I know it’s not a great idea to dabble when it comes to vol product trading, but when the VIX popped today, I thought I’d try something a little bit different than my go-to strategy of selling UVXY calls. Don’t get me wrong — I did sell some UVXY calls, but on a whim I decided to go old-school and buy some common shares of XIV.

Suddenly, I felt like I was 18 again… buying common shares, receiving a fund prospectus in my inbox… all I needed was a Motley Crue poster on my wall and the nostalgia trip would be complete.

The feeling of deja vu overtook me, to the point where I actually considered buying some SVXY as well. Thankfully, I soon remembered that buying SVXY would cause the IRS to send me a pain-in-the-butt K-1 tax form. Plus, Seth Golden reminded me that I was already going to have to deal with beta slippage in my XIV long position; there’s really no need to double down on my beta-slippage breakfast by also purchasing some SVXY.

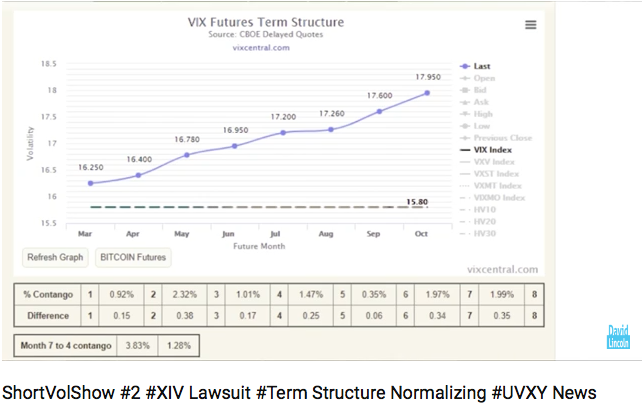

Still, it felt good to buy the XIV shares. Granted, it takes up a sizable share of one’s portfolio to buy XIV (which is starting to get a bit pricey, given its consistent price expansion over the years). Yet, it’s one of the safest ways to take a short vol position: it’s a defined-risk bet, with the max loss being whatever you paid for the shares. Besides, though it does suffer from beta slippage, it also benefits from the same contango that besieges VXX, VIXY, etc.

So, if you have room in your portfolio for a safe alternative to shorting naked UVXY/VXX calls, you might consider stocking up on a lil’ bit of XIV. After all, the classic hits are pretty darned awesome, wouldn’t you agree?

XIV is my goto favorite. Love the liquidity. Love that I don’t have to depend on availability of shares to short. I day trade it almost exclusively. It also makes a great 401k hold.

Selling calls on UVXY sounds too scary from a risk point of view. Would love to see an article detailing that strategy and how to cap the risk involved.

Thank you for the comments, Steve. It is true that XIV has plenty of liquidity; I only wish that they would make it optionable. I have spent a great deal of time thinking about whether I should continue to sell calls on UVXY… An article on this strategy, and its pros and cons, might be in the works. In the meantime, there’s this article: https://www.finomgroup.com/hedge-short-volatility-etp-position/

David, as someone trading with IB which requires roughly a 410% Initial Margin for a short UVXY position(which admittedly at 80% of margin required for a 20% core short position isn’t that far from a 20% short /w 50% cash reserved anyway) I’ve looked a lot at buying OTM calls to keep margin available for trading. Have you given much consideration regarding how many DTE you would want to buy those long calls?

It’s a bit of a double edged sword, while the more DTE have a lower theta decay they do have a higher price and the underlying is likely to keep falling south so we’d lose that premium paid relatively quickly regardless.

Richard, I’ve considered the idea of buying OTM UVXY calls, but only as a hedge for a short UVXY position, not as a means of keeping margin available for trading. I’ve been using Schwab, and they have been reasonable with the margin requirements. (IB seems to be less reasonable in that regard…) Personally, I would usually never buy UVXY except perhaps for hedging purposes in a short vol position.