-

Seth Golden posted an update 4 years, 2 months ago

S&P 500 up 13 of last 17 September option expiration weeks – September’s option expiration week is up 60.5% of the time for S&P 500 since 1982. DJIA and NASDAQ have slightly weaker track records with gains 55.3% of the time and 57.9% of the time

-

Seth Golden posted an update 4 years, 2 months ago

Flow & Liquidity expert at JPM, Nikos P, sees significant equity selling into month-end. Flows have clearly been important in September. Will this one also spook the market?

“We estimate around -$200bn of negative rebalancing flow by entities that tend to rebalance on a quarterly basis, such as US defined benefit pension plans, Norges Bank, i.e.…[Read more]

-

Seth Golden posted an update 4 years, 3 months ago

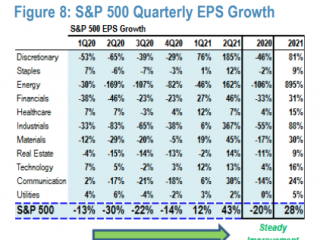

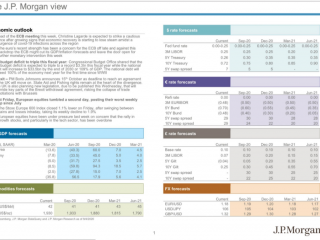

J.P. Morgan outlook of recovery and EPS -

Seth Golden posted an update 4 years, 3 months ago

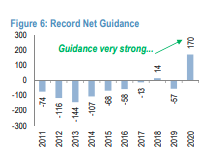

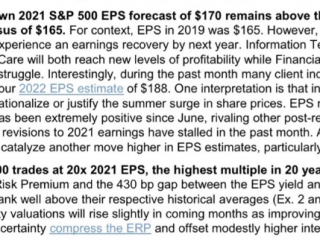

Goldman on 2021 EPS and valuations: -

Seth Golden posted an update 4 years, 3 months ago

Goldman Sachs conversations we are having with clients -

Seth Golden posted an update 4 years, 3 months ago

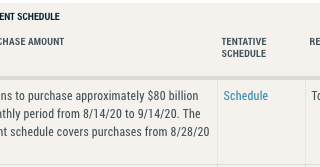

Fed’s POMO schedule will be released tomorrow afternoon -

Seth Golden posted an update 4 years, 3 months ago

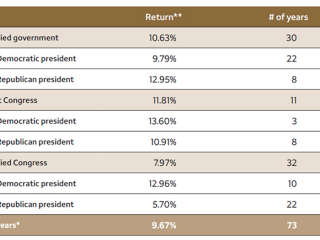

Half of U.S. presidential elections since 1945 have delivered single-party government, including three of the past four.1 Moreover, unified government has historically… -

Seth Golden posted an update 4 years, 3 months ago

J.P. Morgan: “We find little evidence to suggest that retail investors have played a big role in this month’s equity correction, at least up until last week. If anything, small option traders saw last week’s correction as an opportunity to add to their call option buying, especially on individual equities.

We thus suspect that institutional inv…[Read more]

-

Seth Golden posted an update 4 years, 3 months ago

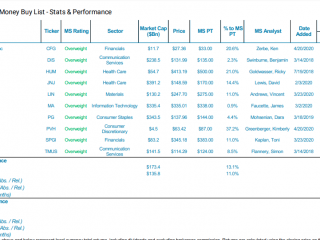

Morgan Stanley’s Fresh Money Buy List -

Seth Golden posted an update 4 years, 3 months ago

J.P. Morgan economic outlook: -

Seth Golden posted an update 4 years, 3 months ago

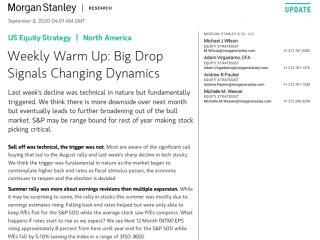

Morgan Stanley’s Mike Wilson: -

Seth Golden and

Daniel Benyo are now friends 4 years, 3 months ago

-

Seth Golden posted an update 4 years, 3 months ago

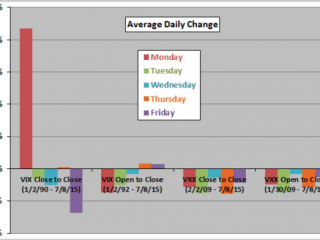

VIX calendar and VXX, 1990 and 2009 respectively -

Seth Golden posted an update 4 years, 3 months ago

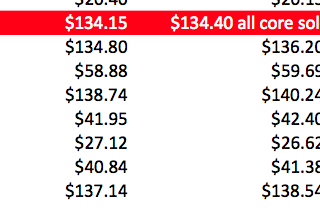

Last week’s completed Finom Group trade alerts. We maintain a 98% hit rate YTD! -

Seth Golden posted an update 4 years, 3 months ago

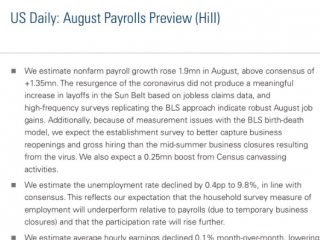

Goldman on NonFarm Payroll -

Seth Golden posted an update 4 years, 3 months ago

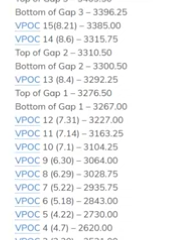

Gap fill zones -

Seth Golden posted an update 4 years, 3 months ago

Merrill Lynch forecasts: “August nonfarm payrolls are likely to rise by 1.2mn and the unemployment rate should improve to 9.6%, falling back down to single digit territory.”

-

Seth Golden posted an update 4 years, 3 months ago

Due to reopening of schools in Florida and scheduling of Parent Open House scheduling, this week we are forced to forgo our weekly State of the Market video. Our weekly Research Report will be available Sunday morning, per usual. If you have any questions, feel free to message me at your convenience.

-

Seth Golden posted an update 4 years, 3 months ago

Breaking down Macy’s Q2 numbers:

-Loss per share: 81 cents vs. loss of $1.77, expected

-Revenue: $3.56 billion vs. $3.48 billion, expected

-Same-store sales: down 35.1% vs. decline of 28.2%, expected

-Online sales up 53% -

Seth Golden posted an update 4 years, 3 months ago

Morgan Stanley: “While it’s no surprise banks have underperformed with 10 year yields so low, the magnitude of underperformance has been even worse than projected by the very powerful relationship. Using MS rates strategy team forecast for 10 year yields to be at 1.30% by June 2021 the change in y/y relative performance of banks would be d…[Read more]

- Load More