@retiredmarine1214

-

Retiredmarine1214 posted an update 7 years ago

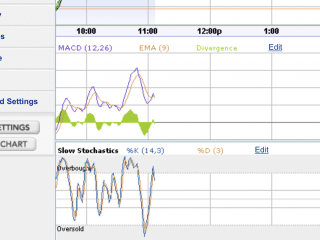

@seth-golden quick question. When rsi makes new lows n price makes new highs. That’s a bearish divergence right? If I even explained right. -

Retiredmarine1214 replied to the topic Hedging TVIX short position in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

Put spread cause u can get more premium that way using way less buying power. And of further down side Incase we did see vix 9-10 but don’t think so. Not like last year. I don’t know about the call side but I would assume ur fighting decay and time again now is not on your side.

-

Retiredmarine1214 replied to the topic Hedging TVIX short position in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

If your nervous about a bad spike I would not hedge with uvxy or vxx calls.

I like to sell put spreads on vix when it’s around 12 and under. I sell about 4 months out. Gives me the ability to wait even as volume makes new lows the put spreads don’t move against u really much. Giving u ample time to wate for the spike. Mean while with vxx n uvx…[Read more]

-

Retiredmarine1214 posted an update 7 years ago

Hey Seth. What do you expect jcp to posibly be that your expecting short term. I have leap calls that are slightly up.

-

Retiredmarine1214 posted a new activity comment 7 years ago

Seems back at bottom of its trading range. Of 129 and 124

-

Retiredmarine1214 posted an update 7 years ago

Seth didnt you say a while back couple weeks ago that GLD got u interested around 124-124.5 ?

-

Retiredmarine1214 posted an update 7 years ago

I think we are beginning to see BTFD coming back a little bit.

-

Retiredmarine1214 posted a new activity comment 7 years ago

Thanks 🙏🏻

-

Retiredmarine1214 posted a new activity comment 7 years ago

Down almost 5% on the Dow now. So we broke that long record that they been talking about. And this is a good thing it finally happed right. Soon normalcy comes back? After the parobolic month of a life time just got beat up?

-

Retiredmarine1214 replied to the topic best interest rates and margin requirements for shorting VIX products? in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

Also take a look at tasty works. You will love the cheap fees. 1 dollar per contract. Any more than 10contracks the fee goes no higher than 10 bucks. I beleive there stock fee is like 4 bucks or so

-

Retiredmarine1214 replied to the topic VIX futures and backwardation in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

My guess is some time Monday we get a volume crush if not some time next week. Seems to be cooling off now. Hope it continues. It’s been 14 days since we hit new lows. It’s going to break that streak soon.

-

Retiredmarine1214 posted a new activity comment 7 years ago

I say safer cause it’s money I am willing to lose. Never intended to profit. Like my safety net. It’s still cost significantly less than the short. But now it’s more profit letting it go on a spike I did not expect.

-

Retiredmarine1214 posted a new activity comment 7 years ago

I did the short the box thing. But with call spreads. Then bought Calls to hedge but with lower price. Been letting the long calls go 1 by 1 every little bit it goes up. First time doing it and I like it. It’s probably safer to do it this way.

-

Not sure it’s safer if you hold it overnight. But nice job! I just covered that scalp per my update! Good action even with a drawdown day to keep the portfolio with realized gains!

-

I’ve been covering my shorts in relative short periods (hard for me to hold a long term core), I consider the LOB strategy very similar, except it takes more MR, and you still need to time it at perfection, or you will see the profits diluting on one side or the other.

For me, just the fact that I need to think when to add or reduce my long is a…[Read more]-

I would agree with your comments Guillermo. We have a different operation as I manage a portfolio, demanding of me profits and to the extent I can actively manage strategies I’m obligated. But for individuals I certainly wouldn’t recommend the LOB, very difficult and needs precision timing.

-

-

-

Retiredmarine1214 replied to the topic Govt’ Shutdown in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

I bought a bunch of long calls almost equalized out my short calls to see what would happen if they shut down.

-

Retiredmarine1214 replied to the topic Sell vix put spread in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

I like that trade seems like a no brainer. Draw down was virtually non existent.

-

Retiredmarine1214 replied to the topic Sell vix put spread in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

Covered half of my bear vix put spread. For about a 25% gain

-

Retiredmarine1214 replied to the topic Spy calls -today’s date- Jan 11th in the forum Daily Market Action: DOW, NASD, SPX 7 years ago

Yes that’s a good idea. But my account is kinda small yet but growing. And that takes a lot of my buying power away to use on drops.

-

Retiredmarine1214 replied to the topic Sell vix put spread in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

I will close mine out tomorrow if it goes any higher. Mine were for feb 14 so I had lots of time to sit and wait.

-

Retiredmarine1214 replied to the topic Sell vix put spread in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

My vix bear put spread is green by about 20%

Started to begin adding to VMIN about every .10 move down.

-

Retiredmarine1214 replied to the topic Sell vix put spread in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 7 years ago

A week later this trade is now beginning to pay off.

- Load More

Yes