Research Report Excerpt #1

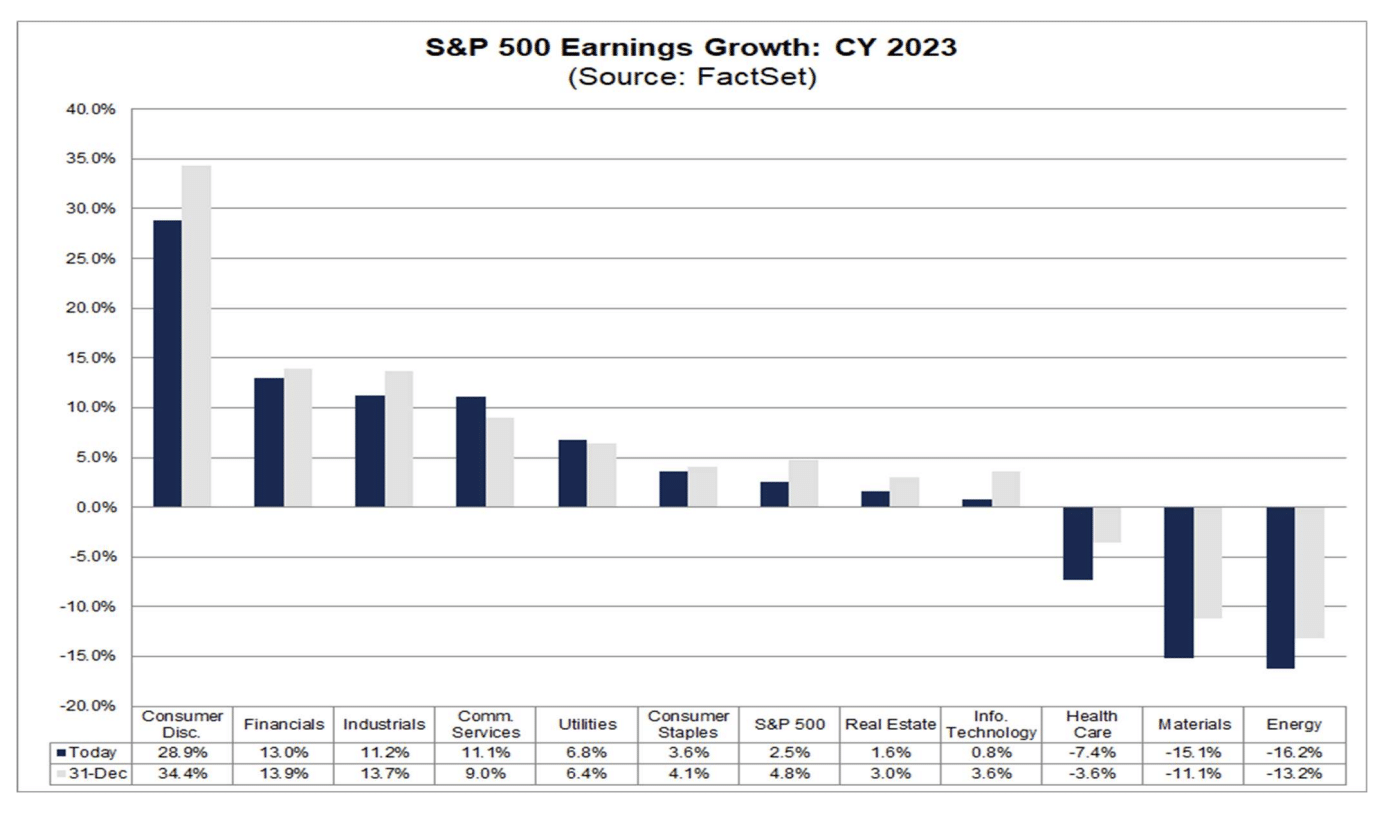

The growth projections by sector are completely flipped for 2023. Analysts anticipate the low comparisons for Consumer Discretionary/Communication Services to be a tailwind for EPS growth in 2023. Unfortunately, the high comparable EPS is anticipated to be a headwind for the Energy sector in 2023. Hence, the price performance has also flipped to reflect the analysts’ expectations for the EPS growth of these sectors, as a means of pricing the coming 4 Quarters of earnings.

Research Report Excerpt #2

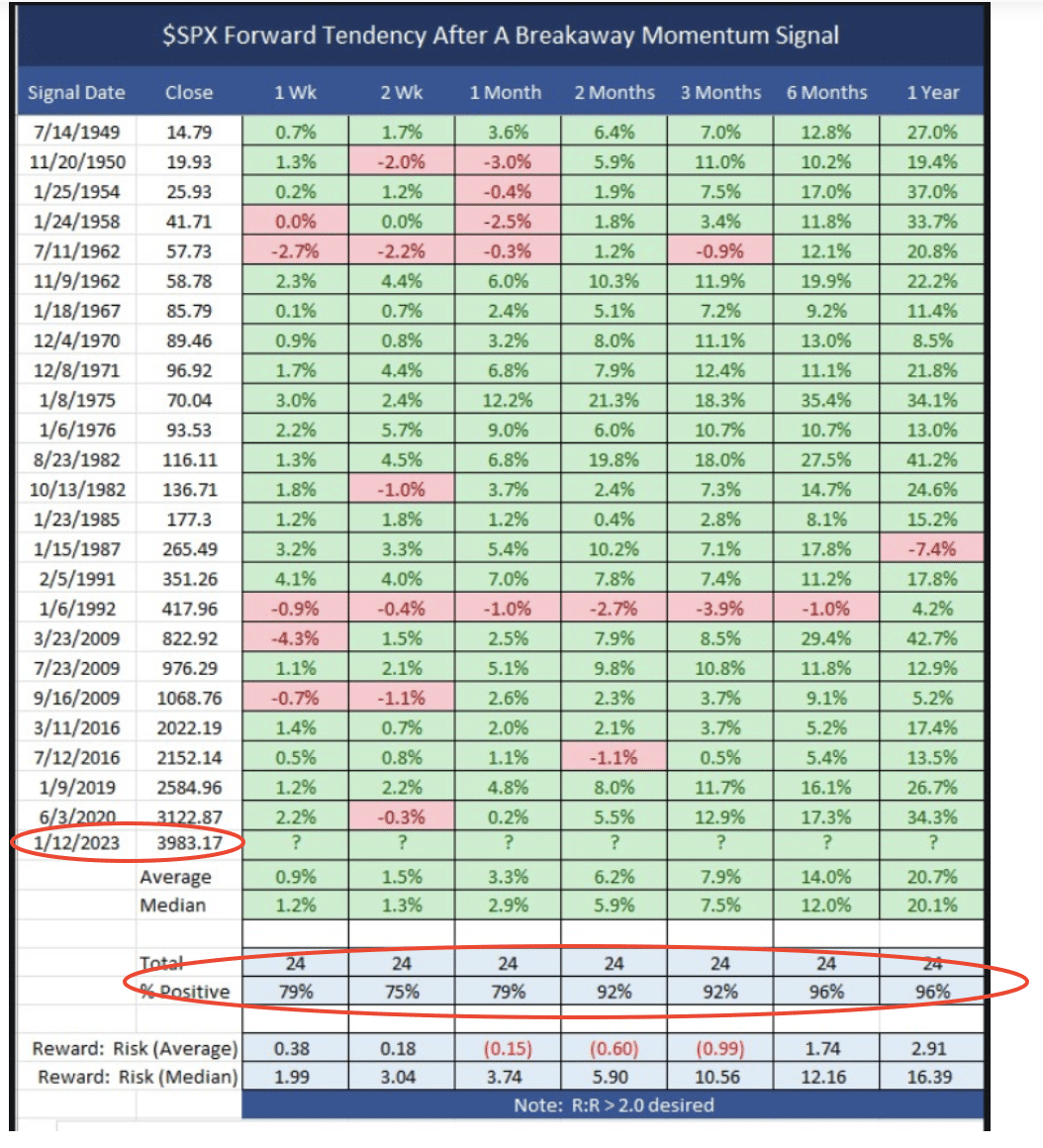

At the expense of sounding like a broken record and/or not providing “healthy reminders” for investors. Here is a list of the breadth thrusts and technical achievements that have occurred during the bear market and into 2023’s possible new bull market, with their associated tables in chronological order. You may want to save the link for this report, to reference in the future.

- Break Away Momentum Breadth Thrust: 1/12/2023

- Whaley Breadth Thrust: 1/12/203

- 2 and 10 Breadth Thrust: 11/30/2022

- 90% of stocks above their 50-DMA in S&P 500: 11/30/2022

- Golden Cross in S&P 500

- January Trifecta, after a down S&P 500 year

- NYSE McClellan Summation Index above 900

Research Report Excerpt #3

In the past, we had disseminated the Oppenheimer Market Bottom Checklist. Within the checklist it accounted for various breadth readings within the NYSE, as detailed below:

The final item in the checklist was actually completed in September of 2022, with Net New 52-week Highs hitting -1,100+. If you don’t know what capitulation looks like, that is what it looks like folks. There have only been a few readings worse than the one in 2022 and since 2000.

Research Report Excerpt #4

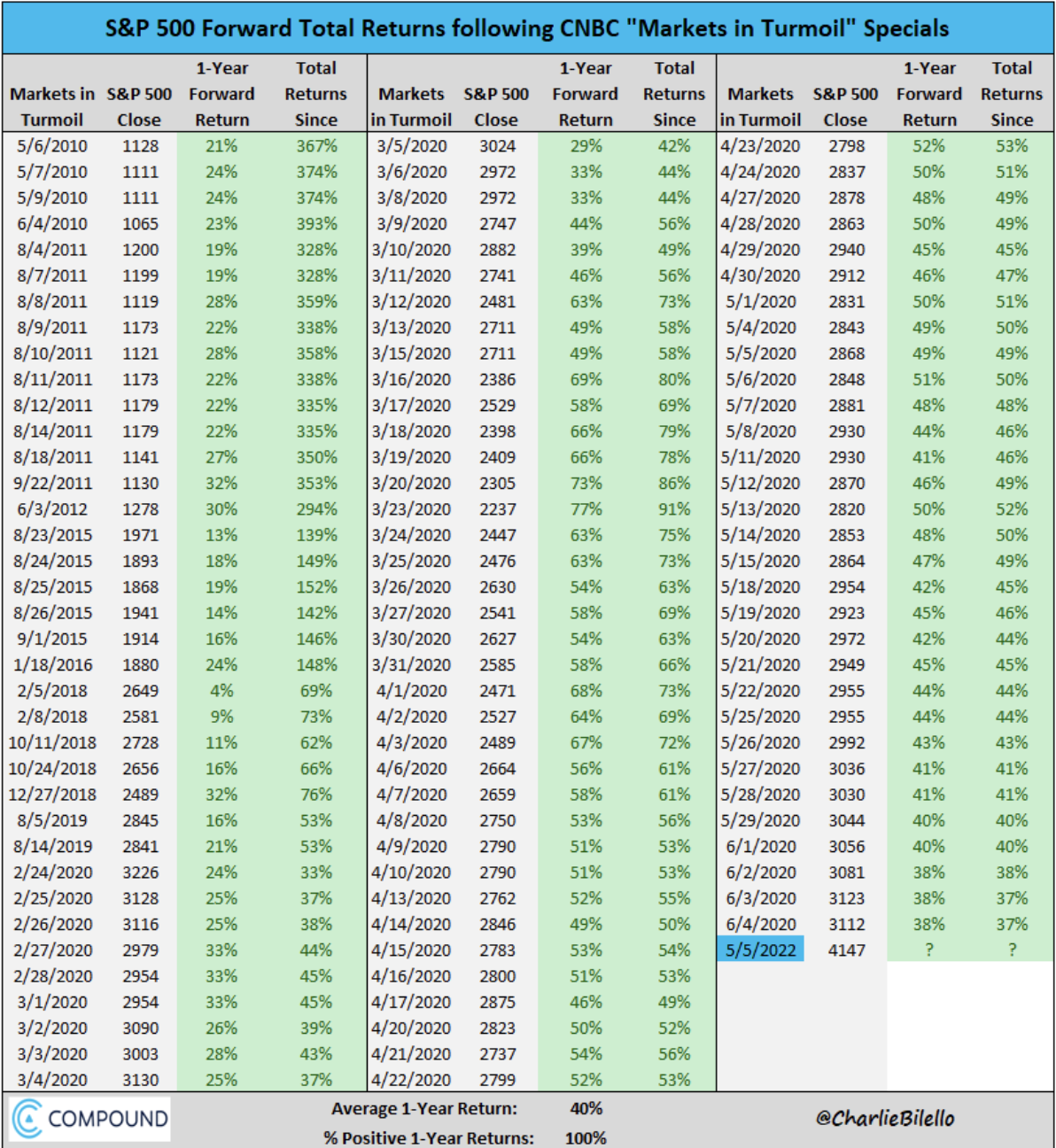

While it is less than sophisticated and completely sentimental, it does have a perfect track record as well. I’m talking about the…

…CNBC Markets in Turmoil.” The 1-year forward S&P 500 return has been positive every single time after the first CNBC Markets in Turmoil special broadcast. The first time this broadcasted in 2022 was on May 5, 2022. The S&P 500 was at 4,147 on that day. If history is any guide, we might anticipate getting back above this level by May 5th of 2023.

Research Report Excerpt #5

Friday’s jobs stunner helped propel the Citi Economic Surprise Index for the U.S. higher by significant degree (chart above). The daily change was the largest since June of 2020. The Atlanta Fed GDPNow jumped from .7% to 2.2% this past week. Many economists have gone from suggesting the Fed was throwing the economy through the windshield in late 2022 to characterizing the economy as strong and accelerating in early 2023.

Research Report Excerpt #6

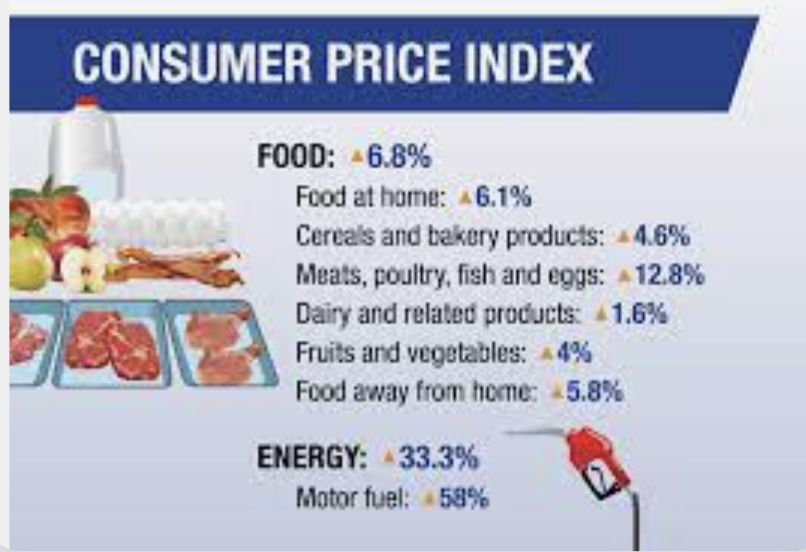

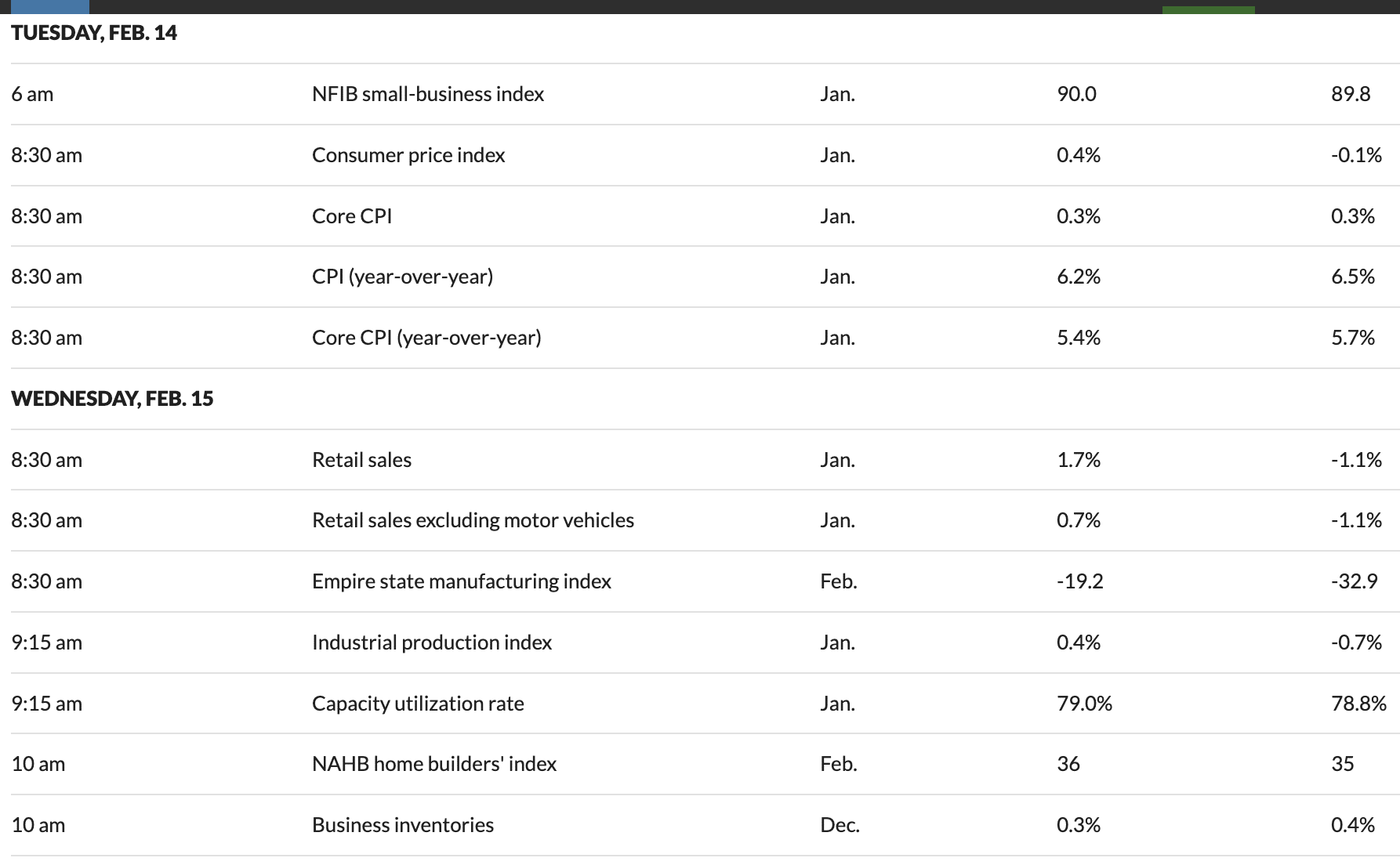

As we can see from the table above, economists are of the view that M/M CPI will have bounced higher in January, but fallen on a Y/Y basis for both the core and headline items. Commodity prices will have likely produced this outcome should it materialize in the data. We did see a bounce off the recent lows in commodity prices during the month of January, but I’m of the opinion this was to be expected. Prices don’t rise in a straight line any more than they fall in a straight line. If a hotter than anticipated CPI reading is delivered and investors prove to sell equities, we would view this as a good buying opportunity, given the disinflation trend is likely to persist, as the lagged Shelter and Owner-Equivalent Rent categories have yet to hit the CPI and are anticipated to do so in the coming months.

Research Report Excerpt #7

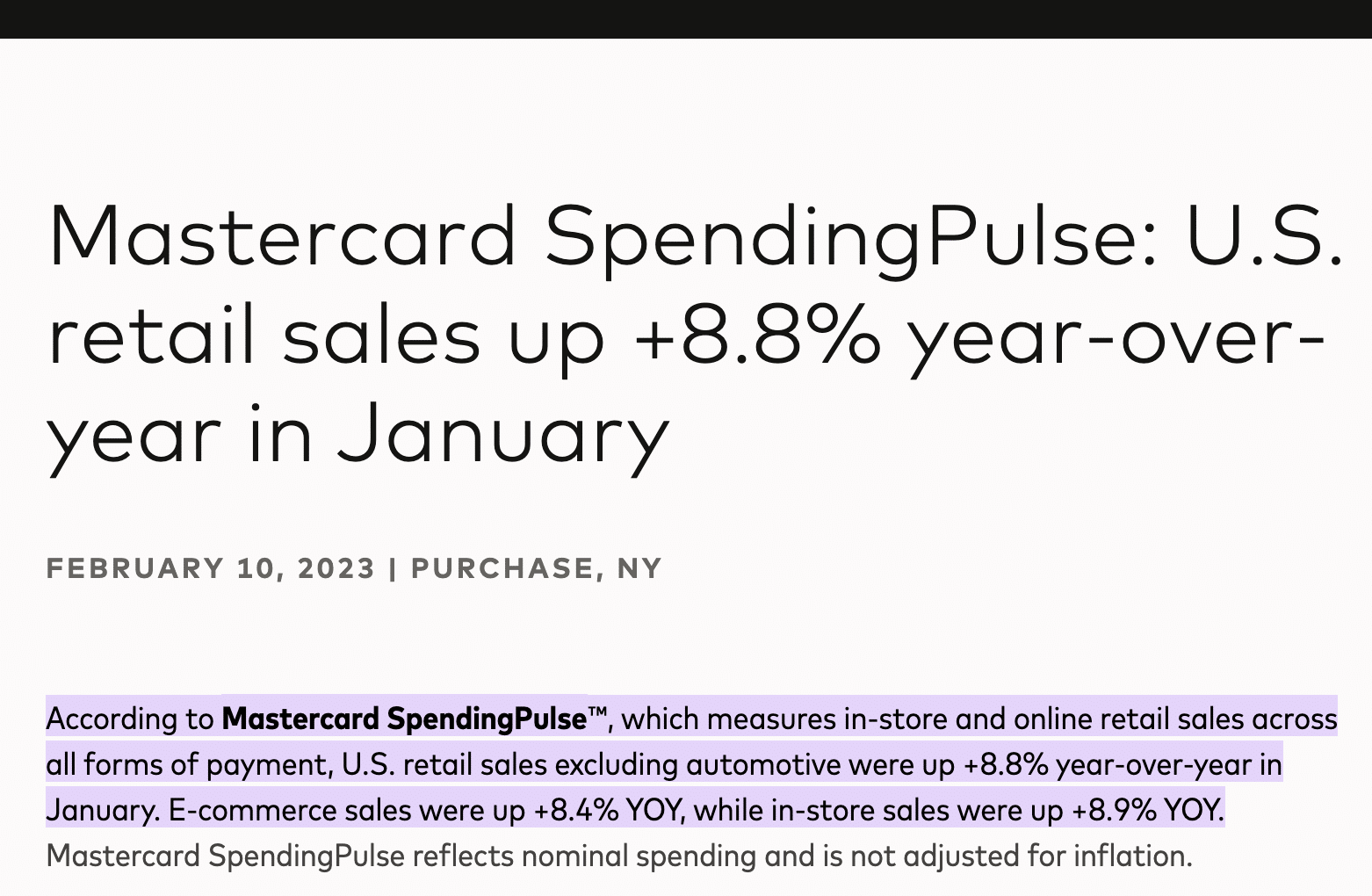

Akin to the strength in consumer spending demonstrated by way of the Bank of America Consumer Checkpoint data was the most recent Mastercard SpendingPulse data, as depicted below:

Research Report Excerpt #8

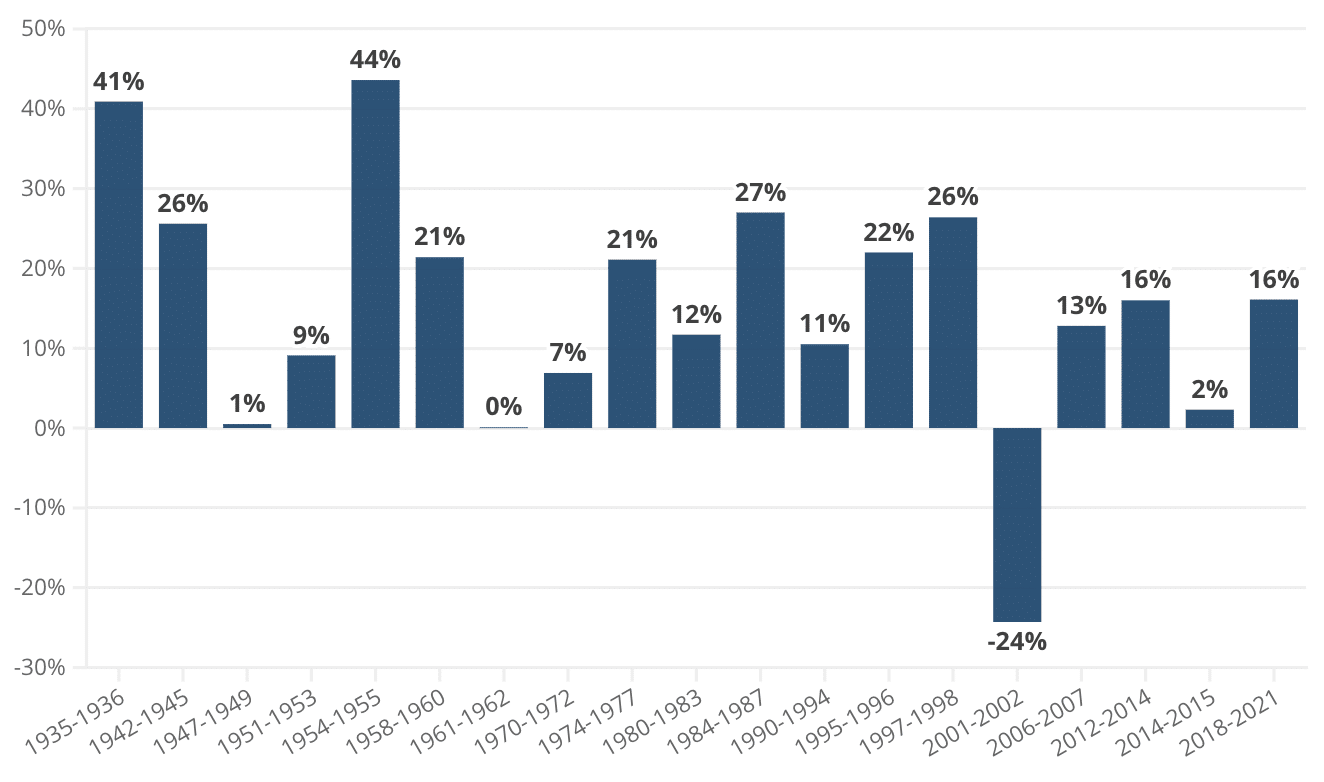

In only 1 instance (5% of observations) do equities give you a negative real return in a DISINFLATION episode. In 13 instances (68% of time) the real return is double-digit or more. On average across all 19 episodes the real annualized return is +14 percent.

Research Report Excerpt #9

Neil Dutta: “In my view, what makes someone worth listening to is whether their thought process makes sense. It is not enough to point to this indicator or that one. Rather, is the analyst laying out a sequence of events that follows logically?”