-

Seth Golden started the topic Goldman on Trade in the forum S&P 500 Analysts Notes 5 years, 2 months ago

GOLDMAN SACHS: “While we no longer expect a comprehensive trade deal with China, we think the more likely path is one in which President Trump puts tariffs on the back burner as we approach the November 2020 election.”

-

Seth Golden replied to the topic Morgan Stanley S&P 500 Underweight from Equalweight in the forum S&P 500 Analysts Notes 5 years, 2 months ago

MS Cross Asset Strategist, Andrew Sheets:

“Last week’s rally shined a light on the market’s bull case, and the importance of a better economy to that story. Given our cautious views on growth, trade progress and central bank action relative to consensus, we maintain our cautious stance. But this week was a shot across the bow: if we’re wrong…[Read more]

-

Seth Golden and

JJ are now friends 5 years, 2 months ago

-

Seth Golden posted an update 5 years, 2 months ago

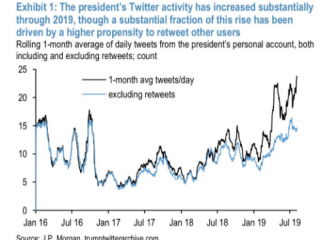

though a substantial fraction of this rise in activity comes from an increased propensity to retweet others.” -

Seth Golden posted an update 5 years, 2 months ago

Trump has averaged 10+ tweets a day since the start of 2016. “Starting in late 2018, however, activity has picked up substantially. The highest volume of tweets over the past four years has in fact come in recent months.” -

Seth Golden posted an update 5 years, 2 months ago

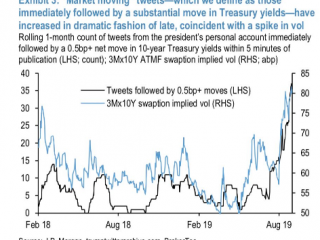

Volfefe corresponding chart -

Seth Golden posted an update 5 years, 2 months ago

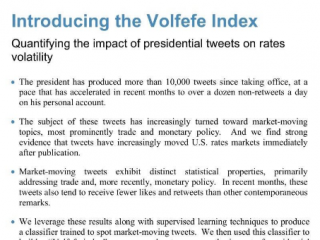

J.P. Morgan introduces the Volfefe Index… seriously! -

Seth Golden and

Brian Strang are now friends 5 years, 2 months ago

-

Seth Golden posted an update 5 years, 2 months ago

Goldman Sachs forecast for NFP: We estimate nonfarm payrolls increased 150k in August … Our forecast reflects a 15-20k boost from Census canvassing activities, but a slower underlying pace of private-sector job gains in part reflecting the return of the trade war. …

We estimate the unemployment rate was unchanged at 3.7%. … We estimate avera…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

Credit Suisse:

Reasons to be bullish: we are in the “yield-curve inversion sweet spot” for equities right now

The US yield curve inverted (2 year/10 year) on August 14th1. 75% of the time the market is able to rise in the following 6 months

2. average rise in 6m is 8%.

3. If ever the US yield curve did not work as a recession pre-cursor it is…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

Marko Kolanovic:

Think employment data will suck…Weaker employment data stands to have a larger market impact moving forward

we recommend investors purchase SPY September 6th 292 strike puts for $0.94, indicatively

-

Seth Golden posted an update 5 years, 2 months ago

Nice trade we completed in the premarket today as we recently shorted shares of $UVXY at $30.91 and covered here today at $29.76. Subscribe today and trade with us! -

Seth Golden posted an update 5 years, 2 months ago

On verge of multi-decade breakout or breakdown again -

Seth Golden posted an update 5 years, 2 months ago

Per Morgan Stanley

3 observations from Morgan Stanley:1. Positioning is now lighter than even 2015 / 2016, and most cases since 2008.

2. $450B of equity has left Mutual Funds and ETFs into money markets this year.

2. Exposure-wise, L/S HF nets are < 5th %-ile, while Systematic leverage is in the 20-30th %-ile.

-

Seth Golden posted an update 5 years, 2 months ago

Chart of the day is $TNX layover with Crude oil. Followed each other post the ISM data release. -

Seth Golden started the topic Bernstein Analyst in the forum S&P 500 Analysts Notes 5 years, 2 months ago

Bernstein believes the recent inversion of the yield curve signifies just a 2% increase in recession risk. The recession probability of the yield curve signal is continuous, but the common interpretation treats it as a binary recession/non-recession signal. While the YC used to be a nifty tool for interpreting monetary policy, various factors…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

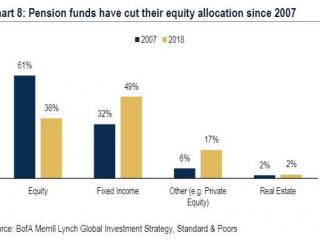

Pension fund deleveraging since 2007, from equities -

Seth Golden started the topic Not Much Has Changed in the forum It's All About The Economy 5 years, 2 months ago

Market fundamentals have changed little and stock valuations remain attractive – especially if you shop from the many cheap sectors.

There are many interesting themes, including the following:

Stocks can rise, even in this uncertain environment.

The trade story remains the most important, since it lies behind the low world-wide interest r…[Read more] -

Seth Golden posted an update 5 years, 2 months ago

Mislav´s 5 reasons to remain bullish:

1) Fed is easing, but without HY spreads or jobless claims spiking, both of which typically deteriorate into a recession. Crucially, if initial Fed cuts are not followed by a recession, the next 3, 6 and 12 months equity returns were historically very strong–2) Global activity momentum is likely to look be…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

Friday’s NFP May prove of greater significance than most are currently considering. Recall in Feb. 2018 the NFPs wave component accelerated beyond economists’ projections and investors feared it would prove a lasting inflationary contributor. Markets were rocked by 1,000 point moves on the Dow. Beyond the headline number and with companies loo…[Read more]

- Load More