-

Seth Golden and

Sanjay Hingorani are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

-

Seth Golden and

Aggy K are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

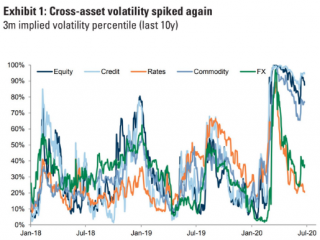

Goldman: “while equity volatility should normalise further with a better macro backdrop, it is likely to remain elevated compared with long-run history in the coming months” -

Seth Golden posted an update 4 years, 4 months ago

Citigroup: 1. Easy money/ loose monetary conditions helps to suppress equity market volatility and reduce the ‘fatter’ left tail in the return distribution

2. positive economic surprises increase confidence that 2021 EPS can bounce materially

3. We want to buy this equity ‘dip’

4. The search for yield could return as

a driver of spreads…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

JPM MId-year outlook: After month-end and the summer months, we expect volatility to decline and see the VIX falling by half, declining from 30 to 15. Lower volatility should drive equity inflows, while the present value of earnings is higher due to lower rates. Value experienced a record rally in May and then a slight pull back, but Value should…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

GS now estimating $65bn of rebal selling

The flow is very well-understood by the market and it has been frustrating for bears that we traded so well earlier….But as the Program Trading desks always say….”a sell-flow of >$50bn is a sell-flow of >$50bn….”

….. it needs to get executed…and it way more often than not has market impact with…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

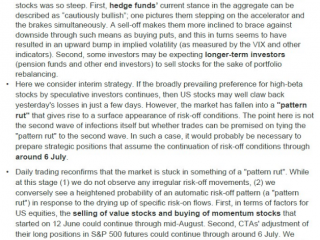

Nomura on yesterday’s sell-off -

Seth Golden posted an update 4 years, 4 months ago

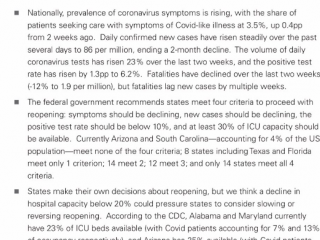

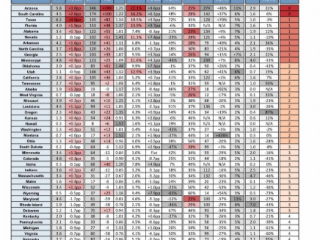

Goldman State Covid tracker -

Seth Golden and

Brandonb1 are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

Pantheon Macro: -

Seth Golden posted an update 4 years, 4 months ago

Deutsche Bank: Before we get too bearish on a Monday morning it is just worth revisiting the “sentiment & positioning” data. Yes – it has become less bearish over the… -

Seth Golden posted an update 4 years, 4 months ago

Everyone has an opinion, but they never offer actionable advice. Perhaps it is because many have zero conviction after they shout their opinion. An empty trash can makes the most noise, and that has been been very evident in 2020.

-

Seth Golden and

mander996 are now friends 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

CITI: “We analyse market drawdowns during ‘QE’ and ‘non-QE’ periods. Whilst pullbacks are just as likely to occur when CBs are undergoing QE, it removes the ‘fatter left tail’ in equity return distribution, and thus corrections are shallower”

-

Seth Golden posted an update 4 years, 4 months ago

Massive amount of options expiring on Friday. $1.8tln of SPX options – making it the third-largest non-December expiration on record -in addition to $230bln of SPY options and $250bln of options on SPX and SPX E-mini futures. -

Seth Golden posted an update 4 years, 4 months ago

There was A LOT of shorts to serve as fuel. According to BofA “tactical short positions in small-cap, value, Europe, EM, banks, industrials were covered *violently*” -

Seth Golden posted an update 4 years, 4 months ago

JPM hosted their “Macro & Quant” virtual conference this week with 3000 participants. An investor survey showed massive bearishness on the economy. Cant these quant guys… -

Seth Golden posted an update 4 years, 4 months ago

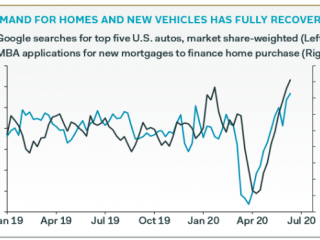

J.P. Morgan US Economic Activity Surprise Index – boosted by yesterday´s data Index measuring the balance between positive and negative economic surprises over a 6-week rolling window -

Seth Golden posted an update 4 years, 4 months ago

“2020 will go down in history for many reasons, including listed option volume that topped 47.1M contacts on June 11, which was the sixth day over 40M this year and s… - Load More