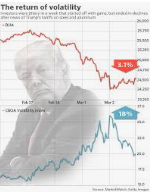

At some point, and we don’t know when, the geopolitical risks will weigh more heavily on investor sentiment than they seem to be weighing at present. But until that point…

It was the press conference that was heard around the world yesterday between President Donald Trump and Vladimer Putin. The conference has drawn criticism from many world leaders, U.S. citizens and GOP lawmakers. The bulk of the concern has come from what appears to be President Trump siding with Moscow against the U.S. intelligence community.

According to multiple experts, the U.S. leader’s focus appeared to be not on his country’s interests, but rather on his own.

“Trump is clearly playing to his domestic base, they love it. If you look at poll numbers now among his base, their view of Russia and Putin is going up,” said Angela Stent, Georgetown University professor and director of the university’s Center for Eurasian, Russian and East European Studies.

“Never in the history of U.S.-Soviet or U.S.-Russian relations has an American president essentially said that he doesn’t agree with his own intelligence agencies, criticized them and essentially agreed with a Russian president who is a former KGB case officer,” she added. “No one has ever seen something like this before. It is unprecedented and it really does raise questions about what really is going on, why he would possibly say that in a public press conference.”

Whether Trump is breaking relationships or at least creating tensions between the U.S. and it’s allies or wagering trade spats with them and China, the geopolitical tensions seem ever growing. The U.S. equity market has performed remarkably well to this point and given the geopolitical headwinds being created, but how long the markets will tiptoe past such growing concerns remains to be seen. With that said, it may come down to the distinction between reality and probabilities. In other words, to date we have trade spats around the globe, but not the reality of a trade war and one that actually affects economic productivity and growth. To date we have geopolitical tensions that largely add up to a multitude of headlines, but no actual affects on the economy. And to date we have a concerning relationship between the White House top officials seemingly showing favor with Russia’s President, but no actual adverse affects on the economy from this variable.

We know, from history, that the equity markets follow earnings over time. Whichever way earnings lean, the market tends to project the same path. The economy has been supportive of record level earnings growth, otherwise supported by tax reform stimulus. Yesterday’s reporting of monthly retail sales continued to show the strength of the economy through the consumer’s purchase activity at retail.

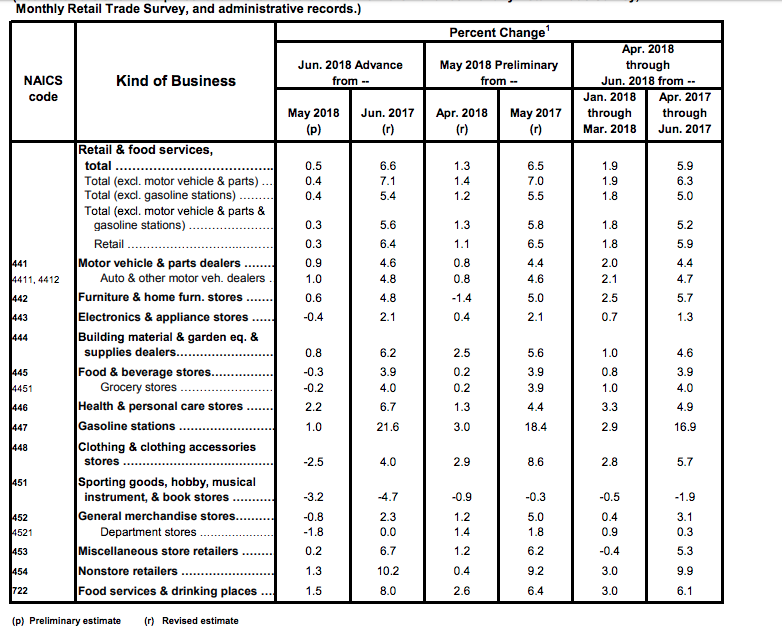

Sales at retailers nationwide grew 0.5% last month, the government said Monday matching estimates from MarketWatch. The increase last month followed an even bigger burst of spending in May, when sales grew a revised 1.3% instead of previously reported 0.8%. Retail sales have increased 6.6% over the past 12 months, slightly above the long-run average since 1980. Some of the strength in the retail sales growth reported for June came from higher gasoline prices and auto sales. Other segments advancing were health and personal care, restaurants, home furnishings and building supply sales. Declining sales were felt in groceries electronic stores, department stores and outlets that sell clothing, books and sporting goods. On the whole, the monthly retail sales report was quite strong, but found with pockets of weakness. It’s still quite relevant to witness the disparity in growth between department store sales and Internet sales.

Internet sales grew at a 1.3% clip MoM and over 10% YOY. Department store sales fell 1.8% MoM and were flat YOY. This was the weakest report for Department store sales since January and may be signaling that much of the recent rebound in the segment was due to very low comparisons and the general curtailment of storefronts around the nation for consumers to shop. What may be missed in some of the recent rising sentiment and share prices amongst traditional retailers is that whether they are closing store fronts or not, they are almost all reducing selling sq. footage in physical retail space or inventories. Retail is not dead, but when you review some of the largest retailers inventory levels YOY, it’s clear they are continuing to shrink at a rate that is not being compensated within at the same rate of their online sales growth.

Yesterday’s trading session kicked-off with more bank earnings and where last Friday’s reported bank earnings failed to shine for investors, Bank of America (BAC) found favor. Bank of America Corp. said Monday that second-quarter earnings rose 33 percent. Quarterly profit at the bank was $6.784 billion, compared with $5.106 billion a year ago. Per share, earnings were 63 cents. Analysts had expected 57 cents per share.

Second-quarter revenue fell slightly though, to $22.609 billion, down from $22.829 billion a year ago. Analysts had expected $22.286 billion. Earnings were expected to benefit from the recent corporate tax cut as well as higher interest rates. Rising rates are typically good for banks because they turn a profit on the difference between what they pay on deposits and the rate they collect on loans. Trading revenue, excluding an accounting adjustment, rose nearly 7% to $3.596 billion from $3.369 billion in the second quarter of last year. Quarterly expenses fell 5% to $13.284 billion, from $13.982 billion a year ago.

Shares of BAC rose sharply on the heels of a stronger than expected Q2 performance, carrying the financials sector and Financials Select Spiders ETF (XLF). Shares of XLF had their best one-day performance in the last 3 months. One strategist is betting on a big bank comeback into year-end.

“It’s going take just a little bit of time and patience,” said John Stoltzfus, chief investment strategist at Oppenheimer, on CNBC’s “Trading Nation” on Friday. “I’m not sure exactly sure when we’ll get the yield curve to extend itself. I think we’re trapped in this flattening yield curve at this time.

As dividends increase, as buybacks actually occur, I think that will help financial stocks. If we can get beyond some of these trade concerns and people feel more comfortable with the sustainability of the U.S. economy we’ll see a pickup so we’re going to be patient for now.

We think it’s going to be a good earnings season. We think the expectations for overall growth in the S&P 500 at 20 percent should be good.”

Another highlight of the trading day yesterday was company specific and related to one of the most concentrated trades in the market, FAANG. Netflix reported its quarterly results after the bell and NFLX shares traded 12% lower after the release. Much of the reaction late Monday came after the company announced it added 5.2 million streaming users in the second quarter, a substantial miss from the 6.2 million estimate the company provided in April. The company added 4.47 million international subscribers and 670,000 domestic subscribers, missing its April estimates of 5.9 million and 1.2 million.

The Company reported a profit of $384 million, or 85 cents a share, topping the FactSet consensus of 79 cents a share and up from $66 million, or 15 cents a share, in the same quarter a year ago. Revenue rose to $3.91 billion from $2.79 billion the year before, just below the FactSet consensus of $3.94 billion.

In a letter to shareholders, Netflix said the company had a “strong but not stellar” quarter, acknowledging the company had “over-forecasted” both domestic and global net subscriber additions and “acquisition growth was lower than we projected.”

GBH Insights analyst Daniel Ives, offered the following with regards to whether this was a one-quarter blip or signs of something more worrisome:

“I think it’s more of a one-quarter issue that shouldn’t bleed into the next few quarters, despite the company’s conservative guidance for September. In uber growth stories, especially in technology, from Apple to Amazon to Netflix, you’re going to run into these one- or two-quarter issues when they’re white-knuckle periods in the very near-term.”

With shares of NFLX falling sharply in the pre-market Tuesday, it is expected that the FAANG stocks will follow and from there the QQQs and Nasdaq. At present, all U.S. major indexes are set to decline at the open on Wall Street and ahead of Fed Chairman Jerome Powell’s semiannual testimony before the Senate today.

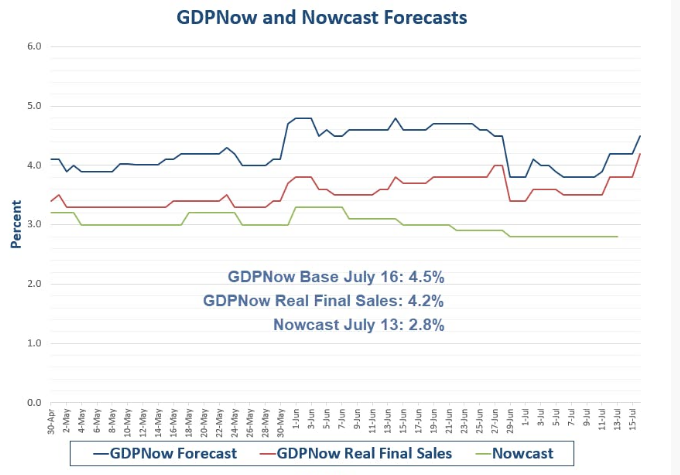

It’s been a mixed sentiment-reporting season thus far, but by and large the earnings are coming in better than forecasted. The economic data has proven inline with earnings strength and Q2 GDP forecasts continue to ratchet higher. The latest GDPNow Forecast rose to 4.5% following the most recent economic reports surrounding consumption and retail sales.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.5% on July 16, up from 3.9% on July 11. The nowcast of second-quarter real consumer spending growth increased from 2.7% to 3.1% after yesterday’s retail sales report from the U.S. Census Bureau. The nowcast of second-quarter real federal government spending growth increased from 1.4% to 5.6% after the Monthly Treasury Statement release on Thursday, July 12, from the U.S. Department of the Treasury’s Bureau of the Fiscal Service.

We’re expecting a choppy and negative trading day on Wall Street, highlighted by the push and pull of earnings announcements and media discussions surrounding the geopolitical climate. The Fed will also be in focus given the 2-day testimony in front of the Senate and the Beige Book due out on Wednesday. Moreover, investors are always awaiting the big economic data point to come next week. Come next Friday, all the speculation on the economy’s strength will be answered when the government releases the Q2 2018 GDP results.

Tags: BAC nflx SPY DJIA IWM QQQ XLF