@minthemouse

-

Mark Minnis posted an update 5 years ago

Mind the gap! How long do you have to wait for an SPX gap to fill? The average is 33 bus days, but the distribution is very skewed. 50% of gaps filled in 7 bus days. 75% of gaps filled in 35 days. 9% of gaps currently unfilled. Data from March 29, beginning of official bull market.

Historically gaps filled been to be a tailwind for SPX. 7…[Read more]

-

Mark Minnis posted an update 5 years ago

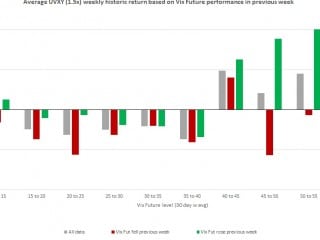

UVXY and other VIX ETPs demonstrate downwards momentum when VIX futures fall in the previous week( especially 15<VixFut40) upwards moment is shown but volatility is very high and sample size extremely small. Making playing the upside significantly more difficult.

-

Mark Minnis started the topic What happens after Fed rate cut in the forum Daily Market Action: DOW, NASD, SPX 6 years ago

As you are discussing the Fed cut I had a look at what was the impact of Dow Jones (price return) over the next 1m. 3m,6m,1y and year following the first fed rate cut (25 or more) after a period of monetary tightening.

1m 3m 6m 1y 3y

Sep 07 0.2% -4.5% -11.8% -21.9% -22.4%

Jan 01 -3.6% -1.4% -3.3% -8.9% -3.7%

Oct…[Read more] -

Mark Minnis posted a new activity comment 6 years ago

Mike raises some valid points about Earnings. I’m unsure if an Earnings recession is imminent as Mike suggests but I’m concerned about the potential slow down in earnings on companies ability to pay interest and refinance debt. Non-financial Debt Service Coverage Ratio has been around 41% since 2017 compared to 44-45% just before the financial…[Read more]

-

Mark Minnis replied to the topic Hedging TVIX short position in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 6 years ago

I was looking at the closing prices and closing NAV where it was 45% discount to NAV taken from Pro shares website. I’m assuming that was at the close of the bell rather than after hours.

The pro shares website of UVXY has a nice tool which enables you to view the distribution of the premium/discount over the quarters (4 quarters are shown). When…[Read more]

-

Mark Minnis replied to the topic Hedging TVIX short position in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 6 years ago

Hi

Does anyone know the reasons why the prices of the long Volatility ETPs (UVXY, VXXY) did not increase as much as their NAV’s and VIX futures during the 5 Feb (Volmageddon). VXX price increase by 33% and UVXY price increased by 66% despite being 2x leveraged at the time. The NAV of these funds increased considerable more UVXY NAV (determined…[Read more]

-

Mark Minnis posted a new activity comment 6 years ago

Hi Seth, That is an interesting chart. Is it created purely from Volatility ETPs or are you also looking at VIX futures and/or SPX options in general?

One thing that has always confused me for every future or options position there is a buyer and a seller so if the net vega position is zero how can you tell what the commercial position is?

-

Mark Minnis started the topic Volatility ETF Arbitrage in the forum UVXY, TVIX, VXX, XIV, SVXY, VIXY, VMAX, VMIN 6 years ago

I’m sure the 5th February 2018 is a date that is etched in all volatility traders minds. The VIX doubled in a single day and short volatility traders experienced what we call in the UK “squeaky bum time” and many inverse ETN products (XIV) were wiped out and subsequently closed down. A few like Chris Cole from Artemis Capital must have felt that…[Read more]

-

Seth Golden and

Mark Minnis are now friends 6 years ago