-

Seth Golden posted an update 4 years, 8 months ago

Mislav Matejka, head of strategy at JPM and a leading voice of the long term bull is slightly changing message:

1. relief bounce is likely given heavily oversold conditions, but markets to remain under pressure for longer…

2. now believe that stocks will remain under pressure for longer.

3. Expect an imminent relief bounce–

4. markets will s…[Read more] -

Seth Golden posted an update 4 years, 8 months ago

Bernstein: short term tactical case to buy equities. Bernstein´s short-term sentiment model has hit a -2 standard deviation level which has only occurred on a handful of occasions before. -

Seth Golden posted an update 4 years, 8 months ago

If a recession is to happen, here is what we might expect from markets via JPM -

Seth Golden posted an update 4 years, 8 months ago

New cases outside the major four outbreaks are accelerating

1. The total number of cases globally rose by 2,358 yesterday, almost double the 1,289 average over the… -

Seth Golden posted an update 4 years, 8 months ago

Positioning for Equity L/S hedge funds

1. Gross leverage decreased -4.4 pts – the largest week/week decline in more than two years – to 169.5% (22nd percentile one-year)2. Nets increased +0.2 pts to 48.6% (95th percentile).

-

Seth Golden posted an update 4 years, 8 months ago

Institutions sold a very large $39bn of US equity, close to 4x std-dev and the biggest weekly $-size on record and broadly consistent with other big risk-off periods ($37bn during the biggest week in Oct-18, $32bn in Aug-15 and $25bn in Mar-18

-

Seth Golden posted an update 4 years, 8 months ago

Port of Los Angeles container shipment data for January. Will have February data this week. https://www.portoflosangeles.org/business/statistics/container-statistics/historical-teu-statistics-2020 -

Seth Golden posted an update 4 years, 8 months ago

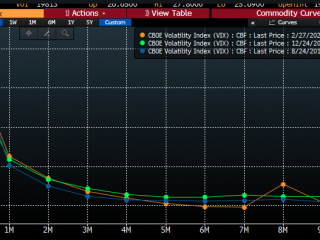

It is interesting how similar the VIX term structure looks to both 12/24/18 and 8/24/15 (minus election bump). -

Seth Golden posted an update 4 years, 8 months ago

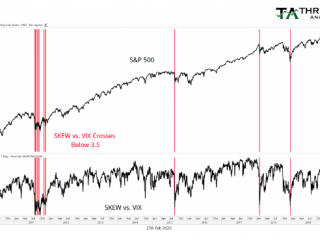

Market may be very near and/or forming a bottom. Whenever VIX/SKEW ratio gets this low, market has been at/near bottom. -

Seth Golden posted an update 4 years, 8 months ago

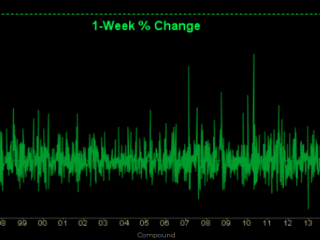

If the week ended Thursday, it would be the largest weekly spike in the Volatility Index ever (note: VIX started in 1990). +129% VIX -

Seth Golden and

Brice Lafontaine are now friends 4 years, 8 months ago

-

Seth Golden posted an update 4 years, 8 months ago

Gap set to be filled down at 3,094, would anticipate test of 200-DMA beyond there. CTAs with massive interest at/around 200-DMA -

Seth Golden and

Stephanie Jewel Ashley are now friends 4 years, 8 months ago

-

Seth Golden posted an update 4 years, 8 months ago

S&P futures top-of-book depth stands at ~$8mm currently vs. ~$21mm as of Wednesday’s close. This is an important indicator to monitor now, as weakening liquidity can… -

Seth Golden posted an update 4 years, 8 months ago

-

Seth Golden and

kylevd23 are now friends 4 years, 8 months ago

-

Seth Golden posted an update 4 years, 8 months ago

We just saw 2 days with 90% of NYSE issues going down. When we saw similar 2 day periods of such widespread selling in the past, $SPX rallied every time 2 months later by a median of +7.6%. 1 year later? $SPX up every time by a median of +24.8% -

Seth Golden posted an update 4 years, 8 months ago

In terms of market manifestations, there is nothing new here. The details might be different, at least a little, but the market behavior is the same. If that is the case, and it is, then that means there is no reason to deviate from whatever investment process you chose for yourself as being best for you, when emotions weren’t muddying the waters.…[Read more]

-

Seth Golden posted an update 4 years, 8 months ago

J.P. Morgan: “There are major question marks about why Italy is the only western country where the virus is spreading despite the major precautionary that had been p… -

Seth Golden and

Nihar are now friends 4 years, 8 months ago

- Load More