-

Seth Golden posted an update 5 years, 2 months ago

today I thought I would simply show how SPY has performed between the time of the announcement and the NYSE close on Fed Days since Mr. Powell took over. -

Seth Golden and

Danny Miller are now friends 5 years, 2 months ago

-

Seth Golden posted an update 5 years, 2 months ago

Brexit Update from JPM

JPM: As the threat of an October no-deal Brexit fades, a January no-deal event is a rising risk. Parliament passed a law forcing PM Johnson to request an extension by October 19 if no deal can be reached with the EU, and talks between the two sides show little progress. It looks likely that Johnson will either have to renege…[Read more] -

Seth Golden posted an update 5 years, 2 months ago

Goldman Sachs:

1. GS estimates CTA/trend length is moderately net long again (~$75bn global eq), and expect some moderate near-term buying to continue in the baseline and most mkt scenarios to re-establish more long positions.2. For the systematic macro community, more trend signals continued to turn positive last week – especially at the…[Read more]

-

Seth Golden and

Daniela Meneghetti are now friends 5 years, 2 months ago

-

Seth Golden and

David Mamelli are now friends 5 years, 2 months ago

-

Seth Golden started the topic Goldman Cuts Apple… Again in the forum Apple Inc. (AAPL) 5 years, 2 months ago

Goldman Sachs just significantly slashed its price target for Apple, predicting 26% downside to the shares because of a “material negative impact” on earnings for the accounting method the iPhone maker will use for an Apple TV+ trial.

“We believe that Apple plans to account for its 1-year trial for TV+ as a ~$60 discount to a combined hardw…[Read more]

-

Seth Golden started the topic Wal-Mart Unlimited Grocery Delivery in the forum State of Retail in U.S. 5 years, 2 months ago

Walmart said Thursday it will be expanding a new “unlimited” grocery delivery service, which costs users $98 annually, to 1,400 stores this fall. https://www.cnbc.com/2019/09/12/walmart-expands-its-unlimited-grocery-delivery-service-nationwide.html?recirc=taboolainternal

-

Seth Golden posted an update 5 years, 2 months ago

JPM on ECB

1. ECB Rate decision(Slightly dovish): Overall the decision was mixed but in aggregate more dovish than anticipated (because of the forward guidance), especially following this week’s repricing by the market.2. Rates(Hawkish): Smaller than anticipated cut(-10bps while markets were pricing approx. -14bps)

3. Forward Guidance(Very d…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

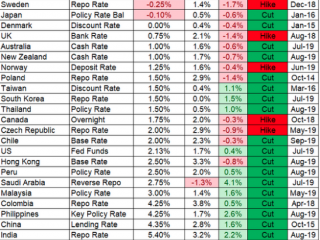

Central bank activity update -

Seth Golden posted an update 5 years, 2 months ago

Citigroup says fade the banks:

1. Fade the rally – Bank share prices will likely reconnect with earnings2. 2020E cons. EPS is -12% YTD vs SX7P +4%.

3. Deposit tiering and new TLTRO terms are minor positives, but largely offset by the rate cut. Overall consensus EPS risk is to the downside

4. We believe fiscal stimulus is required for

banks t…[Read more]

-

Seth Golden and

bruce paton are now friends 5 years, 2 months ago

-

Seth Golden posted an update 5 years, 2 months ago

-

Seth Golden posted an update 5 years, 2 months ago

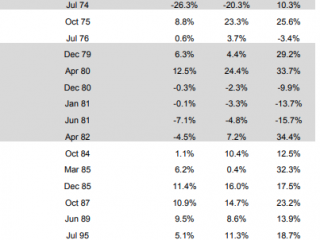

Morgan Stanley: More on MoMO sell-offs and subsequent equity performance

1. As of yesterday’s close, Momentum has posted a -15.9% move lower from its last peak on September 3 (five trading sessions have passed since).2. Since 1999, there have been 11 instances where Momentum has moved lower by 15% or more in consecutive trading sessions.

3. On…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

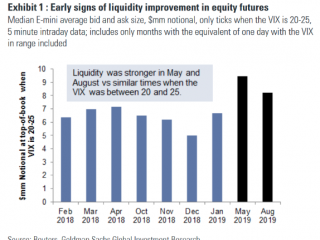

Liquidity improved in May and August -

Seth Golden replied to the topic Berstein on Fund Flows in the forum S&P 500 Analysts Notes 5 years, 2 months ago

How big a cut to earnings forecasts is coming? does not matter – all priced in anyhow….

1. Bernstein expects earnings forecasts to be cut in the coming months following the slowing macro data this summer2. expect 12 month forward US earnings growth to be 4.5%, which is well below the combination of consensus for 1.9% growth for 2019 and 10.6%…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

Goldman Sachs:

Jan Hatzius:1. Beyond September/October, we think the environment will become less supportive for further Fed rate cuts.

2. This is mostly because core PCE inflation will likely turn sharply higher on a year-on-year basis, for two reasons.

3. First, the current year-on-year rate is depressed by outliers to the downside in late…[Read more]

-

Seth Golden posted an update 5 years, 2 months ago

Why did US Banks rally 3.5%?

1. the bank complex traded very well on Mon and led its cyclical peers higher.2. The fundamental driver for the strength was better-than-feared presentations from mgmt. teams at the Barclays conf.

3. Investors were worried about gloomy mid-Q updates given the trajectory of rates but that didn’t happen. Citigroup, C…[Read more]

-

Seth Golden replied to the topic Morgan Stanley S&P 500 Underweight from Equalweight in the forum S&P 500 Analysts Notes 5 years, 2 months ago

MS on Market Rotation

1. active investors (long onlies and HFs) are not embracing / chasing this move2. US trading desk has been way better to sell in the cyclical sectors over the past few days, from active / real money

3. on the surface move appears to be driven by macro/quant sector/factor rebalancing

-

Seth Golden and

Jinhua Pan are now friends 5 years, 2 months ago

- Load More