The smartwatch battle recently began with the respective brand launches from Samsung, Apple (AAPL) and Fitbit (FIT). I chronicled the launch of these individual devices in an article titled Fitbit, Apple And Samsung Go Head-To-Head-To-Head With Smartwatches. In this article, I aim to deliver my thoughts with regards to how the Fitbit Ionic has been received by consumers, initially.

What I fear occurs with such new and heralded product launches that serve to build investor sentiment is that inexperienced writers and bloggers create a false narrative or one that doesn’t appreciate all the variables at play. A clear case of this can be found in an article written recently by Jeffrey Himelson and published on SeekingAlpha.com. The article is titled Fitbit’s Ionic Smartwatch Sales Appear Strong. On the surface it would appear, to novice investors and those not familiar with retail product launches, that sales are robust for the Fitbit Ionic smartwatch. However innocuous the verbiage appears it is anything but. Within Jeffrey’s article, he utilizes e-commerce in-stock levels to surmise a sales conclusion. This is a very dangerous and rudimentary way to go about achieving true sales sentiment.

Firstly and most importantly, Fitbit only announced that it’s Fitbit Ionic smartwatch would be available in select regions and through select retail outlets starting on October 1, 2017. Secondly, this does not dictate that all regions and all retail outlets will have the product available on day 1 for the product launch. In fact, if we take for example Target (TGT) and Best Buy (BBBY) in the United States, to-date, not all stores within the respective chains have received their slated product. So when Jeffrey offers the following pictures denoting wide scale out-of-stocks less than 2 weeks since the product launch date it is not only dubious, but without recognition of inventory levels for participating stores.

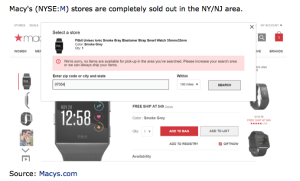

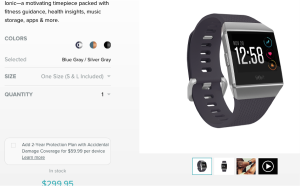

After three years of struggling to grow sales without any success and finding Macy’s in its least enviable position within the retail space, one would think the obvious, many of these Macy’s (M) locations simply haven’t received their slate of Ionic inventory yet. Now had it just been Macy’s that Jeffrey was announcing to have “sold out” of product, in less than 2 weeks, I wouldn’t be so skeptical as an investor. But Jeffrey takes this “sold-out” or out-of-stock sales indicator across Target (TGT), REI, Best Buy (BBBY) and Verizon (V). Of course, most of the touted out-of-stock or sold out stores Jeffrey indicated now miraculously have stock shy of the orange Ionic model and for well understood reasons. And yes, this inventory update also includes Fitbit.com, Fitbit’s very own direct to consumer website as shown below.

In fact, Fitbit.com which previously noted on its website and with regards to its Ionic, which was on back order for 6-8 weeks, the device was only non-orderable for only 4 days. Two things were accomplished by Fitbit.com, a successful but limited launch and developing “buzz” via lesser experienced writers, bloggers and the like. This is not to say that the Ionic is not off to a good sales start despite the tone being offered with respect to Jeffrey Himelson’s narrative, but rather to level set understandings in a more experienced and logical manner.

Fitbit Ionic was always slated to be a limited and select launch with respect to participating retailers around the world. Only a few retailers presently carry the device in the United States and some of those retailers that opted out of the launch are amongst Fitbit’s largest retail partners. Both Wal-Mart (WMT) and AT&T (T) are not participating in the Fitbit Ionic launch. Let’s face it, to supply the likes of Wal-Mart and AT&T combined 10,000+ stores is a feat of strength in terms of monies and supply lines that Fitbit likely could not risk for a new product introduction of this magnitude. Now let’s briefly discuss retail logistics so as investors and readers can fully appreciate why some stores, to-date, still don’t have Ionic inventory.

Retailers like Target and Best Buy with 1000+ retail stores spread out across the nation have multiple distribution centers for which they supply stores on a regional basis. Target, with over 1,800 stores, has distribution centers that not only service regions, but even smaller districts in metropolitan areas that may host 20 stores with a 50 sq. mile radius. Each distribution center across the nation has its own priorities, workload and shipment schedule to work out every single week and with respect to 10s of thousands of skus. A truckload delivery to an individual store can hold upwards of 2,800 case packs. The typical Best Buy store, given its niche category of business segment sales will receive 1-2 trucks a week with many drop shipments. A Target store, on the other hand, can receive up to 10 trucks a week, doing double trucks on select nights and for which each truck will likely have over 2,000 case packs. It’s a daunting, daily task for each individual in-store logistics team. Regardless of the date of delivery for the Fitbit Ionic product, the skus from a truck delivering product from a distribution center to an individual store does not get loaded into a store’s OS until the truck is received during the logistics download process. And here’s the kicker to that, sometimes logistics personnel will not download the truckload properly. This results in a well-known industry problem referred to as “paper shrink”. The product never gets recognized in the OS system if the logistics team does not process it properly. As such the item is not registering “in-stock”. Something I know a great deal about as a former Target Logistics executive and consultant.

Jeffrey Himelson is not the first blogger or writer to make the declarations he is making. Last year, when Fitbit launched Blaze and Alta, Bull & Bear Trading offered the same out-of-stock and/or sold-out rhetoric for these new devices and using much of the same methodology offered by Jeffrey Himelson. The article was titled Fitbit’s Blaze Is Indeed Cleaning The Clock Of Apple’s Watch In The Marketplace. The article was well received and of course I encouraged investors to understand the reality of the launches for these products that was subsequently met with over inventoried stores due to a lack of sell-through/demand. I’d hate to see the same thing happen once again. Bull & Bear Trading doesn’t write about Fitbit anymore given the demise in the share price and obvious misunderstandings about the business model that the author held. Hopefully the same won’t be said about Jeffrey Himelson and I’m of the opinion that he has stumbled upon the stock at the right time in Fitbit’s business cycle. Let’s move on to those Amazon.com (AMZN) reviews shall we?

Using Amazon.com reviews for sales strength has lesser efficacy than using actual Amazon.com rankings. One of the variables regarding Amazon.com reviews that frighten me most is the reality that many of the reviews are influencer generated and done so to elicit a specific reader response. In an article by Home World Business Magazine the influencer review topic was raised back in 2015. I was interviewed for this subject matter having understood the role influencers were playing with regards to Amazon reviews for several years. The article was titled The Rating Game: Rise Of ‘Influencers’ Invites Challenge To Online Reviews.

For a more comprehensive understanding of reviews it’s always a good idea to filter the reviews into “Verified Purchases”. When we filter the Ionic reviews using this filter choice we come to find that of the 800 currently posted reviews, only 183 of the reviews are actually Verified Purchases by and through Amazon.com. That’s a relatively poor ratio for any product and insists that there is some level of influencer participation going on here.

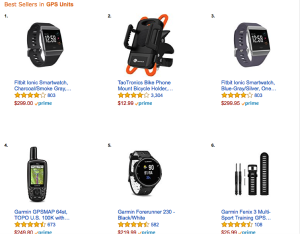

Now, this doesn’t mean that the 4.2 star rating and general sentiment for the product is faulty; it simply means that influencer activity is at the root of the numerical value of the reviews. Having said that, based on sheer sales volume through Amazon.com, Fitbit Ionic is the #1 ranked GPS device, leapfrogging all Garmin devices, and that aint too shabby.

If one does monitor the Amazon.com best selling smartwatches frequently, from time to time Fitbit Ionic will be listed as the #1 selling smartwatch. Having said that it is quickly removed due to a variety of factors.

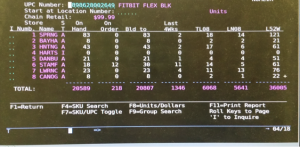

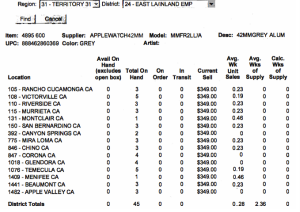

When it comes to defining strength of sales two things are of greatest importance, inventory and the sales themselves. It doesn’t matter if a store sells one item if that is all they received any more than it matters if they sold 5 items, but received 100 units. Strength of sales needs supply and time to develop a trend that can be extrapolated for future forecasting. The sub-2 week time period for which Jeffery would be drawing conclusions on a limited product launch is a dangerous practice, even as I understand the initial sales to be positive. Like NPD Group and other data trackers, I have resourced tie-ins to point-of-sale operations at various retailers around the country. Last year I offered real-time sales data taken directly from a retailer that indicated the strength or weakness in some of Fitbit’s products as shown below.

Last year I also published real time, real sales channel checks from another retailer concerning the Apple Watch as shown below.

These are true channel checks that professionals and data trackers are able to acquire in the sales channel on a weekly and monthly basis. Many institutional investors pay a subscription fee to acquire such data.

In summation, my narrative was not to detract from the works of Jeffrey Himelson, but rather to level set investors’ understanding in what he presented in his article. I don’t discourage boots on the ground research, but hopefully the advanced analytics I offered over the years can help to paint such efforts in the right light. I think the Fitbit Ionic is a fine product and off to a good start. I would be of the opinion that when Fitbit offers its Q3 earnings release they will discuss Ionic’s sales in detail alongside the future distribution of the product through the holiday season. Additional distribution to the likes of Wal-Mart, AT&T, and/or Sprint (S) could be meaningful to top and bottom line results for the Q4 2017 period.