While headlines on trade and/or the White House administration seem to pour out of the media on a daily basis, investors continue to be whipsawed and tumbled about, trying to decipher what is more meaningful to the future of corporate earnings. Yesterday’s most impactful market headline came on the global trade front. According to reports, China’s top planning agency and senior policy advisers are drafting the replacement for Made in China 2025—President Xi Jinping’s blueprint to make the country a leader in high-tech industries, from robotics to information to clean-energy cars. The revised plan would play down China’s bid to dominate manufacturing and be more open to participation by foreign companies.

Opening up the Chinese marketplace to global players would go a long way to easing trade tensions between the U.S. and China, but plans developing do not equate to a treaty or deal thus far. Officials in the Trump administration have called Made in China 2025 a threat to fair competition, saying it encourages state subsidies for domestic companies and forces technology transfer from foreign partners. Some U.S. officials are likely to see the changes as more cosmetic than real. Regardless, equity markets rose sharply on the news intraday, before cutting those gains by more than 60% at the end of the trading day on Wednesday.

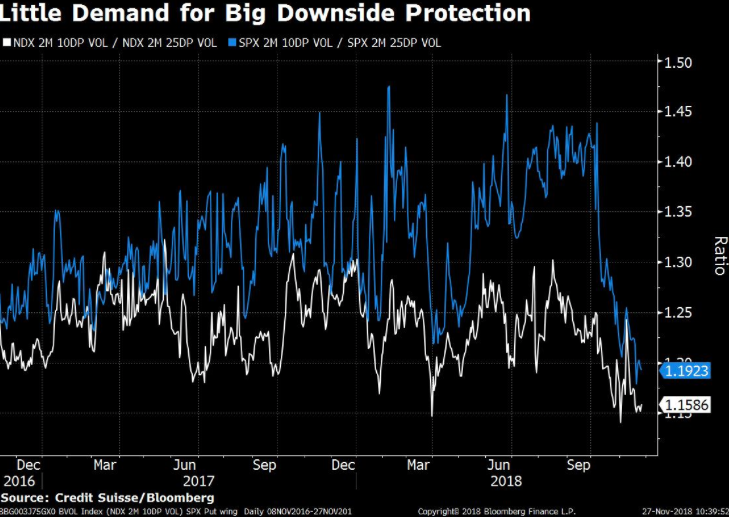

The Dow Jones Industrial Average (DJIA) rose 157.03 points, or 0.6%, to end at 24,527.27, while the S&P 500 (SPX) index advanced 14.29 points, or 0.5%, to 2,651.07. The Nasdaq Composite Index (NDX) climbed 66.48 points, or 1%, to 7,098.31. It was a positive day for the major indices, but one that proved once again not to withstand late afternoon selling pressure. With the Federal Reserve Open Market Committee meeting next week, investors are still expressing cautious behavior, but hedging hasn’t necessarily been in abundance. In fact, when we review the following chart via Bloomberg, we come to find that protection buying has dramatically fallen.

There doesn’t seem to be a lot of demand for further-out-of-the-money 2-month put options on the S&P 500 or Nasdaq 100, relatively speaking and based on the chart above. Additionally, when we review VIX options, another frequented hedging tool, there doesn’t seem to be strong interest of late or at the moment.

As depicted in the screenshot of the Volatility of Volatility Index (VVIX), VIX options have fallen out of favor since early November and when the index had reached 110. Having said that, VVIX proved stronger than implied volatility/VIX yesterday and for most of the trading session. In fact, if we look at VVIX and compare it to SPX for Wednesday, we can see that VVIX may have signaled that investors were positioning cautiously for late afternoon selling pressure.

On the far left hand side of the chart, VVIX (blue line) was rising with SPX (pink line) at the onset of the trading day. Normally VVIX would fall with a rising SPX, unless it is finding investors hedging into a market rally. Either way, the market finished higher with VVIX higher on the day as investors proved hedging was in order ahead of the Fed, at least for the day.

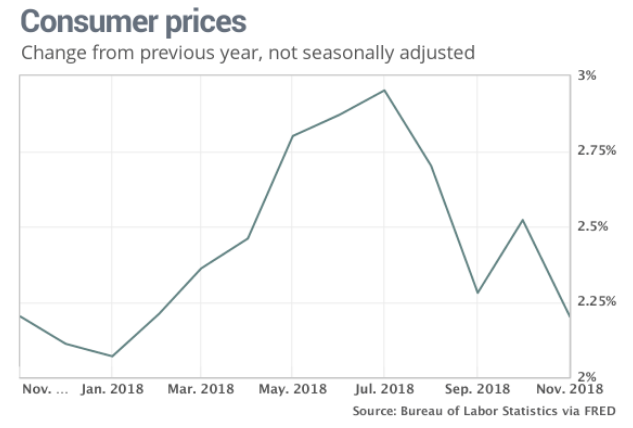

The economic data of the day was light and proved innocuous through the Consumer Price Index. CPI, or cost of living, was unchanged in November, the government said Wednesday.

The increase in the cost of living over the past 12 months slowed to 2.2% from 2.5% and is now near the lowest level of the year. We can thank the price at the pump for the lower cost of living as crude oil prices have fallen sharply since early October. Gasoline prices fell 4.2% last month, suppressing any increase in overall consumer costs. The so-called core CPI that strips out volatile food and energy costs rose 0.2% last month.

Inflation-adjusted pay for nonsupervisory workers rose 0.3% in the month and 1% over the past year. That’s the largest increase over a 12-month span since 2016.

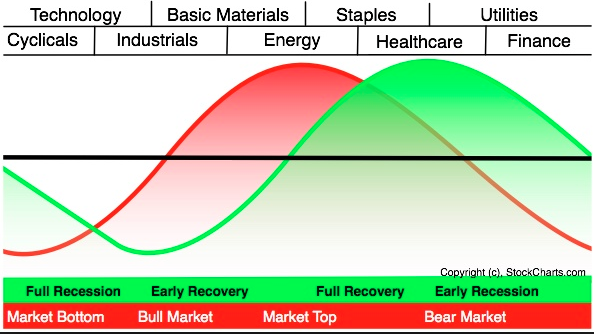

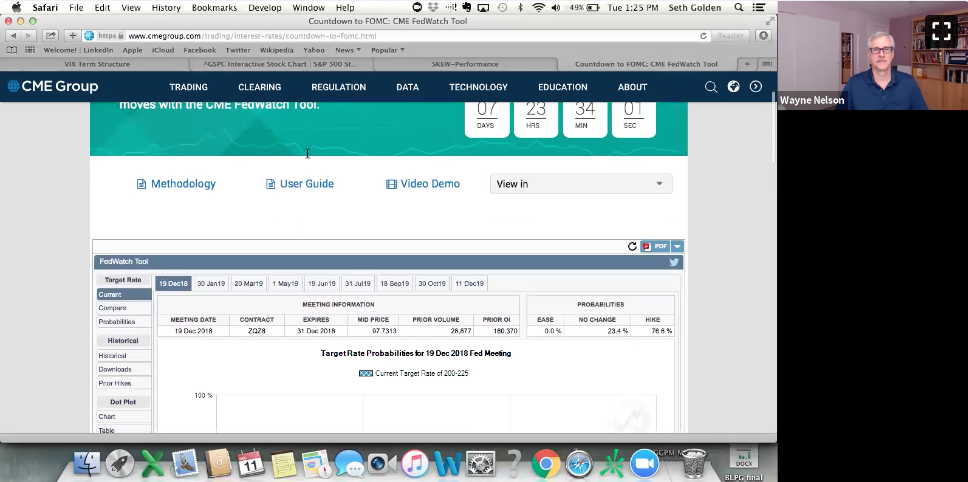

When combined with the Personal Consumption and Expenditures data of late, CPI is showing that inflation has been absent the economy since the late summer months. As such, the FOMC is still likely to raise rates come the December 18-19 meeting, but also indicate a pause in rate hikes is to come. Since taking a more dovish policy stance on interest rates in late November, the market has readjusted its rate hike expectations for 2019. According to the CME’s FedWatch Tool, the market now only expects the FOMC to hike 1 time in 2019. Finom Group’s Seth Golden discusses the Fed and future rate hikes in the following interview with Wayne Nelson of tradealerts.com.

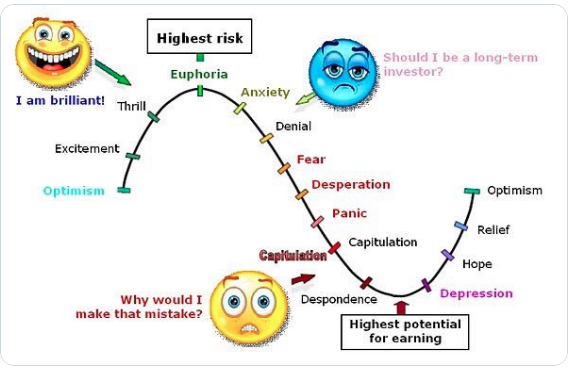

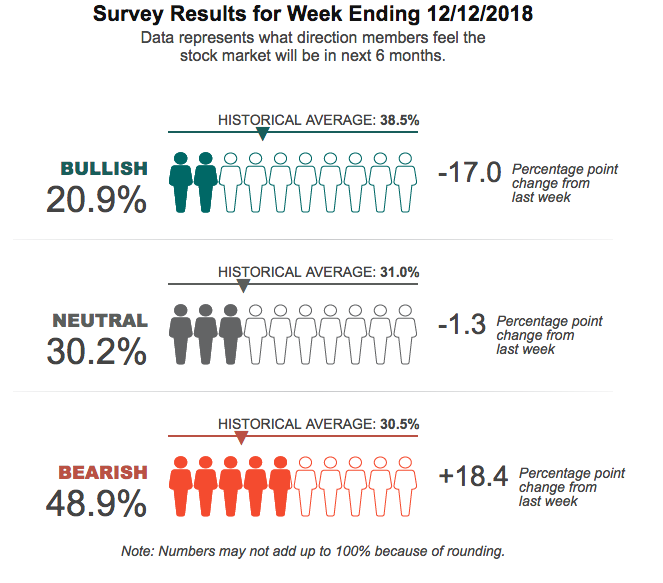

Regardless of how and when the rate hikes come to a halt and the rise in equities thus far this week, market sentiment remains poor, bearish so to speak. The latest survey from American Association of Individual Investors goes a long way to proving just how poor equity market sentiment has become.

As shown above, bullish sentiment plunged during the survey period while bearish sentiment surged. The bullish sentiment is well below its historical average of 38.5% while the bearish sentiment is well above its historical average, consequentially. The sentiment seems to coincide quite well with the S&P nearly touching its February lows on Monday, which is still not off the table for the week. In fact, “bond king” Jeffrey Gundlach believes the market will go significantly lower than the February lows.

As shown above, bullish sentiment plunged during the survey period while bearish sentiment surged. The bullish sentiment is well below its historical average of 38.5% while the bearish sentiment is well above its historical average, consequentially. The sentiment seems to coincide quite well with the S&P nearly touching its February lows on Monday, which is still not off the table for the week. In fact, “bond king” Jeffrey Gundlach believes the market will go significantly lower than the February lows.

“Global economic growth is slowing and weighing on corporate profitability, which will pressure U.S. stocks. But another dynamic that has been adding to the sell-off in equities is the unwind of the Federal Reserve’s massive balance sheet.

Gundlach, citing an Atlanta Fed research study, calculates $600 billion of Federal Reserve asset unwind is equivalent to three interest rates hikes.

It remains to be seen as to whether or not the intraday February low will be taken out, as forecasted by Gundlach, any time soon. More importantly, like anybody else, Gundlach is prone to errand forecasts and investment calls. Remember, Gundlach said the best investment idea for 2018 would be commodities, specifically oil and gold.

Clearly, this has been a dreadful call for the “bond king”, as both oil and gold have come under pressure and are materially lower in value year-over-year. Commodity investing is not easy at all and even the “bond king” can make a bad call.

While the major averages finished higher on Wednesday, equity futures are pointing to a flat to negative open on Wall Street as of the 6:00 a.m. EST hour. The selling pressure that has persisted, even on up days, has brought about a sell-the-rip market sentiment that skews bearish. The volatility residing in the market has been somewhat extraordinary, with a recent streak of the S&P 500 having 4 consecutive down days of at least 1.89 percent. According to Dana Lyons of J. Lyons Fund Management, this has only occurred a scant 11 times since 1960.

The dots on the chart signal instances when the S&P dropped at least 1.7% for four sessions in a row, which has happened 17 times since 1960. As you can see, the bulk of theses drops, particularly recently, took place near clear market bottoms, including 1974, 1982, 1987, 2002 and 2009.

“That might give bulls some hope that perhaps things have gotten so bad, i.e., rock bottom, that there’s nowhere to go but up,” Lyons explained in a blog post. “Although, it is probably a stretch to conclude that we are at a cyclical low right now since we were at all-time highs just about 10 weeks ago.”

Unfortunately, such consecutive market declines for the S&P 500 didn’t have a bottoming effect in 2001 or 2008.

Given the persistent bearish positioning for equities on Wall Street, one market strategist is of the opinion a contrarian move is coming. Nomura strategist Charlie McElligott on Monday called for a “violent short squeeze” in the market.”

“We have “kindling for a massive short-squeeze over the next month. The largest near-term catalyst for a crushing equities move higher remains fund positioning, which is creating an enhanced-risk of positioning squeeze, as it builds fodder for a violent bear-market rally which nobody owns. After the recent spike higher for the market, “buy triggers” are now within reach and could lead to forced deleveraging.”

Other tailwinds for the S&P 500 mentioned by McElligott include overwrought “end-of-cycle” fears, a “dovish pivot” from the Fed, and a bullish tipping over of the crowded “long dollar (DXY) trade. Short squeezes are a rarity despite how they are heralded by market participants and analysts. We wouldn’t position for such an event, although if one occurs, it would still prove beneficial for investors.

Markets remain on “edge”, both literally and figuratively speaking. Jobless Claims are due out before the opening bell and to round out the week the Census Bureau releases monthly retail sales data on Friday. Expect markets to remain rather volatile until otherwise proven.

Tags: DXY SPX VIX SPY DJIA IWM QQQ VVIX XRT