Welcome to Finom Group! The following data and analytics are extrapolations from our weekly macro-market Research Report dated November 3, 2024 and titled “Will Markets Vote For More Gains?” The content serves as a sample, from within the full scale report, and not the complete Report. The content is, in part, an aggregation of researched points we emphasized going into the week of the Presidential Election and FOMC meeting. Again, the content is not complete and for the complete report and access to our full-scale reports, analytics, weekly quant data and analysis, please feel free to subscribe and achieve our best-in-class weekly content with the link provided.

Section #1

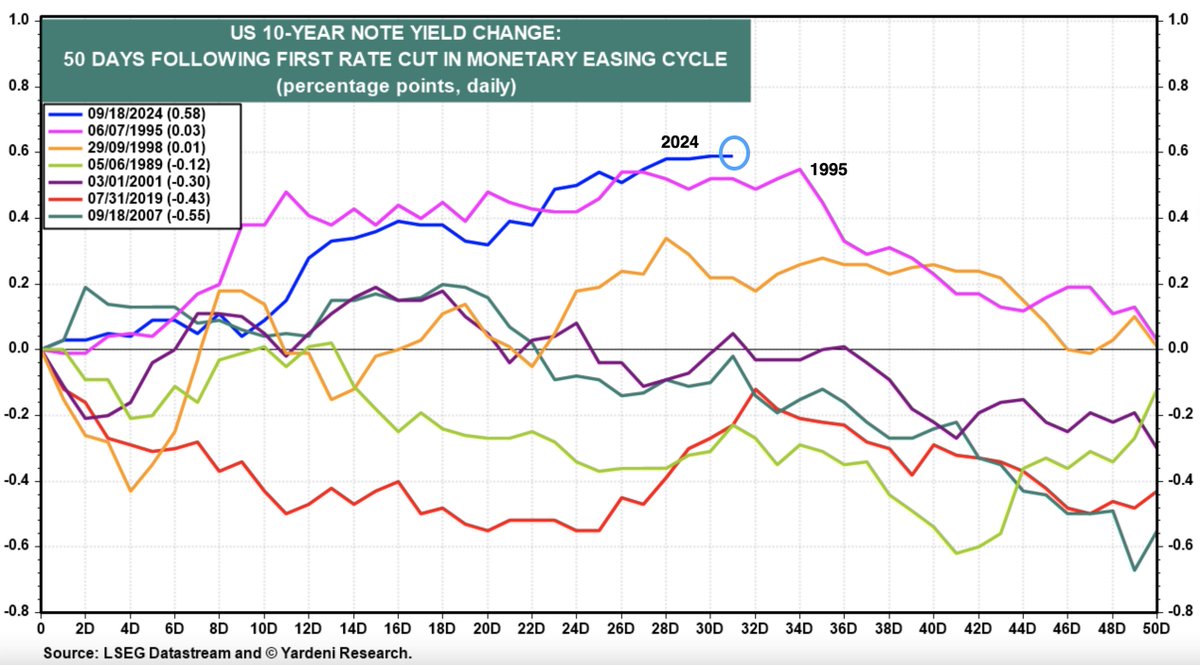

Back in the 1980s, Dr. Ed Yardeni popularized the phrasing that concerned an investor population, which was believed to be working to “fight the Federal Reserve.” He coined the phrase bond vigilanteism. As the Fed was cutting rates “on and off” from 1984 – 1988, often times the long end of the Treasury yield-curve would remain elevated, sometimes rising altogether. This was what Yardeni was referencing, as typically yields across most of the Treasury yield-curve would fall when the Fed was cutting rates. While the popularized phrase of bond vigilantes was fashioned in the 1980s, ultimately it proved to be nothing more than “prisoner of the moment” characterization of bond market price action that simply demanded time to for said price action to normalize.

With the 10-year Treasury yield having risen some 65bps since the first Fed rate cut of the cycle this past September, there is a rising rhetoric that bond vigilanteism has returned. The cause; deficits and or debt. History has taught investors that while you may not win many friends rationalizing what is taking place in the market while assuaging popular rhetoric, you are more likely to extrapolate profits from the market. In the most boring part of this weekend’s macro-market Research Report, we will do just that, rationalize and factually represent what is taking place in the bond market, through fact-based data and historical insights.

As our chief equity strategist Seth Golden has pointed out during the course of the past month, the Treasury Bond ETF’s (TLT) worst month of the calendar year over the past 20 years has been the month of October.

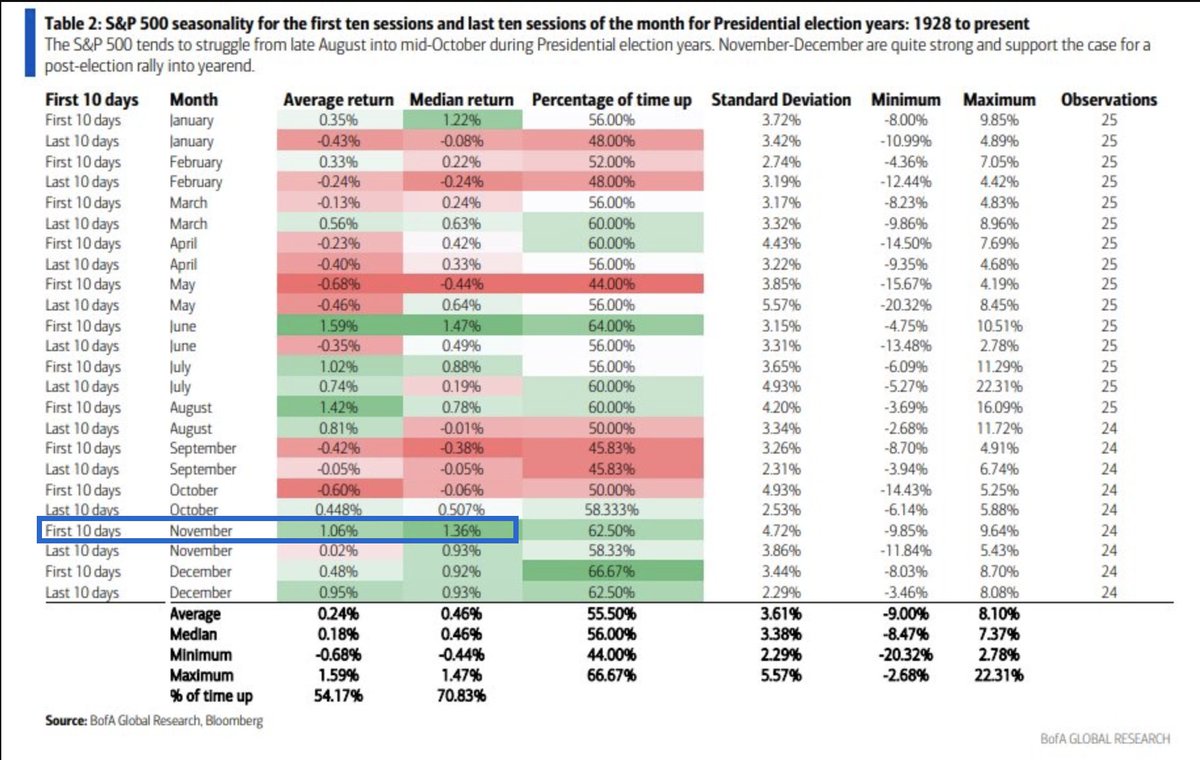

Using just the facts, it should have been no surprise and deserved no additional rhetoric contemplating or hyperbolizing whey TLT performed so poorly in the month of October. As shown in the chart above, however, the Bond ETF has now entered the best performing month of the calendar year. Un-coincidentally, this happens to also be one of the best months of the calendar year for equities, during an election year as well (BofA table, first 10-trading days of November).

Moreover, the question as to why the 10-year Treasury yield has risen so much in such a short period of time finds investors searching for answers. We seem to always need to know the whys. What we know about markets is that there is rarely one reason for any price action, but rather a litany of reasons. Additionally, no matter what the question about price action, ultimately price action normalizes to trend/structure and finds investor concerns and questions mostly a waste of expended emotion and time. Even so, the answer as to why Treasury yields have been rising seems to center on deficits and/or debt to GDP financing costs. What this basically suggests is that the debt has reached a point whereby it becomes more “unsecured” and therefore more risky to own for investors, thus costing the Federal government more money to finance the debt.

The U.S. debt situation is a very serious, but not dire problem. Cries that the United States is about to fall into a financial apocalyptic abyss seem greatly overdone, but the U.S. economy has indeed been paying a penalty for the government’s over-generous spending and tax cuts. U.S. government credit spreads have been abnormally wide for 13+ years. ~Richard Bernstein

Some have suggested that the economy’s cash flow cannot support the current levels of the Federal debt’s interest payments. The country’s interest coverage is a viable concern, but the U.S. has in the past had many years when more of the country’s cash flow went to supporting Federal debt. Chart 5 below, from Bernstein Advisors, shows Federal interest payments as a percent of U.S. GDP. Interest payments as a percent of GDP were higher than year-end 2023’s proportion for 17 years during the 1980s and 1990s. There are some dire projections for interest payments as a percent of GDP, but similar pessimism reigned during the 1980s and those forecasts NEVER panned out. ✅

Perhaps more relevant to the main topic, neither party can be solely blamed for that 17-year period when interest payments were abnormally large because it spanned the Reagan, GHW Bush, and Clinton presidencies. It is unlikely that the U.S. deficit and debt situation will improve regardless of who wins the upcoming Presidential election. Accordingly, investors should probably fade the election on this particular debt to GDP issue, as the bond market is likely to normalize… one way or the other and likely in due time.

If one is nervous, found “2nd guessing” whether or not the Fed has lost control of the yield-curve, this wouldn’t be the first time. The same cast of characters that presented this argument back in the 80s and 90s is the same cast of characters pushing the bond vigilanteism narratives and hard economic landing narratives today.

In the 21st Century, the narrative was formerly brought forward as the Fed first began Quantitative Easing policies after the Great Financial Crisis, and we all know the results of the narrative back then.

I’m (Edward Cordoba) of the view that the 65bp rise in the 10-year Treasury yield will soon abate and retreat back to 4% and below in the coming months and as we enter 2025’s calendar year. Recently rising yields, during what is being labeled a “soft landing”, mirror that from the 1994 – 1995 soft landing economic episode. (chart via Yardeni Research)

Most of the time, the Fed is cutting interest rates in order to tackle a pending or newly commenced recession. During soft economic landing periods and after a former rate hiking cycle, the Fed is then cutting rates to account for overly tight/restrictive monetary policy where such policy proves unnecessarily tight. In such a scenario, the formerly feared recessionary cuts bear out a monetary easing cycle without recessionary conditions. And so as the Fed cuts rates and market participants believe in an ongoing economic expansion cycle, the former recessionary fears fade and the bond market retracts recessionary pricing in favor of a yield-curve that represents the pricing of an ongoing expansion cycle. We would, therefore, consider the recent rebound in bond yields nothing more than mean reversion and removal of recessionary pricing. Long story short, I believe the bond market has normalized for the economic regime, and will find lower rates by year-end 2024 and into 2025.

Section #2

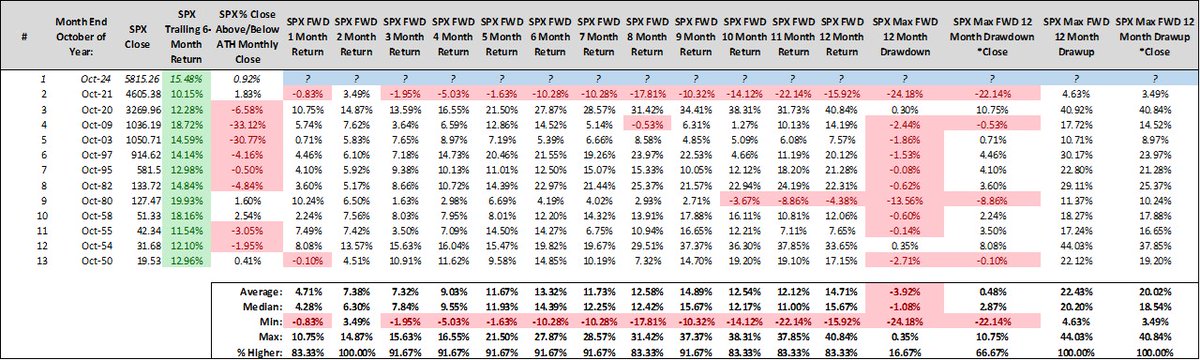

While the end-of-month unwind may seem a negative for investors, as I’ve (Seth Golden) been saying for the last 2 weeks, a pullback would actually set a low bar within a highly positive return period. And that positive return period is detailed ➡️ ➡️ ➡️ ➡️ ➡️ ➡️ The study reviewed once again, from Wayne Whaley, reiterates our longstanding point of bullish consideration.

“The quantitative data below offers investors a perfect 15-0 from October 27 through just November 13th, when the S&P 500 trailing 12-month returns are greater than +20% (highlighted in green, with average and median returns at the bottom).

“Indeed, whatever the closing value proves to be on Monday October 28th, any price below that in between then and November 13th has historically been a strong buying opportunity. The absolute worst return for this study period occurred in 2017 (+.15%).”

We now have the October 28th closing price of 5,823. Based on the perfect track record of this quantitative data set, we should anticipate an S&P 500 price above this level on November 13, 2024, a week after the Fed’s upcoming meeting and second rate cut of the easing cycle. Could higher prices be achieved more quickly? Absolutely! This may have to align, however, with the upcoming election date and general investor positioning. The data speaks extremely positive about upcoming price action, but we should remind ourselves/investors that the data details historical price action in order to deliver PROBABLE outcomes in the future, NOT GUARANTEES FOR THE FUTURE ‼️📣

But bond yields, but bond yields, but bond yields”… That seems to be the push back to most any bullish quantitative or macro-fundamental data over the last month or so. The chants have been coming from all financial and social media platforms. The fear and anxiety has become palpable ahead of the upcoming election and Fed meeting. As always, we’re not in the business of predicting the future, but rather knowing the probabilities. That’s the best we can do as investors, to know the probabilities of the future, and act accordingly. Below is a reply to a positive/bullish post I offered on X/Twitter:

Forget about what Seth is following, and my equally sarcastic reply to the comment. After all, everything about price action can be quantified and if we have the quants we can remove our ignorance of the state of affairs and emotion connected to whatever the state of affairs might be. What we know for sure is that the 10-year bond yield has risen 65bps since the first rate cut, right? So we ask ourselves, “What have stocks done after the 10-year bond yield has risen this much in 30 days?” First, more often than not, yields have retreated. Secondly, the S&P 500…

…As the SentimenTrader data in the table above informs, there is a very high probability that not only has the bond markets bulk of repricing an ongoing expansion cycle likely occurred, but equity markets are likely to move even higher over the coming 1-week to 12-month time periods. Notice the dates in the data above, the 80s and 90s; the labeled bond vigilante periods. Obviously, that did not negatively impact equities much and a year later the market was higher EVERY. SINGLE. TIME. 💯

While there remains a lot of consternation and anxiousness surrounding next week’s election, I’ll also remind investors that the S&P 500 has been…

- Outperforming the average election year performance, proving the best YTD ever.

- Following a similar election year path nonetheless.

In fact, the last time the S&P 500 achieved a 20% year-to-date return by October, with an all-time high in the month of October, and during an election year… 1980.

As shown in the S&P 500 chart of election year 1980, the market would initially peak during monthly Op/EX week in 1980, suffer a pre-election pullback, then launch through year-end and deliver a +7% return after the election. We know the 2024 peak has occurred during the same exact period of October monthly Op/EX. Just saying; history doesn’t always repeat, but I’ll settle for a +7% rhyme. Wouldn’t you?

What may prove the difference between 1980 and the present time period, however, relates more so to the probabilities for the economy in 2025. Yes, the market was up sharply by October 1980, but it was not higher 10/11 months like the bullish trend through September 2024, AND A RECESSION WOULD FOLLOW IN 1981. As such we review the table from The Leuthold Group once again, to reinforce our expectations for the economy in 2025, barring an exogenous event.

In the era of the S&P 500 (1957 to-date), only the 1982 to June 1983 bull market was lower 12-months after such bull market strength, as shown in the table above from The Leuthold Group. It should now be more obvious why 1980 is not denoted in the table; there was not a 10/11 win streak for the S&P 500. With that being better understood, most 10/11 month win streaks continued the streak of positive gains going forward, and there was NEVER a recession occurring 12-months forward.

Section #3

This rise in volatility, former spikes in the Equity P/C Ratio, and recent 2-week pullback in equities all speak to investor/trader positioning heading into Election Day. All of the aforementioned are in-keeping with historical norms. Positioning, positioning, positioning! ✅✅✅

It’s funny how you don’t see many, if any, representations about what happens to volatility after the election is over. But just as such volatility rises going into an election, it tends to fall shortly after the election. the following chart clusters represent (in order from top to bottom) post election moves from the VIX, VVIX, and S&P 500 1-month forward At The Money Option volatility. (below charts/tables/commentary via Nomura’s Charlie McElligott)

They all outline the average historical price trend after the Election Day (dotted perpendicular line). If there’s a contested election or if the results are not fully known the next day is not something we can control and would prove an endogenous event that likely also proves short-lived. If one “hedged” for such an outcome they would have taxed their portfolio in 95% of all election periods. I would rather use such endogeny as a buying opportunity than tax my portfolio above and beyond what the the IRS already achieves.

Now, let’s talk about the existing VOL positioning we know has taken place since August, and when that massive spike in the VIX to 60+ occurred on August 5, 2024. I’m going to try and run through this analysis in laymen terms, but this was clearly pricing for what is called a “left tail risk event”, the pricing for exogeny.

There is a substantial investor cohort known as Volatility Targeting investors or fund managers. Essentially, this cohort will only add to their long equity exposure based on the level of the VIX. Don’t get me wrong, many fund managers operate in this fashion, but the VOL Targeting specific investors/fund managers have bylaws of the fund that hold permissions which must be followed. It’s with this understanding that I first put forth the positioning unwind that has taken place since the left tail risk pricing/hedging, as follows:

- We have already been in the process of seeing those early August “Tail-risk” days now beginning to drop out of the trailing 3-month realized Volatility window, which simply means that as the rVol input goes mathematically lower because those “outlier positions” change days are no longer “in the sample,” equity exposure needs to be mechanically taken higher or increased per the Vol Targeting strategy bylaws.

-

The aforementioned Vol/VIX reset post the (hypothetical until known for sure) election “event-risk clearing out” will then further impact and drag down trailing 3-month realized Vol inputs/options in the weeks which follow, setting up what might be projected as a profound “Reallocation” of BUYING flows in the months ahead, for equites. Down VOL = increasing equity leverage for VOL Targeting funds.

If the aforementioned isn’t laymen enough I apologize, but speaking to positioning in VOL via option markets and how VOL unwinds produce greater equity flows does get wonky. The chart below helps to inform, visually, what the above verbiage details.

As we can see in the chart and accompanying table to the left side, should continued positioning of tail risk unwind we would anticipate 1-3 month Realized VOL to continue downward from the August peak, and as the open interest falls off/unwinds in the options market (table 3-month Drop % red days have already dropped off). Is the market higher than where it was in August? Yes! Is the VIX lower than than the August spike? Yes. That is a more simplistic way of juxtaposing the chart/table with price action having taken place already. So here is how the math hypothetically works, based on the existing VOL/Equity positioning:

- Over the next 1 week period, a 1.0% daily change would be +$30.6B of implied Equities Futures buying(96%ile); a 0.5% daily change would =+$41.4B of buying (98%ile); and a 0.0% daily change would = +$45.5B of buying (99%ile)

- Over the next 2 week period, a 1.0% daily change would be +$32.4B of implied Equities Futures buying (95%ile); a 0.5% daily chg would = +$57.2B of buying (98%ile); and a 0.0% daily chg would = +$67.6B of buying (99%ile)

And here is a corresponding table of what the aforementioned, calculated flows would look like in a post election VOL unwind and equity re-leveraging environment:

The math in the table above is not debatable, it’s pure math, black and white. Furthermore, the backtested returns in the S&P 500 when there has proven similar “Extreme %ile Ranks” in the projected Vol Targeting model, with re-leveraging flows being “this high” only serve to corroborate the following:

- “Equities Higher” in the short-term window thereafter…but also shows that these prior instances have occurred with

- High “Hit Rates”(way more “Equities Up” than “Equities Down”)…and most importantly

- At increased “Excess Hit / Excess Returns”over standard similar fwd horizons

In the tables below (1-week and 2-weeks after election) are the quant data of the above Volatility Targeting, “long buying equity flow” scenarios across “daily change projections” and time-horizons. They all tell the same story which then is about this “incremental demand flow”, as one that could tilt the urgency for other market participants beyond VOL Targeting funds to also then be in position where you’d need to “raise offer prices” and contribute to an upward drift in the markets, after the election. (Please read the headers, column and row labels)

Bottom line: The markets’ positioning and historical data are setup for a steady climb after the election. It WOULD demand an exogenous or endogenous event to derail the historical trend of post election rallies. The bottom table or S&P 500 2-week forward positivity rate of 92% are as strong a guarantee as we could ask for as investors/traders.

Section #4

The next example of overbought conditions was outlined in our October 6th macro-market Research Report, as follows:

“I had posted the following 2-year daily chart of the S&P 500 and its corresponding, upward sloping 50DMA on October 1, 2024 via X/Twitter.

The S&P 500 is currently greater than 5% above it’s 50-DMA and 10% above its 200-DMA. During the nearly 2-year long bull market, EVERY. SINGLE. TIME. such conditions have been met, the S&P 500 has checked back to its upward sloping 50-DMA, just a matter of when. To end this past week, the 50-DMA has moved up to 5,554, and remains upward sloping. History informs the best approach is to add exposure during any consolidation, especially if this time is the first time in the last 2 years the S&P 500 doesn’t consolidate down to the 50-DMA. History informs the worst approach is to sell into consolidation, hoping to buyback lower. Be on the right side of history. And bulls should not be discouraged by the potential of this technical analysis, as the bull market regime has found rapid consolidation and a renewed uptrend equally rapid. Act on local price action with a long-term goal and mindset!”

The good news is that this analysis came into play this past week and with the S&P 500 erasing the overbought conditions, nearly tagging the 50-DMA on Thursday and to close out the month of October with a negative monthly return. It was like we said in the October 6th report: “Poor October Setup: Good Year-End Rally Probabilities.” Probabilities are the key, as we never intend to predict the future, but rather know the probabilities through the usage of any investing discipline (fundamental, technical, quantitative).

How is the aforementioned good news, you might be asking? It is good news because the market did exactly what it had done in the past, identifying that we are not only looking at the “right things”, but identifying the repeatable human behavior engaged with price action. What I would add to this segment is that the market is not out of the woods even after the slight bounce this past Friday, and would not prove to be until it at least recaptures the widely perceived significance of the 21-day EMA, and an RSI above 50. (S&P 500 chart below as of Friday’s close)

While Semiconductor leadership has undoubtedly failed in the last several months, what remains is a risk-on, bullish investor sentiment that we’ve tracked and detailed throughout much of 2024. This has been evidenced by way of the Equal-weight Consumer Discretionary vs. Staples performance ratio i.e. offense vs. defense performance ratio. Here is a review of what we outlined in last weekend’s macro-market Research Report, as follows:

“The 2024 bull market remains firmly in the offensive posture, risk-on! Equal-weight Consumer Discretionary(RSPD)vs. Consumer Staples(RSPS)still informs about bullish risk appetite, despite this past week’s setback for most major averages.

With the positive response to Tesla’s (TSLA) Q3 2024 results and despite the decline in McDonald’s (MCD) shares from e coli headlines, Consumer Discretionary continues to outperform Staples. The only thing left for this performance ratio to accomplish is taking out the all-time highs from 2021, for which upcoming Q3 2024 results from the likes of Amazon (AMZN) will either detract or facilitate. Finom Group’s outlook for Consumer Discretionary stocks remains positive through year-end, with an Overweight rating, and we continue to trade around our long-term core holding in AMZN (cost average ~$70/share since 2022).

Amazon had an extremely robust quarterly performance and managed to recapture $200/share intraday Friday. We remain long AMZN shares in the Golden Capital Portfolio, and all existing Finom Group trade alerts for AMZN have been completed with this week’s surge in share price. Moreover, while price action proved turbulent this past week, Finom Group took advantage of the volatile and downward price action in stocks by trading around core holdings, for daily profits.

Our spreadsheet of completed trade alerts from this past week are noted above. In 2024, we’ve now completed 300+ profitable trades within the 1% for 1%+ strategy, trading only what we are willing to own and around core long-term holdings as a means to continuously lower the core long-term holding cost average. The 1% for 1%+ strategy is a vertical/bolt-on to the widely popular “Buy and Hold” investment strategy. The only thing that has ever been found lacking within the Buy and Hold strategy is active management, where the 1% for 1%+ strategy satisfies this shortcoming.

Moreover and as an update to the Consumer Discretionary vs. Staples performance ratio, indeed, the performance ratio found another multi-year high this past week and before consolidating once again.

I remain of the opinion that this performance ratio informs favorably for not only investor risk appetite but the strength of the economy going forward, at least through year-end.

Lastly, it happened again folks! The typical pre-election correction in the Health Care sector ETF(XLV) happened again. As part of our XLV original thesis delivered in Q4 of 2023, we highlighted that if XLV were to achieve our investment objective with all-time high pricing, there was likely an opportunity still to be found for investors who may have missed this opportunity, in the run-up to the election. Why? Every election year Health Care is a hot button topic under scrutiny and which pressures flows into the sector ETF. This was always part of the investment landscape for our previously outlined investment idea. While XLV has already met our profit objective, I still believe the sector ETF will find higher prices than Friday’s closing value, by year-end. We have positioned trades around this thesis as well.

Naturally, we can review and validate this seasonal and election tendency in the chart below of the monthly, 20-year performance hit rate and average monthly return, which improves greatly in the month of November.

From a technical perspective, the recent all-time high and downtrend that has ensued since looks worse than it may actually prove to be and with XLV down 7% from the all-time high set in September.

Friday’s bounce occurred at the 150-DMA, with an RSI of 29, and thus maintaining price above the charted 200-DMA and RSI back above 30 (bottom panel). This bounce also kept XLV from making a lower-low and falling below the August low. For the most part, the price action screams of a normal and to-be-expected consolidation period. We’ll see how the sector’s price action performs with earnings season and the election soon to be in the rear-view mirror. Finom Group maintains an Equal Weight rating on the sector, although we suggest investors also consider that if the bull market does not end in 2025 i.e. Year 3 of the bull market, Health Care tends to outperform.

Section #5

Price action and positioning has been accompanied by quant studies that reinforce a bullish sentiment going forward, regardless of the macro-uncertainty or anxiety. Recall the study from Steve Deppe, as follows:

When the S&P 500 ends the month of October with trailing 6-month returns of 10% or more, the remaining 2 months of the year have never closed lower (i.e., December’s monthly close was never below October’s monthly close). The average returns over the final 2 months have been sizable. The November positivity rate (1-month forward) is nearly 84%, and the positivity rate for December would be 100% (2-months forward).

Now, once again we would want to take a look 👀 at the MEDIAN return 2-months forward 🚀 🆙 The median 2-month forward return is +6.30%; pretty substantial to say the least. The worst 2-month forward return was +3.49%. Such positivity rates and median forward returns serve to reinforce a belief that any pullbacks, due to macro-events, are likely strong buying opportunities and a means for which investors can offset some of the flawed individual stock performance in their portfolio year-to-date.

Thank you for sampling some of this past weekend’s Research and Analytics! Trust that this was but a small sample of the profoundly informative data and analytics we outline for Finom Group members (Contributor or Premium) on a weekly, quarterly, and annual basis. Our best-in-class Research prices increase each year, during the month of December. Subscribe today to lock-in the current membership fees going forward (cancel anytime). In just a couple of weeks, we will be outlining the Finom Group 2025 Outlook, within our year-end 2024 analysis. You don’t want to miss it!