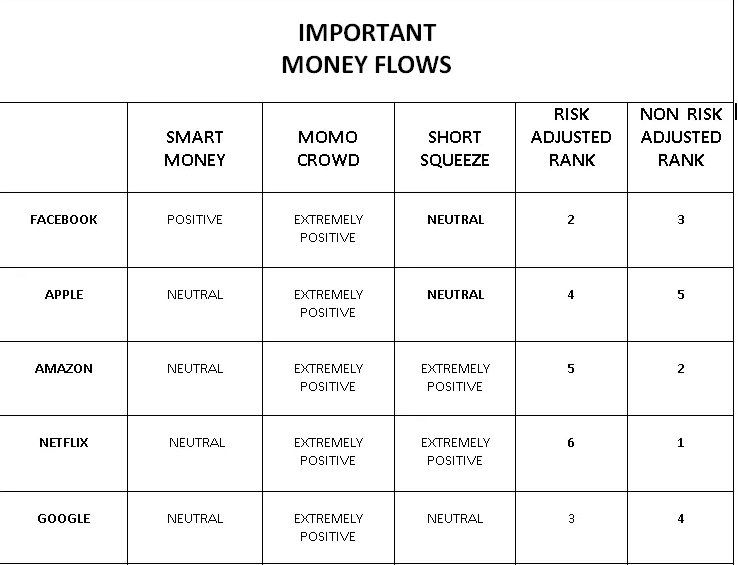

Equity indexes managed an uneven performance yesterday with the Dow falling more than 150 points and the S&P off another 3.5 points while the tech-heavy Nasdaq rose once again by .36 percent. The NASDQ has mirrored, of late, the movement of Apple Inc. shares even as Netflix shares recently pulled back on rhetoric the stock has over heated and in need of a near term correction. In terms of money flows in the tech sector, the FANG stocks have held the highest level of money flows as reported by The Arora Report.

Even though the Dow Industrial Average was down triple digits on Monday, Apple Inc. shares managed to hit another all-time high. The consumer goods stock is edging ever closer to achieving a trillion dollar market cap. Shares of AAPL have been in a rising channel for many years now, according to Chris Kimble of the Kimble Charting Solutions blog. Kimble goes on to explain that AAPL’s recent surge has the stock attempting to break through six-year resistance. If that happens, he believes more buyers will pounce.

The S&P is about 3.1% below the all-time high hit earlier this year, while the Dow Jones Industrial Average is 5.3% below its own record high level. Some analysts have found the market breadth vulnerable in recent weeks as the major averages gyrated back and forth between gains and losses.

“Sameer Samana, global equity and technical strategist at Wells Fargo Investment Institute, recently cited improvement in market breadth—or the ratio of advancing stocks to declining ones—as a bullish signal. He noted the Bloomberg Cumulative Advance-Decline Line, which measures breadth of stocks traded on the New York Stock Exchange, had improved since last month’s correction.

On another note, Bitcoin continues to struggle after falling greater than 20% last week. The People’s Bank of China sounded downbeat on digital currencies last week. Zhou Xiaochuan, the central bank’s governor, said Friday that Beijing does not recognize bitcoin and other virtual currencies as legitimate forms of payment, according to a Reuters report. This news came alongside last Wednesday warning on crypto-trading platforms from the Securities and Exchange Commission. Bitcoin has struggled to stay above $10,000 for much of February and now March.

The major averages will likely take their lead today from potential, inflationary economic data. The Consumer Price Index will be released at 8:30 a.m. and is expected to cool a bit from the previous report that prices rose some .5% in January. Economists polled by MarketWatch expect the CPI to have grown by .2% in February with the core CPI reading to have grown at the same pace. With inflation fears still tied to a rising 10yr yield the data will be critically important for the markets to find near term stability. The CPI will be followed, on Wednesday, by another reading on consumption through the monthly retail sales report.

Last Friday’s market rally has the S&P 500 hovering above its 50-day moving average and some analysts are found more bullish than others longer term. There is no reason to think the bull market is anywhere near the end, BMO Capital Markets chief investment strategist Brian Belski told CNBC on Monday.

“We’re going to have a pause here and there, but this is very, very normal and very healthy.”

Belski predicted the bull market would last 20 to 25 years back in 2009. It turned nine years old this month. While the bull market currently persists, it is certainly long in the tooth historically speaking. Fits and starts may persist throughout 2018 as investors attempt to juggle the polarizing variables of rising rates and economic growth that leads to improving corporate profits. Profits drive markets historically, even as interests rates tick higher, but to what extent and how remains to be seen.