Research Report Excerpt #1

Amazon shares took the biggest hit post-earnings release date. The company missed analysts estimates on the top line, while beating handily on the EPS/bottom line estimate. As I discussed investor’s reaction to the revenue miss with Seth, he offered the following, which was also shared with Finom Group members in the Trading Room Friday.

“I’m not sure why we should expect analysts to appropriately model top or bottom line estimates for Amazon. Last year at this time the country was still largely in a state of lockdown. This year the country/economy is at 90%+ capacity, with only certain aspects of hospitality and leisure/services still impaired. How can we expect analysts to quantify the impact from drastically different levels of economic output. How can analysts model for such unprecedented circumstances. Amazon still grew total revenues 27% off an extremely tough comparison a year ago and when consumers had fewer retail choices, 27 percent. The AWS revenues also beat analysts estimates handily. In my opinion it’s the absolute revenue sales beat that will prevail and find investors bidding up the stock eventually. This AMZN correction post an earnings release movie has played out many a time and it has always ended the same way, with a new all-time high!”

Research Report Excerpt #2

The seasonal chart for the S&P 500 above goes all the way back to 1929, unlike the prior chart which went back to 1950. It doesn’t get any better the further we go back in time with respect to the August – October period (-2.43%). Having said that, the losses aren’t of great consequence, on average.

Research Report Excerpt #3

A 6-month streak is pretty intense and speaks to the long-term trend, but it also may portend weaker returns and probabilities of the market to remain higher over the next 1-month period. As shown in the study above, the 1-month average return is a measly .09% with a 63% probability of higher prices. Yes, higher is higher, but I would urge investors to recognize there is always a natural precedence for investors to de-risk/deleverage after such robust uptrends. And robust this uptrend has been.

Research Report Excerpt #4

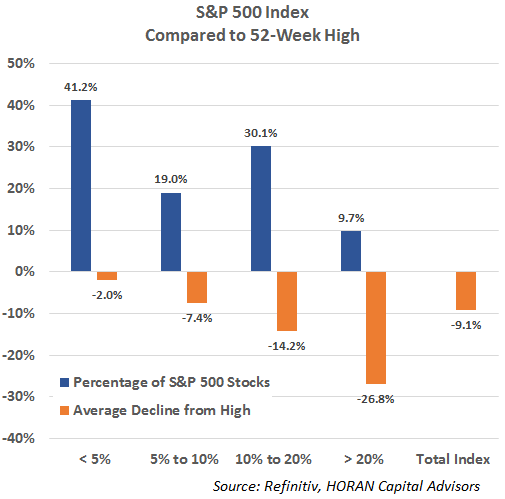

Although the S&P 500 Index is only down .61% from its recent high, under the surface, a large number of stocks have seen significant drawdowns from their own 52-week highs. This is better recognized in the bar chart below: (Horan Capital Advisors)

For the S&P 500, nearly 40% of the index’s stocks are down greater the 10% (combine the 10-20% and >20% column bars in blue) and the average decline for stocks from their 52-week highs is 9.1% (final bar, orange).

Research Report Excerpt #5

- Just as the A/D lines improved this past week, the percentage of stocks trading above their 50-DMA in the S&P 500 also increased from 52% to 54% of stocks trading above their 50-DMA.

- It was a snail-speed improvement, but an improvement nonetheless.

- Lastly, at one point during the week on Thursday, the percentage of stocks trading above their 50-DMA hit 58%, which was the highest level in over a month.

Research Report Excerpt #6

Aside from NAMO and A/D Volume and like the S&P 500, the Nasdaq Composite breadth has been identifying a broad correction has been taking place since February, underneath the surface. Keeping in mind that the index has already expressed a 12% and 8% correction this year, the average stock within the index is still 33% of its 52-week high.

Research Report Excerpt #7

History has also rhymed when it comes to market volatility, more specifically implied volatility as measured by the VIX. July has the lowest VIX mean reading going back to 1990. But it also historically proves the trough point for which volatility swells into the Fall. Historically, the 3rd week of July tends to market the point for which the VIX begins to rise into August. (VIX 2021 monthly average chart below)

Since the 3rd week of July, indeed and as history suggest, the VIX has climbed into the end of the month. It has still maintained the lowest monthly average reading of the year, but if history continues to repeat investors might anticipate a higher monthly mean over the next few months as shown in the heat map of the VIX above. If there is any comfort to be gleaned from the adherence of the VIX seasonal tendencies thus far in 2021, it is simply knowing the tendencies, whereby investors can plan accordingly.

Research Report Excerpt #8

LPL Financial: “We expect continued growth in the third quarter but with a different composition. Consumer spending should still be respectable, but likely will recede a bit due to the fading impact of past government transfer payments. New momentum in services as in-person commerce picks up should continue under the hood. Picking up the slack; though, business investment should continue to recover, and net exports may improve as the rest of the world plays catch-up to the U.S. in their recoveries, consuming more of our goods and services. Government spending and inventories also both have favorable outlooks.

The Delta variant of COVID-19 presents a risk to the outlook, but we see strong reason to remain optimistic. The U.S. is lagging the U.K. in its exposure to the Delta variant, and if we model our trajectory after theirs, which obviously is an imperfect comparison, we expect to see a peak in cases in the coming weeks. In fact, the U.K. is already on a strong path to recovery despite doomsday headlines. Domestically, COVID-19 cases are spiking in areas with the lowest vaccination rates. But, there is evidence that these are also the states experiencing the highest uptick in new vaccinations, which should help self-correct the trends. Positivity rates can be thought of as the fastest-twitch indicator, with hospitalization trends following in the ensuing weeks. Through that lens we see that some of the hardest hit states may have already seen their positivity rates peak.

Research Report Excerpt #9

The forward 12-month P/E ratio is 21.2, which is above the 5-year average and above the 10-year average. During the upcoming week, 148 S&P 500 companies (including one Dow 30 component) are scheduled to report results for the second quarter.

With the abundance of concerns surrounding inflation, or as I see it to be reflation until proven otherwise, the earnings growth rate is important to watch this season. Having said that, equally crucial are companies’ margins!

Although the Producer Price Index continues to rise YoY, so far this quarter, forward operating margins aren’t under pressure and continue to climb. This informs us that the increased costs for companies has been able to be pushed off and onto the consumer, to some degree. Another ancillary benefit since the pandemic for companies has been the fixed cost deleveraging from payroll and other fixed assets. Operating margins are at record levels presently. Inflation/reflation has yet to negatively impact companies on the whole.