@minthemouse

-

Seth Golden posted an update 1 year, 11 months ago

Finom Group will issue its First 2022 State of the Market on Monday January 2, 2023. Happy New Year to everyone!

-

Seth Golden and

cathymcdonnellschultz@gmail.com are now friends 1 year, 11 months ago

-

Seth Golden and

Ashutosh Sangwan are now friends 1 year, 11 months ago

-

Seth Golden posted an update 1 year, 11 months ago

J.P. Morgan LTCM 2023 Outlook -

Seth Golden posted an update 1 year, 11 months ago

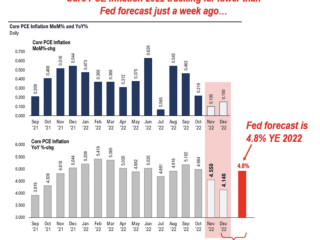

Fundstrat Tom Lee: Calendar will drop 2 and add 3 shortly. Dont be surprised if Fed tenor drops 🦅and adds some🕊. Core Y/Y PCE tracking than 4.8% projected by Fed for y… -

Seth Golden posted an update 1 year, 11 months ago

-

Seth Golden and

Mare are now friends 1 year, 11 months ago

-

Seth Golden posted an update 1 year, 11 months ago

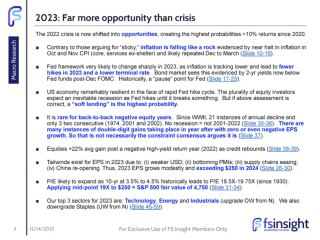

Fundstrat’s Tom Lee -

Seth Golden and

Abonoris are now friends 1 year, 11 months ago

-

Seth Golden posted an update 1 year, 11 months ago

Morgan Stanley Weekly Warm-Up with Mike Wilson -

Seth Golden posted an update 1 year, 11 months ago

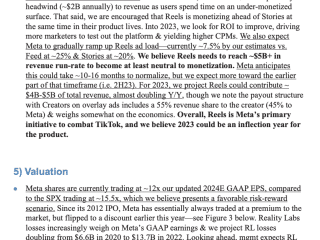

JP Morgan upgrades META -

Seth Golden and

Adrian are now friends 1 year, 12 months ago

-

Seth Golden and

Austin Powers are now friends 2 years ago

-

Seth Golden posted an update 2 years ago

Fundstrat’s Tom Lee -

Seth Golden posted an update 2 years ago

J.P. Morgan’s Marko Kolanovic: Full report Sunday release -

Seth Golden posted an update 2 years ago

J.P. Morgan’s Marko Kolanovic letter to investors with 2023 Outlook -

Seth Golden posted an update 2 years ago

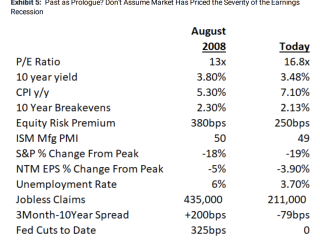

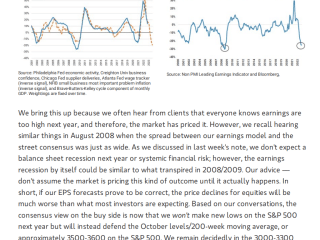

Morgan Stanley’s Mike Wilson -

Seth Golden posted an update 2 years ago

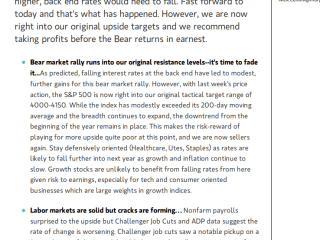

Below is a roundup of 16 of these 2023 forecasts for the S&P 500, including highlights from the strategists’ commentary. The targets range from 3,675 to 4,500. The S&P closed on Friday at 4,071, which implies returns between -9.7% and +10.5%.

Barclays: 3,675, $210 EPS (as of Nov. 21, 2022) “We acknowledge some upside risks to our scenario ana…[Read more]

-

Seth Golden posted an update 2 years ago

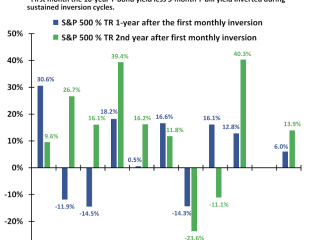

The “average” returns following all nine previous inversions (the far right-side bars on the chart) were surprisingly positive in both “year 1” and “year 2” (i.e., +6%… -

Seth Golden posted an update 2 years ago

Jeff deGraaf of RenMac LLC on ISM Prices Paid:

“It’s in the bottom 1/3 of all years going back 70 years. Historically, this has been EXTRAORDINARILY BULLISH ZONE for equities!”

- Load More