-

Seth Golden posted an update 2 years, 7 months ago

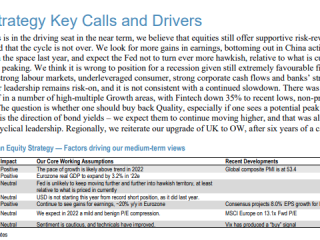

J.P. Morgan’s Dubravko:“We are revising down our 2022 S&P 500 EPS from $235 to $230 (still a healthy ~10% y/y growth). Our estimates for revenue growth (8-9%) and gross buybacks (~$1 trillion) are largely unchanged…”

-

Seth Golden and

MarketMogul are now friends 2 years, 7 months ago

-

Seth Golden posted an update 2 years, 7 months ago

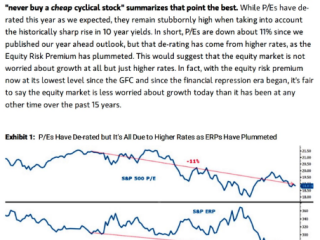

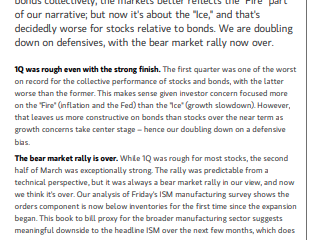

Morgan Stanley’s Mike Wilson -

Seth Golden posted an update 2 years, 8 months ago

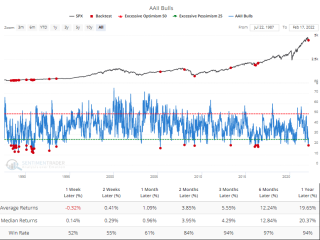

There have been 31 weeks when fewer than 20% of respondents in the AAII survey were bullish.After 29 of them, $SPX rallied over the next 3,6,12 months.

💥 $SPX 3-…

-

Seth Golden posted an update 2 years, 8 months ago

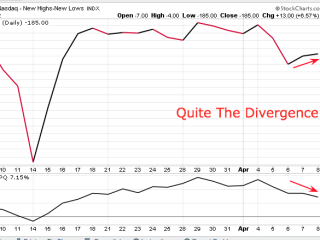

Quite the divergence in Nasdaq price vs. breadth -

Seth Golden posted an update 2 years, 8 months ago

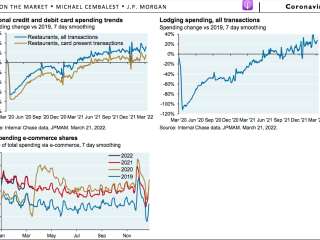

J.P. Morgan Card Spending data link here: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/covid-19/section-4.pdf -

Seth Golden posted an update 2 years, 8 months ago

Morgan Stanley’s Mike Wilson: -

Seth Golden posted an update 2 years, 8 months ago

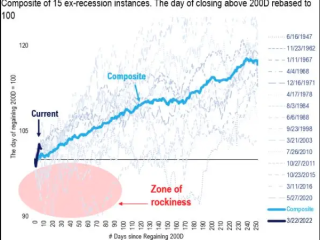

Fundstrat’s Tom Lee:Even as 1Q 2022 ends on a sour note, >90% 💥 probability that bottom for 2022 in.

$SPX fell >6% below its 200DMA and closed >200D = 31 times since WWII = bullish signal

-

Seth Golden and

mmessing are now friends 2 years, 8 months ago

-

Seth Golden posted an update 2 years, 8 months ago

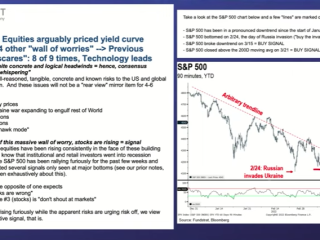

FundStrat’s Tom Lee -

Seth Golden posted an update 2 years, 8 months ago

J.P. Morgan’s Mislav on yield curve, recessions, risks -

Seth Golden posted an update 2 years, 8 months ago

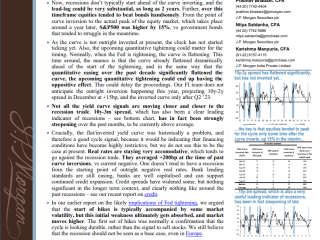

peeling back the LEI onion one layer exposes flags (a couple of red, otherwise mostly yellow) that are worth noting. Shown in the first portion of the table below are… -

Seth Golden posted an update 2 years, 8 months ago

Maximum Intra-Year Drawdown in Year 3 of Bull Market

1949-1952: -6.8%

1957-1960: -13.4%

1962-1965: -9.6%

1966-1969: -16%

1970-1973: -23.4% bear mkt

1974-1977: -15.6%

1982-1985: -7.7%

1987-1990: -19.9% bear mkt

2002-2005: -7.2%

2009-2012: -9.9%Avg. -12.95%

-

Seth Golden posted an update 2 years, 8 months ago

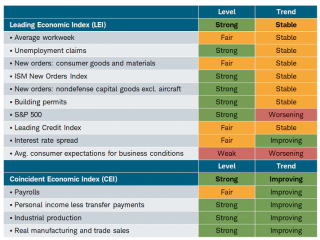

Here is how sectors perform when we have FALLING inflation from high levels.

Most probable from rate-of-change alone. (1st column)

Good for defensives, bad for cyclicals. Part of normalizing PMIs from high levels also. -

Seth Golden posted an update 2 years, 8 months ago

Big jump WoW in CY2022 EPS from $225 to $227.39. Biggest jump from one week to the next in 2022. -

Seth Golden posted an update 2 years, 8 months ago

For every investor concern there’s a full-proof remedy

-Trade war

-Weaker economy

-Recession

-Rising rates

-High inflation

-Yield-curve inversion

-Correction

-Great Financial Crisis

-Monetary tightening

-WarTime is an investor’s best friend; extend your time horizon!

-

Seth Golden posted an update 2 years, 9 months ago

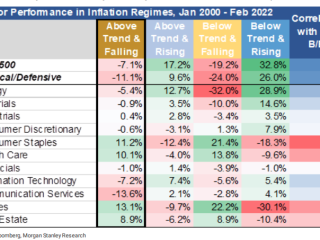

J.P. Morgan:Recessions still unlikely:

🔹More gains in earnings

🔹Bottoming in China activity

🔹Fed not to turn ever more hawkish

🔹Oil rose 238% entering 1974 & 198%… -

Seth Golden posted an update 2 years, 9 months ago

Years that start off bearish tend to end off bullish.

In the last 10 years when the S&P 500 was negative through Feb, 7 of them ended the year positive (70%). The only… -

Seth Golden posted an update 2 years, 9 months ago

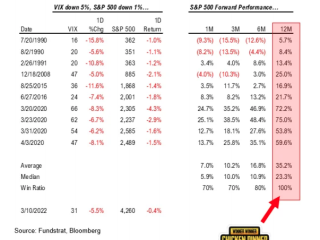

Fundstrat:

10 of 10 times the S&P 500 higher 12 months later

– 8 of 10 times the S&P 500 higher 6 months later

– average gain 35.2% and 16.8%, respectively -

Seth Golden posted an update 2 years, 9 months ago

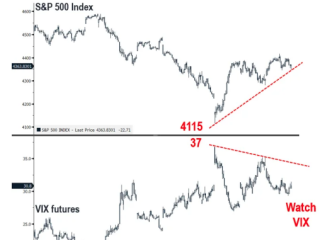

Fundstrat’s Tom Lee and Mark Newton:

In the 2022 context, what this means is that the S&P 500 can bottom well

ahead of the Russia-Ukraine conflict bottoming. We believe… - Load More