-

Seth Golden posted an update 5 years ago

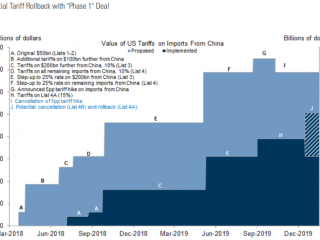

#CHINA’S COMMERCE MINISTRY:

CHINA, US HAVING DEEP DISCUSSION ON SIZE OF TARIFFS THAT NEED TO BE REMOVED;

THE SIZE SHOULD FULLY REFLECT SIGNIFICANCE OF PHASE-ONE DEAL, SHOULD BE DECIDED BY THE TWO SIDES;

TRADE WAR STARTED WITH TARIFFS, SHOULD BE ENDED WITH REMOVAL OF TARIFFS

-

Seth Golden posted an update 5 years ago

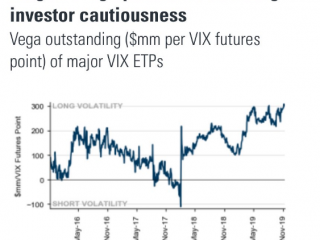

Long VEGA in VIX-ETPs. as usual -

Seth Golden posted an update 5 years ago

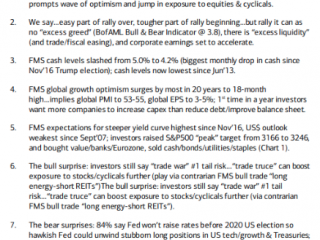

Bank of America FMS survey takeaways -

Seth Golden posted an update 5 years ago

-

Seth Golden and

traderfrankie are now friends 5 years ago

-

Seth Golden posted an update 5 years ago

Kostin: “Looking into 2020, although consensus expectations for 9% EPS growth appear too optimistic, modest negative revisions should not pose a major risk to the market. Consensus estimates are usually too optimistic. Consensus 2020 earnings estimates have come down by 4% since March 2019 and the current trajectory of revisions is consistent with…[Read more]

-

Seth Golden posted an update 5 years ago

Ouch for real estate sector -

Seth Golden posted an update 5 years ago

Kolanovic on rising rates:

“Rotation from defensives/momentum into value/cyclicals to continue. Yields can increase another ~150 bps before they become a potential problem, and that rising yields will only accelerate the upside in cyclical and value stocks as they reflect improving economic conditions” -

Seth Golden posted an update 5 years ago

Goldman on rolling back tariffs -

Seth Golden and

trignomes are now friends 5 years ago

-

Seth Golden posted an update 5 years ago

Goldman Sachs: “Flows yesterday really turned into FOMO, we saw aggressive buying across the banks and a clear bid to value within our franchise flows. As a trader I always take caution when the sentiment on the floor has shifted aggressively and abruptly”

-

Seth Golden posted an update 5 years ago

UBS Macro making some sensible comments on where we are in the cycle:

1. Traditional ideas of late and early cycle have gone out of the window

2. The good news is that we believe that this cycle is not about to roll over and die unless we suffer exogenous shocks.

3. The bad news is that while the Business and Financial cycles have room to grind…[Read more]

-

Seth Golden posted an update 5 years ago

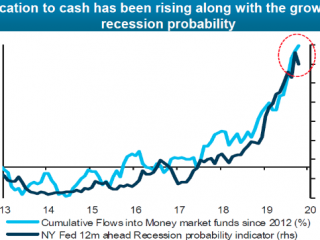

Cash balance on the rise still -

Seth Golden posted an update 5 years ago

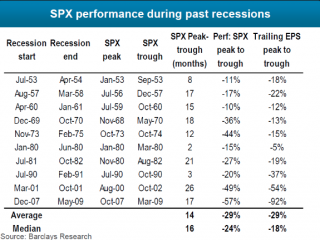

S&P500 peaked on average 11 months after the yield curve inverted and 5 months before a recession started

-

Seth Golden started the topic Merrill says more room in Apple in the forum Apple Inc. (AAPL) 5 years ago

ML on AAPL: if past cycles are any indicator there is significant room for upside

“the relative performance of Apple shares have actually lagged (-6% absolute and -8% relative) into the iPhone 11 launch”Now you know, that chart of AAPL in 2019 is an UNDERPERFORMING stock

we are getting close to an interim peak (for the general market) when…[Read more]

-

Seth Golden posted an update 5 years ago

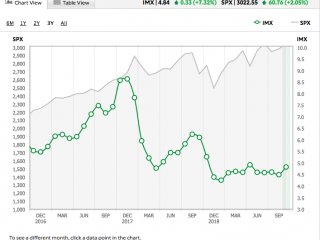

IMX vs S&P 500 -

Seth Golden posted an update 5 years ago

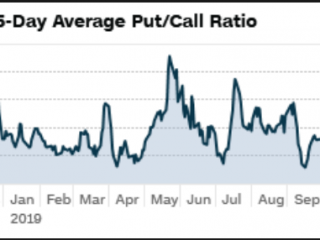

CBOE risk appetite -

Seth Golden posted an update 5 years ago

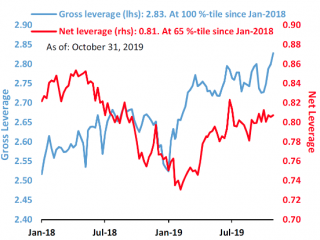

JPM Prime Brokerage data shows a significant spike in gross leverage… -

Seth Golden posted an update 5 years ago

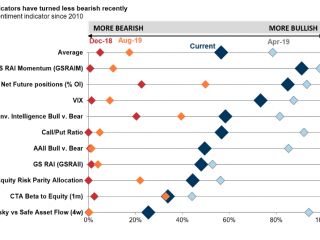

Goldman Sentiment indicators, slightly less bearish -

Seth Golden posted an update 5 years ago

From Goldman Sachs Trading Desk: “Seasonality into year end will be a tailwind and particularly for most fund managers who are underperforming the rally, there is a strong urgency to lift beta growth proxies in a hope this will close the performance gap into year end”

- Load More