The vast majority of traders trading the equity markets find their experiences to be underwhelming and often littered with losses. Unfortunately, that is the hard truth and something most dismiss when they embark on their journey to personally and actively trade the equity markets. “I’m different. I know what I’m doing. I can manage my trades well if I try harder.” It sounds good and sounds, almost, like a plan even. It’s not a plan and it so rarely works out for most traders. We hear the stories all the time and see anecdotal dialogues about “home gamers” gone wrong on the financial news networks like CNBC, Bloomberg or Fox Business. Even though there is hard evidence to suggest that “95% of traders lose money” or “Only a few percent of traders make a living at it, there will always been an endless supply of newcomers to the equity markets whom hope to trade it with success. The failure rate is high, but that’s not really what matters. What matters most is how to be part of the successful traders, and avoid being amongst the unsuccessful 95% category of unsuccessful traders.

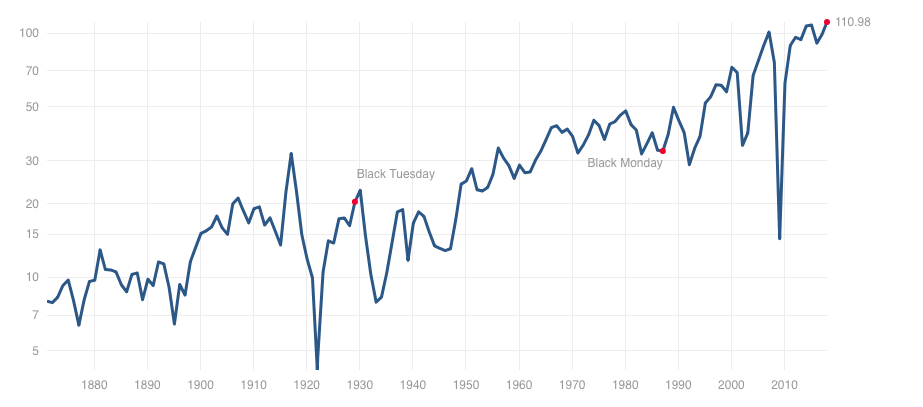

Before we talk about what it takes to be a successful trader, I want to express one very key and factual statement. “Corporate earnings drive markets. When earnings go up, equity indexes go up with time. When earnings decline, equity indexes decline over time.” Take a look at the chart below of the S&P 500 earnings over time.

The chart identifies and validates the very statements made above. So if one was to simply “invest” in the major indexes or index ETFs the path to profitable investing seems rather simple. Don’t get me wrong, this sole strategy will obviously label the investor a market performer, but it’s still relevant. As such, this is where an individual should be asking himself or herself the question as to whether or not they really want to be a trader as opposed to simply investing in the major indexes.

Discipline

So why do independent traders fail to such a statistical degree? Investing or actively trading takes discipline… discipline, discipline, discipline! Of course in order to execute a discipline it takes intellect that corresponds or correlates well to the activity of investing and/or trading. For a great many traders, there simply isn’t the appropriate correlation to find successful trading. Most of these traders will never acknowledge this variable and simply trod on, day-by-day and hoping to find success where the deck is largely stacked against them. Yes, I’m very sorry to suggest with such frankness, but much like any profession or expertise there is an intellectual correlation. Not everyone can become a dentist simply because they have teeth and not everyone should trade the equity markets simply because they have money to do so.

When we speak of trading discipline we speak about the time it takes to formulate a favorable trading discipline. Time is dedication and dedication is measured over time. The more work a trader puts into formulating a discipline the greater the odds of trading with success. Unfortunately, most traders don’t truly commit to a discipline and certainly don’t dedicate enough time to formulate such a discipline. The worst-case scenario for certain of these traders occurs when they find early success trading without such disciplines. They essentially extrapolate a false-positive experience from trading, execute the same lack of discipline and ultimately are met with the inevitable, failed trading experience/s measured by considerable capital lost.

The bottom line is that traders should adhere to a formulated discipline that also centers on a well-defined plan. A trading plan is composed of 3 generalized segments of trading activities: Entry Rules, Exit Rules and Money Management. As is always the case, one should formulate this plan according to their personality and what they truly believe they will be able to execute. If a trader formulates a plan and rules that are routinely modified or simply ignored, they’ve done nothing more than waste time on the road to likely failed trading experiences. A trader must be honest with themselves, know their quirks, nuances and capabilities. As an independent trader, you’re measured against your own performance.

Here’s the hard part about adhering to a discipline and plan: Sticking to that plan! Most, not some, not a few but most, traders find it too difficult to stick to a plan. So what do they do? Well, they modify the plan and modify it further and further until the plan is nonexistent, useless. They’ve become emotional traders. But try telling a trader they are exercising emotion over a plan; see how that works out for you! The inevitable response from the trader will likely be littered with a plethora of excuses and what they believe to be rational accommodations. Rational accommodations; talk about the best sounding political verbiage ever! Again, traders must adhere to a formulated discipline that also centers on a well-defined plan, even when it is uncomfortable. I repeat, even when it is uncomfortable. That likely means taking small losses from time to time rather than linger on with a trade that is expressing ever-increasing losses. The vast majority of traders, seemingly, lack the discipline to exercise this part of the trading plan. Not every trade will prove out a positive return for one reason or another and despite all efforts with regards to research, charting and common patterns. Trading is a lesser science when compared to investing, so to speak.

Are you technically inclined or fundamentally inclined? Traders should really ask themselves this question. Some consider technical trading, the use of charts, an easier and less biased way of trading. Unfortunately, there is little evidence suggesting this to be true, but it still pervades the minds of many traders. Nonetheless, a trader should identify where their greater acumen lay. Is it with technical analysis or fundamental analysis? Both disciplines have a value, but the value can only be extrapolated by the trader. What works, as a discipline for someone else, may not have the same rewards for you.

Personally, and as most would admit, technical analysis is not an exact science. I’m a fundamentals kind of trader/investor. All equities/stocks originate a chart based on the fundamental valuation of a company and the technicals develop from those fundamentals. As such, my belief has always been that fundamentals underline the technicals. So why not go straight to the source? Either way, a trader should define what works best for them. Some traders have acumen for both fundamental and technical disciplines. Is that better, having two disciplines for trading? There’s no right or wrong answer to that question. It’s only better if it works! Sometimes it can prove a valuable exercise to validate the technicals against the fundamentals and visa versa.

Thus far we’ve discussed the major factor that will either make or break a trader. You are either dedicated, with a discipline and plan, or you aren’t. Those traders without a discipline, more often than not, will fail at trading. There are many different ways to create a discipline and as such outlining the various methodologies would prove daunting and overly verbose. For the sake of time and for those who would still feel uncomfortable going down this road of discipline formulation on their own, find a mentor! Yes, a mentor! There are a great many professional trading services available today that weren’t available just 10 years ago. A mentor can participate with knowledge on various trading subject matter as well as prove an invaluable soundboard for ideas and novel idea generation. With a mentor, the success rate for individual traders has generally been found to increase.

Trading and traders are often demonized or referenced frequently as the investor’s “ugly cousin”. Much of the chiding toward traders stems from the chart we positioned within this article. Why trade when you can simply invest in what looks like a “certainty”, so long as you have time on your side? Investing is slow going, takes patience and what appears a great deal of time. Therefore, traders are impatient, unruly and possibly even greedy. That’s just the way some people view trading and traders. I can appreciate the characterization of traders especially when traders demonstrate the understood failure rate through a lack of dedication and discipline. But…but it doesn’t have to be that way as we know.

The Social Complexity

Yes, I see it far too often, traders entering a trade, it fails to generate a profit quickly enough or simply goes against them and they exit the trade with a loss. Shortly thereafter the trade goes in the other direction, but it’s too late. Having a plan helps to offset these behaviors that lead to greater losses. The psychology of trading can prove daunting for many would-be traders and has been the undoing of many former traders. Groupthink is often a problem for many traders as well.

A successful trader finds what works for them and sticks to a discipline and a plan. At worst, they will simply develop that discipline further, enabling the trader to improve their performance in subsequent years. A successful trader does not concern himself or herself with the crowd or group think. The unsuccessful trader allows himself or herself to be moved by social influence or the crowd, which aligns with groupthink. The crowd, unfortunately and often, loses money. It’s not an easy activity to maintain, one that doesn’t blend in with the crowd. In fact, most successful traders are cast out from the crowd, crucified if you will. Why should you find favor both socially and with your trading after all? The fact is, people align with those that think and feel about a trade as they think and feel about a trade. Even as the trade is proving to fail, they won’t adjust course, but rather maintain the group think mentality.

Nowadays the social pressure to join likeminded trades and trading philosophies is found ever increasing. Twitter, StockTwits and other social trading platforms create an environment that begs of social trading whereby groupthink is the more favored participation. Expertise and discipline are often found outcasts in these forums. Unfortunately, those with little trading experience frequent such social trading platforms and imbed themselves with likeminded trades. It’s just too easy and as human beings we find ease appealing.

With nearly 20-years of successfully trading and investing in the real estate and equity markets, I still participate in social media and social trading platforms. I do so in efforts to assist those with lesser experience and in search of information.

So here’s a tip when it comes to engaging with other social media and trading platforms: Take everything you hear with skepticism, but also the dedication to validate that which has been heard or shared. A trader whom is dedicated and plans for success puts in the necessary time to research a trade, an idea or information on a potential trade idea.

The general news media can also prove pervasive to trading psychology. It is yet another form of groupthink that simply recycles the news of the day and that which generates greater viewership. Media headlines, articles, shows and op-eds tend to sensationalize that which is of greatest relevance for that specific time period. The sensationalization and repeating of a message and subject matter can sway a trader to act in accordance with the fear or exuberance that resides in the media’s focus topic. Don’t do that! This is where a good mentor can level set the “noise” from the media for you, offer varied perspectives on the subject matter of the day.

Daily Trigger Psychology

Another barrier or road block to becoming a successful trader roots itself in the psychological realm of trading. I refer to this as the “intrinsic opportunity“. Traders believe that everyday, when the market opens, there is an opportunity to make money. While this is a truism it is but a half truth. You see where I’m going with this, right? It’s a half truth because where the market grants an opportunity to make money there in lay the opposite opportunity, the opportunity to lose money. That is the opportunity that, oddly enough, escapes most traders’ understanding or consideration. And for most traders, it is the reason that on any given trading day, while sitting behind the monitor or mobile device, the trader scans feverishly for a trade execution. If we take into consideration that the intrinsic opportunity is a binary opportunity, it’s quite likely that less trading would occur on a weekly and/or monthly basis by traders. From less trading or the resistance of emotionally driven trades, a trader has a greater chance of developing more sound disciplines that are long-lasting and profitable. Don’t be the trader who is driven by the notion that the intrinsic opportunity is one-sided. While profits can only be achieved through positions taken/capital invested, the dedication to disciplined recognition of binary opportunity can sustain the lifespan of a trader’s trading activity. Oh, and don’t be the trader who demands of himself daily brokerage account balance increases to validate their trading acumen and status as a trader. Ask yourself…

“Are the stresses of daily trade executions with marginal outcomes better than monthly executions with exceptional outcomes.”

Trading is not easy and it takes time to become successful at trading. I’ve been doing this for nearly 20 years, so long I forgot I just said that a few sentences ago. There are no get-rich-quick strategies that don’t wind up with a get-poor-quicker outcome. I co-founded Finom Group in 2017 as a means to share information, insights and my experience with other traders and would-be traders who desire a mentor with a proven acumen. But at the end of the day, every trader’s success depends on his or her dedication to success. All the steps toward success are modestly presented for traders here at finomgroup.com and we hope to find your dedication accordingly. Please feel free to comment in the comment section below and happy trading!

Tags: SPX VIX SPY DJIA IWM QQQ XLF XLK XRT

Thank you for very insightful and reiterative message.. I have so many takeaways from this..

Thank you for taking the time to read and comment. I’m glad you found it relevant.

^^^ Agreed. Thank you for putting the time in to teach us noobs. One of these days I will get this figured out:)

Thanks Seth, I finally read the entire article. discipline, discipline, and discipline. This article got me thinking in a new direction.