-

Seth Golden posted an update 3 years, 8 months ago

According to Goldman’s Prime Brokerga in the US we’ve seen the “largest $ net selling since Jan 27th (-2.0 standard deviations) driven by short sales in Macro Products…Macro Products have been net sold in 9 of the past 10 trading days… ETF shorts have increased +9% week/week (+25% YTD) and now make up 21.4% of the non-Index US short book, the…[Read more]

-

Seth Golden and

Chris Dover are now friends 3 years, 9 months ago

-

Seth Golden posted an update 3 years, 9 months ago

Rising yields = Rising stock prices, historically speaking… -

Seth Golden posted an update 3 years, 9 months ago

J.P. Morgan on Bonds, Tapering, Equities -

Seth Golden posted an update 3 years, 9 months ago

February returns for SPX since 2001

2001: -9.23

2002: -2.08

2003: -1.7

2004: 1.22+

2005: 1.89+

2006: .05+

2007: -2.18

2008: -3.48

2009: -10.99

2010: 2.85+

2011: 3.2+

2012: 4.06+

2013: 1.11+

2014: 4.3+

2015: 5.49+

2016: -.41

2017: 3.72+

2018: -3.89

2019: 2.97+

2020: -8.4 -

Seth Golden posted an update 3 years, 9 months ago

Changes in Warren Buffett’s holdings -

Seth Golden posted an update 3 years, 9 months ago

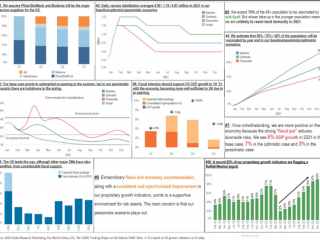

Morgan Stanley: Reaching Herd Immunity -

Seth Golden and

tj12 are now friends 3 years, 9 months ago

-

Seth Golden posted an update 3 years, 9 months ago

The #ValentinesDay indicator is looking good so far.

The avg return since 1950 for the S&P 500 from 2/14 until the end of the year is 7.5%.

But if up >4% YTD on 2/14 it jumps up to 13% the rest of the year.

The S&P 500 is up 4.3% YTD right now.

-

Seth Golden posted an update 3 years, 9 months ago

JPM says very few corporates will follow Tesla into Bitcoin: “In all, while bitcoin got another boost with Tesla’s announcement this week, the 8% allocation of its cash reserves to bitcoin is unlikely to be followed by more mainstream corporates. Irrespective of how many corporates eventually follow Tesla’s example, there is no doubt that this wee…[Read more]

-

Seth Golden posted an update 3 years, 9 months ago

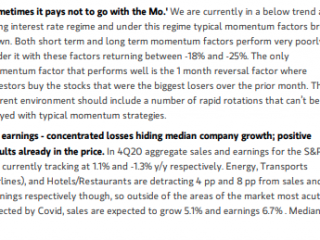

Goldman Sachs economists are expecting the economy to spring in spring. They see Q2 GDP improving at an 11% pace, better than their 10% forecast previously.

Their baseline on stimulus has moved up to $1.5 trill ion from $1.1 trillion and that’s led to the boost, which extend through the year. Their 2021 forecast is now 6.8% comapred to 6.6%…[Read more]

-

Seth Golden posted an update 3 years, 9 months ago

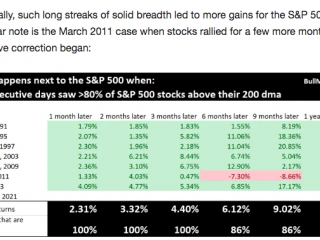

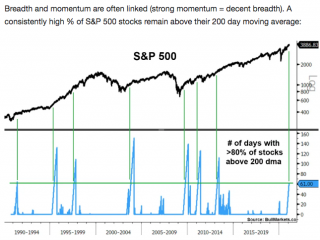

Breadth signal based on % of stocks trading above 200-DMA via Troy Bombardi -

Seth Golden posted an update 3 years, 9 months ago

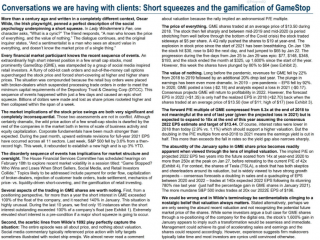

Goldman Sachs conversations with clients -

Seth Golden posted an update 3 years, 9 months ago

The S&P 500 weekly expected move, as priced by the options market has moved from $126 last week down to ~$59 for the coming week. That’s what happens when implied volatility (IV) drops as quickly as it did from one week to the next. -

Seth Golden posted an update 3 years, 9 months ago

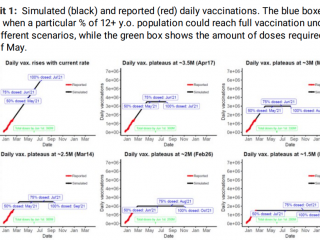

BofA | Outlook for vaccine distribution, the virus and the economy -

Seth Golden posted an update 3 years, 9 months ago

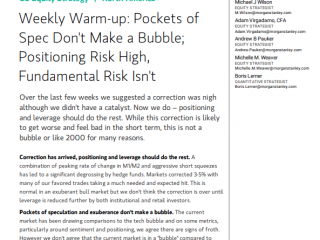

Morgan Stanley’s Mike Wilson & Co. -

Seth Golden posted an update 3 years, 9 months ago

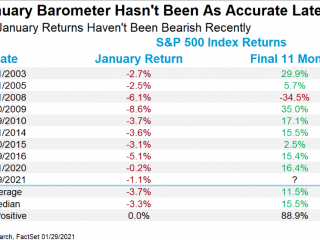

January Barometer failed, but… actually, lately that has been a good thing -

Seth Golden posted an update 3 years, 9 months ago

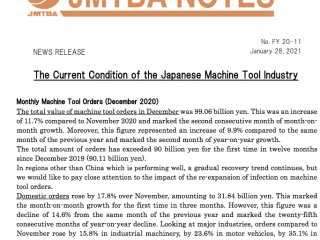

Japanese machine tools orders -

Seth Golden and

Jimmy Spinner are now friends 3 years, 9 months ago

-

Seth Golden posted an update 3 years, 9 months ago

VIX and SPX after 1-day ROC - Load More