-

Seth Golden posted an update 2 years, 1 month ago

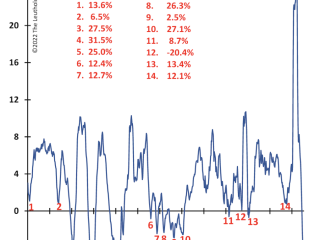

Regardless of what the Fed is doing with the funds rate, real liquidity growth has been strongly correlated with stock market performance. Chart 1 highlights 14 previous cases when annual real liquidity growth bottomed either near zero or below zero. Of those, there was only one instance (2008) in which the S&P 500 declined over the next twelve months. On the whole, buying the S&P 500 at past liquidity lows yielded an average of +14.2% in the ensuing year