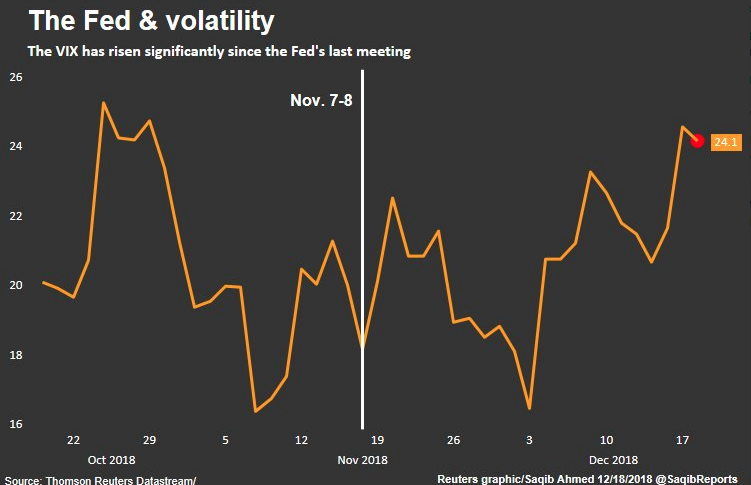

Since the FOMC’s September meeting and when it stated that it was “a long ways away from the neutral rate”, the market has been in a state of turmoil. The S&P 500 has fallen by some 12%+ since that time, taking out the February lows. Market volatility has remained elevated over this period of time.

While volatility has remained elevated since October, the market drawdown has been relatively orderly and not found with much if any panic through the correction period. But what can stabilize the market and provide it with a lift going forward, may very well depend, in part, on today’s FOMC announcements and outlook.

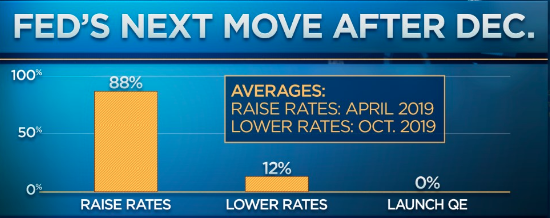

When we review the CME FedWatch Tool we come to find that there is a 71% chance of a Fed rate hike to be delivered at 2:00 p.m. EST Wednesday.

While it seems a very high likelihood of a rate hike, usually there is an over 95% probability defined based on the Fed Fund contracts. It’s why more so than in any previous rate hike throughout the tightening period that began in December 2015, analysts and economists are uncertain of what might be delivered at the upcoming FOMC meeting and press conference. Don’t get it confused; based on labor market conditions alone, the Fed is very likely to raise rates. If they shouldn’t do so, the market may see the absence of a rate hike as signaling something much more dire in the economy or financial conditions that the Fed is seeing.

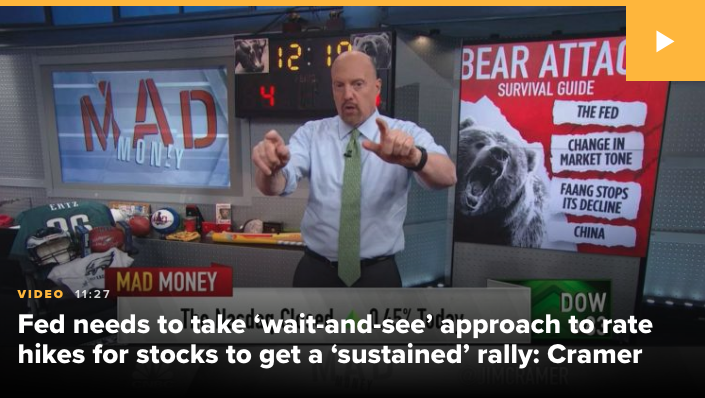

A more critical aspect of the 2-day FOMC meeting is the post rate decision press conference. Alongside the rate hike, most analysts, economists and investors desire the Fed to offer a “wait and see” approach with regards to future rate hikes. Again, if we look at the CME’s FedWatch Tool, hardly a single rate hike has even a 25% probability in 2019. The market is expecting a “wait and see approach”. With oil prices collapsing alongside a rising U.S. Dollar, global growth slowing and uncertainty on trade relations, the Fed has ample cover to offer up a more cautious outlook for rate hikes. CNBC’s Jim Cramer offered a similar sentiment regarding the FOMC announcement to come.

“Remember, if we’re going to get a sustained bounce, we need one thing above all others: after the rate hike everyone’s expecting tomorrow, the Fed needs to make it clear that they’ll wait and see rather than continuing to tighten.”

For market stability, at the very least, the FOMC will prove most critical to the markets on Wednesday, but long-term stability will need to be provided through global growth. Trade spats have proven to slow emerging economies and even that of the world’s 2nd largest economy, China. The trade fights between the U.S. and China have somewhat abated and improving measures between the two nations have commenced. The 90-day trade truce is likely to end with either longstanding resolution or at worst, an extension of the truce in favor of ongoing negotiations. It’s in neither countries best interest to pursue escalating tariff implementations and continue with the trade feuding activities. In the U.S., the political ramifications alone from an ongoing trade feud with China will weigh heavily on the White House. The end game for this period of trade feuding will likely end with some form of concessions on both sides that allows for “more free trade” to take place, but certain tariffs will remain until any agreement is validated by actions over time.

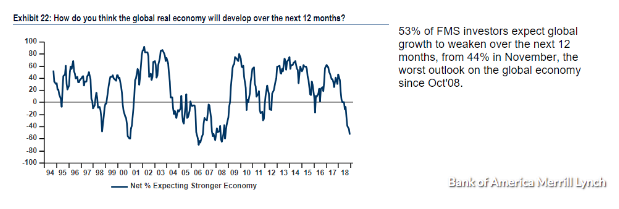

As the market goes, so goes market sentiment and market sentiment has been undeniably bearish in the 4th quarter of 2018. A recent fund manager survey by Bank of America (BAC) examples just how bearish the market sentiment has become.

53% of those surveyed see the global economy deteriorating over the next twelve months, up from 44% in November, the highest share of those surveyed since Oct. 2008. According Bank of America chief investment strategist Michael Harnett, the fact that the dollar trade is crowded against a backdrop of bearishness towards stocks and global growth and the belief that the Federal Reserve is near the end of its tightening cycle means that investors see a “recession coming,” Harnett wrote in an analysis of the survey.

“Eric Wiegand, senior portfolio manager at U.S. Bank, concurs with the results of the survey, telling MarketWatch that he has reduced risk in his client portfolios as he waits for more certainty on global growth, trade policy and the path of Fed monetary policy. “Institutional investors have retraced and taken a more guarded position.”

There’s that ugly phrase again, trade policy. While most economists and analyst believe that the White House is confronting an issue with China’s trade practices that is long over due, living through the adverse affects has been hard to stomach. Fund managers surveyed by Bank of America agree, as 37% of them say that trade-war dynamics are the biggest risk to the economy in the coming months, twice as many as those who named either quantitative tightening or a slowdown of the Chinese economy.

The mood of the market is one that hasn’t the benefit of earnings season to backstop further declines. Earnings won’t be announced until after the New Year. Those earnings, which have trickled out of late, haven’t proven to negate the narrative of a slowing global economy. Late-season earnings reports Tuesday afternoon from FedEx Corp. (FDX) and Micron Technology Inc. (MU) contained worrisome forecasts that suggest a global economic slowdown is firmly in place, but largely in Europe and China.

FedEx announced a plan for employee buyouts to cut costs despite beating earnings expectations with more than $1 billion in quarterly profit. Chief Executive Fred Smith explained that the company reduced its 2019 earnings guidance and instituted the cost cuts because of a slowdown in activity in Europe and China, mentioning the effects of a trade war between the U.S. and China.

“In the U.S., growth remains solid, run by robust consumer spending and favorable conditions in the industrial sector. Internationally, economic strength seen earlier this year has given way to a slowdown,” FedEx executive Rajesh Subramaniam said in extending Smith’s comments. “The peak for global economic growth now appears to be behind us.”

Micron reported fiscal first-quarter net income of $3.29 billion, or $2.81 a share, compared with $2.68 billion, or $2.19 a share, in the year-ago period. Adjusted earnings were $2.97 a share. Of analysts surveyed by FactSet, Micron was expected to post adjusted earnings of $2.95 a share, up from $2.45 a share a year ago. Shares of MU fell sharply after reporting a disappointing quarter, but also lowering its forecast for 2019.

Micron Chief Financial Officer David Zinsner predicted adjusted fiscal second-quarter earnings of $1.65 to $1.85 a share on revenue of $5.7 billion to $6.3 billion on an earnings conference call. Analysts surveyed by FactSet on average had forecast adjusted earnings of $2.39 a share on revenue of $7.26 billion.

The drastic shortfall in the outlook is related to a glut of chips on the market after customers built up inventory as prices had soared over the past year. Chief Executive Sanjay Mehrotra said on the call that inventory levels vary from customer to customer and oversupply issues may not work out until the second half of 2019.

“Our assessment is that inventory adjustments will take a couple of quarters for it to be corrected for it to work through the system entirely and of course we continue to work with our customers in the meantime in terms of understanding their longer-term demand requirements,” Mehrotra said.”

Shifting gears back to the economy and impacts from tariffs, the reality of the impact from tariffs, if not on the whole of the market and economy, is coming into the light. Having said that, the U.S. economy is on strong footing, supported by the strength of the labor market and consumer. The U.S. economy is not expected to witness a recession in the near-term, but after such a strong rate of growth in 2018, most economists and analysts expect that pace of growth to slow in 2019.

It always proves difficult to separate market declines from the economy’s strength or weakness. Most people just assume a declining stock market coincides with a weakening economy. That simply isn’t always the case and to date, the economic data in the U.S. hasn’t supported the notion of a weakening economy by and large. Mike Englund, chief economist at Action Economics offered the following in this regard:

“Stock price declines have driven the growth slowdown narrative, which thus far faces little confirming evidence from actual U.S. economic reports.”

In the most recent CNBC Fed Survey, respondents have boosted the chance of recession next year to the highest level of the Trump presidency, reduced their support for the president’s handling of the economy and lowered their outlook for economic growth and Fed rate hikes. The survey showed that the chance of recession in the next 12 months rose to 23%, the second straight increase, and up from 19% in the prior survey. That’s higher than the 19% long run average for the 7-year-old survey and 9 points higher than the low of the Trump presidency.

While the tone of responses is more negative, 63% of those surveyed believe the recent market sell-off reflects too pessimistic a view of the outlook, with about a third saying the market has it right.

U.S. equities are pointing to a higher open ahead of the FOMC announcement in the afternoon. The market’s reaction to the Fed is highly anticipated and may prove a sell-the news event in the subsequent weeks to come if the Fed doesn’t lean into an outlook and narrative that suggests less tightening measures are to come.

Tags: BAC DXY SPX VIX SPY DJIA IWM QQQ XLF