-

Seth Golden posted an update 4 years, 5 months ago

JPM: “The 2s/10s curve steepening trend extends into the 53.5-57.5bp short-term resistance zone. The technical setup continues to favor an eventual breakout and steepening toward the 70-80bp resistance area” -

Seth Golden posted an update 4 years, 5 months ago

ES-mini liquidity still sucks -

Seth Golden and

STro8 are now friends 4 years, 5 months ago

-

Seth Golden and

AimHi are now friends 4 years, 5 months ago

-

Seth Golden posted an update 4 years, 5 months ago

-

Seth Golden posted an update 4 years, 5 months ago

“For the remainder of the year, we have been expecting a peak of 25% in June followed by a drop to 12% in December. Our real-time numbers suggest that the peak might… -

Seth Golden posted an update 4 years, 5 months ago

1. Goldman Sachs prime brokerage data from Friday showed that net leverage now is at the highest level in more than 2 years.

2. Gross leverage rose to 249.6% (99th percentile).

3. add to this CITI Euphoria data, various recent sentiment indicators as well as RobinHood anecdotal behavior and is it starting to get interesting

-

Seth Golden posted an update 4 years, 5 months ago

Despite a nice rise in SPX this past week, VIX dropped only 2%, hence the weekly expected move for the S&P 500 has only dropped from $73/points to $70/points. -

Seth Golden and

Grant Nguyen are now friends 4 years, 5 months ago

-

satishkk86 and

Seth Golden are now friends 4 years, 5 months ago

Seth Golden are now friends 4 years, 5 months ago -

Seth Golden posted an update 4 years, 5 months ago

CB purchases to fade from $2.4bn per hour to $0.6bn per hour coming months -

Seth Golden posted an update 4 years, 5 months ago

$SPX tactical issues near-term:

1. Gold steady above 1,700

2. Crude possibly top-ping

3. Demark sell signal

4. SPX stocks above 50-DMA 99%ile

5. Macro tensions rise

6. Month-end rebal

7. Rising NDX short interest

8. Defensive rotation (XLP higher lows)

10 MOC sell 2.7bn Thurs -

Seth Golden posted an update 4 years, 5 months ago

Marko Kolanovic, who was one of the absolute first sell-side strategists to turn bullish, is now “dialing down” his positive outlook, based on two risks:

1. paralysis and delays in reopening the US economy

2. geopolitical tensions that could cripple the recovery of global trade

“As the market staged a substantial rally (nearly ~40%) since our…[Read more]

-

Seth Golden posted an update 4 years, 5 months ago

Morgan Stanley: “iPhone is tracking above seasonal trends: …as of May 25th, current air quality metrics suggest industrial production is back above historical levels… -

Seth Golden posted an update 4 years, 5 months ago

Positioning is extremely light

1. institutional investor positioning still appears very light. Systematic strategies have only been modest buyers and leverage remains near the lows – and likely remains there in the near-term as volatility remains high. Futures positioning remains very light and most shorts have not been covered.2. US L/S HF n…[Read more]

-

Seth Golden and

uram1811 are now friends 4 years, 5 months ago

-

Seth Golden posted an update 4 years, 5 months ago

Goldman Sachs: HFs finally buying en masse, as per latest GS PB data.

1. Net Leverage rose +3.8% – the largest increase in eight weeks

2. Net Leverage now 73% (91st percentile one-year).

3. All regions were net bought on the week, led in $ terms by North America and Europe.

4. Industrials saw the largest net buying in more than two years

-

Seth Golden posted an update 4 years, 5 months ago

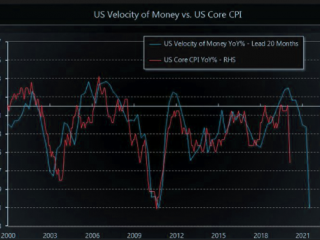

As the Fed is increasing the money supply while US GDP is contracting, velocity of money is slowing down very fast. Without money velocity there is no inflation possible… -

Seth Golden posted an update 4 years, 5 months ago

$1500Bn is bigger than $493Bn

Fed’s $75bn per day buying has changed to less than $10bn per day. Over past 2 months Fed has bought $1500 bn and $493bn has been issued…. -

Seth Golden posted an update 4 years, 5 months ago

JPM on the tactical rally in Cyclicals and in Value style, driven by an expected upmove in PMIs in May/June

“We think the rotation, which appears to have started last week, will have some legs as the investor positioning was very defensive – 70% of the equity funds that we track in Europe have been outperforming the benchmark as of end April, by 1…[Read more] - Load More