-

Seth Golden posted an update 4 years ago

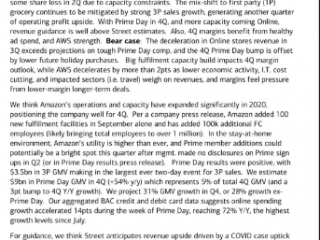

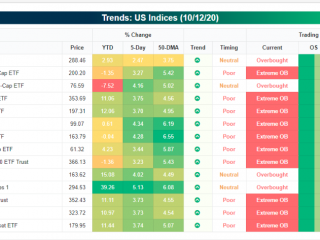

BofA Global Research Q3 2020 AMZN Preview -

Seth Golden posted an update 4 years ago

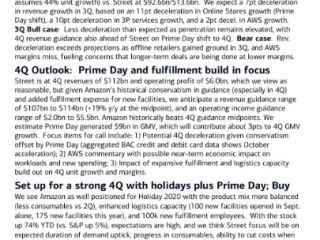

JPM maintains 3,600 price target -

Seth Golden posted an update 4 years ago

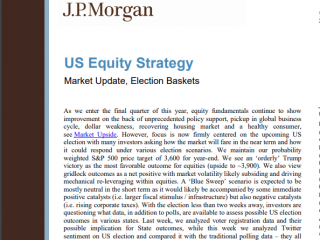

When $SPX kicks off the trading week declining between -1.5% to -3%, what’s the rest of the week looked like?

-

Seth Golden posted an update 4 years ago

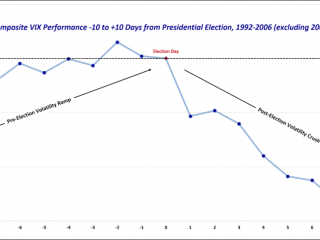

in the graphic below we normalized all the VIX readings from 1992-2016, with the exception of 2008, which just happened to fall at the height of the Great Recession, so the 2008 data is excluded, as it would otherwise skew the results. -

Seth Golden posted an update 4 years ago

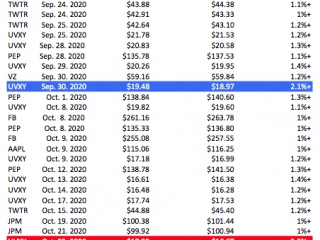

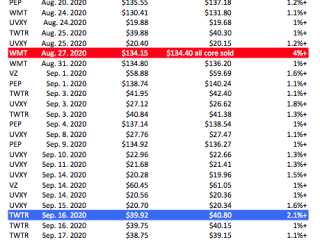

Finom Group completed trades since May 2020 -

Seth Golden posted an update 4 years ago

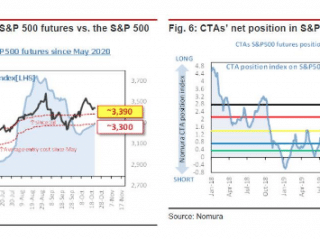

According to Nomura, trend-chasing CTAs seem to still be gradually accumulating long positions in US equity futures. Although they are likely to be drawn into more… -

Seth Golden posted an update 4 years ago

Goldman: Demand for VIX puts has accelerated ahead of election -

Seth Golden posted an update 4 years ago

On this day in 2001, the iPod was launched and revolutionized music and information technology’s history -

Seth Golden posted an update 4 years ago

Goldman Sachs: Still very long, but not as long as just a few weeks ago. Just shaving, or a start of a significant sector-rotation?

“After significant long buying in September and early October, hedge funds have started to sell FAAMG again Collectively as a group, FAAMG has been net sold in five of the past six days (8 of the past 10) on the GS…[Read more]

-

Seth Golden posted an update 4 years ago

$SPX just above the .38% Fibonacci level ahead of Tuesday open. Tuesday found gap filled down to 3,426, HOD was 3,502 index still a bit of no-man’s land. Neckline of H&S… -

Seth Golden posted an update 4 years ago

Citigroup: “we remain cautious on buying the dip at current levels, preferring instead to wait for more supportive levels around 3,340/11,400 in SPX/NDX where profits are small again.”

-

Seth Golden posted an update 4 years ago

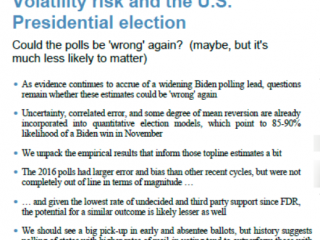

JPM: Could the polls be wrong again? Less likely this time. -

Seth Golden posted an update 4 years ago

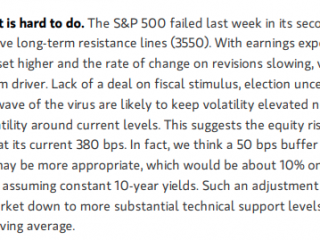

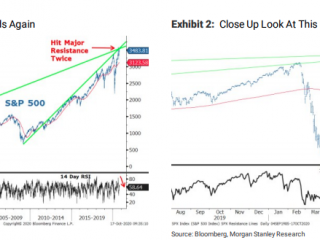

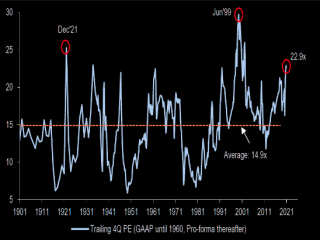

Last month we highlighted ourview that long-term resistancein the S&P500 around

the3550 level would bevery difficult to surpass prior to the outcome of the US

election… -

Seth Golden posted an update 4 years ago

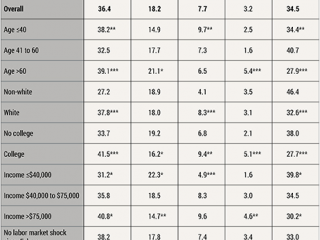

New York Fed: How households spent their stimulus checks -

Seth Golden posted an update 4 years, 1 month ago

BofA Hartnett: Price: historic price rallyPositioning: neutral

Policy: stimulus peaking

Profits: bull surprise

Pandemic: rising risk

Politics: potential…

-

Seth Golden posted an update 4 years, 1 month ago

Gap down market days seem to always test investors’ resolve. From my 22 years of experience there tend to only be a handful of reasons to be a net seller. The market will do its best to test your thesis, but as of today none of my sell indicators have triggered. ~Seth Golden

-

Seth Golden posted an update 4 years, 1 month ago

YTD 2020 Share Repurchase Authorizations of ~$319bn Tracking Down ~(57)% y/y vs. ~$746bn YTD 2019 -

Seth Golden posted an update 4 years, 1 month ago

Deutsche Bank: “With the polls steady and heavily favoring Biden, the market is increasingly shifting focus towards thinking about how the Senate results might be the main driver behind the market reactions to the November 3rd election. Certainly the Senate make-up, and the size of the majority, will be an important part of the response. However,…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

Bernstien: AAPL has had a tremendous run, and now trades at 31x FY 21 estimates, a premium to many consumer companies and its highest relative level in over a decade. While we believe sell-side estimates remain too low, we worry that once a strong cycle is fully “baked” into estimates, likely around Dec-January, the stock could struggle to…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

- Load More