-

Seth Golden posted an update 4 years, 7 months ago

GS prime brokerage book saw the largest $ net selling since Dec ’18 (-2.8 SDs), driven entirely by short sales in Single Names and to a lesser extent Macro Products…. -

Seth Golden posted an update 4 years, 7 months ago

Spread of implied volatility vs. historical volatility has hit all-time lows:

The volatility risk premium – measured as the VIX minus SPX 1m realized volatility – has… -

Seth Golden posted an update 4 years, 7 months ago

Mike Wilson of Morgan Stanley:

“This time, we have a potentially much more inflationary combination of an unprecedented targeted fiscal stimulus and possible deregulation of the banks to get the cash into the hands of lower income individuals and small businesses that are inclined to spend it. Such a dramatic shift in US fiscal and monetary…[Read more] -

Seth Golden posted an update 4 years, 7 months ago

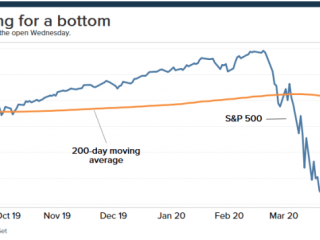

CS Strategy joins GS, JPM, MS etc in “consensus-calling” for equity markets to turn lower….

“We still have not seen all the preconditions we would expect for a market low. We believe that a consolidation/move down over the next month is likely, but that the old lows will hold. We stick to our targets for the S&P 500 of 2700 for year end”

-

Seth Golden posted an update 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

While the direction of the market still hinges on when the coronavirus outbreak is slowed, some signs are emerging that the bulk of the selling in stock and corporate… -

Seth Golden posted an update 4 years, 7 months ago

Check out our Weekend Futures market update video with Wayne Nelson of Finom Group https://www.dropbox.com/s/9zecwd9pvv5y0fo/1024-Wayne-04-05-2020__05.58.717_PM.webm?dl=0

-

Seth Golden and

closetdaytrader are now friends 4 years, 7 months ago

-

Seth Golden and

Blake Martin are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

Morgan Stanley Cross-Asset Sunday call: next 2 weeks will be more tactically challenging

1. we are past the beneficial flows around month-end re-balancing2. sees potential for renewed funds outflows cross-asset

3. we are past peak market uncertainty but not past peak macro uncertainty

4. earnings seasons will be downbeat

5. US covid news will…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

Now that’s what I’m talking about! -

Seth Golden posted an update 4 years, 7 months ago

JPM: latest reporting -

Seth Golden posted an update 4 years, 7 months ago

Will send out the latest J.P. Morgan Strategy Report Monday morning

-

Seth Golden and

EGO FOMIN are now friends 4 years, 7 months ago

-

Seth Golden and

Fourth Street Fund are now friends 4 years, 7 months ago

-

Seth Golden posted an update 4 years, 7 months ago

Goldman Sachs on China Recovery -

Seth Golden posted an update 4 years, 7 months ago

BofA on capitulation

March capitulation: historic $284bn out of bonds and $658bn into cash in past 4weeks ($64bn out of equities = sideshow).

Bond capitulation: record month of redemptions from IG bonds ($156bn), EM debt ($47bn), Municipal bonds ($24bn), HY bonds ($23bn).

-

Seth Golden posted an update 4 years, 7 months ago

The consensus analyst estimate pegs the decline in payrolls for March at 150,000, although the range of estimates suggests the result is anybody’s guess. The most pessimistic estimate pegs the decline at 1.25 million, while the most optimistic analyst expects an increase of 100,000 payrolls. As with everything else, the wide range of estimates i…[Read more]

-

Seth Golden posted an update 4 years, 7 months ago

During the period after March 2000, there were 5 significant rallies within equities that averaged 16% and lasted on average for 75 days.During the GFC period, there…

-

Seth Golden posted an update 4 years, 7 months ago

From Tony Dwyer - Load More