-

Seth Golden posted an update 2 years, 5 months ago

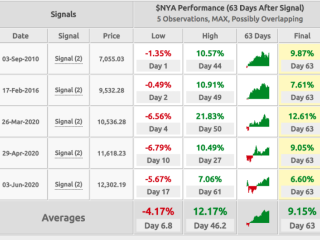

Breadth thrust whereby $NYA had 3 consecutive 80%+ Up volume days while under its 200-DMA. Only 5 times in 20 years. 3 months forward (63 days) events produced a 100%… -

Seth Golden and

thejademacca are now friends 2 years, 5 months ago

-

Seth Golden posted an update 2 years, 5 months ago

-

Seth Golden posted an update 2 years, 5 months ago

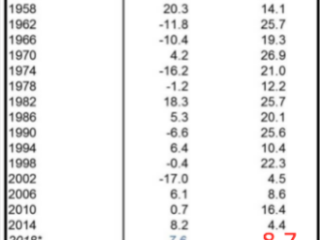

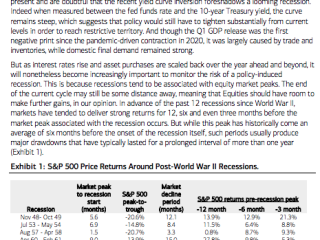

This stock market downturn is flirting with the -20% threshold commonly separating corrections from bear markets. More declines could come—maybe a lot, if it is a full-fledged bear market. That is the bad news. The good news: If this is a correction, it is a very long one—so the end is relatively close by. But it’s similar if a bear market. Their…[Read more]

-

Seth Golden and

JH are now friends 2 years, 5 months ago

-

Seth Golden and

fiscelan are now friends 2 years, 5 months ago

-

Seth Golden posted an update 2 years, 5 months ago

Fundstrat’s Market Newton CMT:

-

Seth Golden posted an update 2 years, 5 months ago

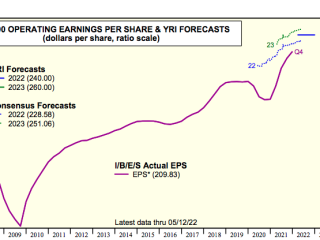

Still no FY2022 Earnings cut -

Seth Golden posted an update 2 years, 5 months ago

The Investing Mattrix -

Seth Golden posted an update 2 years, 5 months ago

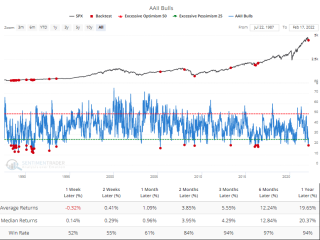

Never has S&P 500 been negative from November-April of a midterm cycle since 1942, batting .1000!The starting point remains to be determined, but the buy signal is undeniable.

Average return ~17%

Positivity rate = 100% -

Seth Golden posted an update 2 years, 6 months ago

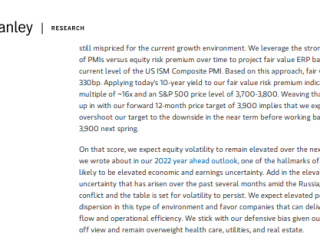

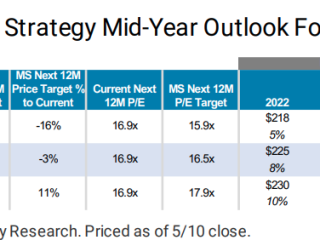

Morgan Stanley mid-year outlook: -

Seth Golden posted an update 2 years, 6 months ago

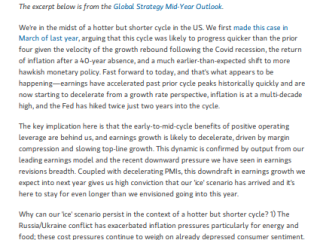

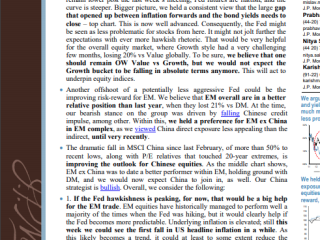

J.P. Morgan’s Mislav: -

Seth Golden posted an update 2 years, 6 months ago

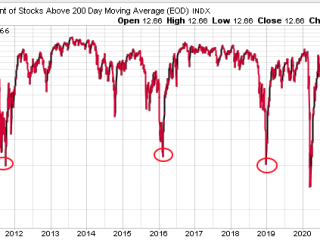

Nasdaq stocks above their 200DMA only 12%:Many bottom fishing indicators. I would suggest of the many, some will achieve their destiny, but not all will, nor do all…

-

Seth Golden posted an update 2 years, 6 months ago

Merrill Lynch: -

Seth Golden posted an update 2 years, 6 months ago

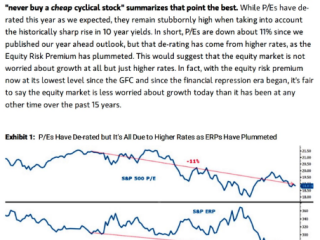

Morgan Stanley’s Mike Wilson: -

Seth Golden posted an update 2 years, 6 months ago

J.P. Morgan’s Dubravko:“We are revising down our 2022 S&P 500 EPS from $235 to $230 (still a healthy ~10% y/y growth). Our estimates for revenue growth (8-9%) and gross buybacks (~$1 trillion) are largely unchanged…”

-

Seth Golden and

MarketMogul are now friends 2 years, 6 months ago

-

Seth Golden posted an update 2 years, 6 months ago

Morgan Stanley’s Mike Wilson -

Seth Golden posted an update 2 years, 6 months ago

There have been 31 weeks when fewer than 20% of respondents in the AAII survey were bullish.After 29 of them, $SPX rallied over the next 3,6,12 months.

💥 $SPX 3-…

-

Seth Golden posted an update 2 years, 7 months ago

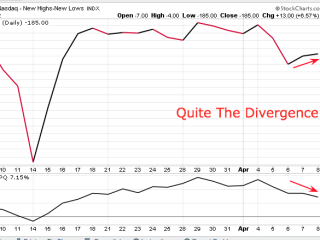

Quite the divergence in Nasdaq price vs. breadth - Load More