Where are markets headed as bond yields rise?

J.P. Morgan’s Global Research macro views and top cross-asset trade ideas

On March 1, J.P. Morgan Research hosted a virtual meeting featuring J.P. Morgan researchers to discuss the drivers of rising US Treasury yields and the implications across asset classes. We view last week’s US Treasury sell-off as a “minor speed bump” and believe that it is too early to tighter financial conditions and the end of easy money. We remain confident in the commitments for sustained policy support that support the reflationary tilt. Our US Treasury strategist believes that a compromised market microstructure as key driver of last week’s sell-off. We highlight our top ten takeaways and include the replay link below.

Top 10 takeaways:

1. The global economy will experience its strongest performance since the early 1980s, and the reflationary tilt will be sustained beyond this year. Our global economics team is now forecasting US nominal GDP to average roughly 7% growth over this year and next as targeted measures have been successful in addressing COVID-19 and economic activity is not being jeopardized. Global growth will exceed 5% and the European economies that were harder hit by lockdowns will have a bigger bounce from pent-up demand and we are forecasting 13% annualized growth in 2Q21 for the Euro area after a -1% contraction in 1Q21 and -2.4% contraction in 4Q20. The US output gap is likely to close and core inflation to return to 2% sometime next year. The Fed is now committing to a sustained period in which inflation overshoots its target and is employing a low-for-very-long yield strategy (LVLY) to achieve its goal.

2. The compromised market microstructure and fragile liquidity were the key drivers of last week’s US Treasury sell-off, with the 5- and 7-year points on the curve most vulnerable. The bulk of the rise in US rates can be justified by the upward growth revisions and accompanying inflation expectations as a 2 pct-pt increase in growth implies a 30 to 40bp rise in rates. The market’s pricing for the timing of the first hike in 1Q23 and 50bp by early 2024 seems out of line with fundamentals, and we believe that a steep decline in market depth contributed to the outsized moves in yields this week. Primary dealers took down double their usual market share, highlighting the liquidity risk. There is little evidence of convexity hedging given spread/yield counter-directionality.

3. It’s too early in the growth, policy and inflation cycles to be defensive, and we are comfortable about core trades that are focused on the growth cycle. Our core cross-asset trade have been focused on the strength of the growth cycle, favoring equities over bonds and cash and US high yield. We have recommended exposure that would benefit from reflation with or without a tapering, including curve steepeners and OW breakevens. Higher yields are not an obstacle to the performance of commodities and we are OW commodities, including base metals, ex-gold. Oil markets are far from tight based on inventories relative to typical post-recession levels and will benefit from demand normalization as vaccines restore international air travel and domestic commuting. Base metals inventories are much leaner than typically holds after a recession.

4. Position for a consumer-driven recovery fueled by pent-up demand and $1.7trn of additional stimulus, as well as the potential for another $300bn of infrastructure spending. We expect the fiscal stimulus to be approved in the Senate around March 14 when unemployment insurance is set to expire. While some modifications will occur and the full $1.9trn is unlikely to be approved by the Senate, we believe that the floor for the size of the package is $1.4trn. An infrastructure package of around $300bn could be introduced later in the year through budget reconciliation. The fiscal stimulus will boost household income and the multiplier effect from the stimulus is around 0.7 pct-pt added to GDP with a lag. Our US economics team is forecasting a 10 % nominal increase in consumer spending or 8% in real terms. Stimulus checks accounted for about $1.7trn (or about 8%) of income in January and the supplement to unemployment payments authorized as part of the December package accounted for about $300bn. Consumer spending for services remains 10% below pre-pandemic levels; by comparison, durables spending has risen by 20%.

5. US unemployment to decline to 4.5% by year-end and 3.6% by end-2022, with Fed tapering to begin in early 2022 but the first Fed hike is likely still an early 2024 event. Our US economics team is forecasting 675,000 jobs created per month or 8 million for the full year, bringing the unemployment rate down to 4.5% by year-end and to 3.6% by end-2022. The labor force participation (LFP) rate remains 0.5% below pre-pandemic levels and has scope to normalize. Talk about Fed tapering could begin by mid-year with actual tapering beginning in 1Q22.

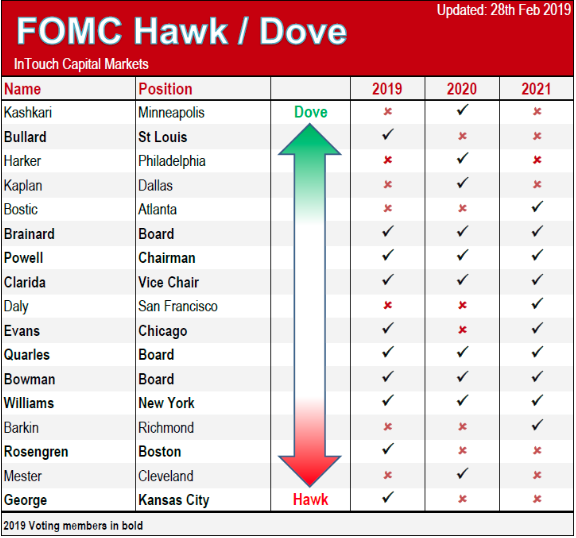

6. The current market conditions are not reminiscent of those that prevailed during the 2013 Fed taper tantrum. In contrast to the 2013 taper tantrum, the forward guidance is clear that the Fed will be on hold until maximum employment has been achieved and inflation is running 2% for a period of time. While there is the potential for personnel turnover on the FOMC, we are not worried about hawkish succession. During the 2013 Fed taper tantrum, rates were also trading 40-50bp below fair value, whereas 10-year yields are now trading cheap given the 50bp rise in US 10-year yields since the beginning of the year. We look for higher yields and a steeper curve over the medium term, but with the market now pricing a full hike by 1Q23 and over 50bp of hikes by early 2024, we recommended tactical longs in 5-year notes. Bearish positions are focused on the 7- to 10-year points on the curve due to lack of demand. Our US Treasury team forecasts the 10-year yield at 1.65% at year-end and the 30-year yield at 2.4%.

7. We recommend taking risk across and within Equities hedged with Commodities and view the EM complex as most vulnerable to rising yields. However, we do not think that EM is vulnerable in the same way they were in 2013, in part because there is little sign of overheating and external imbalances are virtually absent this time around. To the extent that this rise in rates reflects higher global growth, the boost to EM activity should dominate the drag from higher interest rates. Technicals are also favorable. In the current environment, EM is more likely a low Sharpe ratio trade delivering positive returns.

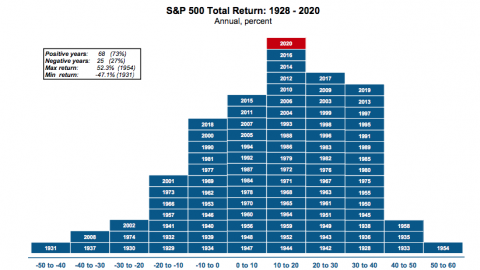

8. Our equity strategists expect a decline in implied equity volatility, which has spiked and contrasts with low realized volatility. A bubble of fear from investors looking to hedge or profit from a hypothetical market selloff has emerged with a near record premium for VIX that was as high as ~400-500% above the ‘fair value’ last week. This potential bubble is disconnected from the underlying short term S&P 500 low realized volatility, which has been orderly. Our equity strategists expect their short-term price target of 4,000 to be reached in the next few weeks and reiterate their target for the S&P 500 to reach 4,400 later in the year.

9. Financials are the highest conviction overweight within US equities, benefiting from reflation and low positioning. COVID-19 recovery plays should be the largest beneficiaries especially within Discretionary (in particular, Consumer Services such as Leisure, Gaming, Hotels, Off-line Retail), as well as Energy (Oil & Gas, Energy Services). The fiscal stimulus supports earnings as every $1trn of fiscal stimulus add around $4-$5 to EPS, implying 6- 7% upside for the remainder of the year.

10. There will still be slack in the global recovery at the end of 2021 and the scarring will play out over 2022 and 2023. The longer term damage from the pandemic will be similar to the Global Financial Crisis, with a slowdown in potential growth over the next decade, with emerging markets more adversely impacted. Given the Fed’s tolerance for an inflation overshoot and its guidance for liftoff, rate normalization is likely off the table at least through 2022. We have not changed our forecast that the first Fed hike will not occur until early 2024.