As an investor, when contemplating the words in the geopolitical and macro realm, deciphering words and verbiage can be critical to a portfolio’s performance. The geopolitical environment investors are forced to consider this year likely outweighs that which one had to consider in the more recent past or during previous U.S. administrations. The last couple of weeks have found investors rocked back and forth by equity markets and in large part due to the rhetoric coming out of Washington and Bei Jing , China.

Let’s quickly outline the latest charge put forth by the U.S. administration. This latest charge by the White House comes in response to China’s response to the White House’s initial trade tariff proclamation on the Chinese Republic.

- March 1: President Trump announces tariffs on steel and aluminum imports, from which the European Union, Argentina, Australia, Brazil, Canada, Mexico and South Korea were temporarily exempted.

- April 1: China announces retaliatory tariffs on 120 U.S. food products.

- April 3: The Trump administration announces additional tariffs on 1,300 productsmade in China and exported to the U.S., to go into effect after a 60-day public commentary period.

- April 4: China announces tariffs on 106 American products.

- April 5: As follows with the below published statements from President Trump.

“In light of China’s unfair retaliation, I have instructed the USTR to consider whether $100 billion of additional tariffs would be appropriate under section 301 and, if so, to identify the products upon which to impose such tariffs,” Trump said in a statement.

The United States is still prepared to have discussions in further support of our commitment to achieving free, fair, and reciprocal trade and to protect the technology and intellectual property of American companies and American people,” Trump said in a statement.”

On the heels of the latest request from President Trump and when it was all said and done last Friday, the Dow Jones Industrial Average fell 2.3%, while the S&P 500 index lost 2.2% and the Nasdaq-100 Index declined 2.3 percent. In the midst of this Friday sell-off, investors may have noticed a rather subdued VIX reaction to the move in the S&P 500, which at one point was down as much as 3 percent. Either the VIX wasn’t buying the decline in the S&P 500 or the implied measure of 30-day volatility was “constructing an outcome” still yet to be discovered. With that being said, the Dow is now down 3.1% year-to-date, with dividends reinvested, while the S&P 500 has had a slight positive return and the Nasdaq-100 is up 3.4 percent. The low of the week, last week for the S&P 500, was 2,552.

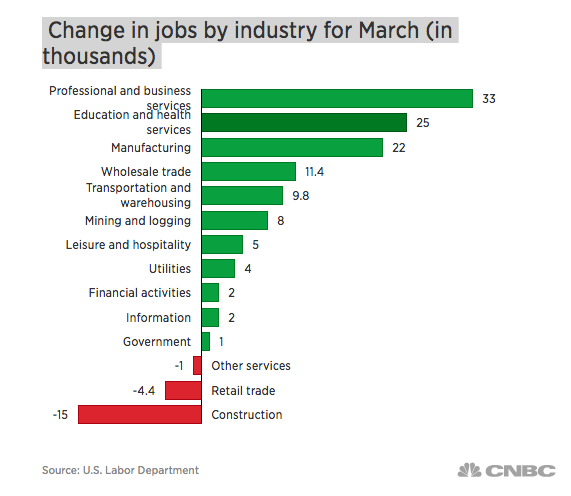

What may have been lost by investors through the concerns over a potential trade war was the Nonfarm payroll data that proved underwhelming, but innocuous at the same time. The Bureau of Labor Statistics said the U.S. economy added 103,000 new jobs in March, well below the consensus estimate of 170,000 among analysts polled by MarketWatch. The unemployment rate remained at a 17-year low of 4.1 percent. Here are the net changes by industry for the month of February, according to Bureau of Labor Statistics.

As we look to the trading week ahead, it is unlikely that the upcoming trading week will be found with anything but continued, elevated levels of volatility. The markets will likely be defined by such volatility in 2018. A VIX reading of greater 16 or greater (VIX reading ended the week at 21.49) assumes a greater than 1% daily move on the S&P 500. The trade war rhetoric is serving to maintain heightened levels of volatility in a market that might otherwise focus on corporate earnings, which we will get too in a bit.

Reverting to geopolitical tensions, investors would be wise to take a long-term view and scrutinize the verbiage surrounding the geopolitical headlines. Those headlines concerning the latest request by the President about possibly finding an additional $100bn in tariffs bears such an exercise of scrutiny or consideration.

“I have instructed the USTR to consider whether $100 billion of additional tariffs would be appropriate under section 301.”

Last Thursday’s latest request by President Trump is just that, a request for discovery and not an implementation. No tariffs have been implemented to date. Nonetheless, it does raise the awareness level and provoke a response from China that continues to weigh on investors, driving forth a risk-off sentiment.

The saber rattling between the U.S. and China has proved a daunting hurdle for markets to climb over the last several weeks. Many analysts remain of the opinion that the trade rhetoric is just that and a means to posture for a greater outcome through pending negotiations.

“Allan von Mehren, chief analyst at Danske Bank in Copenhagen, sees Trump putting maximum pressure on China, with the tariffs accompanying the signing of the Taiwan Travel Act, which opens the door to high-level visits between the U.S. and the island that Beijing claims as part of its territory.

“Trump’s aim may very well be to put maximum pressure going into a negotiation to get as many concessions from China as possible. We have seen this many times before in his tactics on making deals,” von Mehren said.

That could lead to behind-the-scenes deal making that results in a grand bargain, with the U.S.> backing down from the Taiwan issue and reducing the proposed tariffs in exchange for better access for U.S. companies in China and a stronger effort by China to protect intellectual property rights and to stop requiring the transfer of technology in joint ventures.”

Many investors are now forced to juggle the geopolitical conflicts alongside earnings season. The time has come and with great anticipation and hope that earnings season will deflect from the geopolitical concerns. That may prove a fleeting thought, however, depending on the next Presidential tweet! Again, the former statement only serves to define 2018 equity markets’ concerns and why volatility should remain elevated when compared to that of 2017.

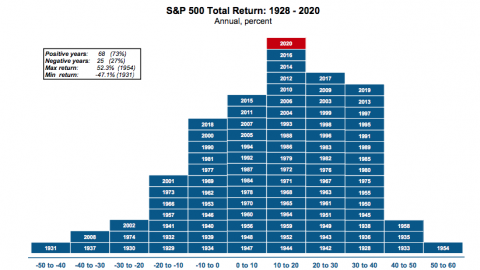

Moreover and as it concerns the volatility residing in equity markets presently, THIS IS NOT NEW AND THIS IS NOT THE WORST IN THE LAST 66 YEARS! I phrase it as such given the recent on-air interview by CNBC with Vanguard founder and former CEO Jack Bogle. He stated the following in the segment that aired last week:

“I have never seen a market this volatile to this extent in my career. Now that’s only 66 years, so I shouldn’t make too much about it, but you’re right: I’ve seen two 50 percent declines, I’ve seen a 25 percent decline in one day and I’ve never seen anything like this before.”

We can’t go back 66 years unfortunately to review a VIX reading or even to the 1987, Black Monday event to see what the VIX reaction was and what the VIX reading would have been in the subsequent weeks to follow. But even if we just travel back to August 2015, a couple of years ago, we can discern that Mr. Bogle’s statements were a bit of hyperbole. The chart below represents the August through early November 2015 period whereby the VIX spiked dramatically and stayed elevated for a good period of time.

The VIX managed to stay above 20, the historic median average, for greater than 5 weeks and before decaying below 16. Additionally, the VIX re-emerged from its complacent levels and back above 20 in the month of November. As such, from late August to early November (spanning some 2.5 months), the markets were quite volatile in VIX terms.

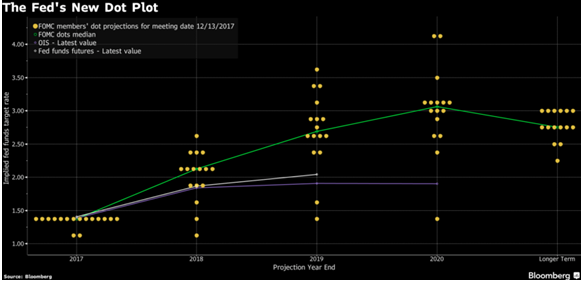

Our last point on macro factors involves rate hike consternation that will persist at this stage of the economic cycle whereby the Fed is tightening monetary policy. Last Friday in a speech to the Economic Club of Chicago, Fed Chairman Powell stated the Fed’s approach has been one of benefit to the economy.

“The FOMC’s patient approach has paid dividends and contributed to the strong economy we have today. Going slow on rate hikes has also reduced the risk of “an unforeseen blow to the economy” that might have pushed the economy into recession otherwise. My FOMC colleagues and I believe that, as long as the economy continues broadly on its current path, further gradual increases in the federal funds rate will best promote these goals” of 2% inflation and a strong labor market.”

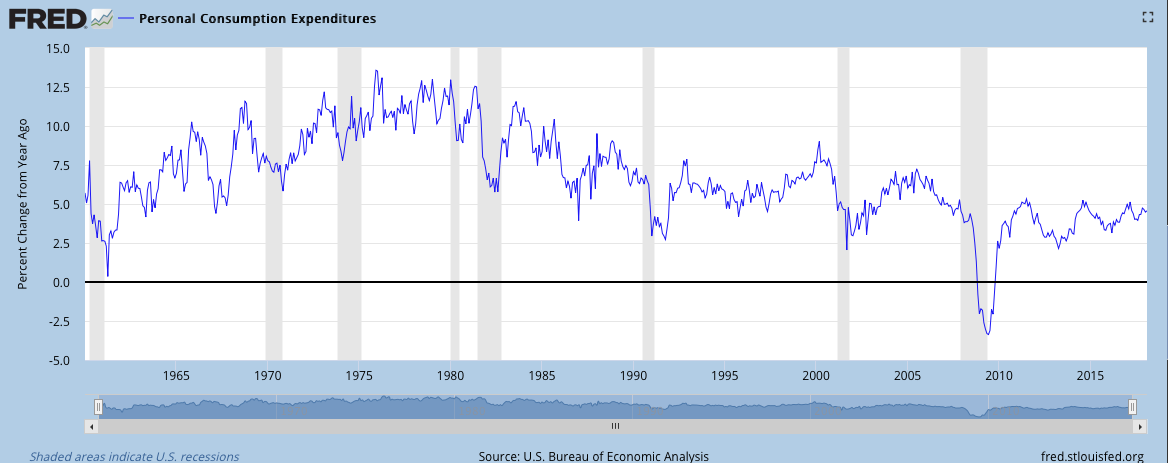

The Fed has hiked rates, now, 5 times since 2015 and is on a path to hike rates 3 times in 2018. The Fed’s most closely watched indicator of inflation is Personal Consumption & Expenditures, which is presently below the Fed’s 2% target mandate, but elevating year-over-year. One thing that we can clearly discern from the historic data on the PCE is that there have always been offsetting measures for inflationary concerns in the economy. See U.S. Bureau of Economic Analysis historic charting of PCE below:

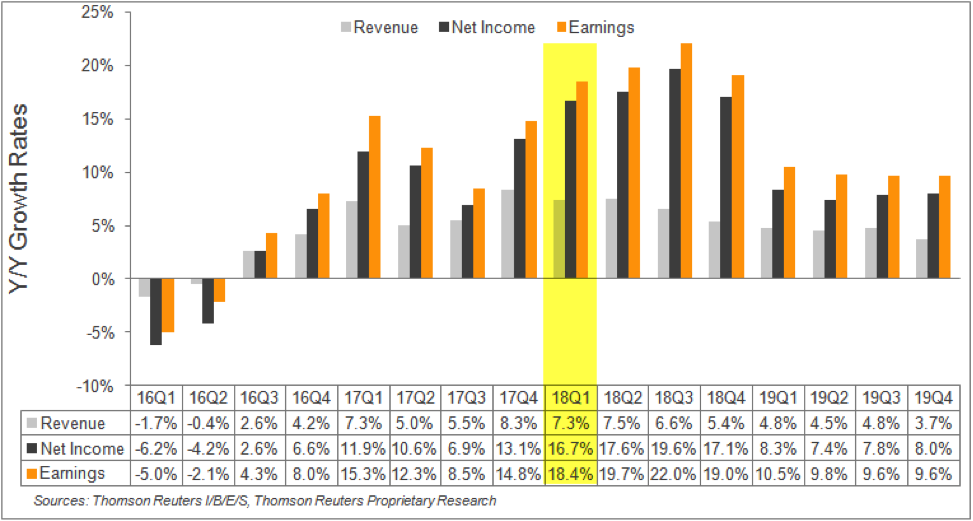

With the geopolitical and macro factors in our rear-view mirror, we now focus on earnings. First-quarter earnings season gets under way in earnest on Thursday and Friday, with results from large banks including BlackRock Inc. Wells Fargo & Co. and JPMorgan Chase. Expectations for a strong earnings season have been the focus of long-term investors. Investors have not been presented with such a quantitative earnings outlook in quite some time, as tax reform legislation serves to improve the quantity of earnings for the S&P 500 in 2018. The forecast for S&P 500 corporate earnings is presented below and by Thomson Reuters/Lipper Alpha Insights.

Investors cannot and should not ignore corporate earnings growth. At the same time, the macro-headwinds have proven to compress the valuation of the S&P 500 as uncertainty has outweighed the prospects for earnings growth in 2018 to date. The tug of war will likely continue until… a more certain geopolitical/macro picture is presented.

Be it in 2015 or presently, Finom Group continues to trade the volatility presented in the market place and shares trade alerts with subscribers through our private Twitter feed as displayed in the latest tweet alerts last Friday.

Feel free to subscribe to our service that includes trade and investment thesis alerts, bountiful research, social sharing and much more.

Tags: SPX QQQ VIX SPY DJIA IWM QQQ

There are starting to be rumblings that cutting back by one rate hike would make the markets rally. Do you think that is true? Thank you for the great article.

@famis-dave you would see it show up in Fed Futures which hasn’t changed much at all since latest rate hike. Still on schedule for 3 as of now.