germany will contract it (58M…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

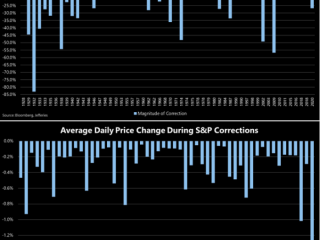

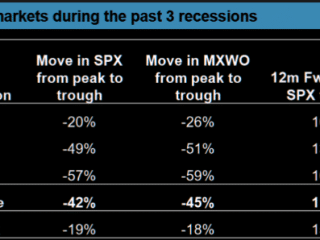

Although nearly 1/3 of the corrections we have seen over the past ~100Y have been worse in magnitude compared to where we are today, we have never seen an SPX correction… -

Seth Golden posted an update 4 years, 7 months ago

JPM Mislav Matejka, head of equity strategy: we could see a more sustained rally if/when

1. We get a much more aggressive fiscal policy response

2. If the original problem, virus outbreak, starts showing clear signs of seasonality/peaking out

3. If markets overshoot in pricing in of a recession, something which we think we are still some way away…[Read more] -

Seth Golden and

Samir Ruparel are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

Yesterday’s daily drop makes the list as #2 worst day ever. Accordingly, today “should” be an up day. -

Seth Golden posted an update 4 years, 7 months ago

MORGAN STANLEY: “.. it is time to start adding to equity risk for longer term investors. Fed action is likely to be imminent, swift and substantial. While that will n… -

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

The only modern comparable to now is 1987

– $SPX fell 20% in one day, rose 15% the next 2 days, then returned to the low the following week

– Then rose 15% again and then retested the original low 6 weeks later

– It was up 25% a year later and back at prior highs 2 years later -

Seth Golden posted an update 4 years, 7 months ago

Leuthold Group’s James Paulesn compares 1987 crash with 2020 -

Seth Golden posted an update 4 years, 7 months ago

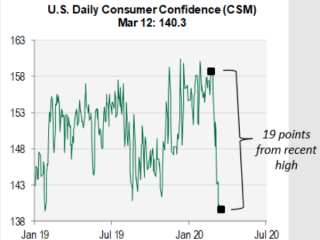

Cornerstone Macro proprietary consumer sentiment survey -

Seth Golden posted an update 4 years, 7 months ago

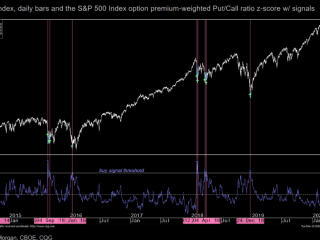

The CBOE VIX Index closed at 75.5 today, the 4th highest close ever. In every instance from this/similar levels, the S&P 500 rallied by +10% immediately thereafter & over just 1 or 2 days

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

GOLDMAN: sets new mid-year S&P 500 target of 2450, “(15% below the current level and 28% below the market peak.)”

-

Seth Golden posted an update 4 years, 7 months ago

JPM Technical analyst: Historically, similar extreme technical conditions led to multi-week rebounds, even in cyclical bear markets. While there is always the concern… -

Seth Golden posted an update 4 years, 7 months ago

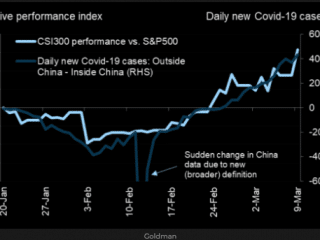

1. Chinese A shares have been a bright spot in the global equity arena, losing only 1% and outperforming its peers (MSCI AC World) by 17pp since the peak of global… -

Seth Golden posted an update 4 years, 7 months ago

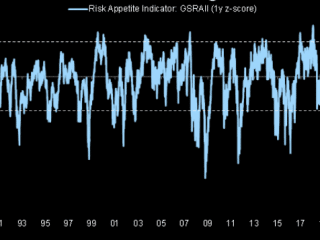

Goldman´s RAI is now below GFC trough levels - Load More