Investors’ belief in a 2H EPS recovery is growing amid a stronger than expected reporting season. Meanwhile, the recent...

Latest News

A financial market resource for the every-day investor and trader.

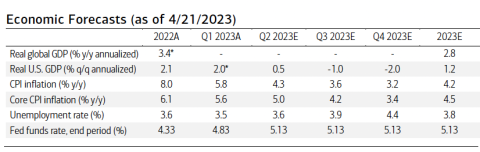

By Merrill Lynch Macro Strategy—The Calm Before the Storm? Economic indicators continue to support our view that U.S. growth...

Weekly State of the Market: It Ain’t Perfect, But It Ain’t A Recession

Seth Golden, , Research Reports, 0The big money is made in waiting and simplicity. Not in overactivity and complexity. ~Brian G of Alphacharts You...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of...

The coming week will prove a meaningful earnings week, as the Mega-cap Growth companies will be reporting their quarterly...

While we are forgoing our traditional State of the Market recording and process, please review our latest video (link...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of...

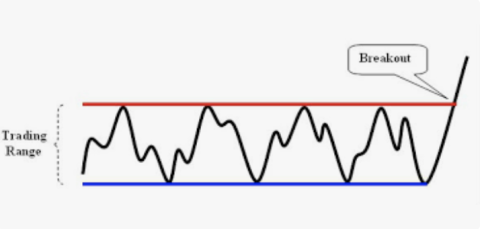

It really feels like the markets have not traveled too low or too high since hitting their peaks in...

“It’s not that optimism solves all of life’s problems; it is just that it can sometimes make the difference...

Merrill Lynch: Credit Restraint And Grinding Macro-Market Outlook

Seth Golden, , Research Reports, 0By Merrill Lynch Macro Strategy—Deep Credit Restraint Likely In The Pipeline: Rapid-fire Federal Reserve (Fed) interest rate hikes...

In recent years, we’ve supplemented our longstanding normalized earnings technique with the simpler method of referencing any past peak...

Weekly State of the Market: Tech Leadership, With Recession Fears?

Seth Golden, , Research Reports, 0David Tepper was once asked about his thoughts on Gold and whether or not it has a place in...

by Morgan Stanley’s Mike Wilson and Company Recent increase in Fed balance sheet is not QE, in our view…Many...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of...

What a quarter, right? The Q1 2023 period was a rollercoaster ride unlike any in recent history, as the...

Weekly State of the Market: Credit Crunch Or Just Another Headwind?

Seth Golden, , Research Reports, 0If you came to the markets in 2008, that you likely will relate everything since and to come to...

Morgan Stanley’s Weekly Warm-up: When Markets Question the “Higher Powers,” They Can Re-price Quickly

Seth Golden, , Research Reports, 0By Morgan Stanley’s Mike Wilson and Team With bond markets questioning the Fed’s dot plot, bond volatility has increased...

Macro Strategy—Time to End Quantitative Tightening Fast Approaching: Quantitative tightening (QT) has reached its limits in the regional banking...

Avoid at all costs: If you’re bullish on the markets you are probably only digesting bullish data points. If...

Morgan Stanley Weekly Warm-up: This Is Not QE; Focus on the Fundamentals

Seth Golden, , Research Reports, 0With the back-stopping of bank deposits by the Fed/FDIC, many equity investors are asking if this is another form...

Research Report Excerpt #1 Remember, the Nasdaq is mainly a growth index, holding no banks or financial sector stocks...

Investors Wade Through Uncertain Trends, Into An Uncertain FOMC Meeting

Seth Golden, , Research Reports, 0There is never a time to not be honest with oneself as an investor/trader. We should always remain objective...

The non-seasonally adjusted headline CPI eased for an eighth consecutive month to 6.0% in February (Chart 1). The seasonally...

By Ian Shephardson of Pantheon Macro Economic Slowing Wage Gains will Give the Fed Room to Pause, but not...