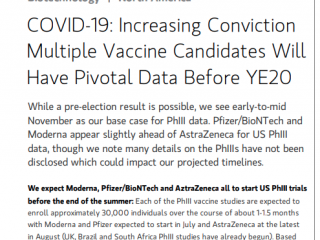

-

Seth Golden posted an update 4 years, 4 months ago

-

Seth Golden posted an update 4 years, 4 months ago

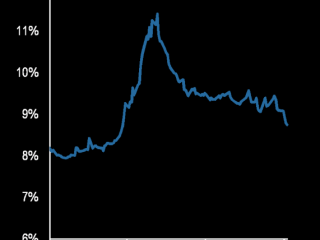

“While we acknowledge that equity short covering has advanced further in recent weeks, we still find room for further covering at the equity index level in the US and at… -

Seth Golden posted an update 4 years, 4 months ago

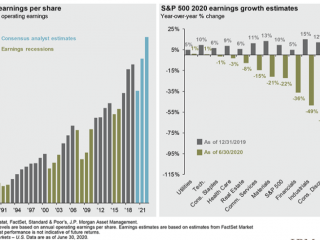

J.P. Morgan S&P 500 EPS: -

Seth Golden posted an update 4 years, 4 months ago

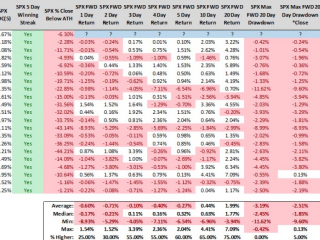

$SPX gains 4% or more over 5 trading days and doesn’t close at an ATH. Lots of red early on, lots of white later on, historically. -

Seth Golden posted an update 4 years, 4 months ago

Remember quarterly S&P 500 EPS in 2009, more than doubly worse than in 2020 thus far -

Seth Golden posted an update 4 years, 4 months ago

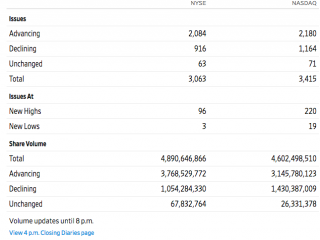

Today’s breadth -

Seth Golden posted an update 4 years, 4 months ago

If the 2009 analogue holds true, we should continue to see a rangebound S&P 500 over the coming 2 trading weeks with a new relief rally high in week 3 of July -

Seth Golden posted an update 4 years, 4 months ago

J.P. Morgan: Matejka, head of equity strategy, who has a very successful call in calling the bottom and being bullish throughout the spring – sounds more negative now.

1. Investor sentiment surveys are far from depressed, and positioning has recovered nicely, with retail investors strongly participating. Robust retail buying was historically not…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

Citi: 1. We expect global equities to still be around current levels in 12 months.

2. We would not chase markets higher from current levels, but would prefer to wait for the next dip.

3. Bull: Global Central banks are likely to buy $6trn of financial assets over the next 12 months, over twice previous peaks.

4. Bear: bottom-up global EPS…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

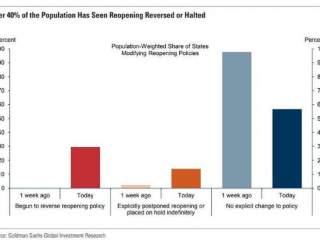

Goldman Sachs: Re-acceleration of Covid makes GS cut outlook for service consumption growth in July/August. They downgrade Q3 GDP forecast from +33% (quarter-on-quarter annualized) to 25%.

“The sharp increase in confirmed coronavirus infections in the US has raised fears that the recovery might soon stall. Although a significant part of the…[Read more]

-

Seth Golden posted an update 4 years, 4 months ago

Goldman Sach (GS)’s latest state-level coronavirus tracker calculates that 40% of the U.S. has now reversed or placed reopening on hold following the rise of cases. -

Seth Golden posted an update 4 years, 4 months ago

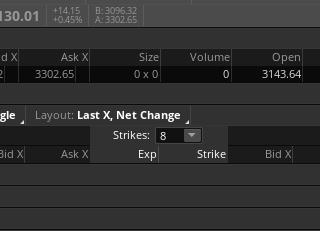

S&P 500 weekly expected move drops from $101 in the past week to $80 as the VIX fell some 20% this past week. -

Seth Golden posted an update 4 years, 4 months ago

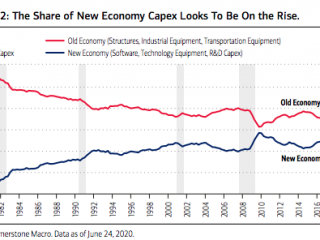

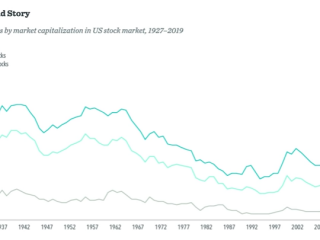

Dow Theory will no longer hold in the information technology era -

Seth Golden posted an update 4 years, 4 months ago

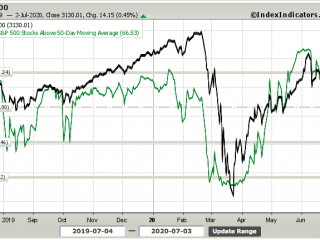

% of stocks trading above 50-DMA jumped from 45% to 66% over the trading week. -

Seth Golden posted an update 4 years, 4 months ago

Top stocks are always the driving force of the market, top 5 or top 10 -

Seth Golden posted an update 4 years, 4 months ago

Goldman Sachs on Joe Biden: Don’t fear too much:

“The dominant market issue in our view so far has been Vice President Biden’s proposal to reverse half of President Trump’s cut in the corporate income tax rate from 35% to 21%, which we think could become a strong possibility in the event of a Democratic “sweep”. Given that such a reversal would t…[Read more] -

Seth Golden posted an update 4 years, 4 months ago

SOTM video: We had a coding issue that has now been fixed. Our apologies everybody!! It is now remedied and viewable!

-

Seth Golden posted an update 4 years, 4 months ago

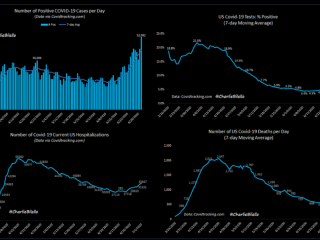

In everything apart from deaths…-New cases: 52,982 (new high)

-7-day avg of pos cases: 43,682 (new high)

-7-day avg of new tests: 608,572 (new high)

-% positive 7-day avg: 7.2% (highest since 5/14)

-

Seth Golden posted an update 4 years, 4 months ago

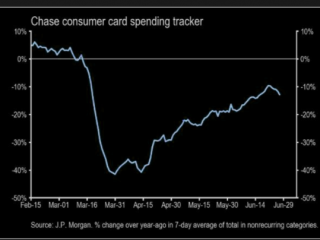

J.P. Morgan “At its peak on June 21, our tracker of card spending in nonrecurring categories was down 9.6% from its level last year at this time, but it has reversed course since last weekand is now down 12.9% through June 27” -

Seth Golden posted an update 4 years, 4 months ago

Merrill on slowdown: “Total card spending turned lower and is now running at -3.8% yoy for the 7-days ending June 27th vs. flat over the prior 7-day period.

The states … with increasing virus cases have led the national slowdown, particularly in restaurants.”

- Load More