-

Seth Golden posted an update 4 years, 7 months ago

During the period after March 2000, there were 5 significant rallies within equities that averaged 16% and lasted on average for 75 days.During the GFC period, there…

-

Seth Golden posted an update 4 years, 7 months ago

From Tony Dwyer -

Seth Golden posted an update 4 years, 7 months ago

Futures openly slightly higher this evening, sideways action near-term would be ideal, but keep in mind that VIX at roughly 60 equates to ~4% daily moves on SPX

-

Seth Golden posted an update 4 years, 7 months ago

GOLDMAN: “We left our March nonfarm payroll estimate unchanged at -180k (mom sa) and our private payroll estimate also unchanged at -200k.”

-

Seth Golden posted an update 4 years, 7 months ago

Report Trump has signed off on plan to reduce tariffs for 3 months

-

Seth Golden posted an update 4 years, 7 months ago

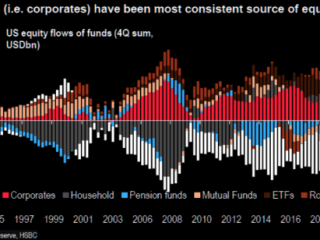

Long-term chart/heat map of who the buyers have been -

Seth Golden posted an update 4 years, 7 months ago

Larry Fink Letter: “In my 44 years in finance, I have never experienced anything like this”

1. Many of BLK’s clients are looking to increase their equity allocation in this market; “Tremendous opportunities to be had in today’s markets”2. Reevaluating assumptions: “our infatuation with just-in-time supply chains or our reliance on international…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

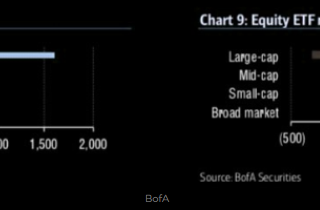

BofA saw the largest weekly inflow since 08, hedge funds, institutions and private clients were all buyers.Buybacks slowed to lowest levels in 1.5 yrs, expect no buyback benefit to EPS growth this year.

-

Seth Golden posted an update 4 years, 7 months ago

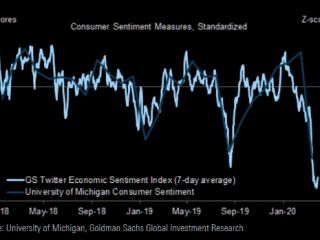

Goldman Sachs Twitter Sentiment Index -

Seth Golden posted an update 4 years, 7 months ago

Goldman Sachs: 1. Last week buyback was tracking 0.6x vs 2019 ADTV, 0.6x vs 2018 ADTV, and 0.9x vs 2017 ADTV.

2. We estimate ~90% of the S&P 500 are now in their blackout period

The new bull market doesn´t need no buyback support….

-

Seth Golden and

Chris Johnson are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

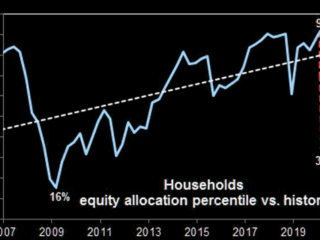

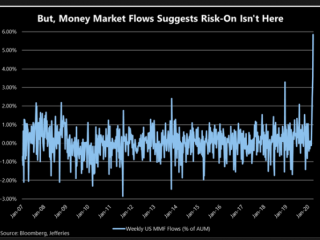

There is evidence of a material de-risk by the retail investor. Money Markets, for example, registered the largest weekly inflows on record this week +$159B, breaking… -

Seth Golden and

aaron lim are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

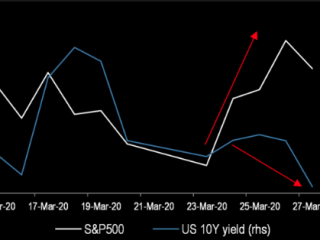

US & German bond yields are not joining the equity bounce, which is not encouraging… -

Seth Golden posted an update 4 years, 7 months ago

The $254B that flooded US MMFs last week was about 170x the average weekly inflows since ’07 -

Seth Golden posted an update 4 years, 7 months ago

JPM: risk of a wave of heavy hedge fund redemptions low

1. Risk of a wave of heavy hedge fund redemptions causing a double dip in equity markets similar to March 2009 is low in the current conjuncture.2. The anecdotal evidence we have from our conversations with our colleagues in Prime Finance business as well as investors and fund…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

Tony P sees S&P500 coming down again to 2000-2300 range

Tony Pasquariello, macro guru at GS does not think market has bottomed.1. Positioning much cleaner than a month ago, but not yet “fully clean”…

2. corona news (from a US perspective) still not at peak awful

3. market propped up by month-end rebal flow

4. market will trade lower as…[Read more]

-

Seth Golden and

Jon Abu are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

GOLDMAN: “.. we believe it is likely that the market will turn lower in coming weeks, and caution short-term investors against chasing this rally.” History shows bear markets “are often punctuated by sharp bounces before resuming their downward trajectory.” (Kostin)

-

Seth Golden posted an update 4 years, 7 months ago

MS communicating bullish tone on Sunday´s cross-asset call. Remember that they switched to “constructive” last Sunday, which in hindsight was a perfect bottom-picking call.

1. Monday lows will hold

2. will not get an equally “fat pitch” again in this cycle

3. Fiscal & Monetary response better than expected and will be enough

4. the…[Read more]

- Load More