-

Seth Golden posted an update 4 years, 1 month ago

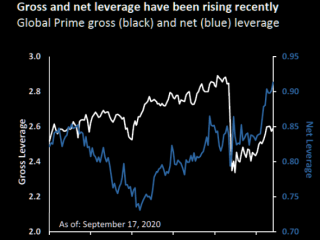

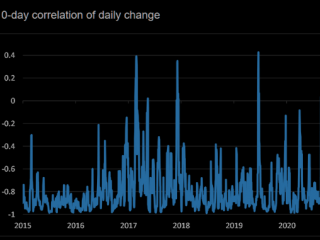

We have seen a lot of data from various prime brokers that hedge fund net exposure is at 2 year 100%tile levels. The below chart from JPM shows the same thing in another way – and also the massive rapid rise in nets during the past few months. -

Seth Golden posted an update 4 years, 1 month ago

JPM derivatives team headed by Dr Kolanovic sees CITI volatility screening cheap.

JPM equity research analyst concurs and wants to buy the dip in the sector as a) fundamental operating environment is unchanged b) the $2T in assets referenced were part of suspicious activity reports (SARs) –so banks acted exactly as they were supposed to act and c…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

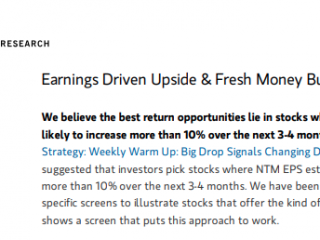

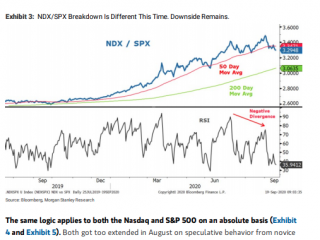

Morgan Stanley’s Mike Wilson says correction has legs, but will give way to UPSIDE -

Seth Golden posted an update 4 years, 1 month ago

Morgan Stanley’s Mike Wilson -

Seth Golden posted an update 4 years, 1 month ago

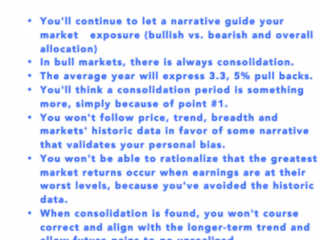

If this is you, then you may not be following the right macro and technical signals? -

Seth Golden and

Christopher LaFata are now friends 4 years, 1 month ago

-

Seth Golden and

Dr. CS are now friends 4 years, 1 month ago

-

Seth Golden posted an update 4 years, 1 month ago

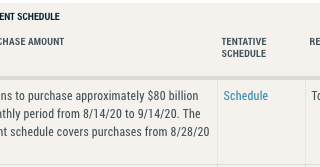

Just a heads-up: Today is the largest #POMO day of the Fed’s 2-week schedule issued on Sept. 14th, at $12.5bn -

Seth Golden posted an update 4 years, 1 month ago

volatility is elevated this time of the year, so making money buying index volatility is rather tough (historical vol premium and correlation risk premium).This year…

-

Seth Golden and

Ruben George are now friends 4 years, 1 month ago

-

Seth Golden posted an update 4 years, 1 month ago

Citigroup:

1. FED and COVID more important: Expect volatility in a contested election, but the Fed and pandemic recovery likely will have greater influences.2. USD could rally……a USD rally is possible in a disputed election, but will remain unsupported otherwise.

3. Trump winners……Sectors that may benefit from a 2nd Trump term include…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

Today’s market consolidation was found with broadening breadth as the mega-caps took a back seat and financials kept a bid. Equal weight (RSP) outperformed cap-weight… -

Seth Golden posted an update 4 years, 1 month ago

S&P 500 up 13 of last 17 September option expiration weeks – September’s option expiration week is up 60.5% of the time for S&P 500 since 1982. DJIA and NASDAQ have slightly weaker track records with gains 55.3% of the time and 57.9% of the time

-

Seth Golden posted an update 4 years, 1 month ago

Flow & Liquidity expert at JPM, Nikos P, sees significant equity selling into month-end. Flows have clearly been important in September. Will this one also spook the market?

“We estimate around -$200bn of negative rebalancing flow by entities that tend to rebalance on a quarterly basis, such as US defined benefit pension plans, Norges Bank, i.e.…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

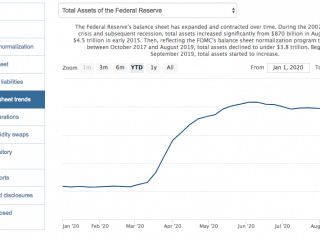

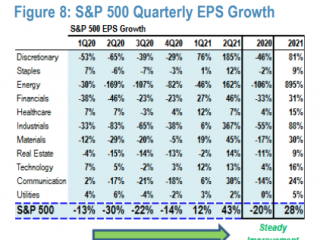

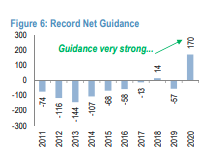

J.P. Morgan outlook of recovery and EPS -

Seth Golden posted an update 4 years, 1 month ago

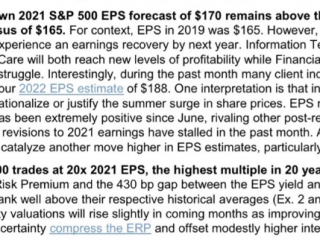

Goldman on 2021 EPS and valuations: -

Seth Golden posted an update 4 years, 1 month ago

Goldman Sachs conversations we are having with clients -

Seth Golden posted an update 4 years, 1 month ago

Fed’s POMO schedule will be released tomorrow afternoon -

Seth Golden posted an update 4 years, 1 month ago

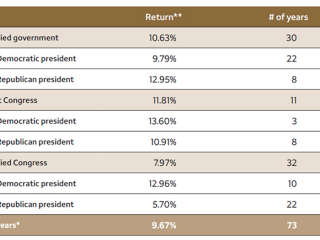

Half of U.S. presidential elections since 1945 have delivered single-party government, including three of the past four.1 Moreover, unified government has historically… -

Seth Golden posted an update 4 years, 1 month ago

J.P. Morgan: “We find little evidence to suggest that retail investors have played a big role in this month’s equity correction, at least up until last week. If anything, small option traders saw last week’s correction as an opportunity to add to their call option buying, especially on individual equities.

We thus suspect that institutional inv…[Read more]

- Load More