-

Seth Golden posted an update 3 years, 11 months ago

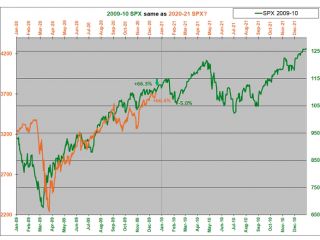

2009 analogue, continuing into 2010… -

Seth Golden and

Goosebill Greywing are now friends 3 years, 11 months ago

Goosebill Greywing are now friends 3 years, 11 months ago -

Seth Golden posted an update 3 years, 11 months ago

When the S&P 500 gained 1% or more the week after Black Friday, the next three months averaged a return of 3.9% with over 80% of the returns positive. When next week has… -

Seth Golden posted an update 3 years, 11 months ago

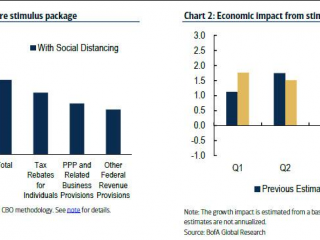

Based on cost estimates of the various provisions and applying the corresponding fiscal multipliers (Chart 1), Bank of America estimates that the new stimulus package… -

Seth Golden posted an update 3 years, 11 months ago

The chart below highlights the average daily change (absolute value) in the S&P 500 (SPX) for each month of the calendar year. Thus far (through 12/9), December is the least volatile on average. -

Seth Golden posted an update 3 years, 11 months ago

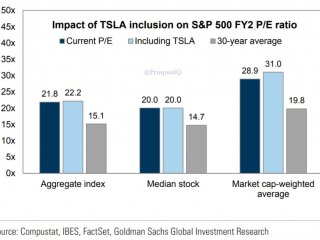

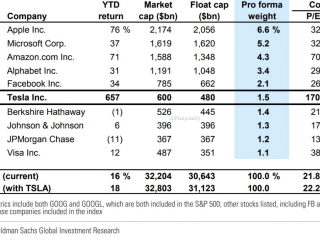

Goldman Sachs: $TSLA inclusion will lift the aggregate S&P 500 P/E by just 0.4 turns -

Seth Golden posted an update 3 years, 11 months ago

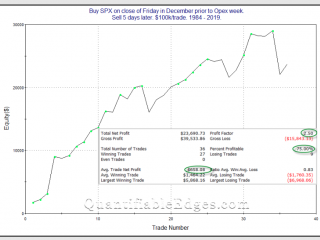

Below is an updated look at the stats and profit curve for owning SPX from the close of the Friday before December opex to the close on December opex. -

Seth Golden posted an update 3 years, 11 months ago

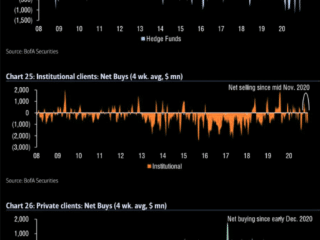

According to the latest franchise flow data from BoAM the battle in the trading pit is between a small professional well-trained army of institutions and hedge funds… -

Seth Golden posted an update 3 years, 11 months ago

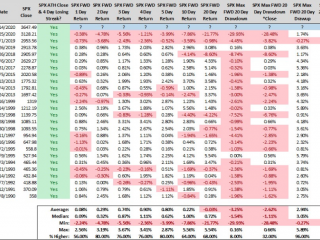

When SPX closes at a fresh new all-time high and then declines 4 days in a row. -

Seth Golden posted an update 3 years, 11 months ago

-

Seth Golden posted an update 3 years, 11 months ago

J.P. Morgan:

1. expect next year to be front-loaded with most of the market upside realized in the first six months of the year2. continued exceptionally easy monetary policy (US M2 money supply +24% y/y, largest increase since 1940s) and another round of fiscal stimulus ($700-900b) in the near future;

3. COVID-19 vaccine distribution and…[Read more]

-

Seth Golden posted an update 3 years, 11 months ago

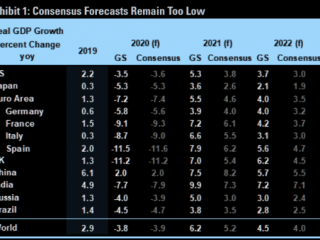

Jan Hatzius explains why Goldman is right and consensus is wrong: “Our global growth numbers remain well above consensus because we think too many forecasters are… -

Seth Golden posted an update 3 years, 11 months ago

-

Seth Golden posted an update 3 years, 11 months ago

-

Seth Golden posted an update 3 years, 12 months ago

To start November, systematic strategies were running $240 billion worth of long exposure compared to a max long of $530 billion of exposure in February, so plenty of scope to add. During the middle of November, it was forecasted approximately $12B billion worth of systematic buying per day with the VIX ending November at 20.57, its lowest close…[Read more]

-

Seth Golden posted an update 3 years, 12 months ago

OUCH!! The JPM Chase sample of 30mm Chase debit and credit card holders saw a 19% YoY fall in their Black Friday spending. The data shows a shift to online spending,… -

Seth Golden and

dasbof are now friends 3 years, 12 months ago

-

Seth Golden posted an update 3 years, 12 months ago

This is an important development. Global stocks have been in a bear market since Jan 2018. When a breakout like this occurs… anticipate a retest before more upside,… -

Seth Golden posted an update 3 years, 12 months ago

According to Pay with GasBuddy data, gasoline demand last week (Sun-Sat) was down 7.3% from the prior week. -

Seth Golden and

Kris Price are now friends 4 years ago

- Load More