It was a rather mundane Tuesday until the late afternoon on Wall Street. The major averages meandered for much of the trading session up until the point where President Trump offered his negative opinions on China trade talks to the press. The Dow, which started Tuesday’s session on a high note, dropped nearly 200 points Tuesday following the president’s remarks. When it was all said and done Tuesday, the Dow fell .72%, the S&P 500 declined .31% and the Nasdaq fell .21 percent. The U.S. 10-yr. Treasury yield also slipped on the day and is falling alongside equity futures in the pre-market. Ahead of the all-important release of the Fed minutes at 2:00 p.m. today, global equities are under significant pressure.

Banks could be in focus after the House on Tuesday voted for a plan to roll back parts of the 2010 Dodd-Frank financial law. The move would ease rules placed on small and midsize banks during the financial crisis. The Financial Select Sector SPDR Fund was one of the market ETF outperformers yesterday, finishing flat in an otherwise negative tape.

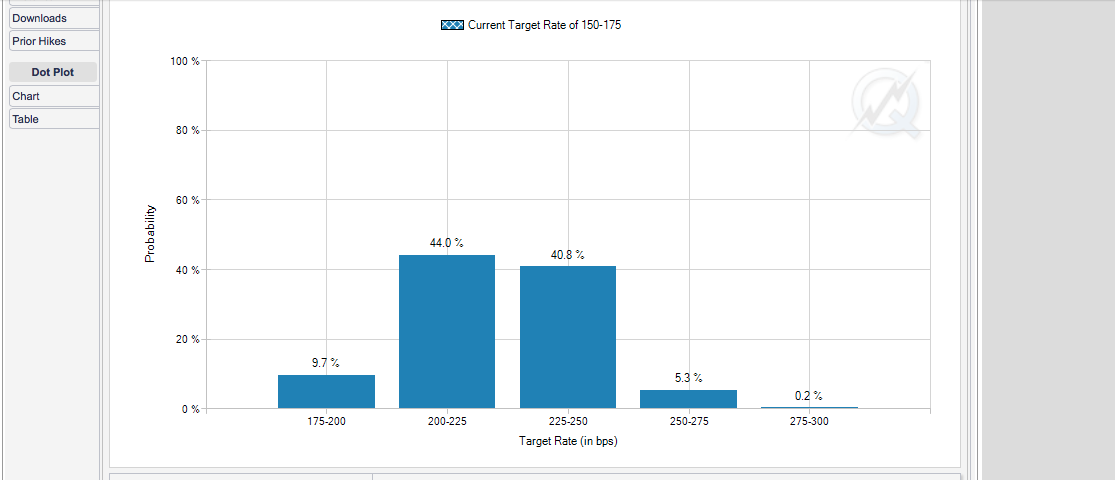

While we would be of the opinion U.S. equities will remain under pressure leading up to today’s release of the Fed minutes, the verbiage will lend itself to how equities finish the day. The majority of Fed officials are targeting 2 or 3 more rate hikes this year. A June quarter-point move is viewed as a certainty. And the question of whether to hike rates in September as well as December is not likely to be outlined in the minutes. The current rate path signals a total of 3 rate hikes in 2018, but given the strengthening economy and reflation taking hold, economists and analysts are baking in the probability of a 4th rate hike in December as depicted in the screenshot below.

A December rate hike has been increasing in probability since March. Expect markets to become responsive to the headlines surrounding the Fed minutes post 2:00 p.m. EST. One thing that many economists will be looking for in the Fed’s language does surround the long game or future forecast. Some Fed officials have said the goal is to have a neutral stance on interest rates, one that neither boosts nor contracts the economy. The Fed sees the “long-run” neutral interest rate just under 3 percent.

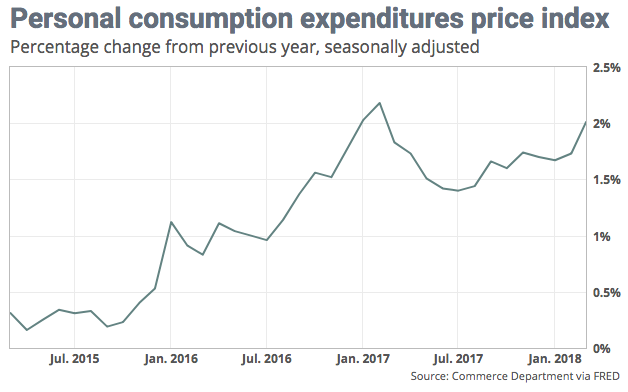

Moreover, analysts and economists will be looking at the minutes to clarify new language in the May policy statement, which included the addition of the phrase that Fed officials expect inflation to run near the Committee’s “symmetric” 2% objective over the medium term. A little above or a little below is the defining aspect for onlookers. Most economists and analysts expect, now, for inflation to run just above the Fed’s 2% objective.

“Therein lies the crux of the market’s interest/concern, how far will officials let inflation rise above “ their 2% target,” said Sam Bullard, senior economist at Wells Fargo.”

The recent rise in the Personal Consumption and Expenditures (PCE) data has given the Fed some additional cover to continue on their tightening path in 2018. This is the Fed’s favorite inflation gauge. The PCE rose to 12-month rate of 2% for the first time in a year this past April.

Those showing signs of concern for the U.S. economic conditions also point to consumer debt. This variable is almost always rising as the economy tends to be growing over time alongside a growing labor market. According to the most recent Federal Reserve data on consumer debt that was analyzed by Lending Tree, Americans and their total tab for consumer debt could reach a record $4 trillion by the end of 2018.

Americans owe more than 26% of their annual income to this debt. That’s up from 22% in 2010. It’s also higher than debt levels during the mid-2000s. Debts on auto loans and credit cards are climbing by more than 7% annually, while housing debt is rising at a little more than 2 percent. Consumer credit has been rising by 5-6% for about two years. At these levels, consumers are spending about 10 percent of their income paying these debts each month, Lending Tree chief economist Kapfidze said. From 2000 to 2008, that averaged about 12-13 percent. Also of importance, credit card delinquency rates, which are at 2.4%, are low.

“It’s a level of debt that’s pretty manageable for consumers on aggregate,” Kapfidze said.”

Based on the most recent data and analysis offered by Lending Tree, it doesn’t appear as though consumer debt is of any great concern despite the large numbers. It is also important to understand that consumer debt strips out mortgage debt.

While the focus of the day seems depressing to begin Wednesday, with global equities under pressure, there may be found a strong underpinning to the markets. In recent weeks and months, the S&P 500 has found great support at the 200-DMA and is presently finding its footing after a period of consolidation. One factor supporting the S&P 5000, and likely for the balance of 2018, is the massive amount of buybacks planned by corporations. The stock buyback boom continued in the first-quarter earnings season with U.S. companies announcing $6.1 billion of buybacks a day, according to Trim Tabs Investment Research. That’s second only to the roughly $6.6 billion-a-day announced with fourth-quarter earnings. Companies announced new stock buyback programs totaling $183.4 billion in the April to May earnings season, according to the research firm, second only to the $191.4 billion announced in the January to February season.

Here are some of the biggest stock buyback announcements so far in 2018, according to Kiplinger.

- Apple – $100 billion

- Cisco – $25 billion

- Wells Fargo – $22.6 billion

- Pepsi – $15 billion

- AbbVie – $10 billion

- Amgen – $10 billion

- Google parent Alphabet – $8.6 billion

- Visa – $7.5 billion

- 9 eBay – $6 billion

In earnings news yesterday, Kohl’s highlighted the day oddly enough. The stock soared in the premarket by nearly 7%, before plunging the same amount shortly after the company’s conference call began. Earnings per share shot up 64% to 64 cents, beating views by 15 cents, according to Zacks Investment Research. Revenue rose 3.4% to $4.208 billion vs. consensus for $3.951 billion. Same-store sales grew 3.6%. Consensus Metrix forecast a same-store sales gain of 2.7 percent. The reason shares of the KSS fall on rather spectacular results was largely due to what it said on its conference call with respect to sales comps. Kohl’s said a friends and family promotion pulled forward more sales into Q1 than expected, suggesting weaker comps in the current Q2. Even with this anomaly, the company raised FY18 guidance. Kohl’s now expects full-year EPS of $5.05-$5.50 vs. its prior target of $4.95 to $5.45. Analysts had expected $5.29.

Before the opening bell today, Target Corp. will announce its Q1 2018 results. The stock pulled back from recent highs as the whole retail sector succumbed to Kohl’s price action yesterday. MKM Partners is bullish about Target Corp. first-quarter earnings thanks to brands like Universal Thread and Opalhouse. Analyst Patrick McKeever thinks the 10-plus exclusive brands that Target launched in the past year are setting the retailer apart and improving traffic. FactSet consensus is for 2.8% same-store sales growth.

“We also believe the limited time Hunter for Target collection has been very successful, with high sell-through, even though the classic tall women’s rain boots had to be pulled from stores/online because of a manufacturing defect,” McKeever wrote.”

“Our 2% comp estimate for fiscal 2018 doesn’t assume much lift from expanded fulfillment options, but this is likely conservative as we believe the early read on Shipt, Target Restock (now available nationwide), Drive Up, and other initiatives has been very positive.”

MKM rates Target shares Buy with a $93 price target. Target has an average hold rating with a $76.36 average price target. Finom Group has a $77 price target that has been achieved and will reassess a new 12-month price target post Target’s Q1 2018 results. The historic multiple for TGT shares is 14.5X EPS, which is where the stock is roughly trading around the $77 level.

Target is expected to report earnings of $1.39, according to the FactSet consensus, up from $1.21 last year. FactSet analysts expect revenue of $16.58 billion, up from $16.02 billion last year. Target’s report will likely set the tone for an otherwise beaten-up retail sector as of late.

Wednesday will be a media headline, littered day as concerns over a meeting between President Trump and North Korean leaders may not come to fruition. Trade with China remains a worrying spot for many in light of President Trump’s latest remarks. Oil prices rising and the USD’s unabated strength in 2018 are also seen as market headwinds for equity moves higher. While these are the concerns of the day, none have limiting effects on earnings for the foreseeable future. All aforementioned macro and geopolitical concerns existed prior to Q1 earnings season and all remain post the earnings period. In time, the market will likely digest these concerns and lean in favor of corporate earnings… in time.

Tags: KSS SPX VIX SPY DJIA IWM QQQ TGT XLF XRT