-

Seth Golden posted an update 3 years, 7 months ago

Morgan Stanley global report. Copy link: file:///Users/sethgolden/Downloads/GLOBAL_20210316_0000.pdf

-

Seth Golden posted an update 3 years, 7 months ago

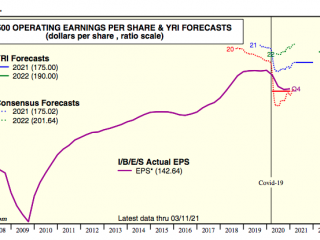

Continued earnings revision evolution -

Seth Golden posted an update 3 years, 7 months ago

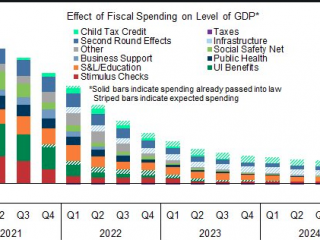

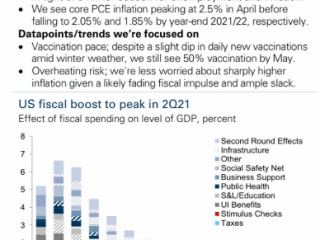

“In light of larger fiscal package just enacted, we now expect slightly higher GDP growth of +6% / +11% / +8.5% / +6.5% in 2021Q1-Q4 which implies +7.0% in 2021 on a full-year basis (vs. +5.5% cons) and +8.0% on a Q4/Q4 basis (vs. +6.0% cons)” -

Seth Golden posted an update 3 years, 7 months ago

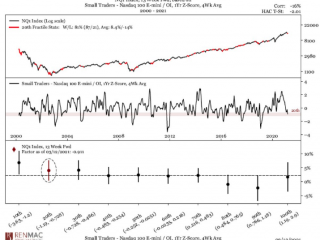

Nasdaq positioning is actually pretty light: -

Seth Golden posted an update 3 years, 8 months ago

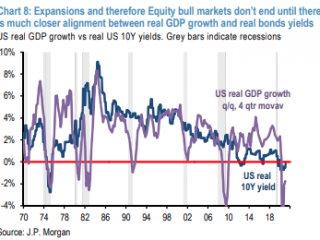

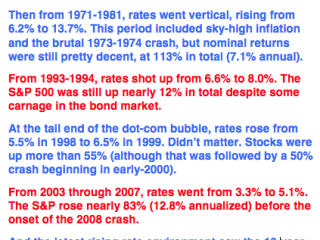

4) What level of interest rates stresses the economy

and Equities? Interest rates always rise to some degree asthe economy revives, but the risk of a negative… -

Seth Golden posted an update 3 years, 8 months ago

-

Seth Golden posted an update 3 years, 8 months ago

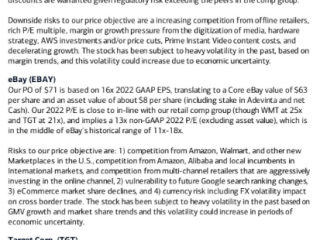

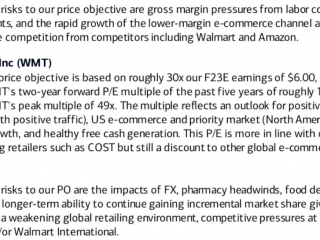

BofA Global Research: Price targets for e-commerce retailers -

Seth Golden posted an update 3 years, 8 months ago

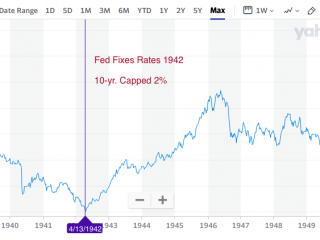

WWII Federal Reserve implemented YCC or capped rates. Here is what the S&P 500 did in April 1942-forward -

Seth Golden posted an update 3 years, 8 months ago

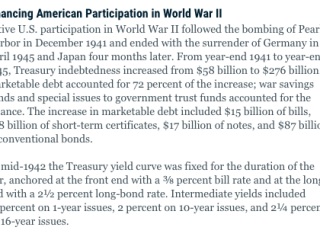

Yield curve controls -

Seth Golden posted an update 3 years, 8 months ago

When the normally weak month of February gains >2.5% for the S&P 500 (like ’21) then March is quite strong.

Since ’50?

Lower twice.

Flat 3 times. Higher the other 13 times.

-

Seth Golden posted an update 3 years, 8 months ago

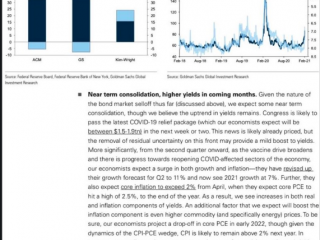

Goldman Sachs: Boost to economic growth and inflation expectations = rising yields -

Seth Golden posted an update 3 years, 8 months ago

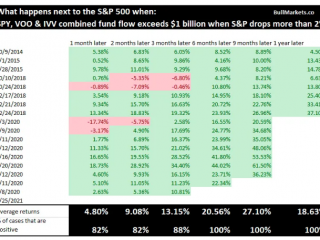

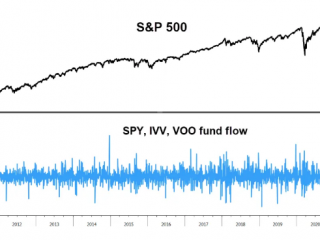

On Thursday, when the S&P 500 index saw a market decline of more than 2%, the S&P 500 ETFs SPY, VOO and IVV still saw inflows of greater than $1 billion. (Troy… -

Seth Golden posted an update 3 years, 8 months ago

Goldman Sachs latest views: -

Seth Golden posted an update 3 years, 8 months ago

According to Goldman’s Prime Brokerga in the US we’ve seen the “largest $ net selling since Jan 27th (-2.0 standard deviations) driven by short sales in Macro Products…Macro Products have been net sold in 9 of the past 10 trading days… ETF shorts have increased +9% week/week (+25% YTD) and now make up 21.4% of the non-Index US short book, the…[Read more]

-

Seth Golden and

Chris Dover are now friends 3 years, 8 months ago

-

Seth Golden posted an update 3 years, 8 months ago

Rising yields = Rising stock prices, historically speaking… -

Seth Golden posted an update 3 years, 8 months ago

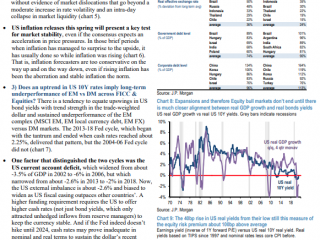

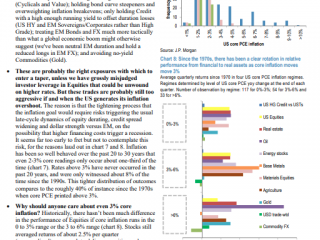

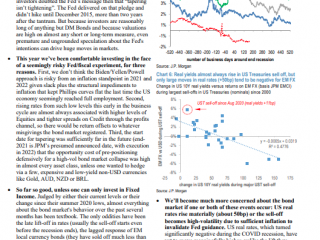

J.P. Morgan on Bonds, Tapering, Equities -

Seth Golden posted an update 3 years, 8 months ago

February returns for SPX since 2001

2001: -9.23

2002: -2.08

2003: -1.7

2004: 1.22+

2005: 1.89+

2006: .05+

2007: -2.18

2008: -3.48

2009: -10.99

2010: 2.85+

2011: 3.2+

2012: 4.06+

2013: 1.11+

2014: 4.3+

2015: 5.49+

2016: -.41

2017: 3.72+

2018: -3.89

2019: 2.97+

2020: -8.4 -

Seth Golden posted an update 3 years, 8 months ago

Changes in Warren Buffett’s holdings -

Seth Golden posted an update 3 years, 8 months ago

Morgan Stanley: Reaching Herd Immunity - Load More