-

Seth Golden posted an update 4 years, 1 month ago

History says expect outflows ahead of the election. History doesn’t have a zero interest likeness to compare -

Seth Golden posted an update 4 years, 1 month ago

$SPX So far here’s been the hesitancy:-Has to close back above June support/resistance

3,230s

-Has to close back above 3,300

-Has to close back above 38.2% retrace… -

Seth Golden posted an update 4 years, 1 month ago

Nice Jump in Redbook sales to end September -

Seth Golden and

unsung zero are now friends 4 years, 1 month ago

-

Seth Golden posted an update 4 years, 1 month ago

Goldman Sachs: From an earnings perspective, a Democratic sweep could have a modestly positive net impact on the trajectory of S&P 500 profits. -

Seth Golden posted an update 4 years, 1 month ago

Typically the spike in the number of stocks trading at 20-day Lows is a buyable dip, within an uptrend. Nibbling! -

Seth Golden posted an update 4 years, 1 month ago

The percentage of stocks trading above their 200-DMA jumped back above 50% on Friday, a positive breadth development -

Seth Golden posted an update 4 years, 1 month ago

Kronos Workforce Activity Tracker -

Seth Golden posted an update 4 years, 1 month ago

Very busy and profitable week for our Finom Group traders. Trade alerts attached for the week. All profitable! (UVXY shorts) -

Seth Golden posted an update 4 years, 1 month ago

BofAML Michael Hartnett:

1. Sept/Oct = “midlife crisis” phase of investment year…however sees this as “healthy rather than dangerous correction”2. tactical view: Sept correction is part of “topping process” but don’t expect big bear move when Fed so easy, Wall St flush with cash, vaccine expectations strong

3. upside risks taking SPX back in…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

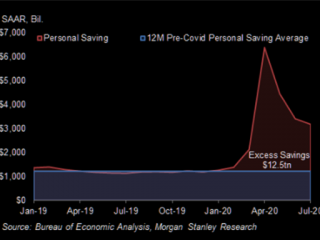

MS Econ Team estimates from April through July the US consumer built up a cumulative $12.5tr (annualized) in excess savings (savings above the monthly pre-Covid… -

Seth Golden posted an update 4 years, 1 month ago

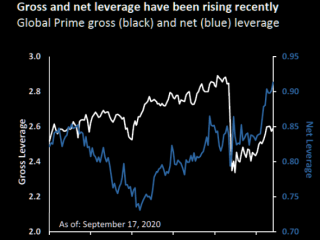

We have seen a lot of data from various prime brokers that hedge fund net exposure is at 2 year 100%tile levels. The below chart from JPM shows the same thing in another way – and also the massive rapid rise in nets during the past few months. -

Seth Golden posted an update 4 years, 1 month ago

JPM derivatives team headed by Dr Kolanovic sees CITI volatility screening cheap.

JPM equity research analyst concurs and wants to buy the dip in the sector as a) fundamental operating environment is unchanged b) the $2T in assets referenced were part of suspicious activity reports (SARs) –so banks acted exactly as they were supposed to act and c…[Read more]

-

Seth Golden posted an update 4 years, 1 month ago

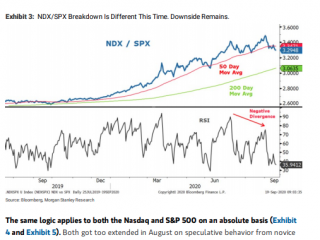

Morgan Stanley’s Mike Wilson says correction has legs, but will give way to UPSIDE -

Seth Golden posted an update 4 years, 1 month ago

Morgan Stanley’s Mike Wilson -

Seth Golden posted an update 4 years, 1 month ago

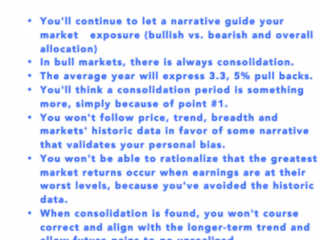

If this is you, then you may not be following the right macro and technical signals? -

Seth Golden and

Christopher LaFata are now friends 4 years, 1 month ago

-

Seth Golden and

Dr. CS are now friends 4 years, 2 months ago

-

Seth Golden posted an update 4 years, 2 months ago

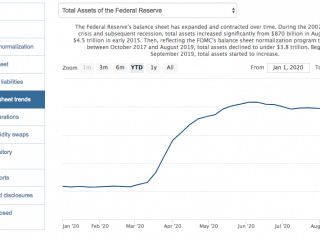

Just a heads-up: Today is the largest #POMO day of the Fed’s 2-week schedule issued on Sept. 14th, at $12.5bn -

Seth Golden posted an update 4 years, 2 months ago

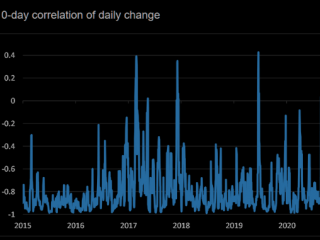

volatility is elevated this time of the year, so making money buying index volatility is rather tough (historical vol premium and correlation risk premium).This year…

- Load More