-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

JPM: “In our client conversations, we continue to detect widespread skepticism and bearish sentiment among equity investors. As a result, the recovery in equity markets has been causing a lot of frustration among predominantly bearish investors”

-

Seth Golden posted an update 4 years, 7 months ago

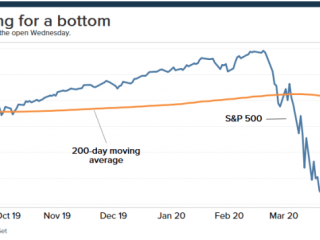

A definitive low in Equities this early in a recession has no precedent,but neither does so much stimulus so early either

Chart: Performance of S&P500 in two years… -

Seth Golden posted an update 4 years, 7 months ago

Morgan Stanley Quant Team: MS QDS notes that while the market recovery and vol compression are impressive, they are not enough to force material buying from systematic strategies (Vol Target Funds and Trend Following CTAs). To generate meaningful demand from Trend Followers, the S&P 500 would have to rally closer to 2900 (50d moving average, and…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

Yield is all that matters. Yield for stocks is at all-time high compared to bonds -

Seth Golden posted an update 4 years, 7 months ago

Bond and Treasury volatility has collapsed since the panic highs -

Seth Golden posted an update 4 years, 7 months ago

The below tidbit from Sanford Bernstein head of strategy summarizes the massive consensus view right now. Two questions bears have to ask themselves:

1. can consensus be right?

2. if many of the bears out there anyhow are bullish on a 12m time frame – how close to switching sides are they…?

If the markets are made to make as many participants…[Read more]

-

Seth Golden and

bastek are now friends 4 years, 7 months ago

-

Seth Golden and

Ash Gummi are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

Will Congress enact further fiscal measures? GS: Almost certainly…

“Phase 4 suggest that Congress might enact measures expanding the deficit by another $500bn (2.4% of GDP) or so in the remainder of 2020, on top of the recently enacted policies, with additional fiscal expansion of another $1 trillion or so cumulatively in 2021 and 2022” -

Seth Golden posted an update 4 years, 7 months ago

GS prime brokerage book saw the largest $ net selling since Dec ’18 (-2.8 SDs), driven entirely by short sales in Single Names and to a lesser extent Macro Products…. -

Seth Golden posted an update 4 years, 7 months ago

Spread of implied volatility vs. historical volatility has hit all-time lows:

The volatility risk premium – measured as the VIX minus SPX 1m realized volatility – has… -

Seth Golden posted an update 4 years, 7 months ago

Mike Wilson of Morgan Stanley:

“This time, we have a potentially much more inflationary combination of an unprecedented targeted fiscal stimulus and possible deregulation of the banks to get the cash into the hands of lower income individuals and small businesses that are inclined to spend it. Such a dramatic shift in US fiscal and monetary…[Read more] -

Seth Golden posted an update 4 years, 7 months ago

CS Strategy joins GS, JPM, MS etc in “consensus-calling” for equity markets to turn lower….

“We still have not seen all the preconditions we would expect for a market low. We believe that a consolidation/move down over the next month is likely, but that the old lows will hold. We stick to our targets for the S&P 500 of 2700 for year end”

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

While the direction of the market still hinges on when the coronavirus outbreak is slowed, some signs are emerging that the bulk of the selling in stock and corporate… -

Seth Golden posted an update 4 years, 7 months ago

Check out our Weekend Futures market update video with Wayne Nelson of Finom Group https://www.dropbox.com/s/9zecwd9pvv5y0fo/1024-Wayne-04-05-2020__05.58.717_PM.webm?dl=0

- Load More