-

Seth Golden and

Kevin Millard are now friends 3 years, 12 months ago

-

Seth Golden posted an update 3 years, 12 months ago

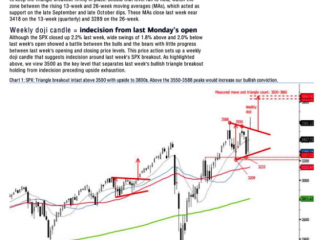

BofA global on triangle breakout -

Seth Golden posted an update 3 years, 12 months ago

Weekly expected move for S&P 500 ~$75/points -

Seth Golden and

Gus Skarlis are now friends 3 years, 12 months ago

-

Seth Golden posted an update 3 years, 12 months ago

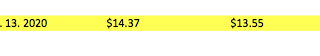

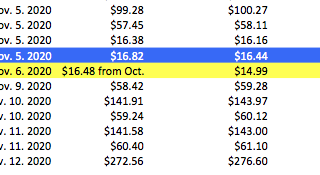

Trade alerts for our Premium and MasterMind members completed this week. -

Seth Golden posted an update 4 years ago

Goldman Sachs Outlook -

Seth Golden posted an update 4 years ago

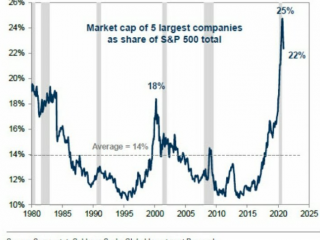

FAAMG accounts for 22% of the total $SPX market cap. Data compiled through 11/9/2020 -

Seth Golden posted an update 4 years ago

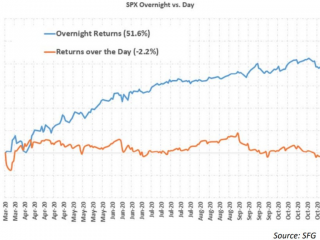

Since March, the S&P 500 has returned +52% in overnight trading, while its returns during the day are -2%, -Susquehanna -

Seth Golden posted an update 4 years ago

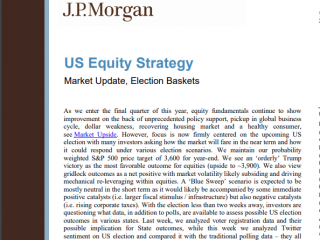

J.P. Morgan Marko Kolanovic: -

Seth Golden posted an update 4 years ago

Goldman Sachs: “They expect to supply globally up to 50mn vaccine doses in 2020 and manufacture up to 1.3bn doses in 2021. Based on PFE/BNTX dosing schedule each person will require two doses.PFE noted on the company’s 3Q earnings call that they expect to provide 30-40mn doses in the US by the end of 2020 assuming they receive approval and the…[Read more]

-

Seth Golden posted an update 4 years ago

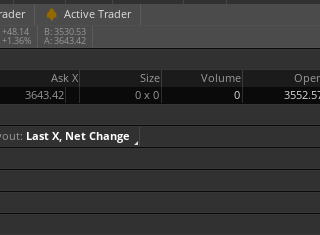

SPX weekly expected moved as priced by the options market -

Seth Golden posted an update 4 years ago

Goldman Sachs Macro-Outlook -

Seth Golden posted an update 4 years ago

Goldman Sachs NFP estimate -

Seth Golden posted an update 4 years ago

Goldman Sachs: GS cross-asset macro conf call yesteday focusing on read-across the election can be summarized like this: “no change”. Nothing to see here, circulate back to CB BS….

Key message is that “our forecasts look about right” and there seems to be very little need to change anything.

Economics: current forecasts look about right. If…[Read more]

-

Seth Golden posted an update 4 years ago

85% upside day gives us back-to-back 80% upside days and counters negative implications of last Monday’s 90% downside day. Percent of stocks trading above 50-DMA has moved back above 50% as of Tuesday. -

Seth Golden posted an update 4 years ago

-

Seth Golden posted an update 4 years ago

JPM: Election Wildcards -

Seth Golden posted an update 4 years ago

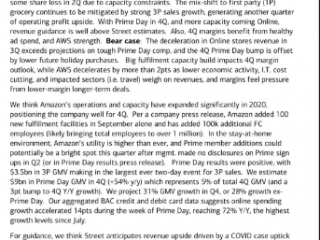

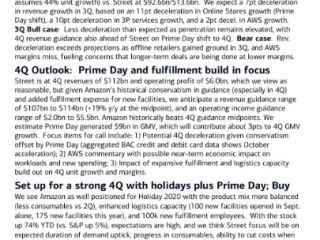

BofA Global Research Q3 2020 AMZN Preview -

Seth Golden posted an update 4 years ago

JPM maintains 3,600 price target -

Seth Golden posted an update 4 years ago

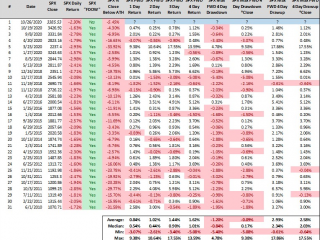

When $SPX kicks off the trading week declining between -1.5% to -3%, what’s the rest of the week looked like?

- Load More