One thing after another has been holding the major averages in a pretty narrow range as of late. Most issues surround the White House while others are more market or economy specific. If we were to line up the market concerns they might look as they are bullet pointed below and in no specific order of priority:

- Comings and goings of White House officials

- Mueller investigation

- Yet another U.S., looming government shutdown

- Trade tariffs

- Facebook’s mea culpa

- Rising bond yields

- Number of Fed rate hikes in 2018

- Equity market valuation (S&P 500)

- Consumer debt level at all-time highs

- Housing market slowing

That’s a pretty long list for markets to overcome and likely much of the reasons for market stagnation. While the S&P 500 has not revisited its February lows, it has yet to revisit its recent highs either. The S&P has been enacting a one step forward, one step backward dance for the last couple of weeks as investors attempt to wait out the list of concerns that are otherwise overcome through the expectations of corporate earnings in 2018.

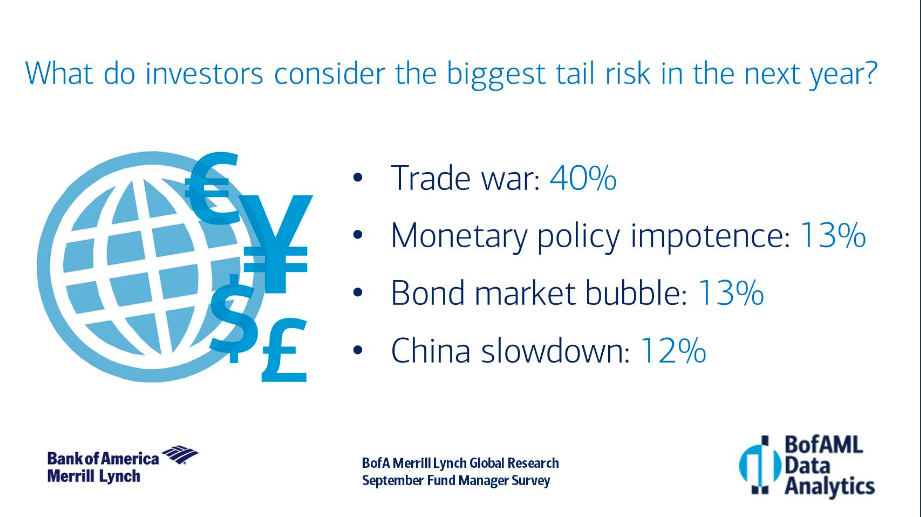

A recent survey by Bank of America Merrill Lynch suggests that my list of noted market concerns is inline with their respondents.

“Concerns about trade, stagflation and leverage are evident in its latest survey of money managers overseeing a combined $579 billion, yet they remain “stubbornly” long on risk assets, the bank said.

The threat of a trade war has surpassed inflation as the biggest tail-risk for fund managers, according to the survey. Eighty-seven percent of investors think protectionism would be inflationary or stagflationary, it said.

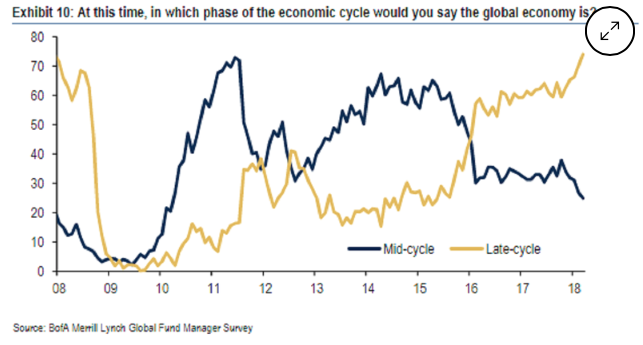

Global growth expectations have fallen to the lowest since July 2016, and a record 74 percent of investors now believe the world economy is in late cycle, according to a survey held between March 9 and 15. Inflation expectations have risen to the highest since June 2004.”

Most importantly, as it pertains to BAML’s survey is the “sticktowitivness” of investors. Despite the concerns and headwinds, investors remain in stocks and are largely short bonds. So what would cause investors to change the stock-preference habits? A 10-year U.S. Treasury yield of 3.6 percent is the “magic number” that would incite a rotation from stocks to bonds.

While the laundry list of concerns remain forefront of investor minds, one of the key concerns can find a degree of levity today with the FOMC meeting, announcement of an anticipated rate hike and the subsequent press conference. U.S. equity futures are relatively flat ahead of the open and 2:00 p.m. EST announcement. The cautious trade thus far comes after stocks closed with gains on Tuesday, with the Dow industrials finishing 0.5% higher and the Nasdaq Composite Index and S&P 500 ending up 0.3% and 0.2%, respectively.

Many economists and analysts are denoting the more hawkish leadership at the Fed this year when compared to a Yellen led Fed. As such, pundits are expecting a bit more of a hawkish tone to the Fed’s policy statement and its dot-plot, which projects the course of interest rates and economic forecasts. Based on this expectation, Fed Chair Powell will need to use his press conference with reporters post-meeting to quell market fears about the rate hike path. Finom Group is of the opinion that tilting the dot-plot toward 4 rate hikes in 2018, at this time of the year, is a bit early to do so and as such the Fed shouldn’t hint at 4 rate hikes… just yet at least. The economy, by means of the latest economic data and probability of a sub 2% Q1 GDP, doesn’t seem to be overheating. Under that assumption, the Fed requires more time to raise its rate hike forecast as the Q2 2018 period sheds more light on the economy and the prospectus of inflation. To put a pin in the Fed discussion until we ultimately know, later today, economists expect Powell will replay his two-day testimony to Congress from last month where Powell sounded hawkish initially, but on the second day he stressed any overheating of the economy was nowhere in sight and wage inflation was not found.

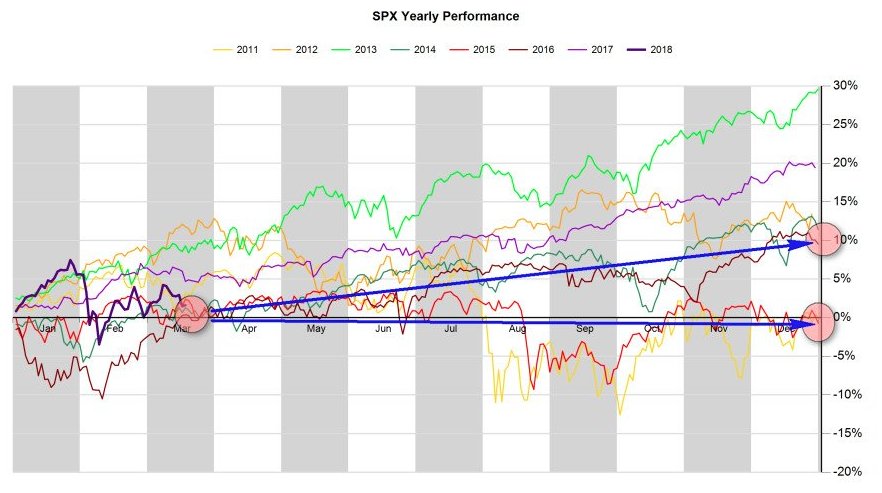

Typically, March and April are pretty strong months for equities. March hasn’t played out that way to date as the noted market concerns weigh heavily on the S&P. As pointed out in a recent tweet by Vixcontango:

“When $SPX hasn’t made a meaningful advance through mid March, in the last 10 years there have been 2 outcomes – either flat for the year or 10%. 2 times flat (2011/2015), 2 times 10%. Note that in those years the SPX traded at substantially lower trailing and forward PE”

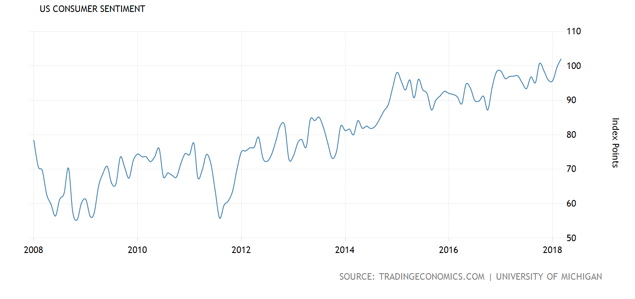

So let’s bottom-line it for the day. Clearly, market uncertainty is ruling the day with the S&P 500 back below its 50 DMA and as such, trending negatively. But the economy is rather healthy with corporate earnings expected to grow in the mid-teens for 2018. What is important is that a lot of the economic data looks strong, not overwhelmingly strong or overheating. The recent jobs report, higher-than-expected consumer sentiment, a healthy level of inflation, and other elements are indicative of strong growth and should support equity prices.

Consumers are confident and retail sales, while trending lower MoM, are growing some 4% year-over-year. CPI inflation of about 2% is favorable to equities and not presently pointing to break away inflation. The PCE gauge, focused and more heavily weighed by the Fed, is lower at just 1.5%, suggesting that 2018 warrants only 3 rate hikes presently.

Investors await the Fed, but at Finom Group we believe with such heavy anticipation and uncertainty in the market, investors might be best to await the fed with both hands firmly planted beneath their bum. Unless of course there’s an unbelievable opportunity to be acted upon. Feel free to join our subscription service with trade alerts delivered electronically and via our private Twitter feed. Yesterday’s call of the day was a short scalp on SODA as depicted below.

And it looks like Twitter is in the range we desired to see it decline to before initiating a potential trade. Good luck to all traders on this all-important Fed day!