If you just looked at the closing prices for the major averages on Monday, you might have overlooked the significance in the headlines that surfaced before the market opened that day. The Federal Reserve said Monday it will launch a number of programs aimed at helping markets function more efficiently as the aim to help ease the painful period brought about by COVID-19.

Among the initiatives is a commitment to continue its asset purchasing program “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.” There’s no dollar amount offered in the asset purchase intent, that’s the key takeaway folks! That represents a new chapter in the Fed’s “money printing” and as it commits to keep expanding its balance sheet as necessary, rather than a commitment to a set amount.

The Fed also will be moving for the first time into corporate bonds, purchasing the investment-grade securities in primary and secondary markets and through exchange-traded funds. The move comes in a space that has seen considerable turmoil since the crisis has intensified and market liquidity has been sapped.

Other initiatives include an unspecified lending program for Main Street businesses and the Term Asset-Backed Loan Facility implemented during the financial crisis. There will be a program worth $300 billion “supporting the flow of credit” to employers consumers and businesses and two facilities set up to provide credit to large employers.

There are no details yet on the Main Street program, with a news release saying it will help “support lending to eligible small and-medium sized businesses, complementing efforts by the SBA.”

The Fed also said it will purchase agency commercial mortgage-backed securities as part of an expansion in its asset purchases, known in the market as quantitative easing. The move represents an expansion into the commercial sector of real estate for the central bank’s acquisitions.

Equity markets quickly lauded the Fed’s announcements and bazooka-release with a rapid pre-market futures recovery, but that recovery failed once regular trading hours commenced. Although equities didn’t finish at their lows of the session with the Dow and S&P 500 off nearly 3% and the tech-heavy Nasdaq outperforming its peers, off just .27% on the day. In the absence of energy and financials, the tech sector will have to lead markets back from the abyss when a market rebound takes shape. And we expect that rebound of sorts this week.

In Finom Group’s weekly Research Report titled Preparing for a Rebound, we make it quite clear that we’re anticipating a bounce in markets this week. There is a catch, of course! The market has been screaming for a fiscal stimulus package to accompany the monetary policy efforts and announcements already in exercise and discussed by the FOMC. With the S&P 500 falling some 32% from its record highs set in February, the message has been heard by the FOMC and the legislative branch, but the typical politics of Washington D.C. have failed to deliver on the markets’ desired actions thus far.

Nonetheless, with each passing day, a fiscal stimulus bill is closer to a vote and aims to deliver roughly $2trn in aid and stimulus to the economy near-term.

Moreover, within our weekly Research Report one of our points of analysis/discussion centered on the VIX. Here is what we offered our subscribers:

“While indeed the VIX failed to climb on Friday even with the S&P 500 falling some 4.3%, and such a VIX decoupling does usually serve to signal a near-term bottom for the S&P 500 , we would exercise caution on using history as our guide. Remember, the VIX has remained extremely high for more than a week and recently had an all-time closing high above 82 this past week.

Extremes are often met with some mean reversion and independence of their market correlation/s. Don’t be the trader who relies on history as a guide in the current market cycle, beyond the fact that we will always overcome the issues of the day and in all matters. Be the trader who finds confirmation in market trend and price firstly.“

As mentioned previously, the VIX fell some 8% on Friday even as the S&P 500 was down more than 4 percent. This is highly unusual for the typical inverse relationship between the two indexes. But as noted in the paragraph above, “Be the trader who finds confirmation in the market trend and price firstly.” Confirmation may have been found on Monday with the S&P 500 tumbling once again, and yet, the VIX continued to fall. And the VIX fell on a MONDAY! Why do we emphasize MONDAY? Portfolio and hedge fund managers have automatic hedging programs that execute on Monday’s and to deliver weekly hedges against long market exposures. This, coupled with the usual VIX reset from lowered options bids the previous Friday typically find the VIX index higher in value in the first few hours, at least, on Mondays. Given the two day decline in the S&P 500 and VIX, it would seem as though equities are setting up for the bounce we assumed ahead.

The S&P 500 Index is down >7% in the past 2 sessions and the VIX Index is down >10 points. That’s unprecedented, something we’ve mentioned quite a bit during the unprecedented market decline since February. There hadn’t been a 2-day stretch in which stocks declined 5% and the fear gauge was down even 5 points, historically.

While we could outline a great deal of options positioning through the peak-to-trough, 35% S&P 500 route that found hedging and long-VOL positioning extreme to detail the rise in the VIX and VVIX, the recent decline is more a factor of elevated premiums that defy the need for protection after a 35% S&P 500 decline. It’s one of the reasons our Seth Golden offered the following on StockTwits Monday:

The only caveat to our interim rebound forecast would come from failure to vote in favor of fiscal policy measures by the Legislative brand during the week. While the political ranker has already commenced, Finom Group still anticipates a Senate Vote by Thursday this week and possibly a House vote over the weekend. If either branch fails to pass the fiscal stimulus bill, the market is likely to continue “screaming”. We’d anticipate a market reaction to any failed vote akin to that seen during the TARP voting from 2008.

LPL Financial took up the topic of the fiscal stimulus package with the following comments:

The failure of the Senate’s procedural vote Sunday night followed the typical path of these negotiations and likely will lead to more compromises today, including more worker protection clauses and more restrictions on business loans backstopped by the US Treasury. Policymakers understand the importance of providing economic assistance as quickly as possible, including support for the healthcare system. It’s also about preserving as many jobs as possible over the next 60 to 90 days, using businesses small and large as a conduit to do so, while doctors work on treatments and a possible cure.

“A $1.5 trillion stimulus package sounds like a lot, and it is,” noted LPL Financial Equity Strategist Jeff Buchbinder. “But given the unemployment rate might be headed to double-digits and many impacted businesses won’t survive through the spring without some help, it probably won’t be enough.”

Large and small businesses alike are shuttering and suffering amidst the COVID-19 global outbreak. A survey of 1,500+ Goldman Sachs 10,000 Small Businesses participants highlights critical need for policy action and immediate support.

The fact that small businesses believe they can only maintain operations through a 0-3 month shutdown identifies the dire need for stimulus. The Goldman Sachs’ survey is only magnified by the findings from J.P. Morgan.

According to a study of US small businesses by JP Morgan, the median small business has less than 27 cash buffer days in reserve. And there’s a wide variance amongst industries. Healthcare services hold roughly 32 days of cash in reserve, while at restaurants just 16 days of cash in reserve.

While a vote in favor of passing a substantially fiscal stimulus bill is desperately needed near-term, investors remain focused on an abatement of the market selling pressure. Most breadth metrics have reached record levels if not extremes not seen since 2008. When such breadth extremes are found, we usually see market breadth and sentiment improve in the weeks and months ahead.

This table shows forward returns over the 3, 6, and 12 months following a breadth extreme where the number of 52 week highs minus lows is measured. With the exception of the 1930s, by the time the market became this extreme most of the downside was complete.

While the table above suggests a rebound soon and points to gains over the next 3,6 and 12 months for the S&P 500, other extremes in breadth and momentum are found in the Dow Jones Industrial Average.

We certainly can’t deny that in each of the noted Dow RSI extremes in the past we’ve seen a market bounce, but as MacroChart and Finom Group have denoted many times, the current situation is unprecedented in the macro, which has bled into the micro, technical and all aspects of market mechanics. Here is what MacroChart offered in tandem with the chart above Monday in a tweet:

“Scary to think about it, and irresponsible to expect it. But this market has broken every “rule” in the book, wouldn’t surprise me if the textbook 4-8 week retest goes out the window too.”

These are truly unprecedented times and as such we remain with a modicum of caution. As noted in the past, we’re ok with missing a 10% relief rally/bounce near-term, especially given the circumstances that usually find the market retesting its lows if not making new lows. What we’re not ok with is missing the following 90% rally thereafter and over the coming months and years. Regardless, when we see such breadth extremes coupled with sharp downturns in the markets, it usually means at least one thing: The dividend yield on the S&P 500 has risen substantially. In fact, the S&P 500 dividend yield is now 2.6%, the highest in 10 years.

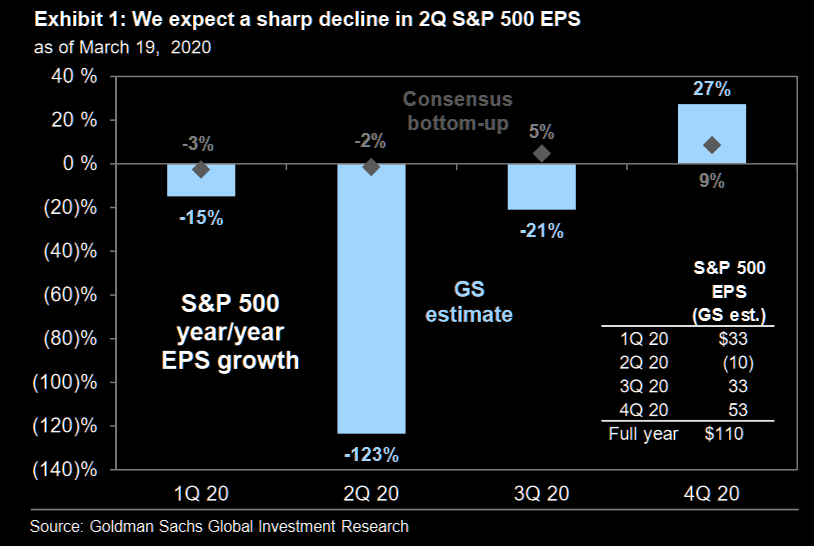

The outlook for the economy and markets are quite murky near-term, but long-term investors stand to benefit from this downturn should they remain grounded and with discipline, knowing this too shall pass and mankind always finds a way to overcome! As we look toward the future, we have to recognize that as earnings go, the market goes and in the present day those earnings are being marked down by both big and small Wall Street firms. During the March 19 week, they expected the following YoY growth rates for Q1 (-2.9%), Q2 (-1.8), Q3 (4.7), and Q4 (8.4). All are down sharply from their expectations at the start of the year: Q1 (3.7), Q2 (6.1), Q3 (9.5), and Q4 (13.7).

Keeping in mind that the data above is an extrapolation and modeling from firms tracked by Refinitiv, we know that firms such as Goldman and J.P. Morgan have lowered estimates by more than the aforementioned forecasts. Goldman’s EPS forecasts is one that mirrors the gloom and doom presented in the rapid descent in markets.

“We now forecast S&P 500 EPS of $110 in 2020, a decline of 33% from 2019. On a quarterly basis, this reflects year/year growth of -15%, -123%, -21% and +27%. We have cut our 2020 earnings forecast three times in 30 days (-37% in total) as the magnitude of the economic slowdown has become increasingly apparent.”

J.P. Morgan’s EPS revisions are not quite as dire. The firm’s base case calls for S&P 500 EPS to contract by 8% to $150 in FY2020, down from current consensus expectations of $169. However, depending on size and timing of the fiscal stimulus there could be meaningful upside to their estimates, as they claim in their most recent report. “Investors will likely view the hit to 2020 EPS as a one-off event and anchor their equity view to 2021 EPS. While there are many unknown variables and it is still early, we expect ~15% EPS growth in 2021.”

- J.P. Morgan’s Top-down Approach: 2020 S&P 500 EPS is $148 (-9% y/y). Historically, corporate earnings experience larger cyclical swings than GDP due to operating and financial leverage. We estimate that a decline of 1% in real GDP translates to ~5% decline in earnings growth.

- A stronger USD is also a headwind to earnings with a 1% appreciation translating to ~ -0.5% decline in S&P 500 earnings. Using JPM US real GDP forecast of a -1.5% decline in 2020, and assuming USD stays at the current level, our top-down model implies EPS contracting by 9% in 2020 to $148.

- However, a stronger than expected recovery and a weaker USD could easily push earnings growth substantially higher (see sensitivity matrix, Fig 3).

- As discussed above, $148 EPS does not include the fiscal stimulus benefit.

- Separately, lower oil prices have traditionally been a positive for earnings with implicit benefit to consumers more than offsetting the earnings hit to energy companies. However, the shale revolution turned US into a net exporter of oil making the corporate sector and credit markets more vulnerable to lower oil prices.

- Energy is a small sector weight in S&P 500 however it is the largest detractor for aggregate S&P earnings followed by Industrials and Consumer Discretionary.

As recognized in the J.P. Morgan notes and EPS estimates is the energy sector impact. Crude oil prices are at there lowest levels in more than a decade. But it is important to recognize the sector weighting is muted within the S&P 500. Sector weightings are noted below: (from DataTrek)

- Technology: 30.3% (adding back Google and Facebook, currently in Communication Services).

- Health Care: 15.2%

- Financials: 13.8% (adding back Real Estate current 3.0% weight)

- Consumer Discretionary: 11.9% (adding back Disney, Comcast and Netflix, currently in Comm Services)

- Consumer Staples: 8.2%

- Industrials: 8.0%

- Telecomm: 4.3% (Comm Services minus adjustments noted above)

- Utilities: 3.5%

- Materials: 2.4%

- Energy: 2.4%

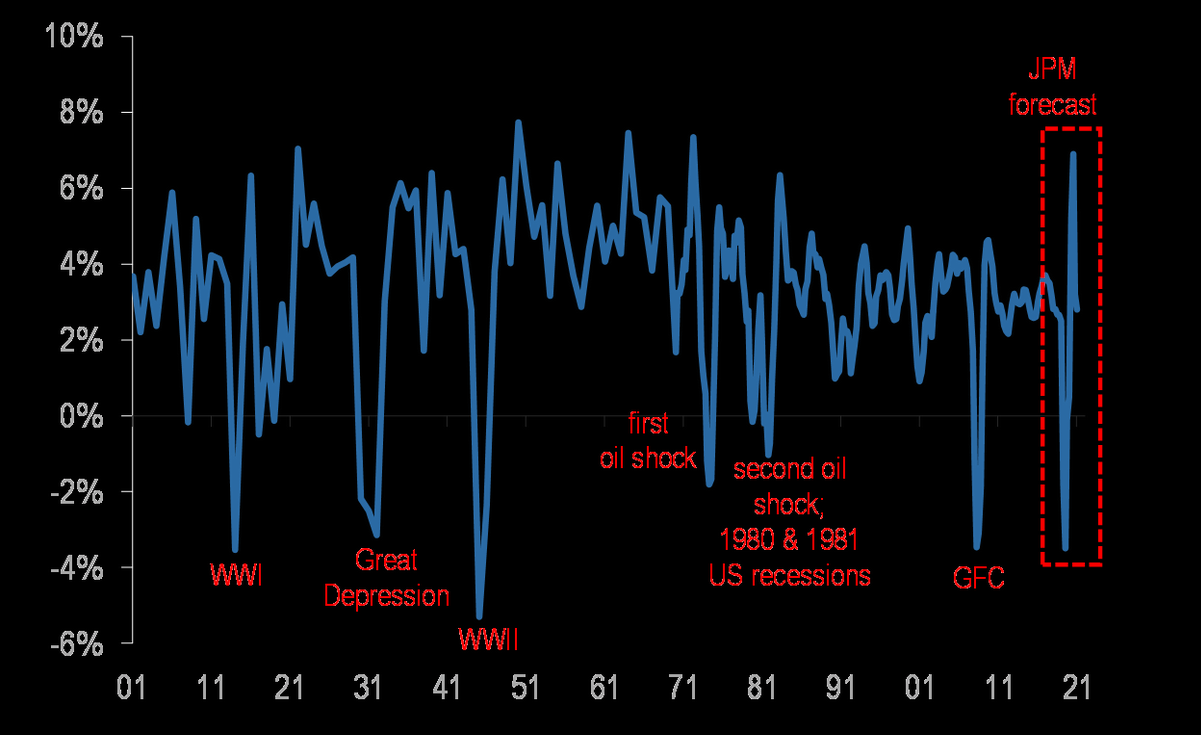

While the world is lingering in a state of uncertainty and abnormal social conditions, J.P. Morgan emphasizes that the current issues are likely to be short-lived. “COVID-19 could deliver one of the largest growth shocks in a century, but also potentially the briefest. The chart below represents global real GDP growth YoY as a spliced series from various sources. Annual data pre-1970 and quarterly figures after.“

“Considering the macro setup above and acknowledging that equity markets globally are now down 30-50% from their recent highs (i.e. in-line or worse than the median correction historically), and that investor positioning has become increasingly favorable (see Market Commentary), we see an asymmetrical return profile for equities with upside significantly higher than downside over the next year. We expect S&P500 to reach 3,400 by early next year. The key immediate risk to this view is the US administration failing to pass a comprehensive fiscal package promptly.”

3,400 seems so far away and yet the S&P 500 was nearly at that level just over a month ago. It’s hard to see the forest for the trees sometimes and behind a litany of negative press headlines that seemingly cascade daily. But with the bad, there is the good and the good may very well be materializing in the infection rate data coming from Italy over the last 3 days.

The infection and death rate are both slowing, akin to the same chronology from South Korea’s former rate of decline or flattening of the “curve”. The COVID-19 data on March 23rd for the outbreak in Italy started to show potentially the first signs of the impact of lower rates of infection on new cases. The growth in new cases fell to its lowest level during the outbreak so far in Lombardy and also trended lower in the rest of the country. We hope this the first evidence that the lockdown is starting to reduce the number of cases. Clearly we need to see this trend continuing and the number of new cases continuing to fall in the coming days.

The market will continue to await a fiscal policy vote and passage of the stimulus package, but until then, U.S. equity futures are seemingly doing what we’ve anticipated and forecasted, surging to “limit up” on Tuesday morning. We can suggest this is due to optimism within the data from Italy, but more than likely it is a factor of pension and hedge fund rebalancing, as equity positioning is extremely low going into the end of the month and quarter. Either way, hold on to your hats folks! And don’t, don’t forget your disciplines and capital allocation game plan as the economic data will continue to plague investor sentiment for the foreseeable future.

After a robust Existing home sales report last week, New home sales is due out Tuesday and alongside some manufacturing data that is anticipated to prove in contraction. Much of the economic data releases that lay ahead will be dismissed by investors, as a recession has largely been priced into the equity and bond markets. Weekly jobless claims will be the most widely followed as this is expected to jump significantly this week and the coming weeks. As jobless claims rise, the unemployment is also expected to climb. All the more reason for fiscal stimulus urgency.

- U.S. initial jobless claims rose by a near record amount last week; they could rise by three million this week, indicating the negative shock to the U.S. economy could be the largest on record

- The governor of California ordered the state’s 40mm residents to stay at home. New York could be next. It is worse affected than the Golden State, with 60 people in every 100,000 people in Manhattan alone already infected – one of the highest rates in the world

- Combined economic output for both states is almost $5 trillion, or around a quarter of US GDP

California normally accounts for almost one-fifth of all U.S. jobless claims, according to Lipper. The state’s governor has said that initial claims totaled 40,000 on Sunday, and doubled to 80,000 by Tuesday. If you average that over a week, it is consistent with initial claims in California alone spiking to 525,000 – a level that is entirely without precedent. Based on an upward trend, and the recently announced lockdown, the risk is that the final figure ends up higher. Across the states for which we have data, claims so far this week are running at a rate that is 15 times higher than they were in March last year. That figure is consistent with a rise in jobless claims from 281,000 to around three million next week. That would be the largest such increase by a factor of more than ten.

If it comes to pass, that would be consistent with the unemployment rate increasing by around 2 percentage points in a single week – a figure that is more than double the largest ever monthly increase in the unemployment rate. With financial support and effective control of the virus, both of which are uncertain, many of these lay-offs could prove to be temporary. Another reason for cautious optimism is that since the recession is so widely anticipated, policymakers should, in theory, be able to respond to it better.